In the business world and professional life, it doesn’t matter how honest and loyal you are, your lender will always demand to create a promissory note template. It is beneficial to create a promissory note because it secures the integrity of the loan. Additionally, you can create it by using promissory note templates. These templates are simple to use and have everything in them.

Table of Contents

- 1 What is a promissory note?

- 2 Different types of promissory notes:

- 3 Essential elements of the promissory note:

- 4 The uses of promissory notes:

- 5 Creating a promissory note:

- 6 How to pay back the promissory note?

- 7 Benefits of creating the promissory notes:

- 8 Conclusion:

- 9 Faqs (Frequently Asked Questions)

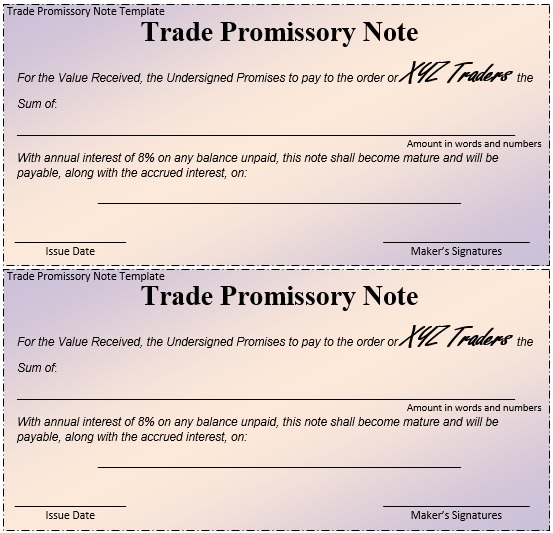

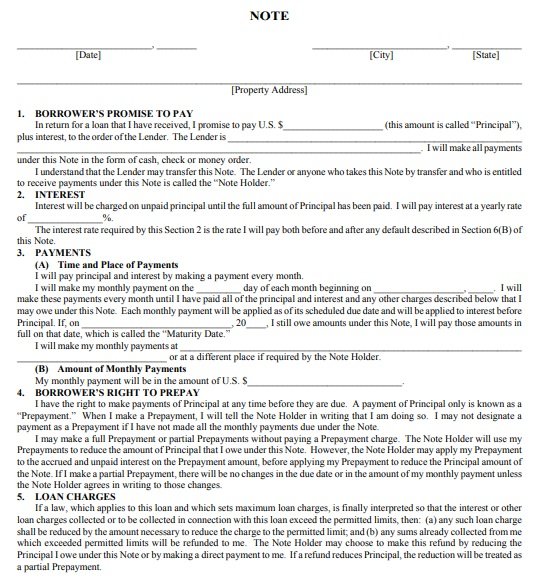

What is a promissory note?

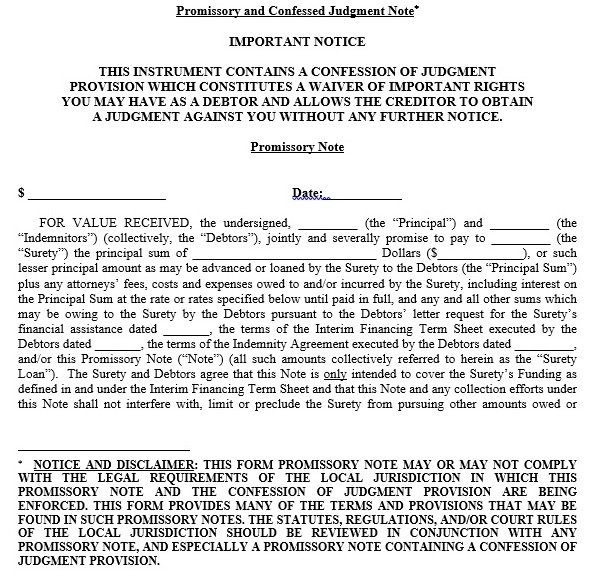

A promissory note is a written promise that is created by a debtor. Basically, it’s a legal financial agreement that contains a payer (maker of the promissory note or debtor) and a payee (lender). Furthermore, this document is used in business transactions around the world as it is a saleable and unconditional financial tool. The lender also used this document to file a civil lawsuit on the debtor, if he fails to pay the loan as per the agreement in the promissory note.

