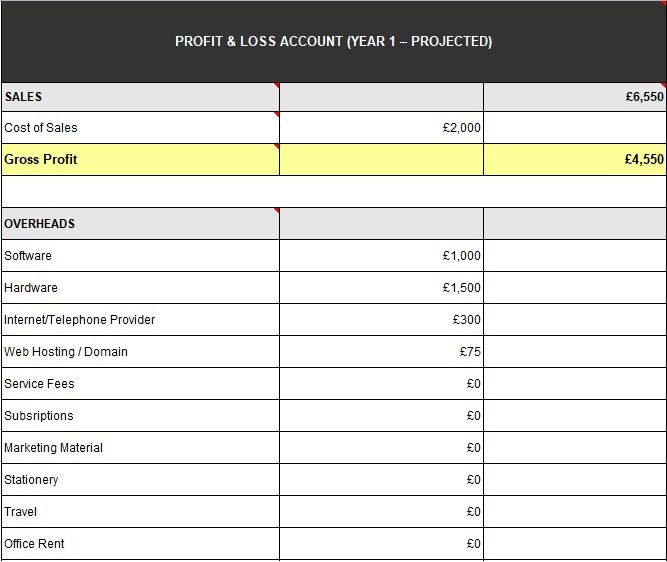

The profit and loss statement is one of the most important financial documents of any company. It consists of a summary of revenues, costs, and expenses for a specific business period usually for a fiscal year.

The profit and loss statement template is similar to the income statement template. This type of financial documents is used to analyze the financial stability of a business.

Also, it assesses the ability of a business to generate profit by managing revenue, costs, or both.

This statement sometimes also referred to as earning, income, financial results, expense or profit, and loss statement.

The purpose of the profit and loss statement template is to manage the revenue and cost of a business to generate profit and eliminate the probability of loss for any period of time. You may also like Debt Snowball Spreadsheet Templates.

Table of Contents

- 1 What is a profit and loss statement?

- 2 Purpose of Profit and Loss Statement Template

- 3 What is present on the Profit and Loss Statement Template?

- 4 The parts of a profit and loss statement:

- 5 What isn’t shown on a Profit and Loss Statement Template?

- 6 How to Create a Profit and Loss Statement?

- 7 Small business profit and loss statement:

- 8 Why should you use a profit-and-loss template?

- 9 Why is a Profit and Loss Statement important?

- 10 Faqs (Frequently Asked Questions)

What is a profit and loss statement?

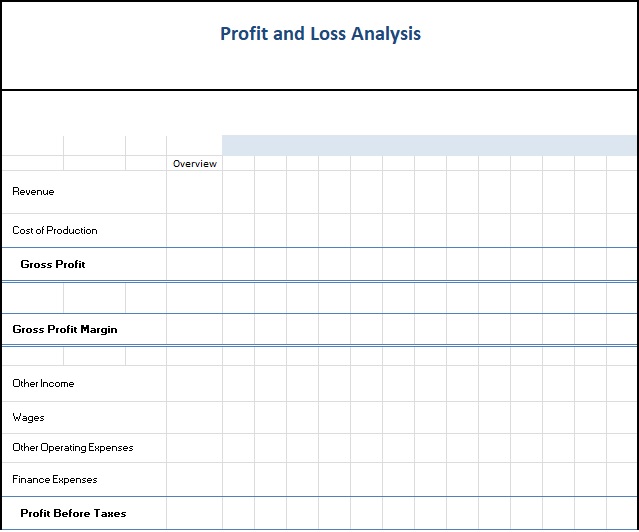

A Profit and Loss (P&L) statement is a financial statement that provides a summary of the company’s revenues, expenses, profits, and loss over a specified period. This statement is also known as an income statement or statement of operations.

The profit and loss statement is one of the three financial statements issued by the company along with the balance sheet and cash flow statement quarterly and yearly.

P&L statement along with the balance sheet and cash flow statement provides an in-depth look at the company’s financial performance. It is considered to be the most popular financial statement in business plan as it provides quick information about how much profit/loss is generated by a business.

