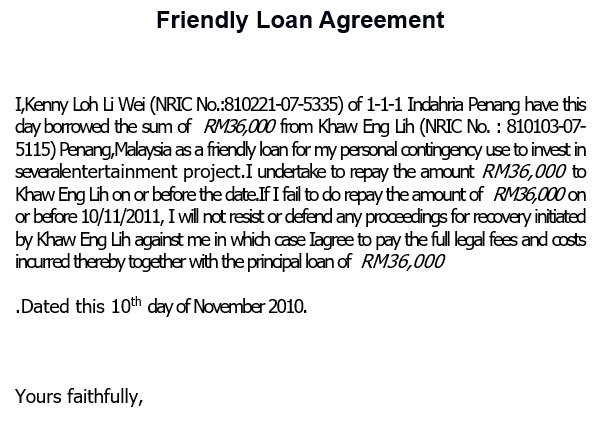

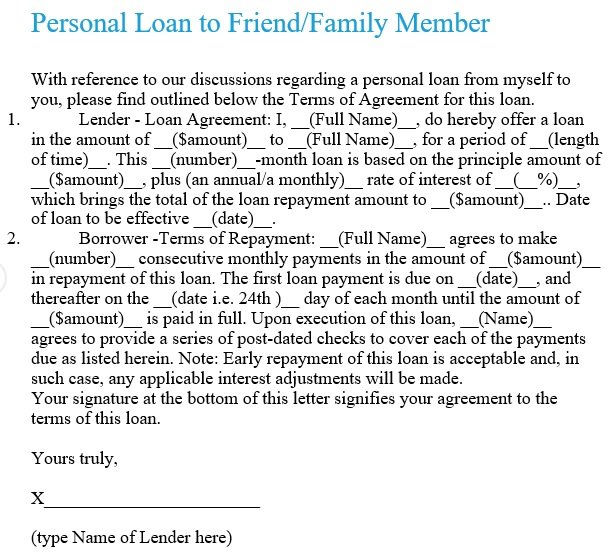

A family loan agreement template is an agreement between members of a family for a loan. This agreement comes in handy when any member of a family needs money as a loan. The purpose of the loan doesn’t matter. Also, this loan doesn’t need the services of a credit union or any other leading entity.

Table of Contents

Things to consider before loaning from a family member:

It is very daunting to lend money to one of your family members. Due to this, you have to be very clear by creating a family loan agreement. Here are a few things to consider before creating a personal loan agreement between friends or family;

Think whether your family member have any other options

At first, you have to identify what the issue is. Ask your family member can you help him/her in other ways aside from providing financial support. If there isn’t any other option then just offer or agree to a loan.

Do you afford to lose the money?

If you are ready to lend money then ensure that you can afford to lose it. There is no need to go out of your way to break the bank especially when you have saved your money for an essential purpose.

Set your expectations

Draw a formidable loan schedule and payment plan that works for you if you have decided to push through. For reference, you should look at different family mortgage loan agreements. In case, your family member doesn’t agree with your terms then don’t have to lend them money.

