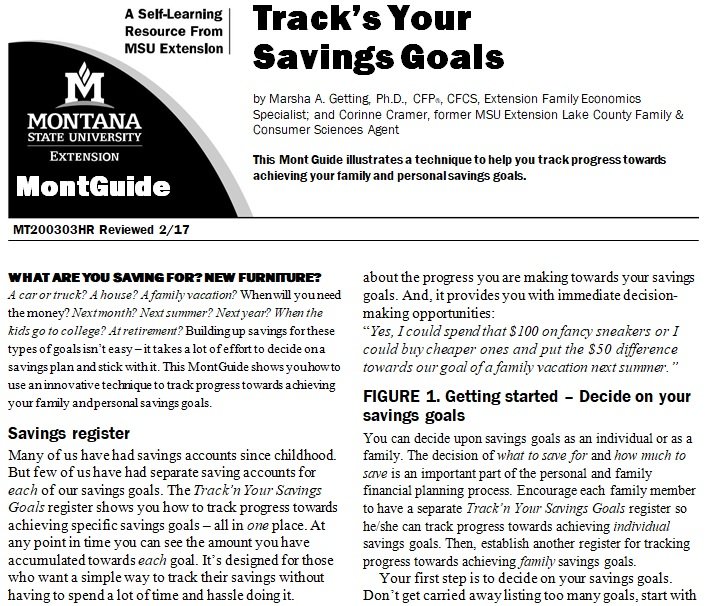

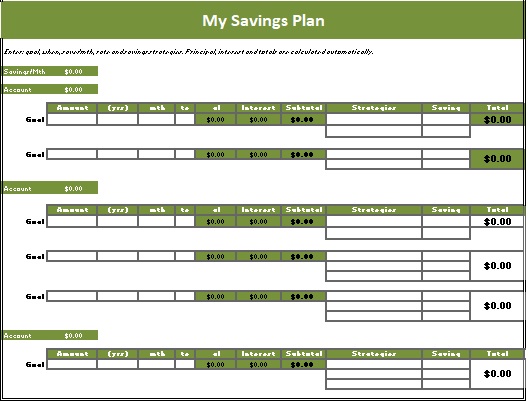

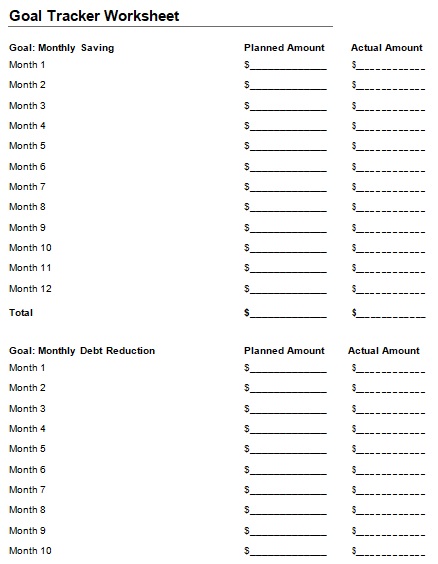

Savings goal tracker sheets can be used personally or in businesses to control the budget and achieved savings as planned. Moreover, these templates are helpful to plan and realize the savings from different income sources and expenses.