Purpose of Profit and Loss Statement Template

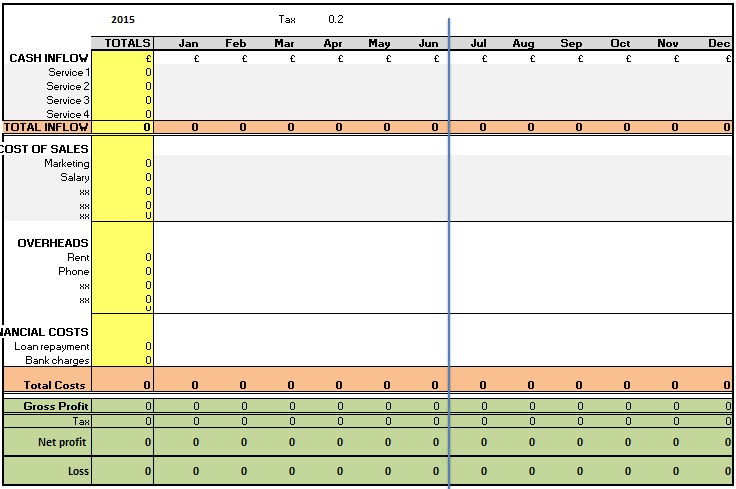

The basic purpose of using a profit and loss statement template is to check the profitability and sustainability of the business.

So, a resultant profit in the income statement means the business is revenue more than its expenses. On the other hand, a loss means the expenses are more than the revenue of the business.

Therefore, the profit and loss statement is used to answer a lot of questions such as;

- Is there enough revenue generated by the business to cover the costs?

- How much is the return of investment for the expenses of the business?

- Is the business profitable?

While profit and loss statement template can be used to record the top and lowest-earning revenue and spending. Also, it calculates the gross margin of business by dividing the costs of goods sold by generated revenue.

Moreover, the profit and loss statement template presents the factors impacting the growth and profitability of the business.

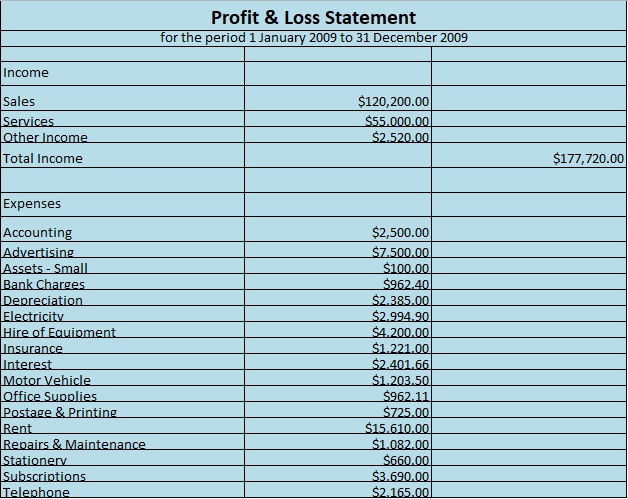

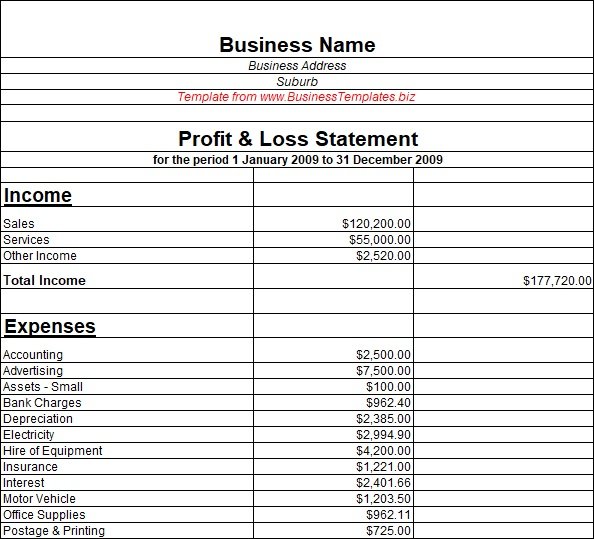

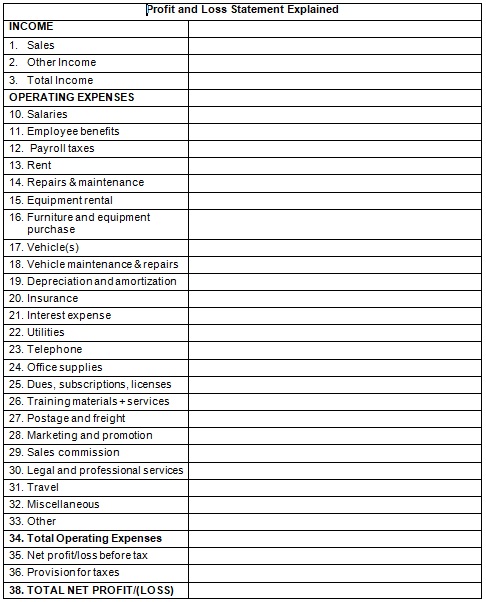

What is present on the Profit and Loss Statement Template?

