You should make use of a personal financial statement template if you want to live your life without facing any financial difficulties. You should educate yourself regarding the basics of personal finance. It is important to calculate your own financial position.

Table of Contents

What is a personal financial statement?

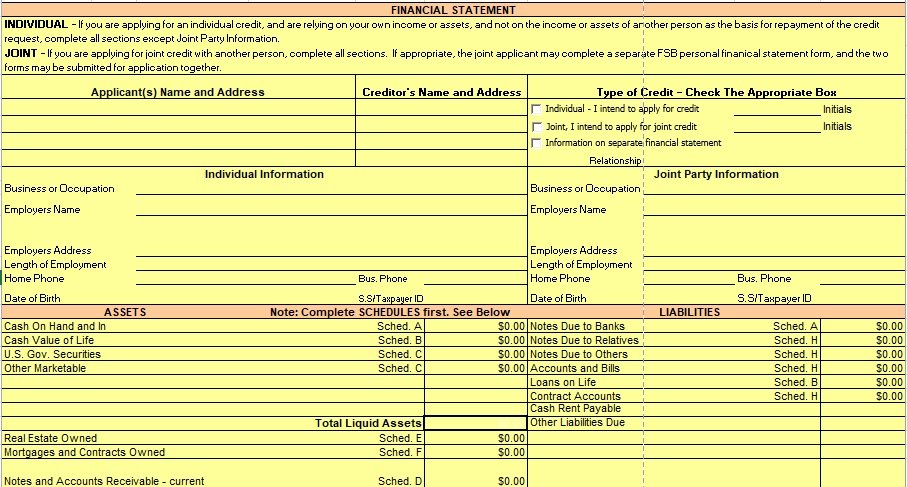

You may have some idea regarding the term financial statement. It is a statement states the random numbers that are said to depict the financial standing of the company. However, the financial statements aren’t just for companies. People can also have their own financial statements that are known as ‘Personal Financial Statements’. You may also like Financial Statement Templates.