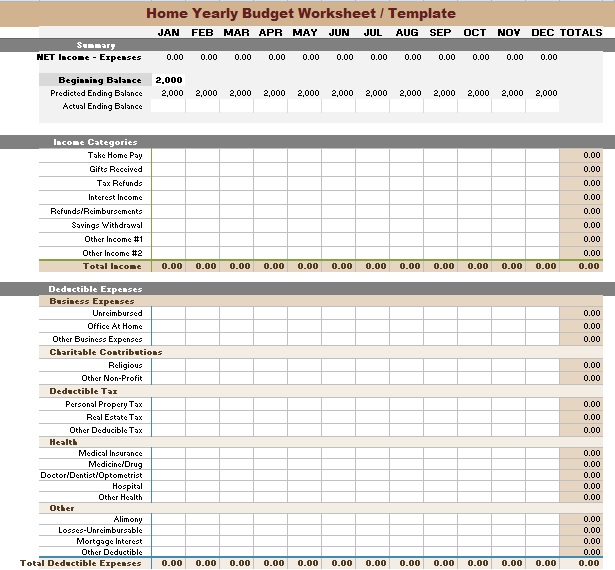

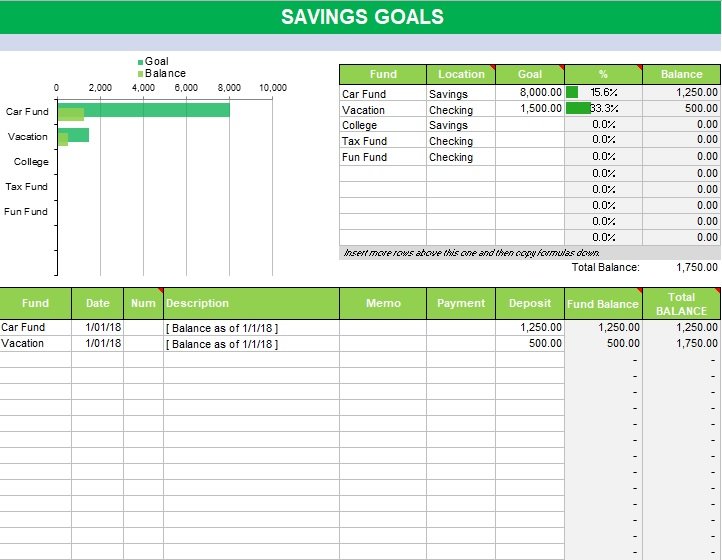

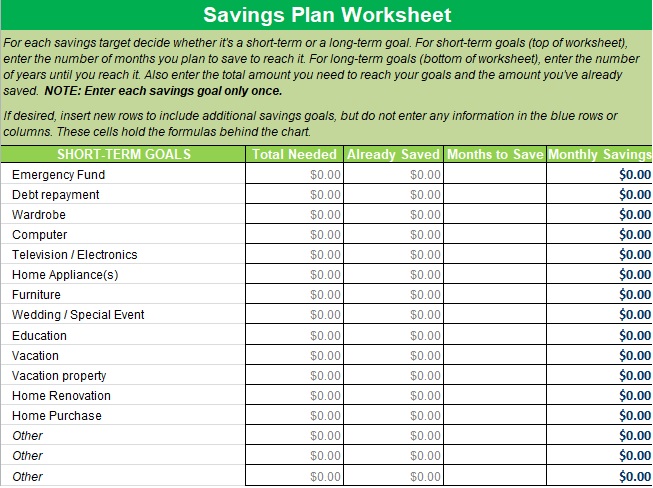

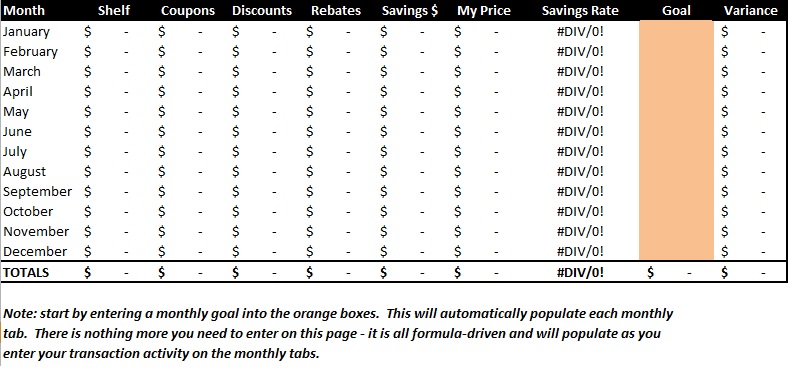

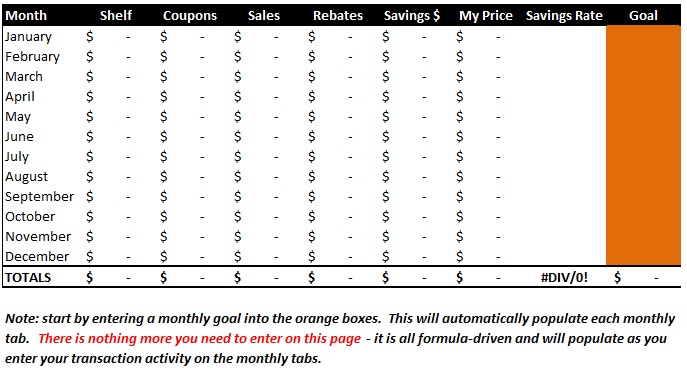

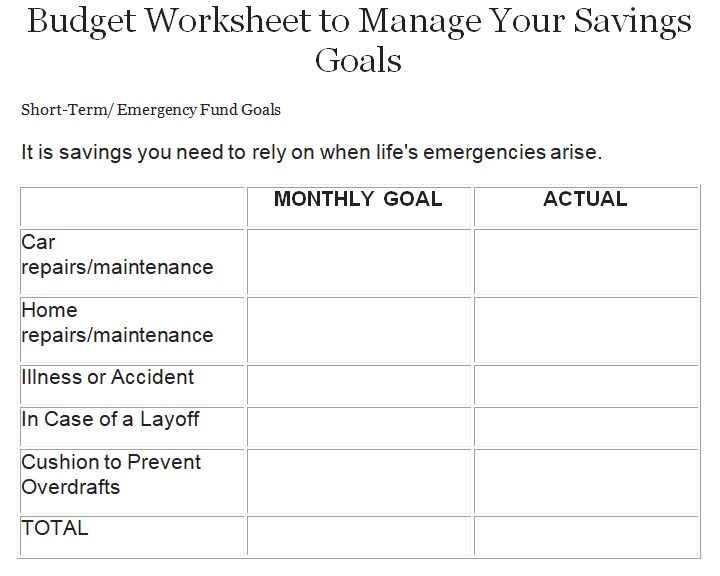

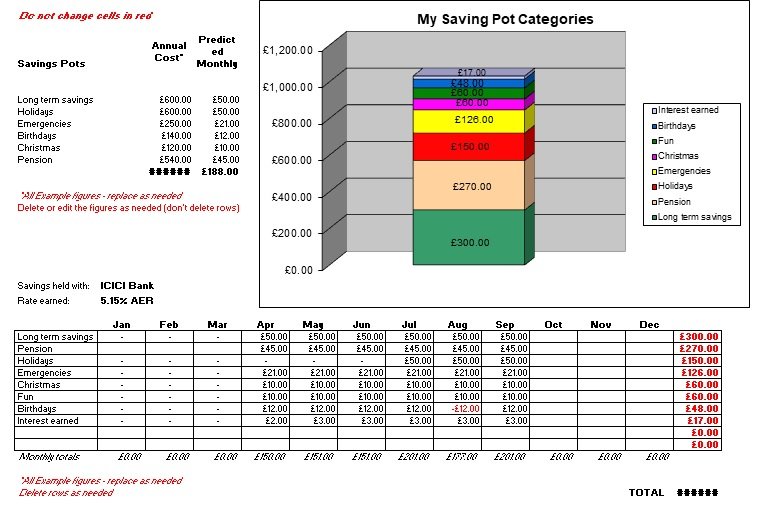

The savings goal tracker works by planning a monthly amount to be saved from different expenses. It also serves the purpose of the expense sheet that is used to control the budget. Moreover, it can be used to calculate the deficit in income and expenses and plan the savings accordingly.