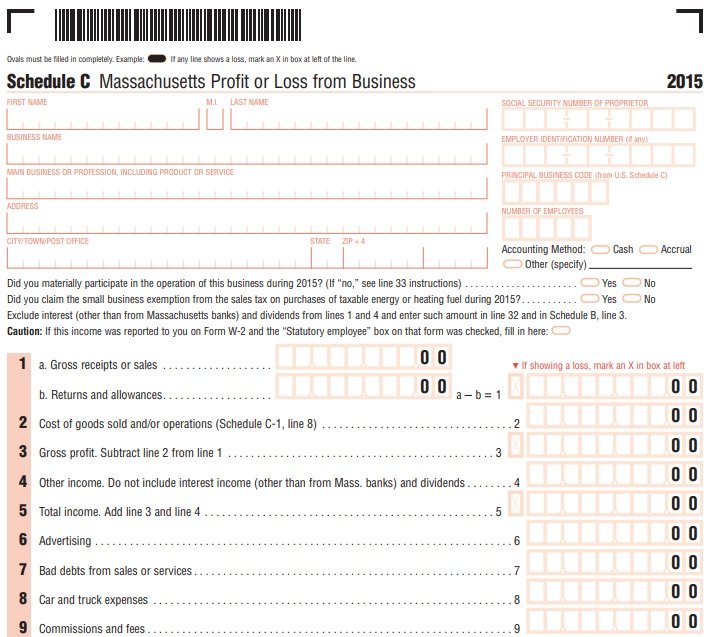

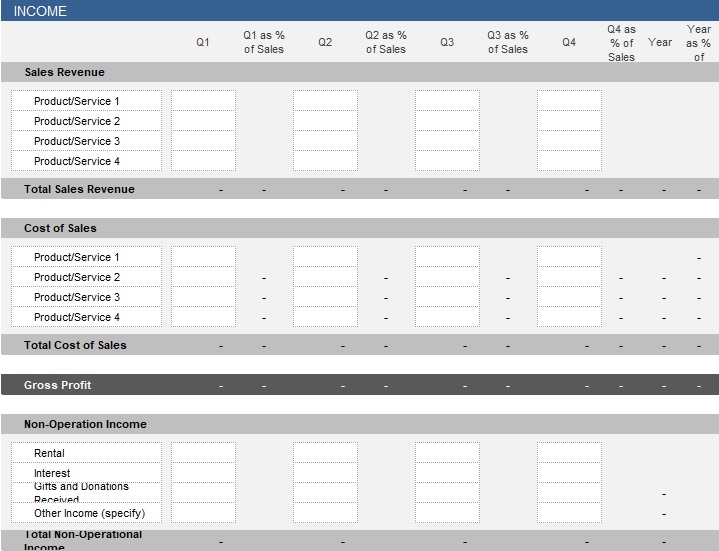

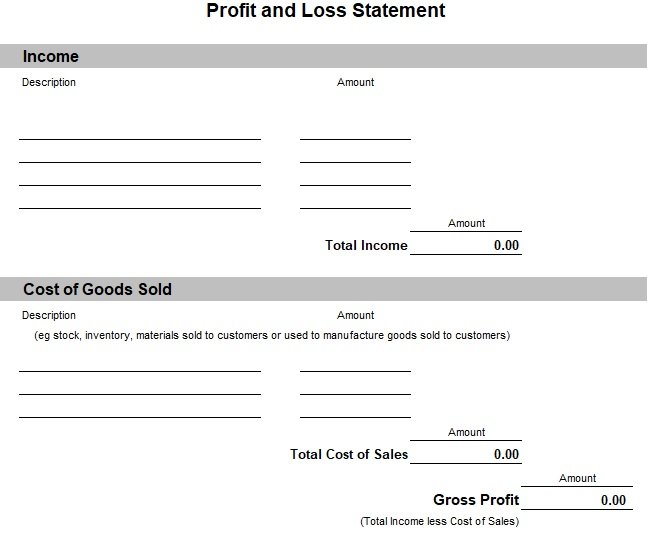

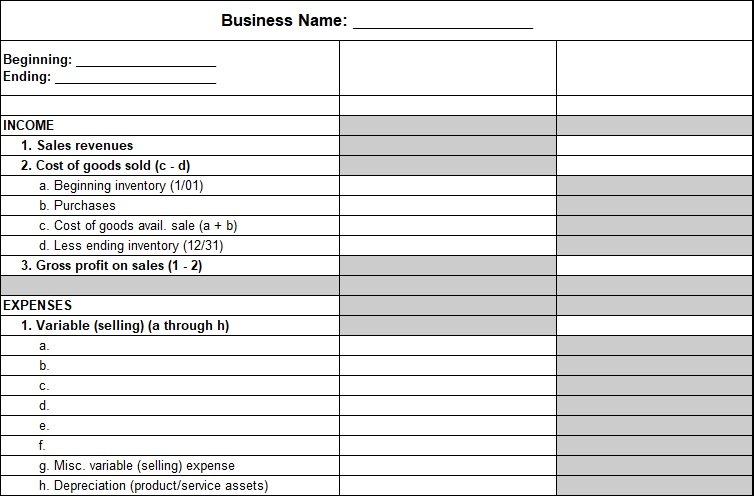

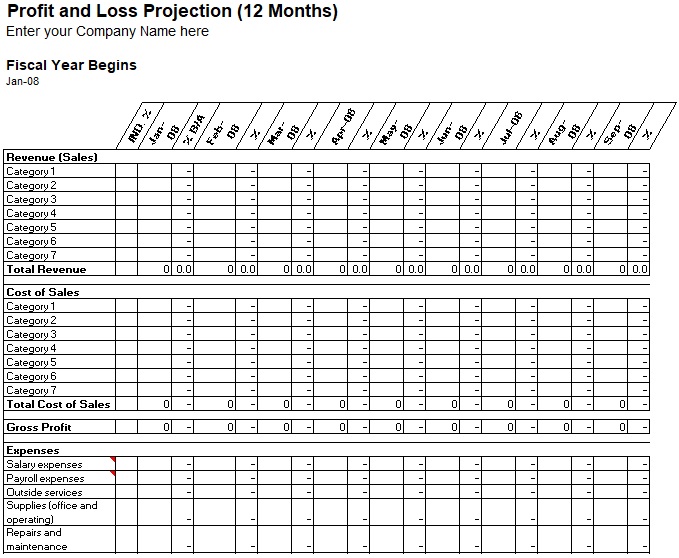

There is a specific set of information that must be present on the profit and loss statement template. So, to achieve all the benefits mentioned in the above section. The profit and loss statement template has the following major sections. You should also check the Stock Certificate Template.

- Income

- Cost of Goods Sold

- Gross Profit

- Expenses/Costs

- Net Operating Income

- Other Income

- Other Costs/Expenses

- Net Other Income

- Net Income

Each of the above sections is sub-categorized. The income section enlists all the sources that generate revenue for the business.

While the other income sources can be anything that isn’t directly linked to the core competencies of the business but generates some revenue.

Expenses record the list of all costs incurred by a business to produce the products. While other expenses may include anything such as taxes and penalties.