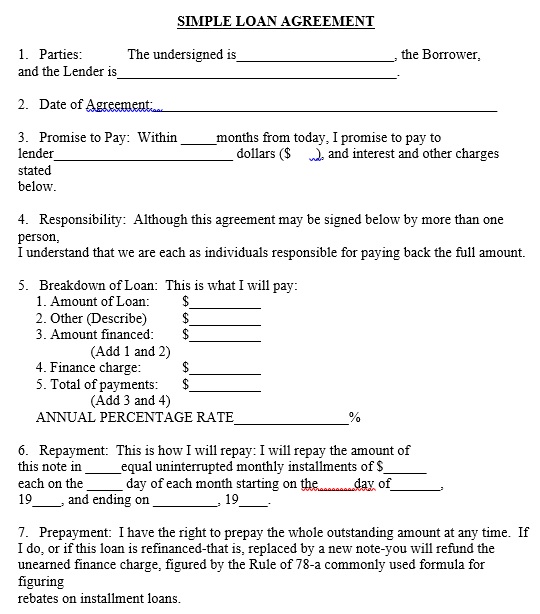

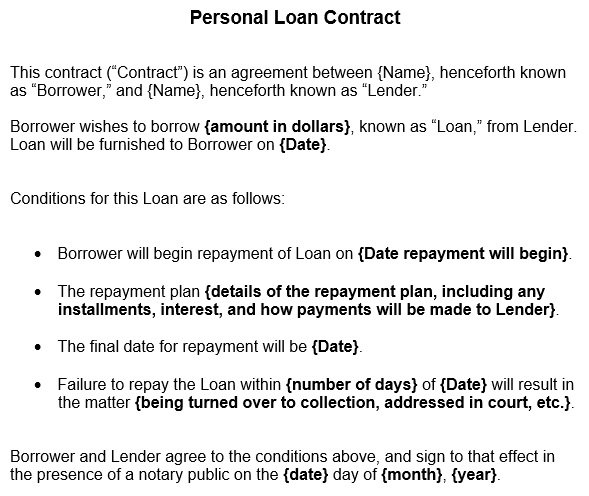

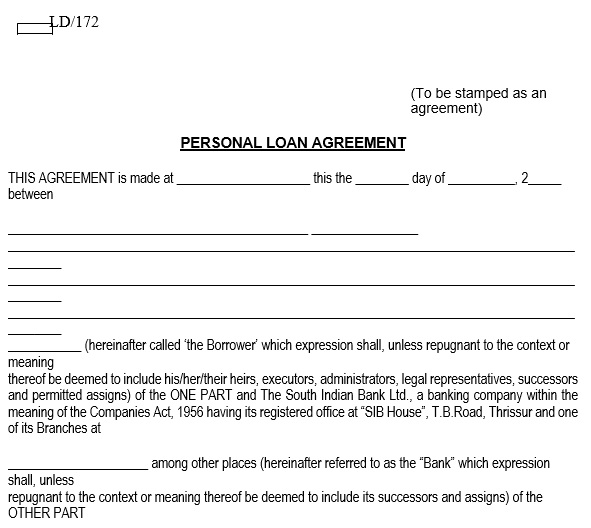

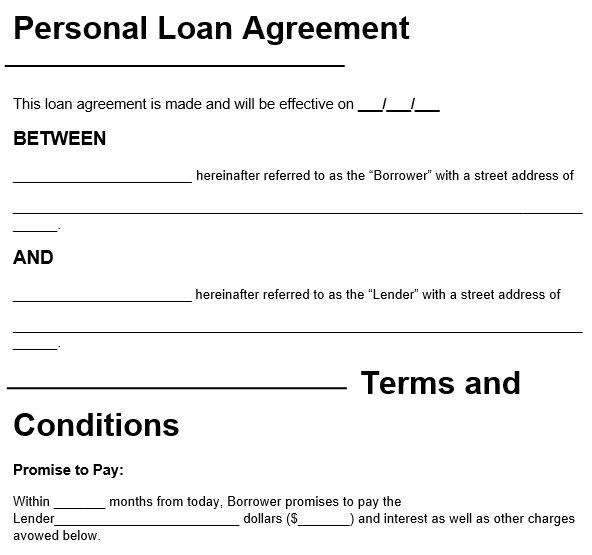

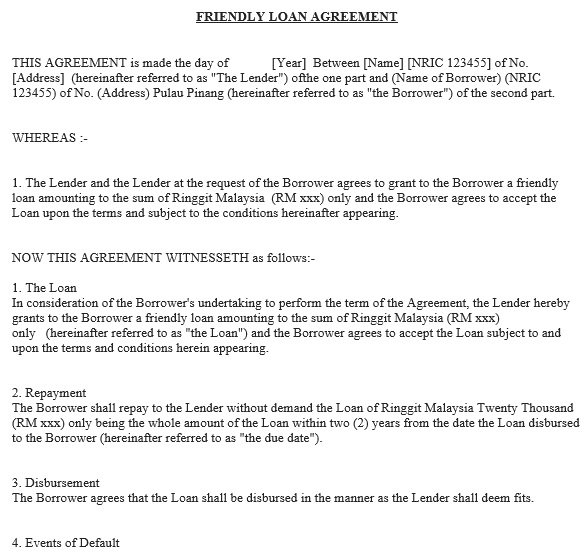

How to write a family loan agreement?