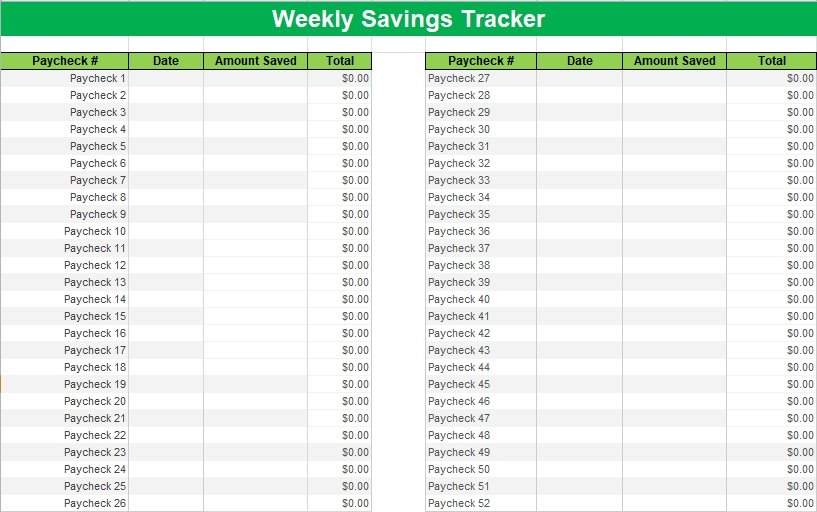

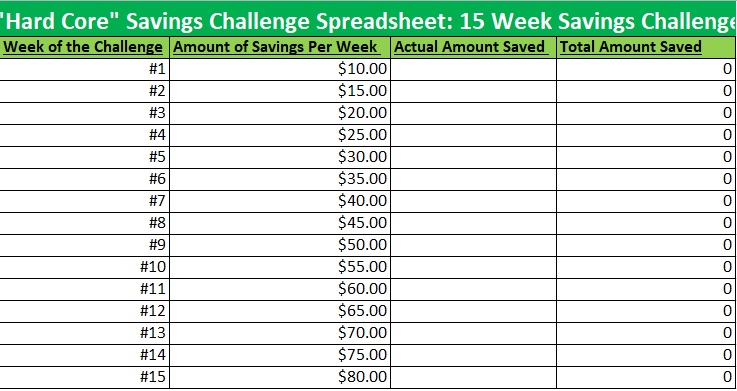

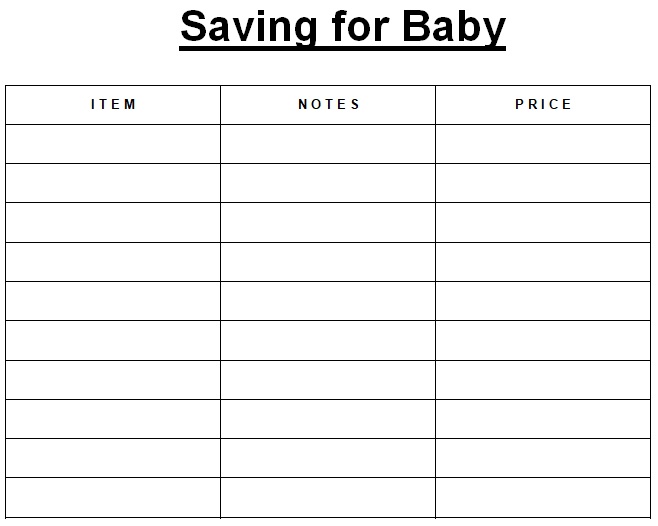

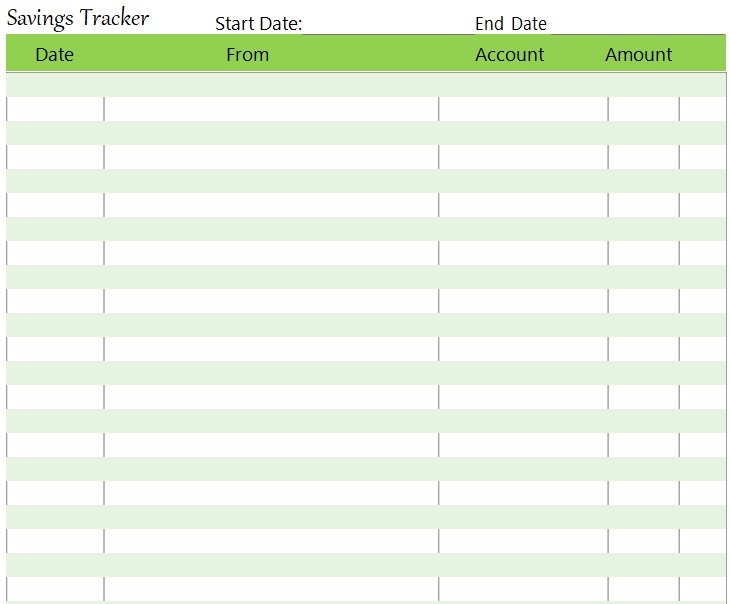

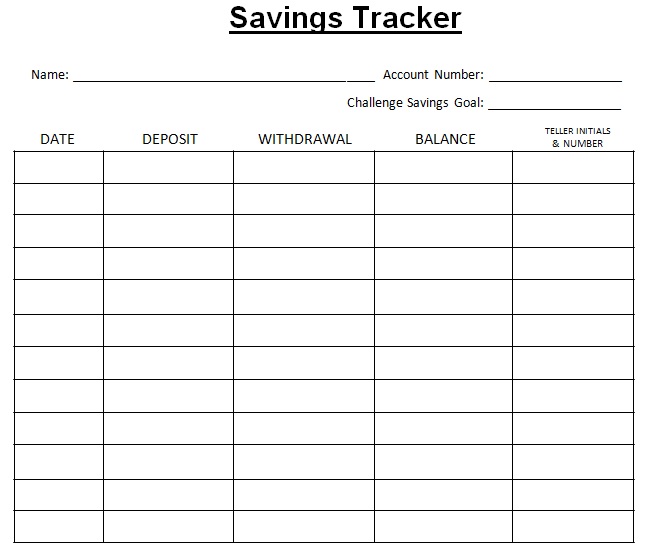

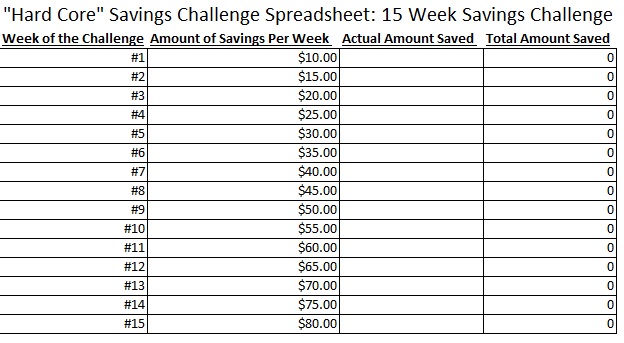

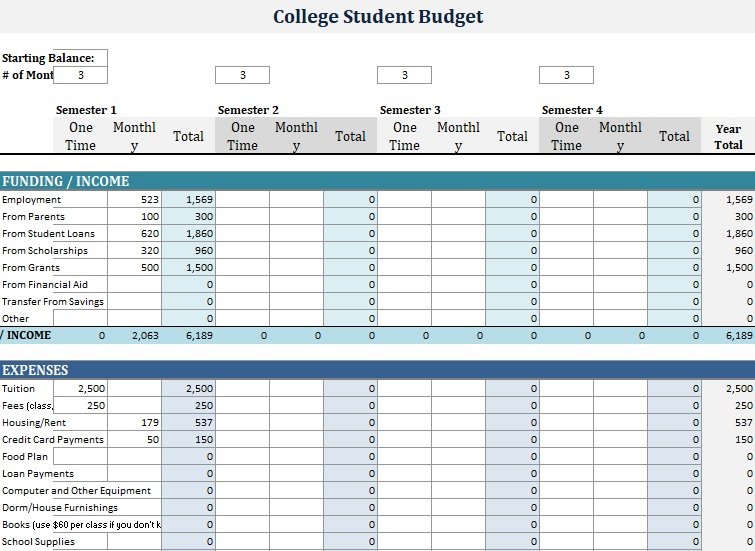

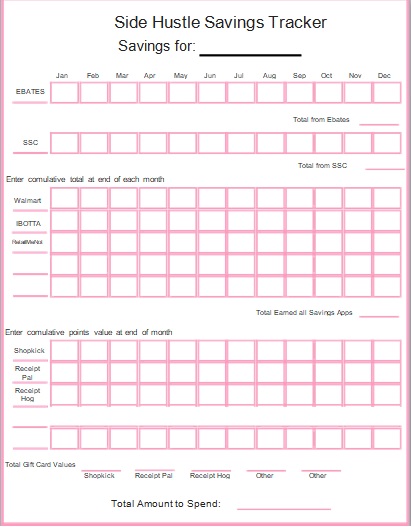

There are different types of savings goal tracker templates. Some are used to present the detailed information and serve the purpose of the expense sheet as well. However, some sheets just record the information weekly to analyze and track the plan and actual savings.

Table of Contents

- 1 What is a savings goal?

- 2 What are the different types of savings trackers?

- 3 Importance of Savings Goal Tracker Template

- 4 How can I reach my savings goal?

- 5 Essential Elements of Savings Goal Tracker Sheet

- 6 How to make a savings budget for your savings tracker?

- 7 How do you use a savings tracker?

- 8 Tips To Do Savings using Savings Goal Tracker Sheet

- 9 Some tips to save money:

- 10 Conclusion

- 11 Faqs (Frequently Asked Questions)

What is a savings goal?

When you set a certain savings goal then this will help you start saving money. However, it is important to save money to achieve a specific goal. Maybe your savings goal is for investing money in your home. Either you can save money for dream vacations or buy a new car. Furthermore, you may also save money for an emergency fund. Once you identify what you are saving for then you will save a certain amount of money that you require to reach a goal.

What are the different types of savings trackers?

You can organize the way of saving money by using a savings tracker or a money goal tracker. Let us discuss below some different types of saving trackers;

- To break down your savings into specific increments, you should use a saving tracker. When you reach that specific amount, highlight the blocks on your savings goal tracker.

