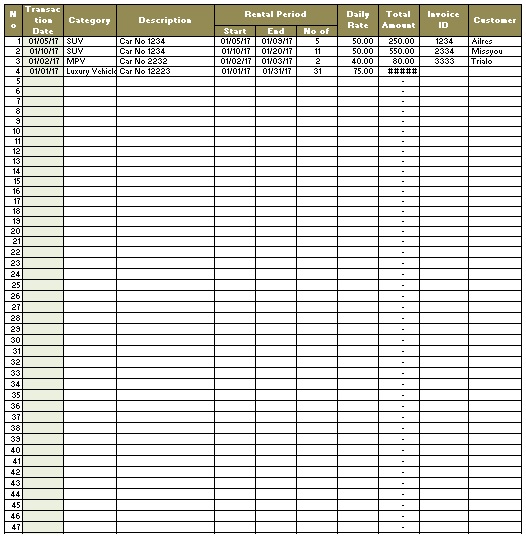

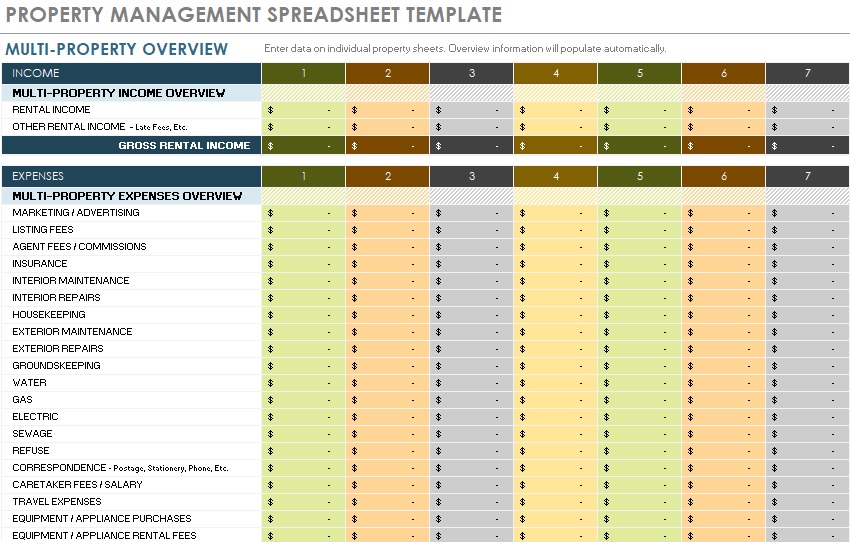

A rental property expenses spreadsheet is used by landlords to keep track of their monthly rental income and expenses. Tracking them is important to effectively manage your rental property and getting the most out of your investment. Rental income and expense worksheet help you stay on top of your bookkeeping.

Moreover, there are various rental property expenses spreadsheets online that you can download and personalize to meet the needs of your rental business. These spreadsheets are particularly designed for property owners. They have a section for each category of income and spending that are related to managing a rental property. These sections are broken down by month and by property. Also, they automatically calculate the totals. The calculations provide your gross income, net income and total expenses for the year.

Table of Contents

What are rental property expenses?

There are several types of rental property expenses listed by IRS Topic No. 414 Rental income and expenses. An investor may deduct theses expenses from the total rental income received;

Operating expenses

They are necessary for the operation of the rental property. They include the following;

- property managers

- landscaping and utilities

- property taxes and insurance

- mortgage interest expense

Repair costs

Repair costs are required to keep the property in good working condition. It also requires excluding work that adds value to the property like a new roof or air conditioning system. You may also like Rent Increase Notice Templates.

Depreciation expense

They are necessary for exhaustion, and wear and tear of the property.

Furthermore, most investors are cash basis taxpayers according to the IRS. This indicates that;

- income is recorded when it is obtained

- when bills are actually paid, expenses are booked

A refundable security deposit that is given back to a tenant is neither income nor an expense. It is recorded on the balance sheet as a liability when the deposit is received.

How do you keep track of rental property expenses?

You can keep track of rental property expenses by the following three main ways;

Spreadsheet

By using programs like Microsoft Excel, Numbers, Google Sheets, or OpenOffice, many beginning investors create a simple spreadsheet. A first, entering expense manually on a spreadsheet may work fine. But, most investors think that this type of back office work isn’t the best use of their time. However, you can search online “rental property expense worksheet template” in case you’re looking for a simple template to use.

Generic Accounting Software

Millions of people worldwide including property owners purchase generic, off-the-shelf software such as QuickBooks. The investors who have a good grasp of accounting and time to personalize the software to meet their requirements, these programs the best match for them.

In addition, you should first download a trial version before purchasing general purpose software in order to make sure the program works as intended. To ensure that the software accurately tracks every transaction and books, do the following steps;

- Create a rental property and tenant

- enter bank and mortgage information

- receive rent payments and book expenses

- generate financial reports

Rental Property Software

For the independent real estate investor, real estate-specific software runs range from full-blown property management programs to software designed.

Why should real estate investors keep accurate rental property expense records?

Rental property expenses are tracked in an itemized list or report format along with a paper trial. This gives back up to prove that every expense claimed is true and correct. However, tracking expenses can be time consuming. Here are four effective reasons that why real estate investor should keep accurate rental property expense records;

- Tracks profit or loss of a rental property

- Gives data to calculate on ways to maximize profits

- Enables investor for claiming every possible tax deduction

- Make a paper trail for audit purposes

Furthermore, with the help of accurate rental property expense records, you can determine potential opportunities to enhance revenues and the overall return on investment (ROI) of a rental property;

Operating expense ratio (OER)

It is calculated by dividing operating expenses and operating income to calculate how well expenses are being controlled.

Non operating income (NOI)

It is calculated by subtracting operating expenses from income.

Capitalization rate

This rate measures the return or profit on investment by dividing NOI by property value.

Internal rate of return (IRR)

In a rental property, it estimates the interest or return get for each dollar over the holding period.

Cash flow

At the end of each month, it is the money remaining when the rent has been collected and all of the bills have been paid.

Cash-on-cash return

It makes comparison between the cash received each year to the amount of cash invested. You should also check Rental Application Forms & Templates.

Main types of rental property expenses:

There are a lot of rental property expenses a real estate investor can deduct. Some of the main types of rental property expenses are as follow;

- Accounting and legal expenses

- Advertising and marketing costs

- Depreciation

- Insurance

- Maintenance expenses

- Mortgage interest

- Property management fees

- Property taxes

- Repairs

- Travel expenses

- Utilities paid by the landlord

Conclusion:

In conclusion, a rental property expenses spreadsheet is used by property owners to maintain all records. This record also offers all legal safety to the tenant. This spreadsheet allows you to keep track your monthly rental income and expenses in an orderly manner. You can also download free spreadsheet template online and the use it to simplify management of your rental finances. You can also use it as a starting point to create your own.