The net income of the business can be calculated by extracting the cost of goods sold, expenses, and other expenses from the sum of income and other income of the business.

The parts of a profit and loss statement:

Let us discuss below the four main elements of a profit and loss statement;

Business revenue

The total business revenue is the first section of a profit and loss statement. It is the sum of everything the company made for a particular period. You have to track all money coming in for business revenue. Use the following formula to calculate your business revenue;

Total number of units sold x average price

Business expenses

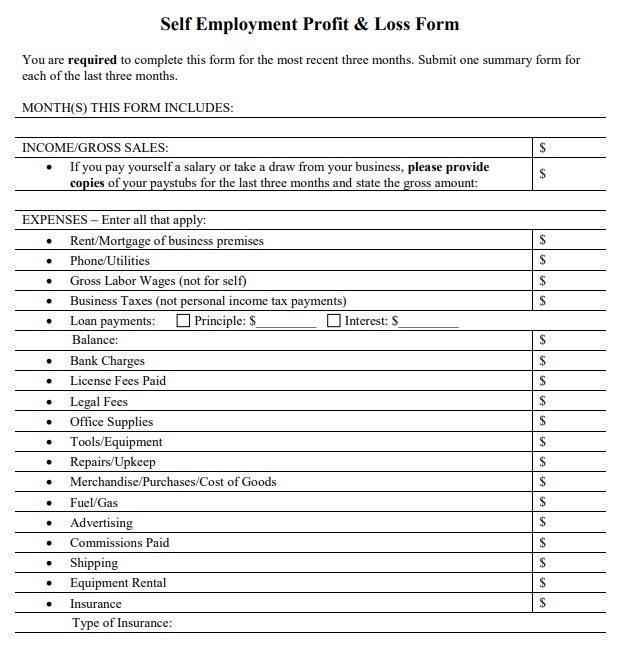

The costs you incur for running your business are your business expenses. Some examples of business expenses are;

- Building rental

- Utility bills

- Payroll

- Insurance

- Office equipment

- Marketing

Some expenses are variable and some are fixed. It is important to understand which is variable. This is because the variable expenses can fluctuate from one statement to the next.