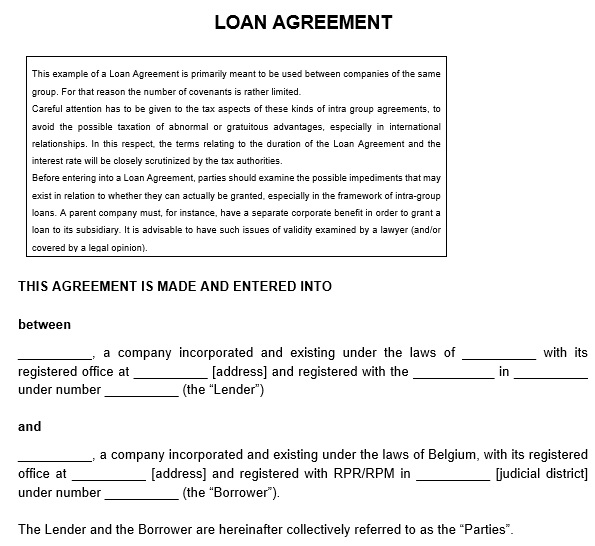

For the IRS, the money transfers made between members of the family are gifts and to proof that the transfer money is the loan you have to show them a family loan agreement. Consider the following steps for writing a family loan agreement;

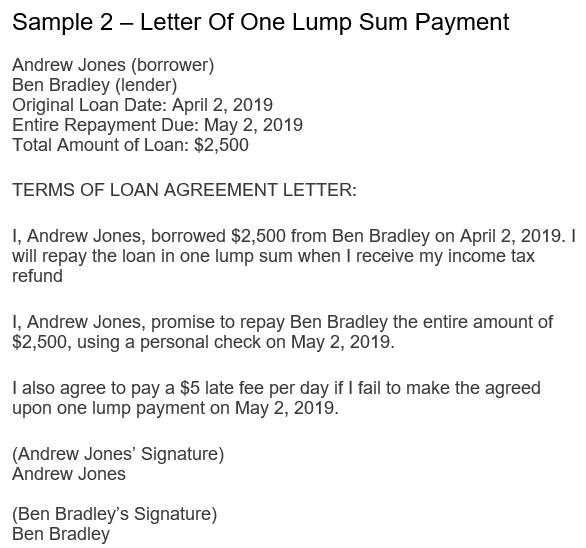

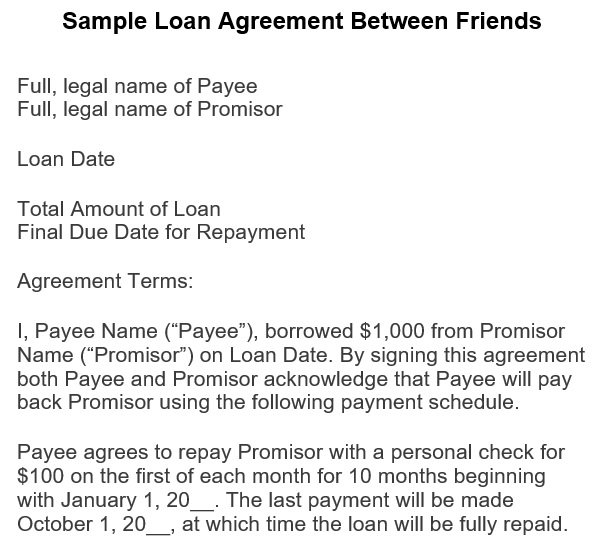

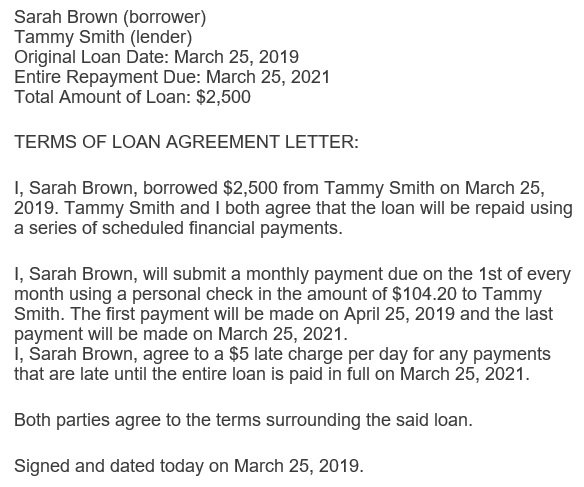

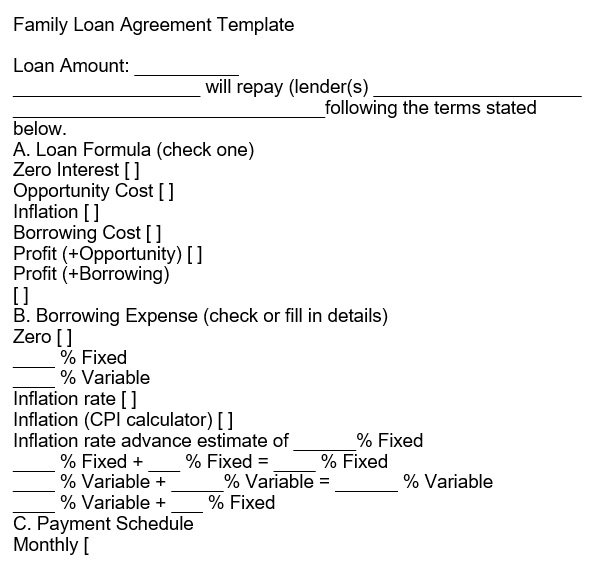

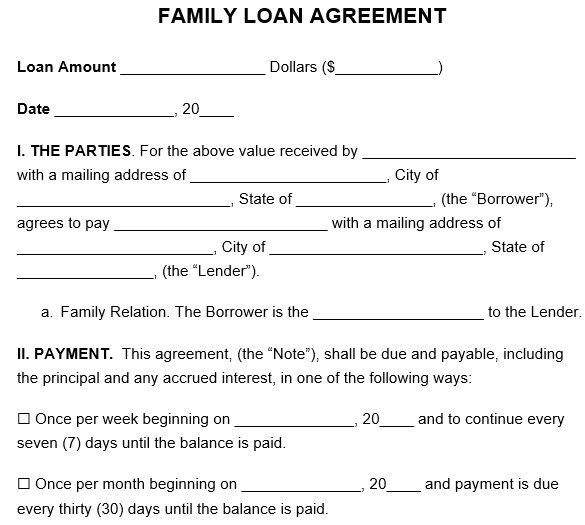