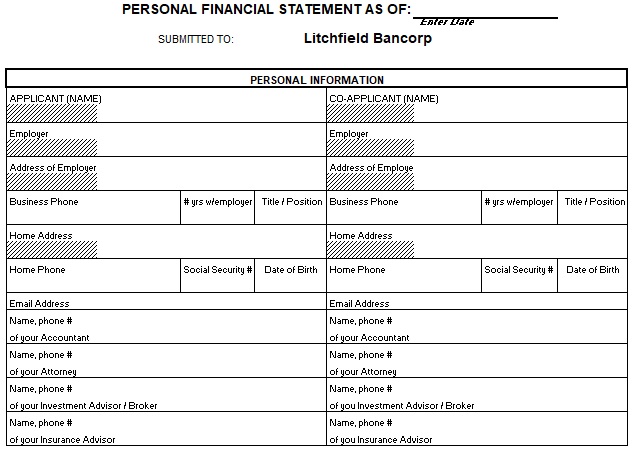

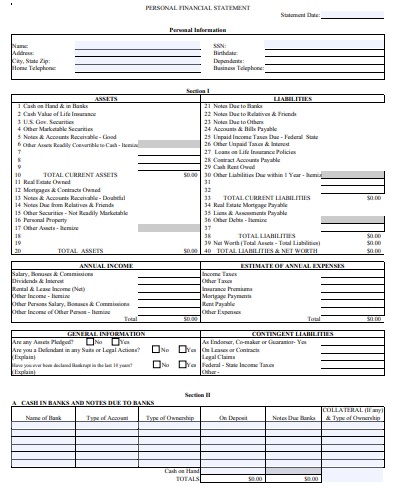

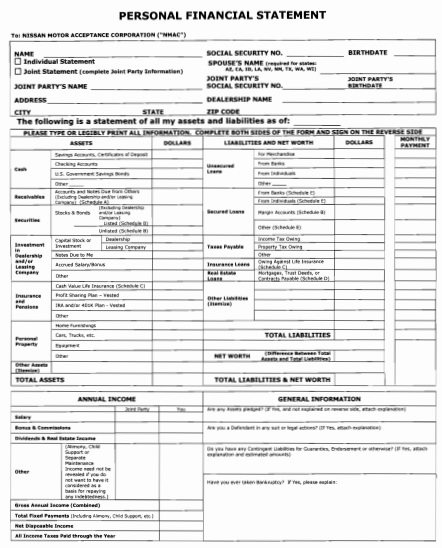

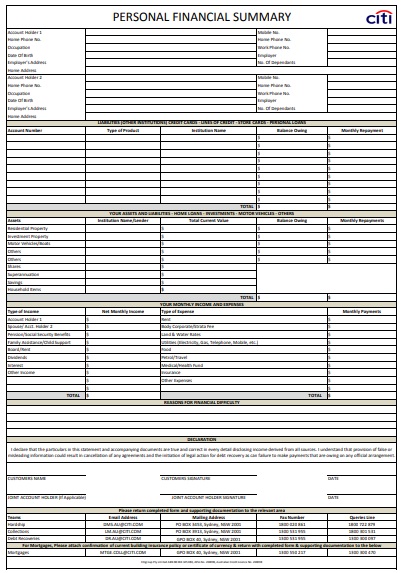

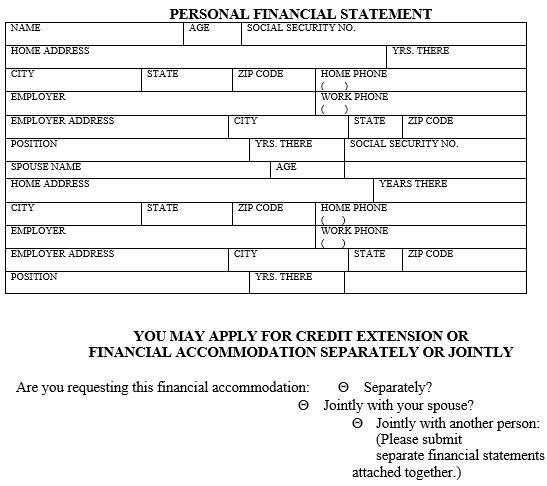

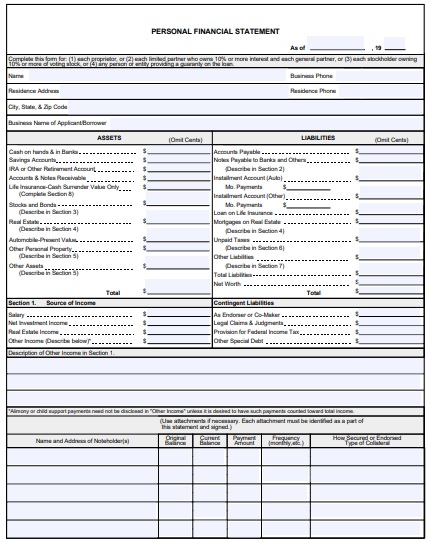

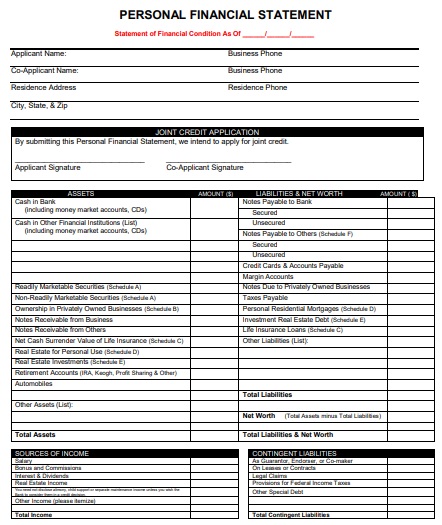

The personal financial statement is mainly used when someone wants to apply for a loan. a holistic view to the credit officers of a bank or any lending institution is provided by this document about a person’s financial muscle. The banker can make an informed decision by having this statement that what should be the credit limit of a specific individual. In any personal financial statement template, the most common sections contain information relevant to total assets and total liabilities.

Uses of a personal financial statement:

Let us discuss some common uses of a personal financial statement;

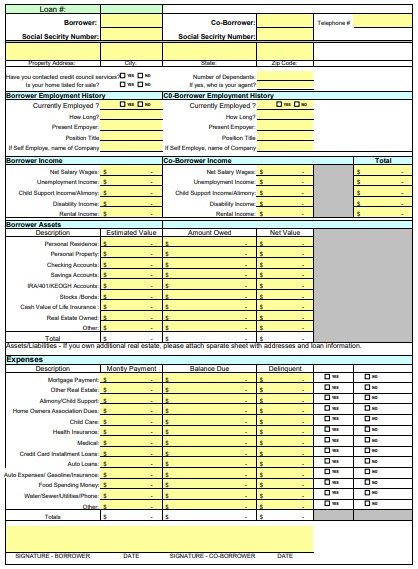

- People use it while applying for a loan

- This statement is also used for effective financial planning.