Different types of promissory notes:

Generally, there are two main types of promissory notes;

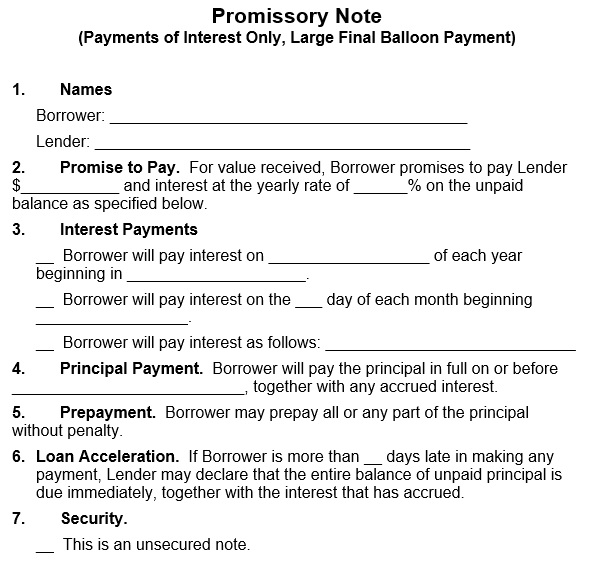

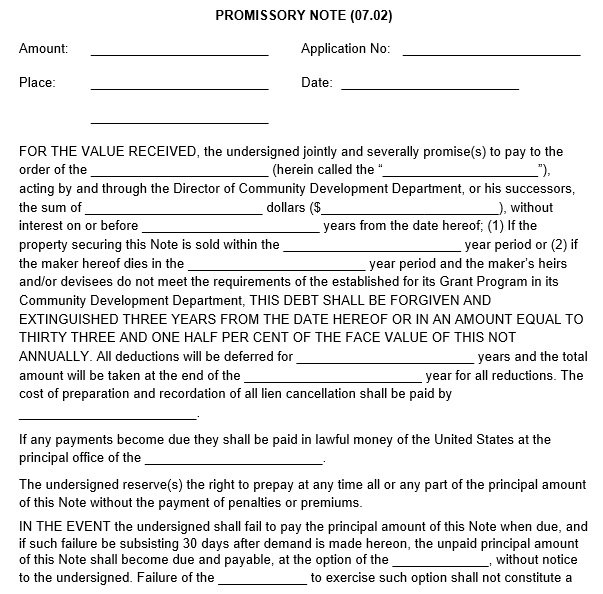

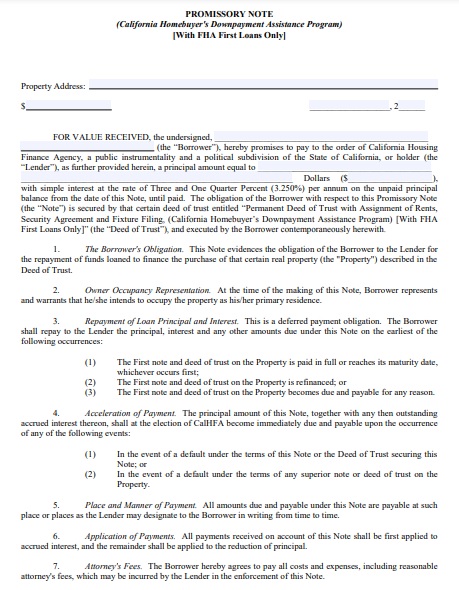

Secured promissory notes:

This type of promissory note has valuable security for the loan amount such as car, house, any valuable property, etc. If the debtor fails to pay the debt amount on the due date then the lender has all the right to take the debtor’s any valuable property which is kept as a security. However, this type isn’t beneficial for the debtor because he can lose his valuable property. But it is useful for keeping the integrity of the note.

Unsecured promissory notes:

Unsecured promissory note, as its name implies, is the ones in which the debtor doesn’t have to put his any valuable things as security. It has legal values and if the debtor doesn’t pay the loan on the due date then the lender can take action against the debtor.