- For your savings, you can break down your savings tracker into different areas.

- Make use of an old-fashioned design and some cute icons to design your tracker as a coin holder.

- On your bullet journal, place a money jar and create a drawing of a huge jar that you can break every month. After that, to reach your savings goal, decide on how much to save for each month.

- Draw attractive flowers in a bullet journal to track your savings. A savings increment is represented by each flower petal that you would color every time when you set aside enough money.

- Keep a separate saving tracking when you’re saving up for a new home. In the middle of the page, draw a house that surrounds by bricks and then color one each time when you reach your goal.

Importance of Savings Goal Tracker Template

The savings goal tracker template is helpful in many ways to realize the planned savings for a particular time frame. It is important to understand the significance of savings itself to value the process of being properly tracked. You should also check Wedding Guest List Templates.

There can be the following advantages of savings:

- It makes a person financially independent.

- An asset can be acquired from the saved money or the debt can be paid off.

- The unseen expenses can be managed without any burden.

- The amount in hands allows living a good standard life.

- I can plan to go on vacation for peace of mind.

- Allows thinking about early retirement.

- Allows starting thinking about buying business equipment.

- Gives an Entrepreneurial Thought

How can I reach my savings goal?

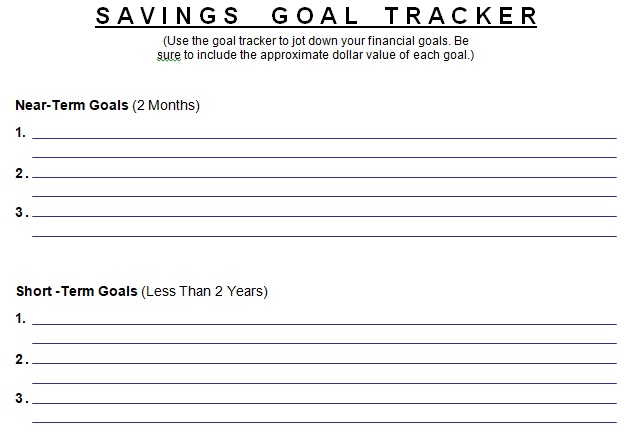

Let us discuss how you can reach your saving goals;

- At first, write down your goals. You have to define and identify what you want in your future. When you write down your goals then you can think more realistically about how to achieve them.