- It is used to identify the amount that you have to save.

Applying for a loan

If you believe that you never need a loan, then you are making fool yourself. Your credit card is a devise that you will always remain balls deep in debt. Aside from this, if you are planning to attend a college you will require a loan. Furthermore, to start a new business you will also need a loan in order to guarantee the smooth day-to-day operations of your business.

For all this, the banker will ask you to submit your own personal financial statement. The credit officer in a bank or any lending institution after getting this personal financial statement will determine how much credit facility should be extended to your small business. You should also check Financial Projections Templates.

Financial planning

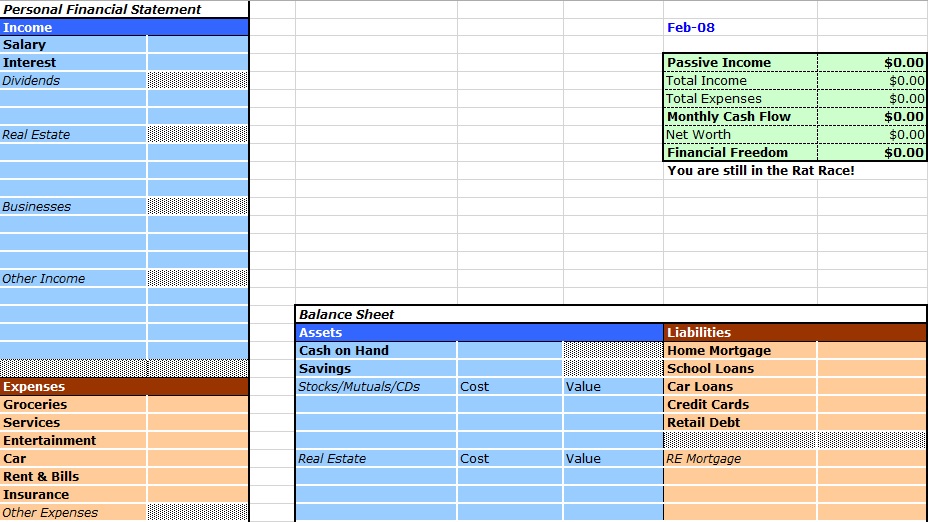

The difference between a penurious and a well-off person is considered financial planning. You should download a personal financial statement template if you know nothing about your current financial situation or your net worth. With the help of this template, you can easily calculate your net worth.

If you find your net worth is in negative numbers, there is no need to be terrified, horrified, and petrified. Instead of this, you should quickly take steps to reduce your liabilities and enhance your income-generating assets. But keep in mind that all this begins by filling out a personal financial statement form correctly.

Saving purpose

It is a perfect recipe to failure not to maintain and update your personal financial statement. This is because you will likely not be able to save money for the future. A personal financial statement will enable you to pay yourself first. Before paying bills or spend your money carelessly, you should set money aside for your savings. You should be well aware of the expenses and the uncovered liabilities. The money that you save and invest today, keep in mind that it will compound in the future.

Elements of a personal financial statement template:

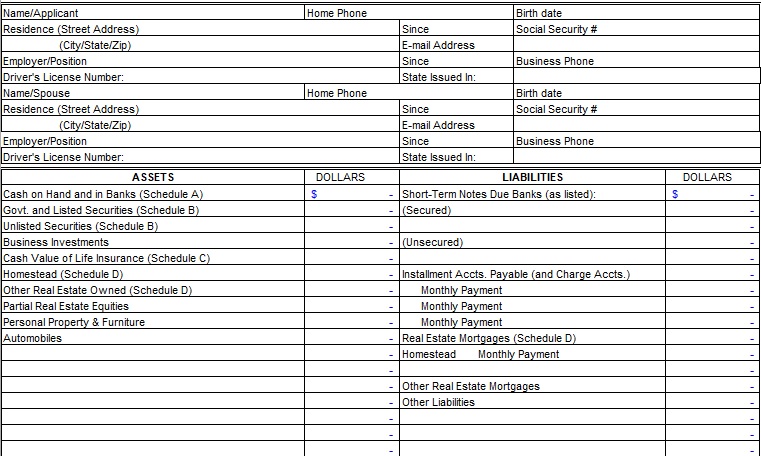

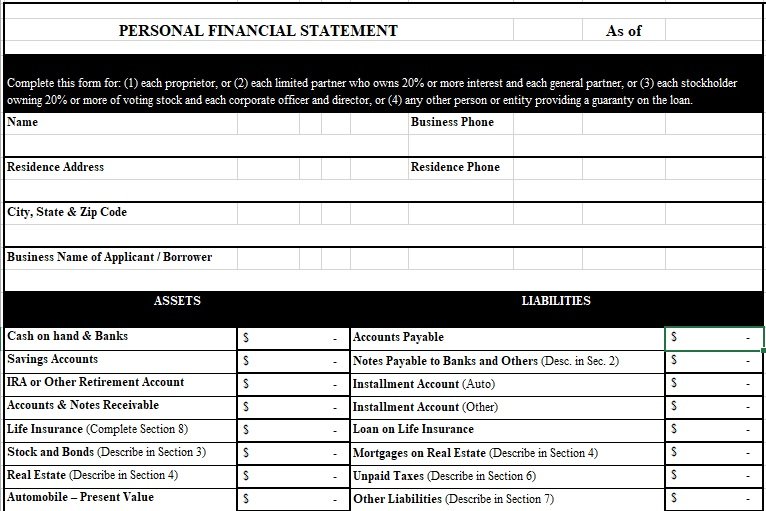

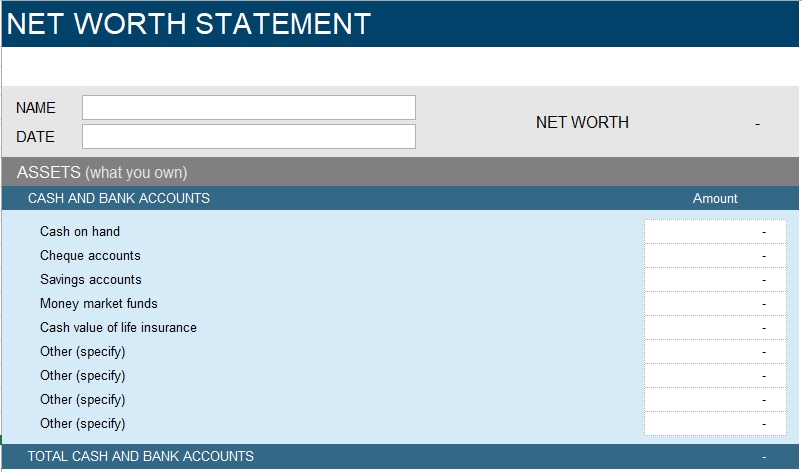

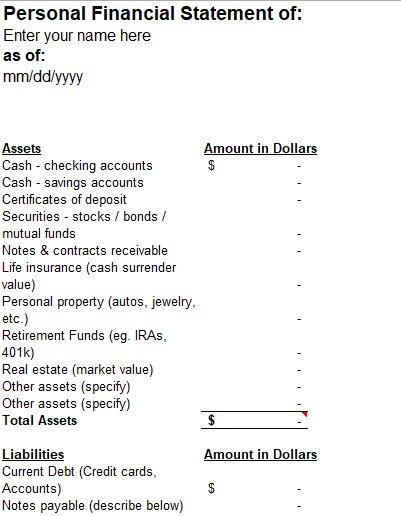

There are four major sections that you will find in almost all personal financial statements;