Other types of promissory notes are;

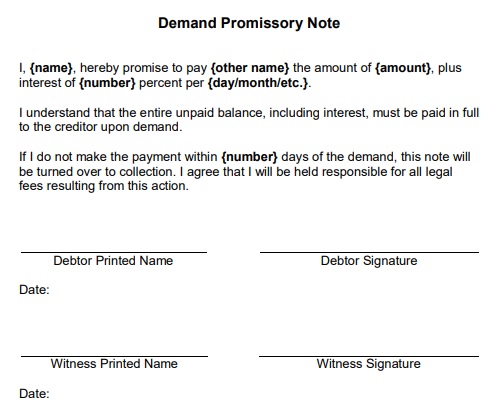

- Demand promissory note

- Due on a specific date

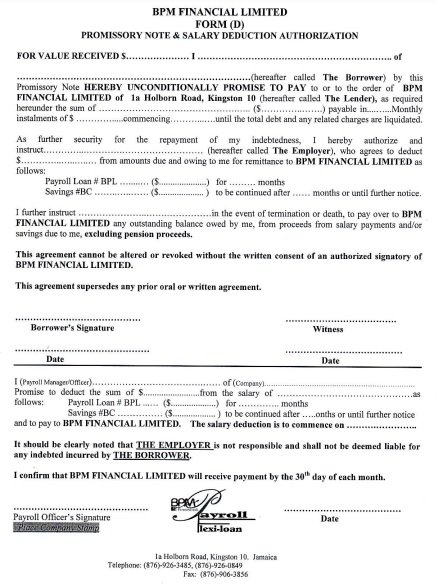

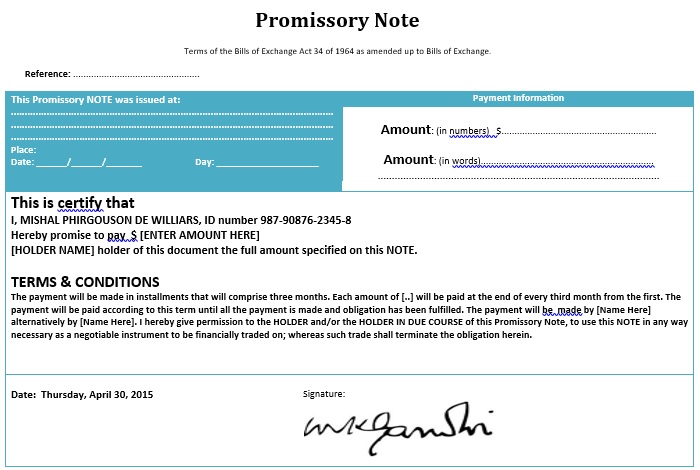

- Installment payment promissory note

- Interest bearing promissory note

- Posted a dated promissory note

- Inland promissory note

- Foreign promissory note

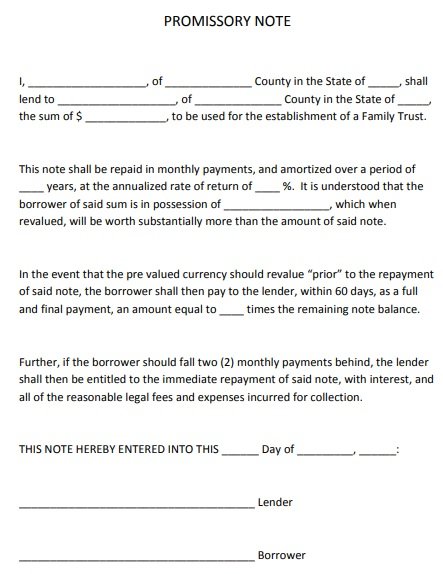

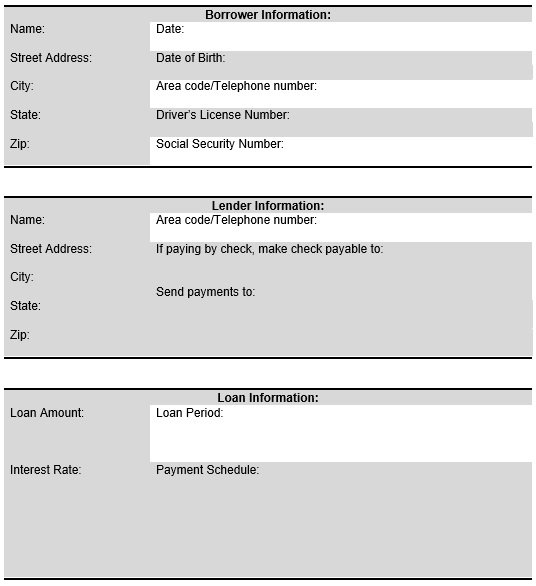

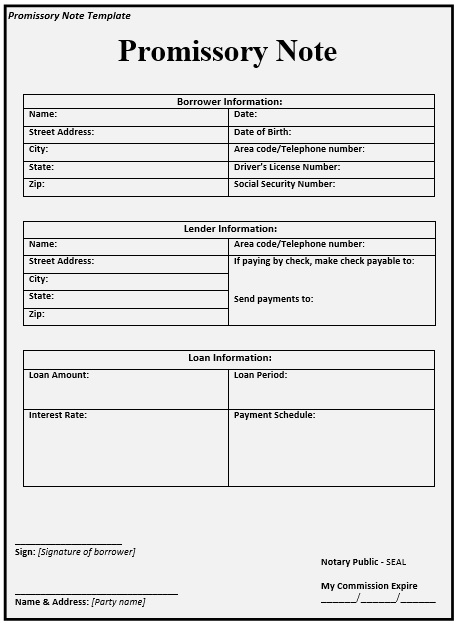

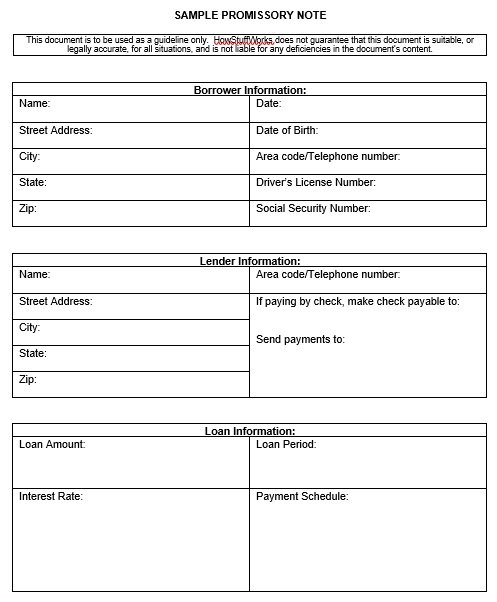

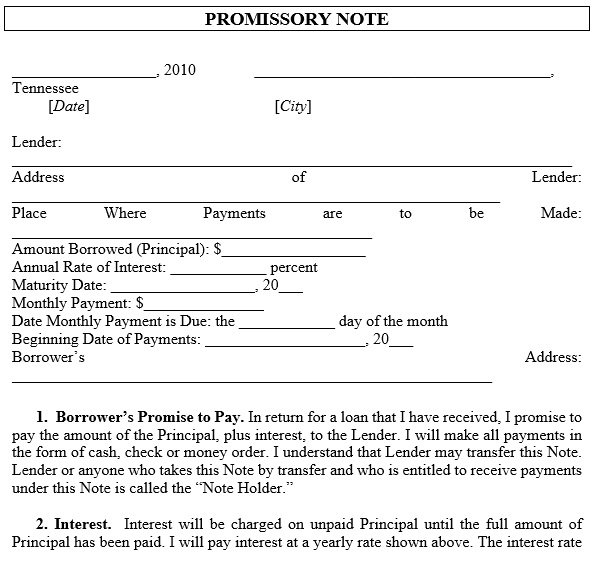