- Your next step is to start saving now. We often consider financial goals less important. But to enhance the likelihood realizing of your financial dreams then it’s important to start saving now.

- After that, start contributing regularly. You should start with the small amounts you save each month because everything in life starts out small. If you have ASP (automatic savings plan) account then you can make regular savings contributions.

- The last thing you have to do is to stick with your plan. If you have an ASP account then you can easily focus on your goal.

Essential Elements of Savings Goal Tracker Sheet

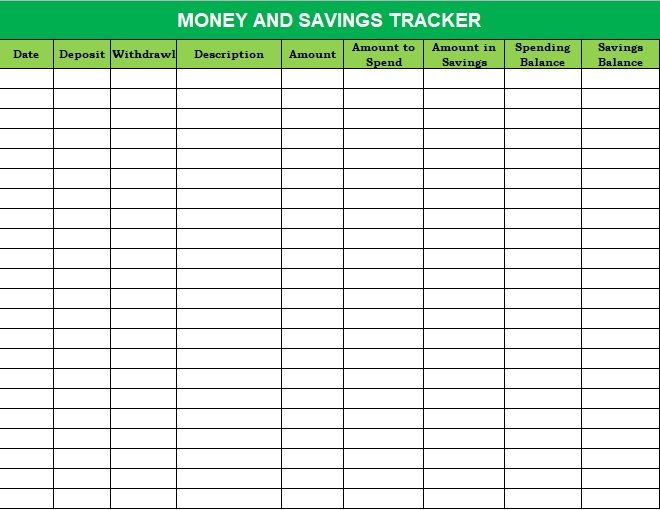