For repayment, come up with a schedule:

You should use a family agreement template that has a repayment schedule. To avoid any misunderstandings or disputes in the future, the best solution to this type of loan is to set up a clear schedule.

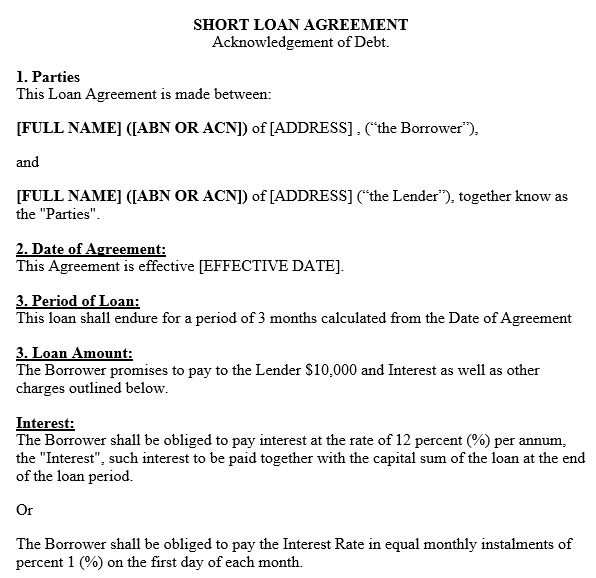

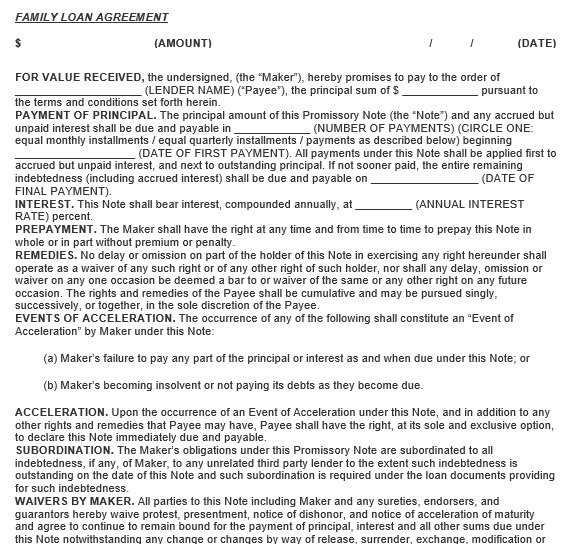

Set and interest rate:

The minimum interest rate that has been set by IRS is known as the “Applicable Federal Rate.” This rate may vary on the basis of the duration of the loan.