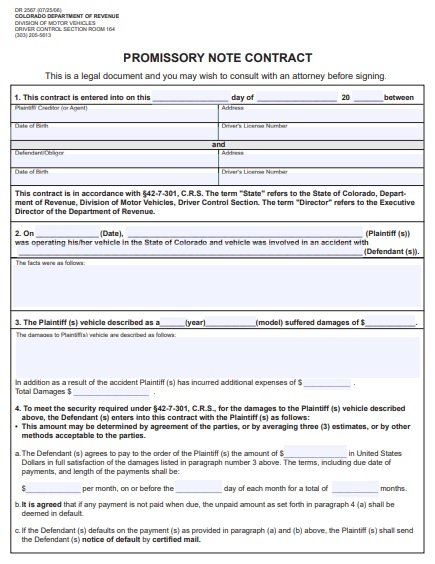

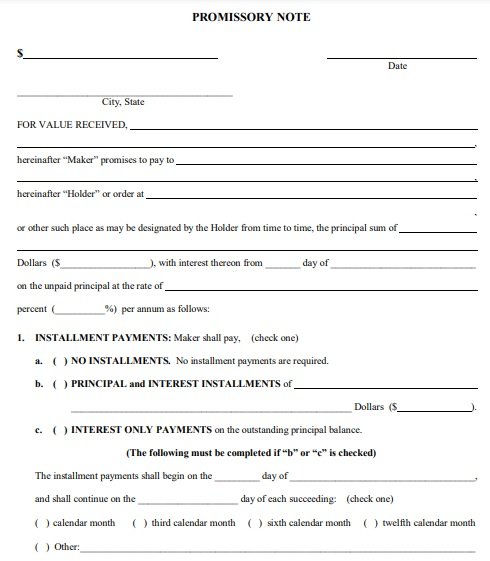

Essential elements of the promissory note:

The promissory note commonly contains the following elements;

The payee:

The payee in the promissory note is the person who is giving a loan to the debtor.

The payer:

The payer in the promissory note is the person who promises to repay the debt.

The amount:

This is the total amount of loan that is taken by a payer.

The date:

Here you have to mention the date of loan issuance and the date (the promissory note ending date) when the payer promises to repay the amount of the loan.