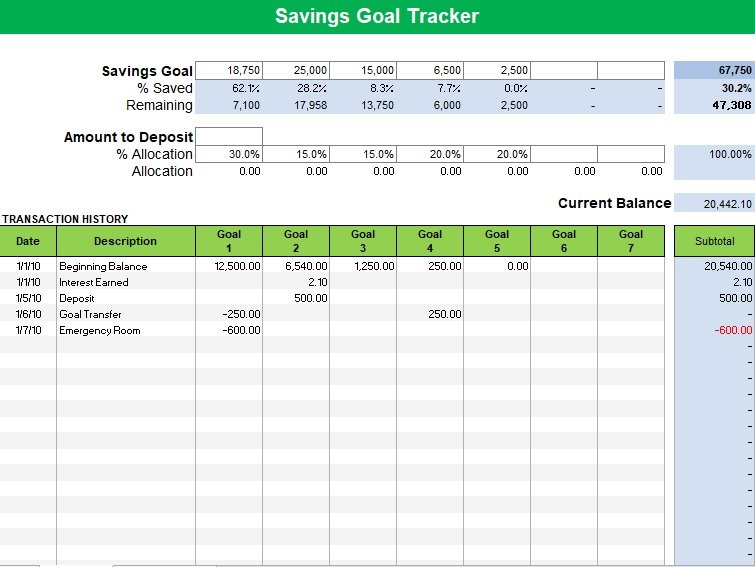

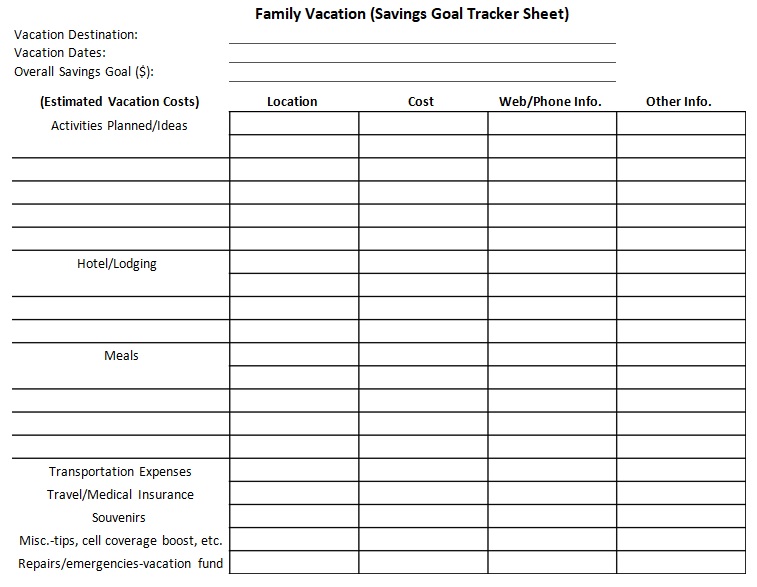

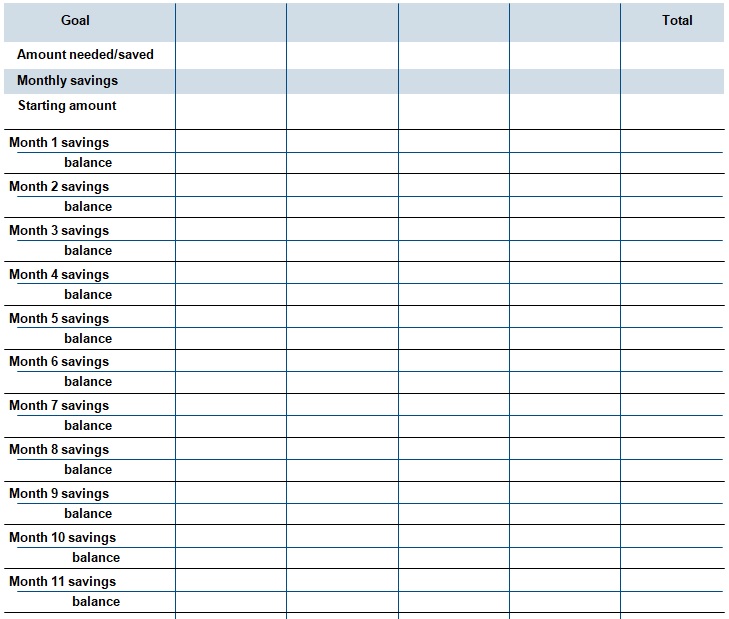

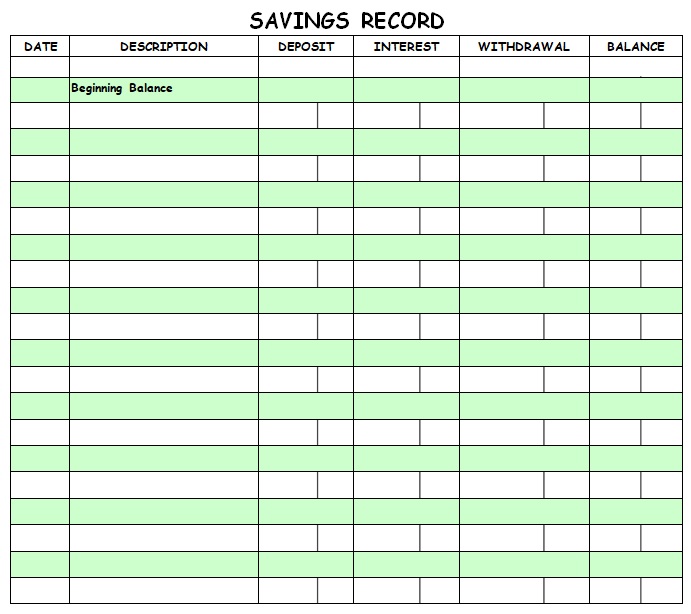

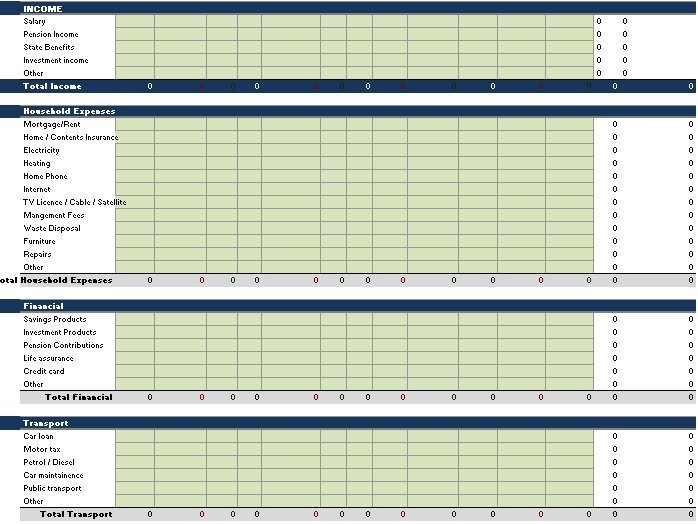

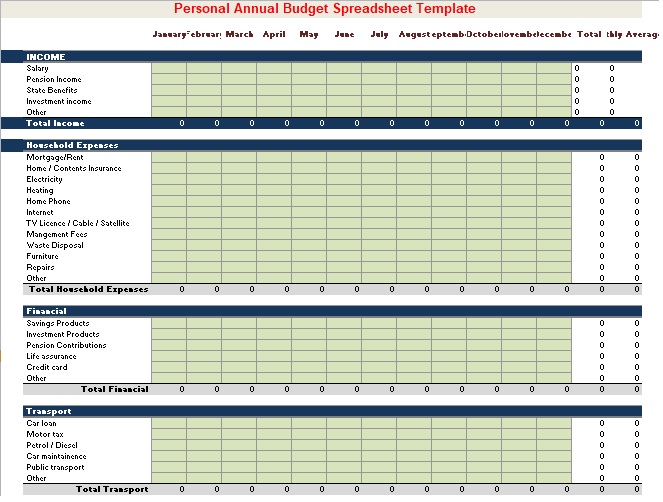

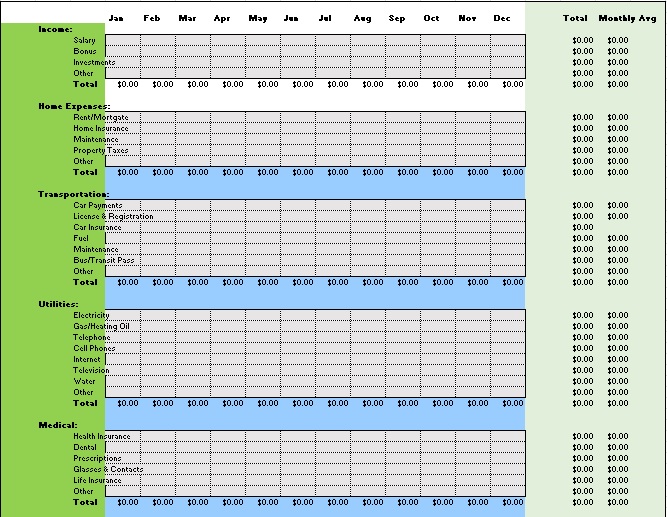

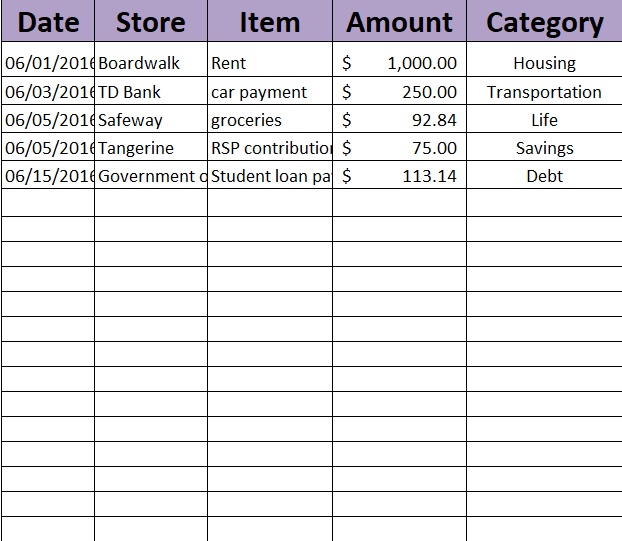

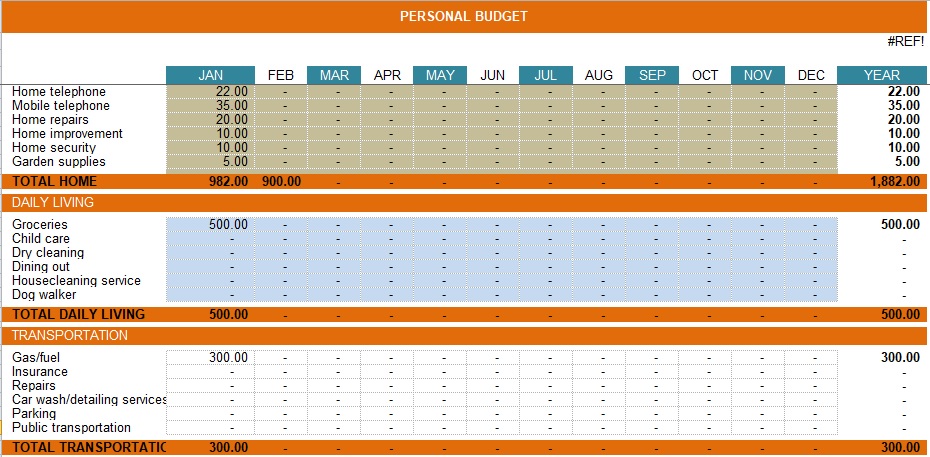

A simple savings goal tracker sheet has two main sections. The top section highlights the target, current balance, and allocation from each expense category. While the lower section notes the details of each transaction.

Therefore, the most important elements of a savings goal tracker sheet are:

- Expense Categories such as Taxes, Medical Bills, Car, Travel, Repairs, Large Items, and others.

- Savings Goal against each expense category.

- Current Balance for each expense.

- % Saved till the date

- Remaining from the Goal

- Amount to Deposit

- % of Allocation

- Amount of Allocation

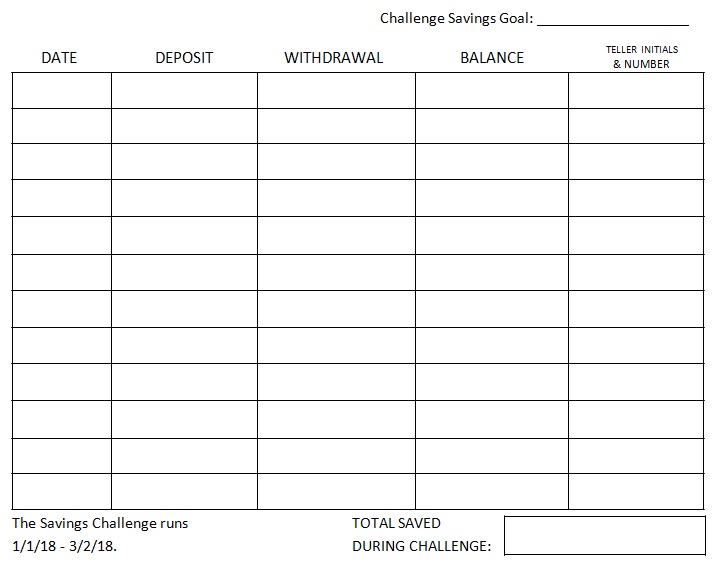

In the details section, the following information is recorded:

- Date

- Description

- Expense Categories

- Subtotal of each date.

- Subtotal of each category.

- Grand Total

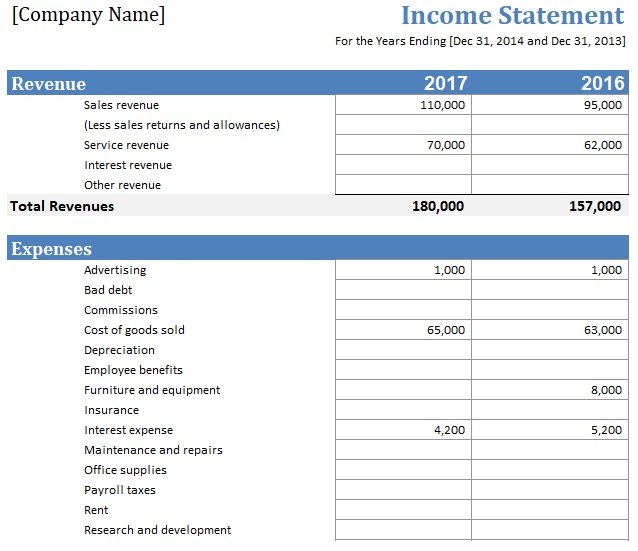

How to make a savings budget for your savings tracker?