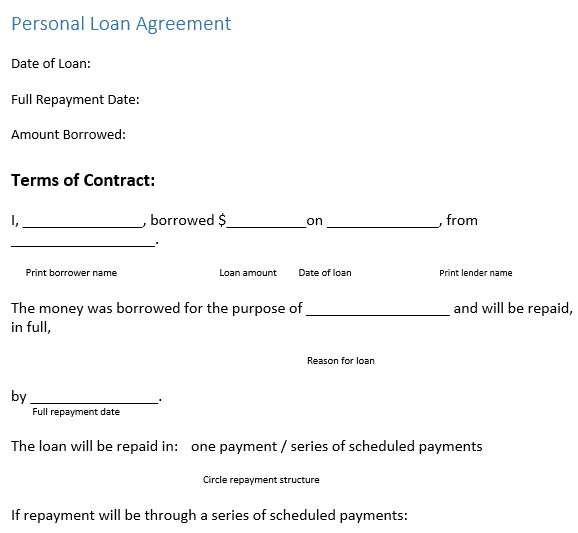

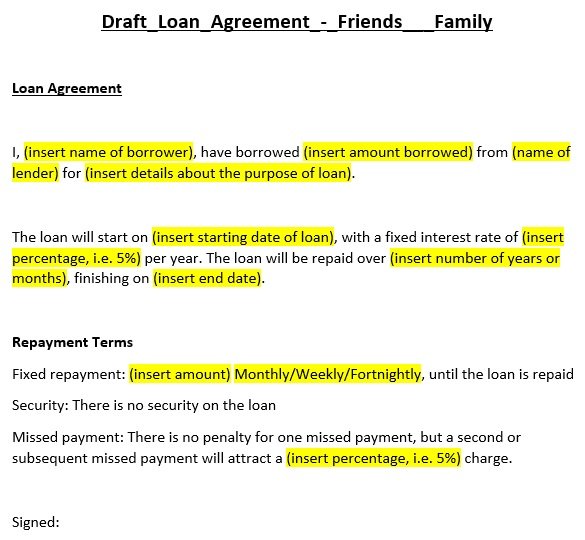

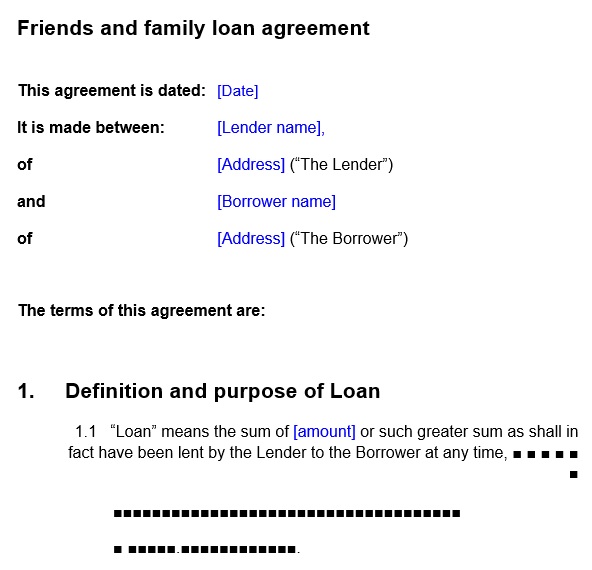

Put your agreement in writing:

It is suggested to place your payment terms and schedule in writing. This provides you a concrete document that indicates your expectation that the family member will pay back their loan.