The interest rate:

It is the amount of interest rate either in the form of compounded interest or simple interest. This amount basically charges on the amount of the loan.

Terms:

These are the terms and conditions assuring that if the payer repays the amount of the loan before the maturity date then the penalty can be reduced or eliminated. However, every promissory note doesn’t contain the prepayment penalty.

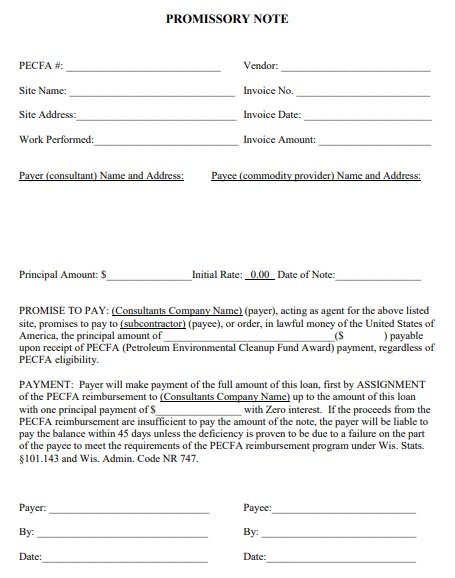

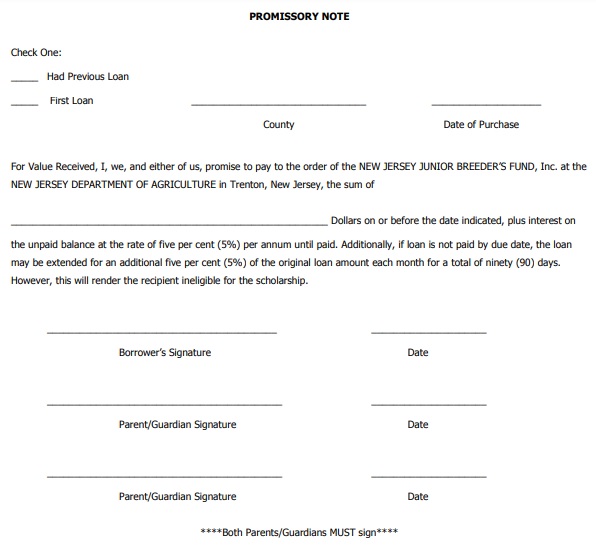

The uses of promissory notes:

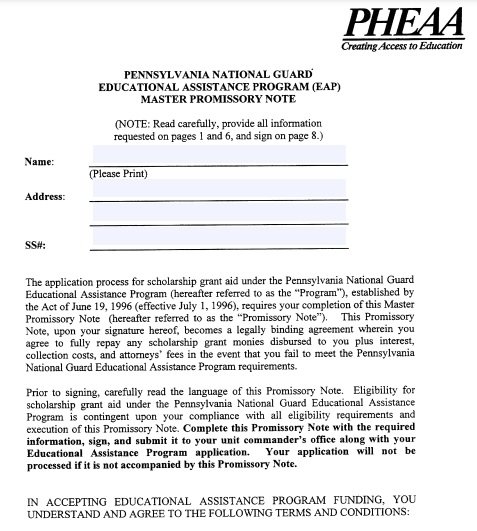

You have to make a promissory note while borrowing or lending money. It must contain payment information, interest rates, collateral, and late fees. There are various types of promissory notes. You can use them for different purposes. Some of them are as follows;

- Personal loans among family members, friends, and colleagues

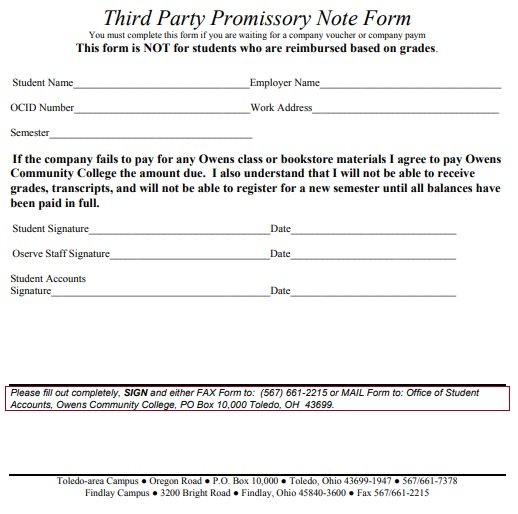

- Student loans

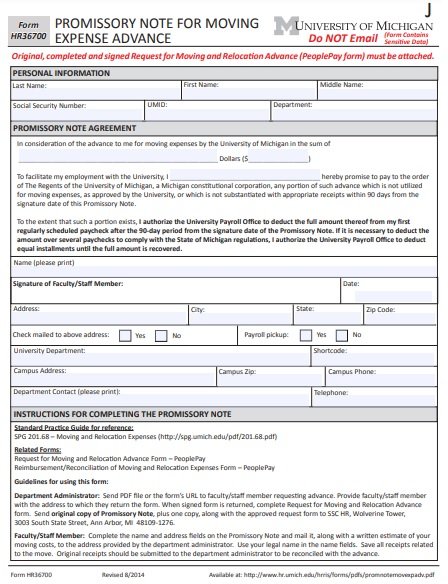