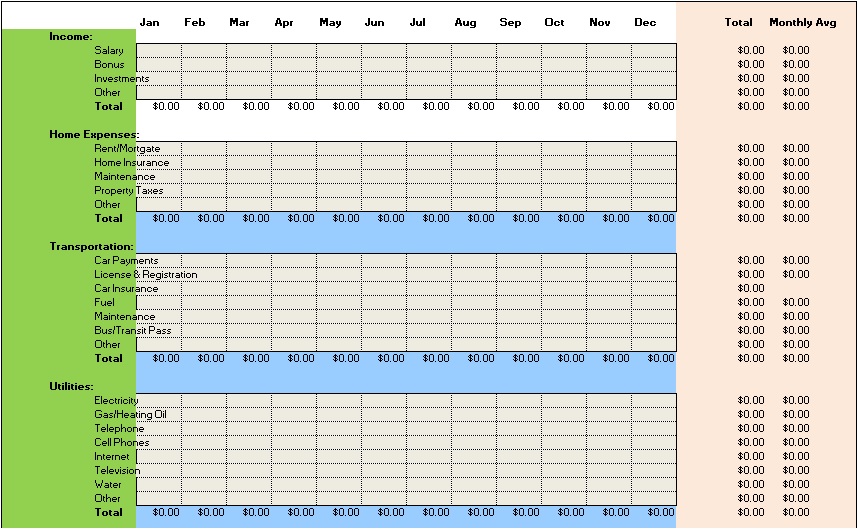

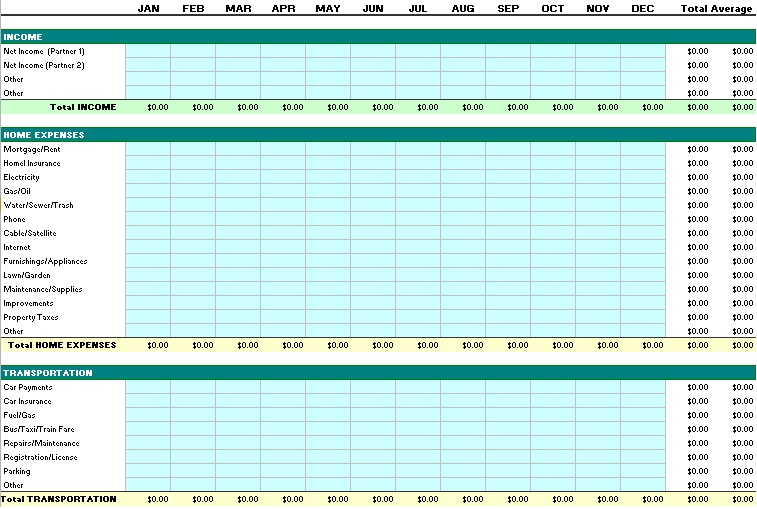

You have to determine all the expenses you incur in the course of one month before making a savings budget for your savings goal tracker. This provides you with an idea of where you are spending your salary. Consider the following steps;

- First, understand the concept of paying yourself first. A lot of financial analysts recommend this method. Here, as part of your saving plans, you set SMART goals.

- Create an expense tracker by using a journal or a computer spreadsheet. At the top, total all your expenses and under each of the columns, entries for costs in the rows. At the end of the month, total all of your expenses.

- You can also include in the expense tracker yearly and occasionally expenses such as;

1- Bi-annual or annual insurance payments

2- Presents for the holidays

3- Presents for other special occasions

4- Costs of vacation

5- Annual dues

6- Doctor’s bills - Now, the total you got, divide it by 12, and then to get your yearly expenses, add this to the total amount from your yearly or occasional expenses. After that, compare your yearly expenses with your yearly take-home salary.

- Go back and check where you can make adjustments in case your expenses exceed your pay. However, you are in a good financial situation in case your salary is more than what you’re spending.

- Comparing your goal to the difference between your take-home pay and your expenses is the next step. You have to reduce your expenses in order to reach your savings goal.

- In the end, divide your yearly savings goal by the total number of paychecks you get in a year. This provides you with the amount that you have to put in your savings every time you receive a paycheck.

How do you use a savings tracker?

A savings tracker enables you to reach your goal. It not only defines and visualizes your goal but also shows a visual representation of your progress. Thus, this savings tracker keeps you focused and motivated by reminding your priorities and the steps you have to do to achieve your goals.

Before using a savings tracker you have to decide the following things;

- For what purpose you are saving money?

- How much money you have required?

- Will, there is a need for savings in the future?

When you know the answers to the above questions then you are ready to start tracking. Other than what you are saving for, you can also use a savings tracker to achieve any goal because it helps you to reach your goal.

Tips To Do Savings using Savings Goal Tracker Sheet

There is a different saving goal tracking sheet. However, the purpose of each sheet is to keep the person aware of the target has been set for doing savings. The total savings of the whole month and the savings from each expense category as per the potential.

However, the following simple tips can be followed to save the money earned after a lot of hard work:

- Learn more and more about financial management and set financial goals.

- Do proper budgeting and plan the savings.

- Try hard to increase earning.

- Stay away from the debt traps.

- Control the unplanned expenses by limiting the use of credit cards.

- Invest in skill enhancement.

Some tips to save money:

Here are some valuable tips that can help to save money;

- Instead of dining outside, you should opt to eat in. This way, you can save a bundle. When you eat at home, you can save a lot of money.

- Don’t throw and donate your defaulted clothes. Instead, you should repair them. You should buy high-quality clothes they may be a little bit more expensive but they will last a lot longer. In addition, you can always have them repaired if they get damaged.

- The clothes that you haven’t used for ages, donate them or sell them to earn a few more dollars.

- Whenever you go shopping, use a shopping list. This way, you can only buy those things that you need. Make a shopping list and stick with it strictly.

- You could drain your cash by buying reading materials. Rather than buying a book to read, you should borrow those bestsellers from your local library.

- Debts can add up fast when you use credit cards as they affect your budget. So, when you go shopping, leave those cards at home.

- Cancel your subscriptions as these are the areas where hidden costs can add up rapidly. In order to ensure that you’re not getting charged monthly fees on apps, you should make it a point to always check your phone app settings.

Conclusion

In conclusion, the savings goal tracker sheet is used to control the budget and save the amount from the expenses as per the set goals.

Faqs (Frequently Asked Questions)

Having a savings goal is a motivational tool. With the help of a savings goal, you known what you will achieve and you are the only head of that goal. It keeps your priorities in focus. Moreover, saving goals also determine what’s important to you. Saving money is easy when you know your priorities. It sets your priorities. Due to these reasons having a savings goal is important.

Long-term savings goals generally demand a huge amount of money. You may take several years to achieve those goals. These goals require more attention than short-term savings goals. Long-term savings goals include a retirement fund, starting a new business, saving money for your child’s bright future, etc.