Net revenue

Net revenue is the total income you generate minus adjustments. These include the following;

- Returns

- Refunds

- Discounts

- Commissions

You can use the below-mentioned formula to work out your net revenue;

Gross revenue – adjustments

Profit

To calculate your company’s profitability, start with the following formula;

Net revenue – business expenses

You just have to subtract the total business expenses from the net revenue figure to calculate your profit. You are in the black if you get a positive balance and you are in the red if you receive a negative balance.

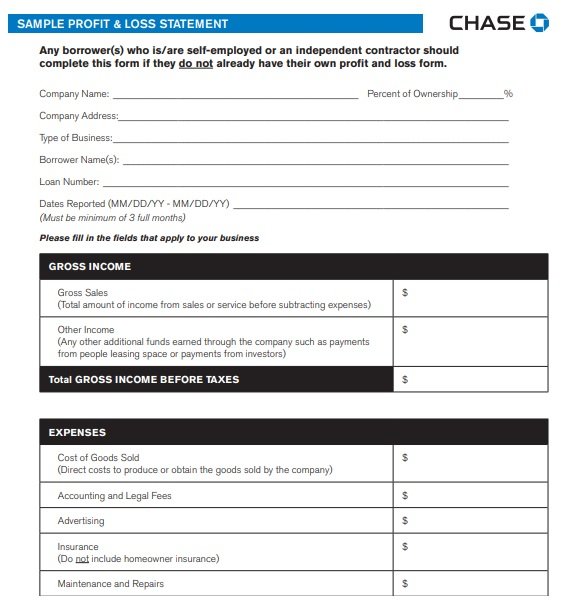

What isn’t shown on a Profit and Loss Statement Template?

To differentiate between the profit and loss statement and other financial statements. It is important to keep the information within a specified limit to make it effective. You can also free download Monthly Financial Management Report Template.

The information that must be present on a profit and loss statement template is revenue, costs, and cost of goods sold. While the profit and loss statement should include any information about the assets, liabilities, and equity of the business.

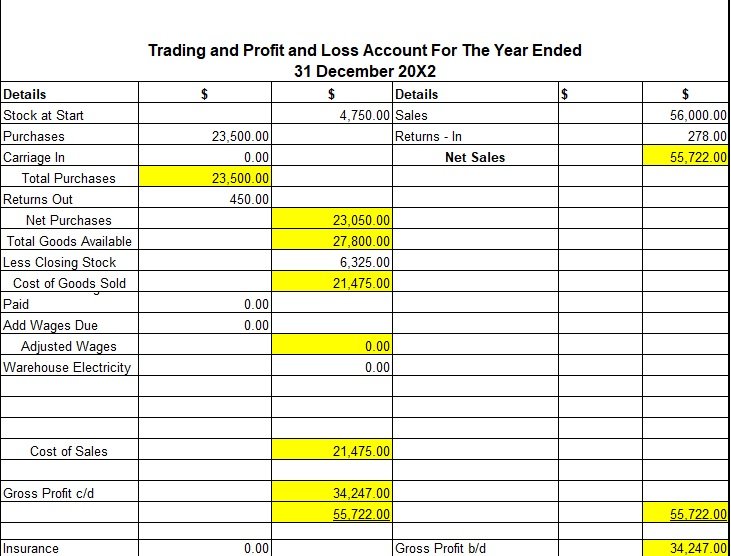

How to Create a Profit and Loss Statement?

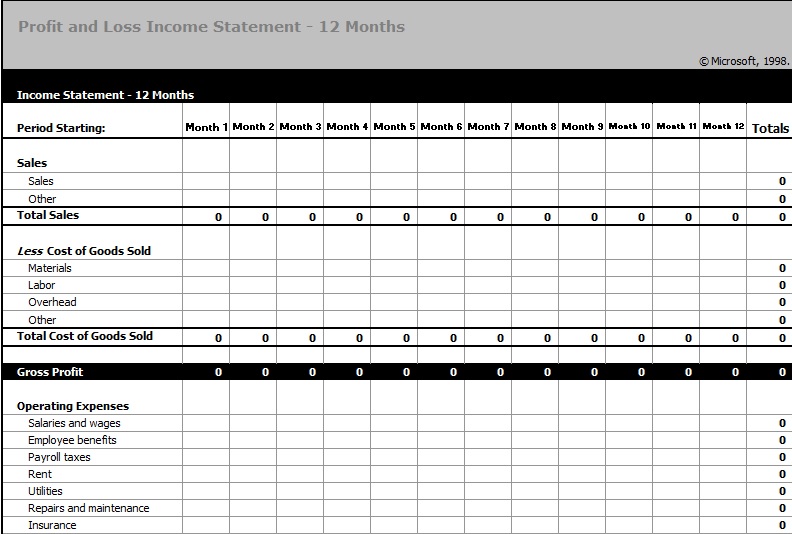

Here are the steps for creating a profit and loss statement for your business.