- Automobile, vehicle, or car loans

- Bank loans

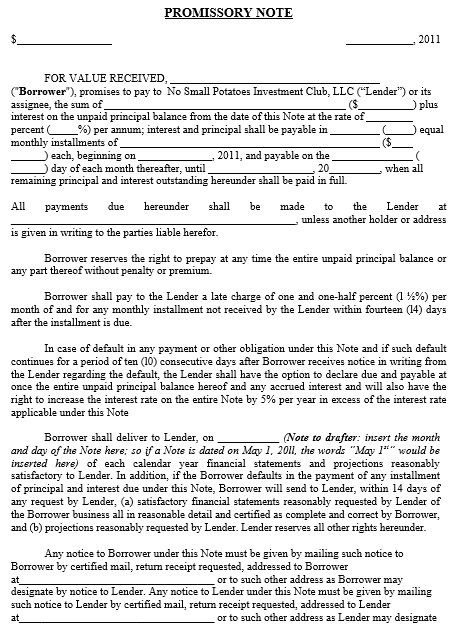

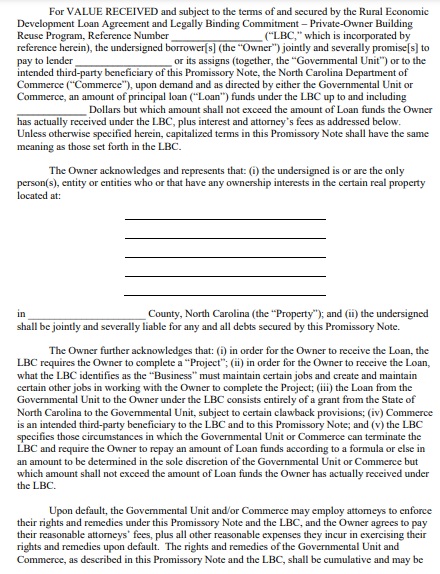

- Business loans

- Investment loans

- Real estate loans

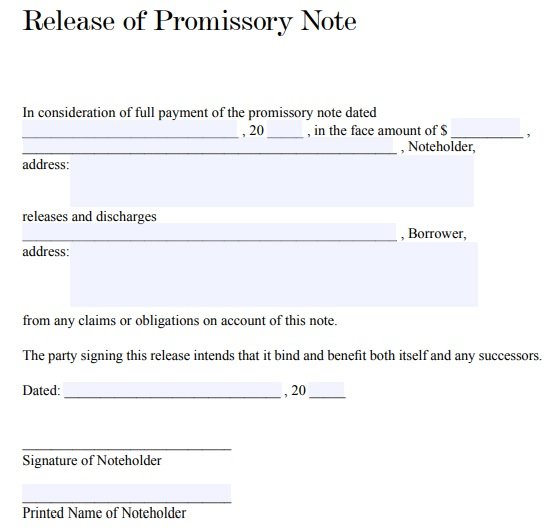

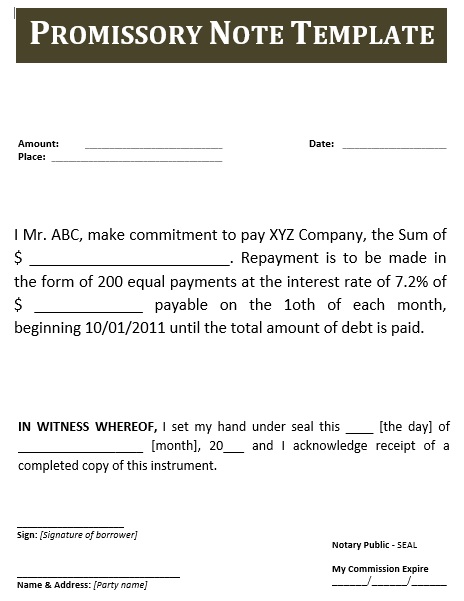

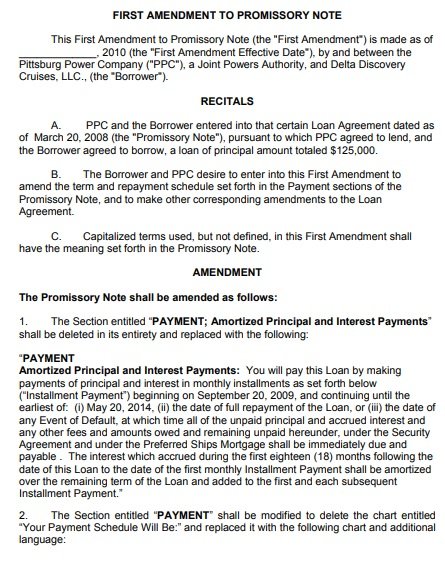

Creating a promissory note:

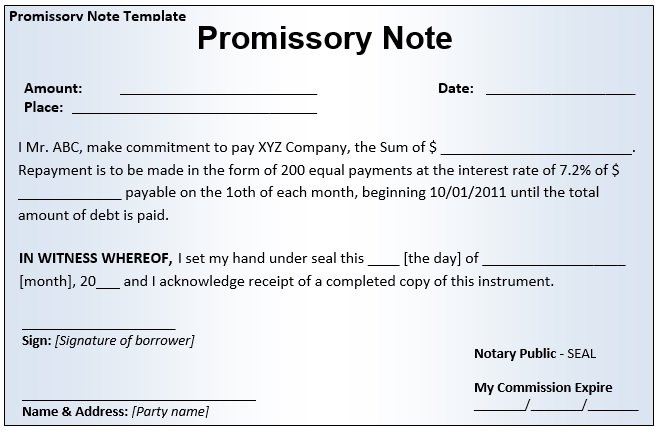

Let us discuss step-by-step how to create a promissory note;