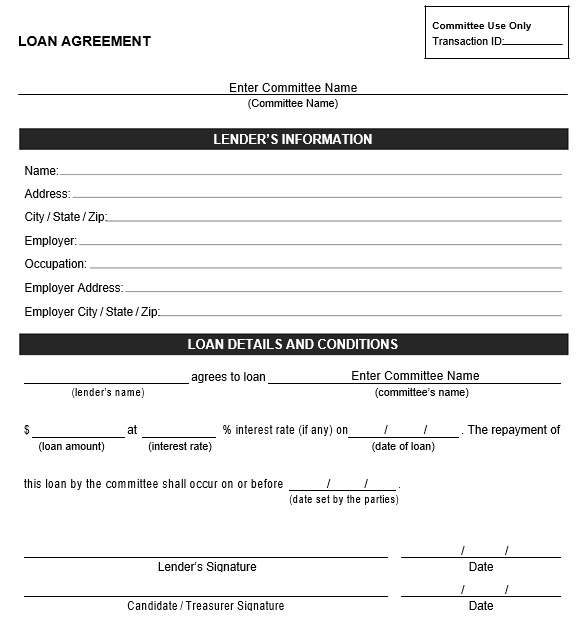

Keep payment records:

All of the payments that the borrower makes, you have to keep a record of them. This assists you in keeping track of the loan’s remaining balance. This assists you with the taxes and keeps you and the borrower on the same page. Moreover, the loans and gifts tax rules can get complex. It is recommended to seek the advice of a tax professional if both parties don’t know the tax implications of family loans.

The money can you loan a family member:

As a lender, this depends on you that how much you are willing to loan and how much your family member requires. Keep in mind that you have to treat a loan to a family member like a business transaction. You should keep the following thing in mind while lending money to family members;

Don’t expect too much

The lender should always keep his expectations low. However, this means that you wouldn’t expect your money back. Also, it doesn’t mean you won’t get your money back. You have to till trust your relative. By having low expectations your loan isn’t repaid.

The repayment of your loan may take time

In case of a family loan, if there is no legal obligations attached to it then the dynamics of loans change. The family members usually seek loans from family as they cannot get this elsewhere. If they get a loan from a financial institution they have to pay very high-interest rates. In addition, they also have to repay the loan faster.

Don’t keep secrets from each other

If you are married and you lend money to a relative then ensure that your partner knows about your decision to lend money. Also, let your partner know about a bank account. When you take out money from your account, it may put a strain on your savings and your relationship. However, it is important to involve your partner while making important decisions.

Minimum interest rate for a family loan:

With the family values and relationships, put an interest rate on money loaned to a relative might clash. This agreement looks like a business deal just like in the case of a parent to child loan agreement. Sometimes you don’t have any option other than to borrow from a family member.

But, you are already foregoing potential earnings from the interest when you advance a sum of money to a family member. You can still charge interest if you are loaning to a member of your family. If you agree on a loan then don’t set an interest rate higher than the “Applicable Federal Rate” set by the IRS.

The risks of family lending:

The lender is always in a higher risk when they lend money to a family member. Lending money to a family member in the default of payment is the most obvious risk. There are situations that may prevent the borrower from paying the loan aside from how reliable a lender believes the family member. This may arise verbal arguments between family members that can destroy relationships.

Moreover, on the lender’s finances, family lending may also have a negative impact. This is because it reduces their funds that affect their capability to meet their requirements. Because of reduced financial gains from lending money to family members, the lenders can get involved in in a precarious financial condition.

The benefits of family lending:

In family lending, a family loan agreement is used. By reducing or pausing the amount paid by the borrower, it makes the lender able to refrain from enforcing loan payment. This way, the lender helps the borrower with emergency funds as well as it makes sure that the money remains within the family when repayment with interest does take place.

Conclusion:

In conclusion, a family loan agreement template is an agreement made between relations by marriage or blood. In this agreement, one party acts as a lender and another party the borrower. The loan receiver has to pay an interest rate. The lender has to include the interest rate in the agreement to make things clear.

Faqs (Frequently Asked Questions)

The main reason of borrowers turning to family loan is the refusal of traditional lending institutions to lend them any money.

These may involve the lender’s direct family like their children, siblings, and other relatives as well as indirect family members like the lender’s in-laws.

Often, family loans don’t bear interest if you want to do so then you can. Firstly, check your laws governing loans and interest rates in case you select to put an interest on top of the principal amount.

There isn’t a specific amount that you can lend to your family members. However, an interest-free loan should be no more than $14,000 as per the IRS annual gift threshold.