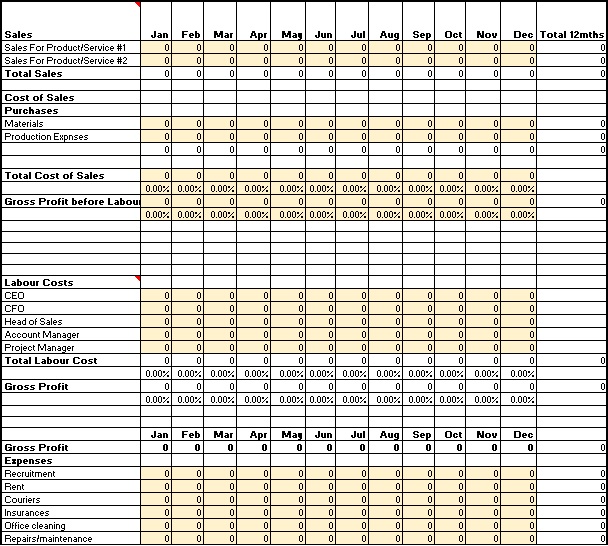

- Firstly, you have to calculate all the revenues your company has received. If you are building a monthly P&L statement then you have to include all the revenues that were received in that time frame. From general ledger and current account receivable balances you can get current account balances.

- Then, calculate the costs of goods sold; it is important for any profit and loss statement.

- After that, subtract the costs of goods sold from your calculated revenue to get the gross profit (the profit that a company earned by selling their goods or from their services)

Gross profit= revenue – costs of goods sold - The next thing you have to do is to calculate all your operating expenses.

- Now, for obtaining operating profit/loss subtract the operating expenses from the gross profit.

Operating profit/loss= gross profit- operating expenses - If you didn’t include any additional income such as interest income and dividends from investments in revenue then add them in operating profit to get EBITDA (Earnings before interest, taxes, depreciation, and amortization).

EBITDA= operating profit + additional income - The next step is calculating the interest, taxes, depreciation, and amortization expenses.

- In the end, by subtracting interest, taxes, depreciation, and amortization expenses from EBITDA you finally obtain the net profit/loss.

Net profit/loss= EBITDA – (interest, taxes, depreciation, and amortization)