Step#1:

At first, write down the terms and conditions on which both the lender and the debtor have agreed upon. You should mention clearly all the terms and conditions for;

- The amount of loan,

- Repayment dates,

- Interest rates,

- Terms for late payment,

- Amount after applying the interest rate and other default terms and conditions.

Step#2:

Now, after writing all the terms and conditions, it’s time to decide the types of promissory notes. We have discussed above the two types of promissory notes. If you want to avoid potential issues then it’s better to select a secured promissory note. By selecting the secured promissory note, you are giving the right to the lender to take charge of your valuable property in case of a late or missed payment.

Step#3:

In the end, make it enforceable by affixing the signatures of all parties. The promissory note will not be applicable in the court of law if it is not signed. Hence, to make it enforceable, include all the important details such as names of all parties, their contact numbers, and addresses as well as the signatures of the lender and the debtor. The promissory note is considered enforceable if it contains all of this.

How to pay back the promissory note?

It is compulsory to repay the loan given through a promissory note. But, for doing so, there are a lot of options. Let us discuss below those options and the consequences for missed or late payments;

The options for paying back a note

It’s up to you whether pay the whole sum of the promissory note or pay it in installments. The borrower repays the lender in set payments over time while using an installment payment option. Another option is for a promissory note to be paid in installments. In this option, at the end of the agreed repayment schedule, a final “balloon” payment is made.

In case, you are repaying the whole sum of the note at once, it’s up to you either repay by a set due date or repay ‘on demand’ of the lender. The borrower has to repay the lender when the lender requests that money in case there is a ‘due on demand’ payment option.

A prepayment of the promissory note

Prepayment refers to repaying the loan earlier than the due date. Without any penalty, the borrower can repay all or part of the loan at that time. Some lenders ask the borrower to give them a written notice first.

The consequences that borrowers may face if they miss a payment or pay late

If the borrower misses a payment or pays late, they may be subject to late charges and other penalties. These penalties depend on the promissory note’s terms and make sure they fall within legal parameters for lending money.

Benefits of creating the promissory notes:

There are various benefits of generating the promissory notes;

- The promissory notes act as legal proof. It doesn’t matter how credible and reliable you are because in this litigious world no one can trust you. If you ask someone for a loan then he will demand a written promise from you instead of a verbal promise. Therefore, promissory notes are created. They prevent the truthfulness of the loan and act as legal evidence.

- It develops the repayment process as it allows the lender and the debtor to decide on terms and conditions for the repayment process. They mutually decide the schedule of payments such as monthly, weekly, biweekly, or annually at a particular date. In addition, the length of the debt is also decided.

- Most importantly, it resolves the tax issues. On the basis of the length of the loan, there are tax implications on the loan. By having the promissory note, you can get relief from tax as it acts as proof that the money isn’t a gift and is in fact a loan.

- When both the lender and the debtor discuss the constituents of the promissory note clearly then later on all disagreements are eliminated.

Conclusion:

In conclusion, the promissory note should be created if the debtor asks for the loan. This document is beneficial for the lender as it secures the lender money. Moreover, the promissory note binds the debtor to the law. You can also use different promissory note templates. These templates are available on different websites you just have to download them and edit them according to your requirement. After that, print them out and sign the agreement.

Faqs (Frequently Asked Questions)

No, it isn’t a legal requirement to notarize a promissory note. However, if want, you can get it notarized.

Yes, a promissory note can be handwritten but it isn’t easy to add or change information in a handwritten note.

The borrower’s signature on a promissory note is the only signature legally required.

A promissory note becomes invalid if it doesn’t follow state and federal financial and legal regulations.

No, you don’t need witnesses to sign a promissory note. However, in some cases, lenders may require it.