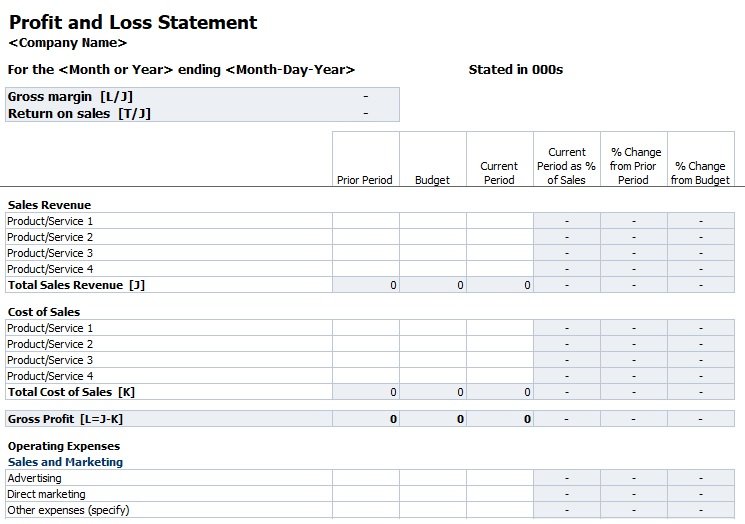

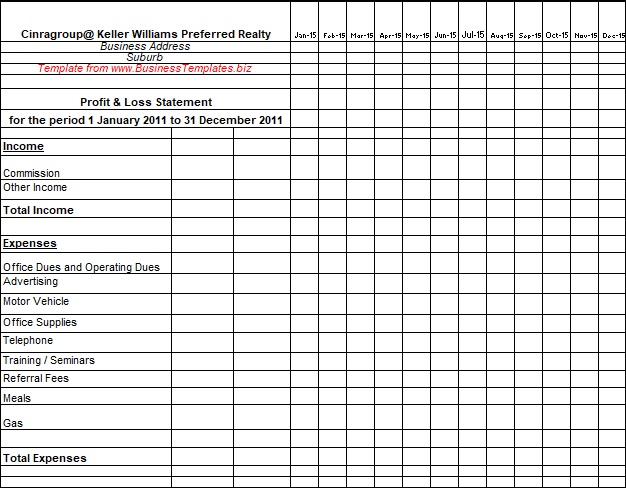

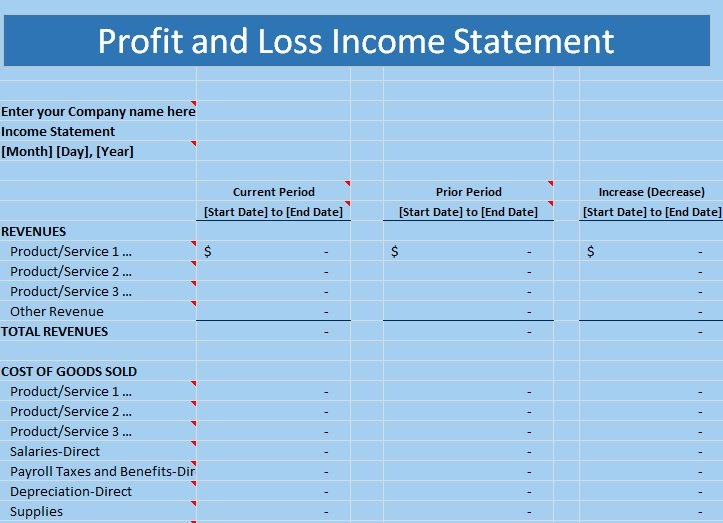

Small business profit and loss statement:

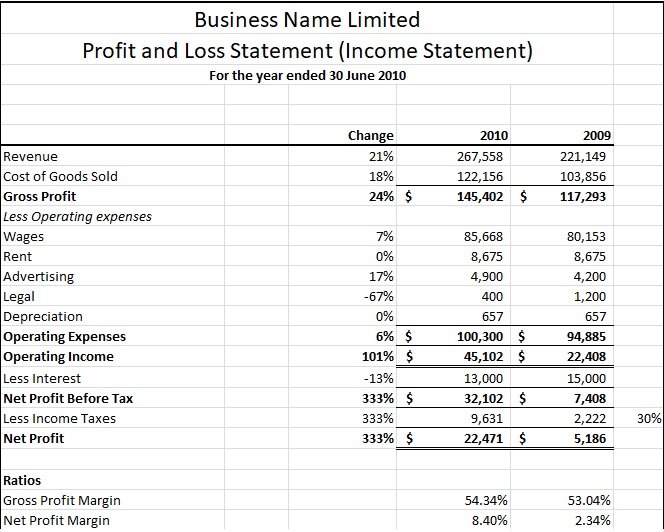

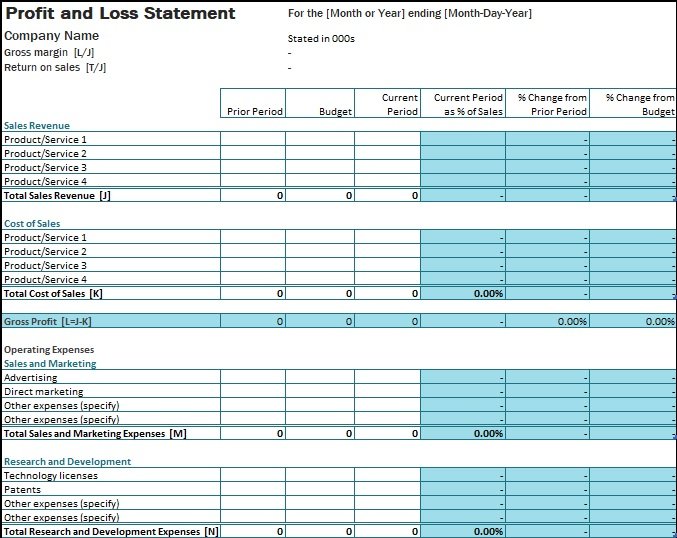

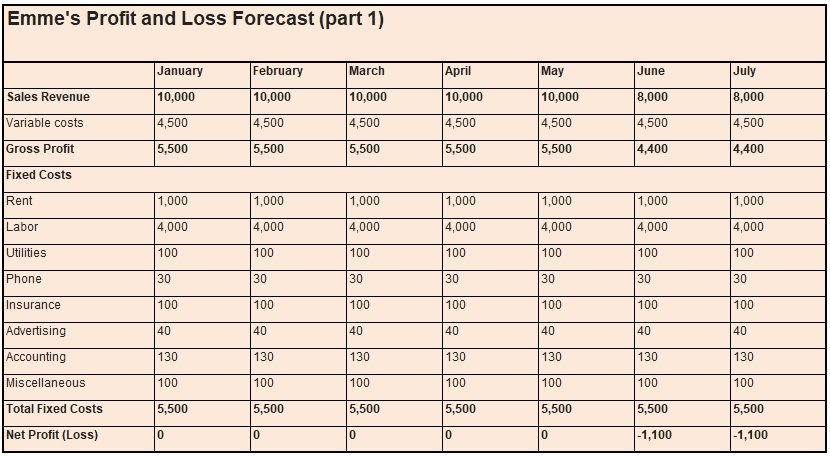

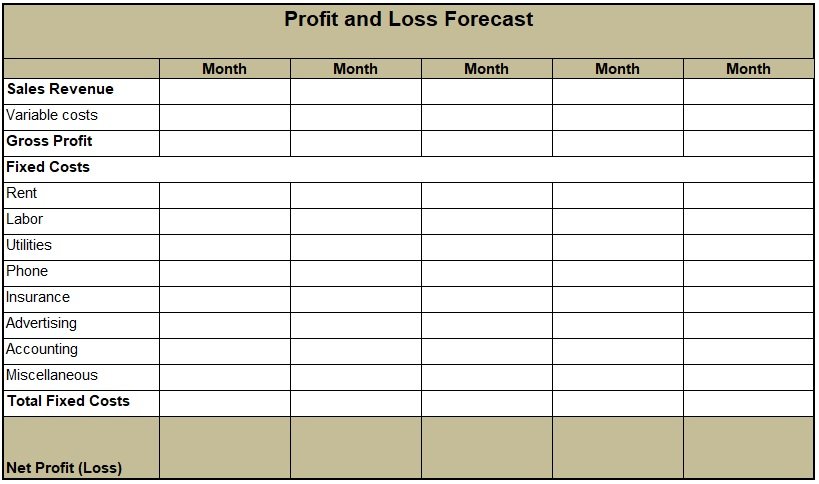

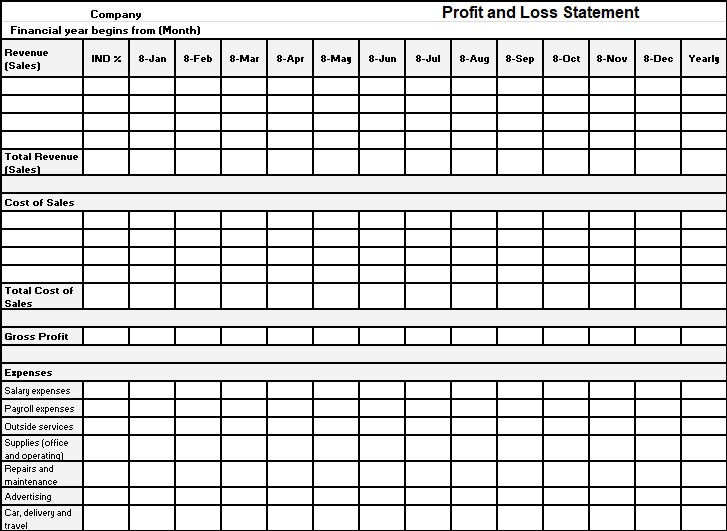

If you are a small business owner, you should use a small business profit and loss statement template in order to monitor your company finances. The MS Excel template allows you to calculate the percentage change from one month or year to the next. This way, you can determine your financial health.

Enter your sales revenue and cost of sales information and then itemize them as per the individual products or services. Here are the three most important columns;

- Prior period

- Budget

- Current period

Why should you use a profit-and-loss template?

A profit-and-loss template saves a lot of time. It provides you with a huge head start by indicating all the relevant information. You just have to drag and drop the relevant data.

Also, it provides you with a professional’s take on the various fields your statement includes such as revenue, cost, or anything in between. Thus, it enables you not to forget an important factor in your statement.

Why is a Profit and Loss Statement important?

A profit and loss statement is important because every company needs it by law or association membership to complete it. It represents the overall probability of a company. It can help you to analyze how efficiently your business enables you to translate your expenses into revenues.