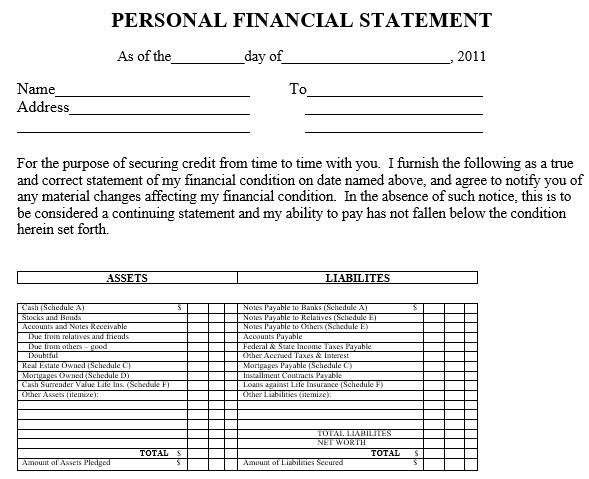

Assets

In the start of every good financial statement, all the assets that an individual possesses are listed. In the US, the people believe that the house they purchased is their most valuable asset. But, your home isn’t your asset because an asset is something that puts money into your pocket periodically. While, your home takes money out of your pocket in the form of bills, taxes, etc.

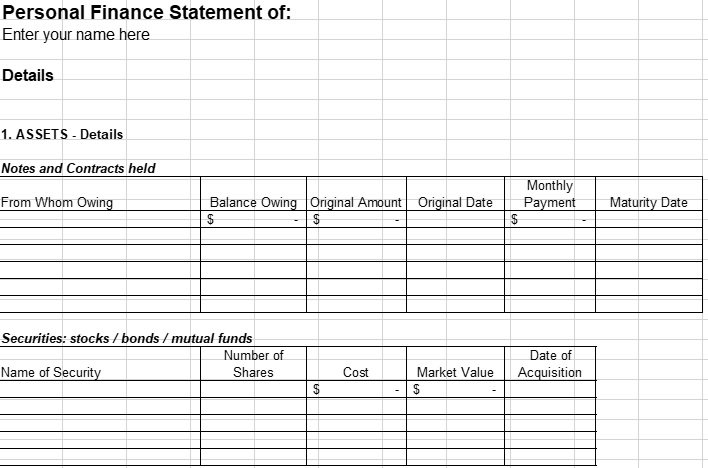

Additionally, in the asset column of your personal financial statement, include the item such as cash that you have saved in your bank balance as well as in the home. Also, the asset column of your personal financial statement will record the cash value of your investments in stocks, bonds or any other investment.

There is a distinction between current (liquid) and non-current (illiquid) assets. The assets that can be converted to cash in a short period of time is referred as current assets. On the other hand, the non-current assets do not have a vibrant and robust secondary market

Liabilities

It is the amount of money that you have to pay. For instance, the money that you owe. You will specify all the sources to whom you owe money and also the amount that you owe in this section. In the liability column of your personal financial statement, list all the loans taken out from a bank, taxes due, mortgage payments due and any other debts. It’s better to use a personal financial statement template if you can’t remember your creditors. They already has some basic and obvious creditors listed in the template.

In case, you are living in a rented house, then your monthly rent payment is also considered in your liabilities. Your credit rating will be affected adversely if you don’t honor/settle your liabilities on time. The liabilities are also divided into current and non-current liabilities likewise the assets.

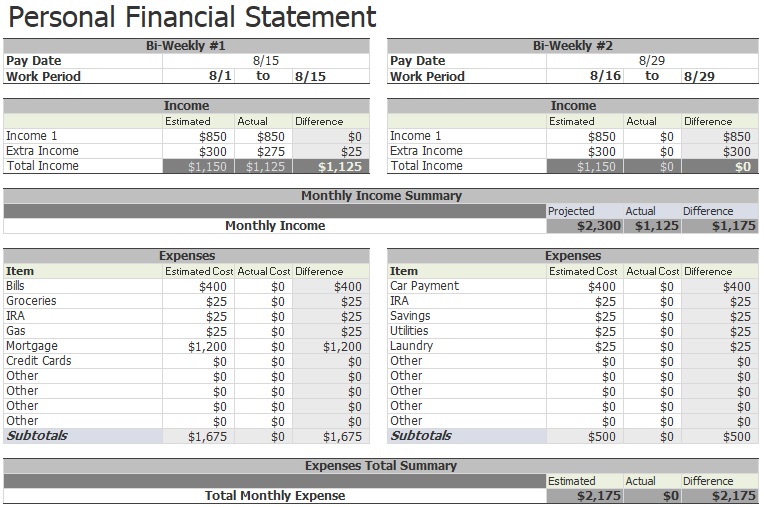

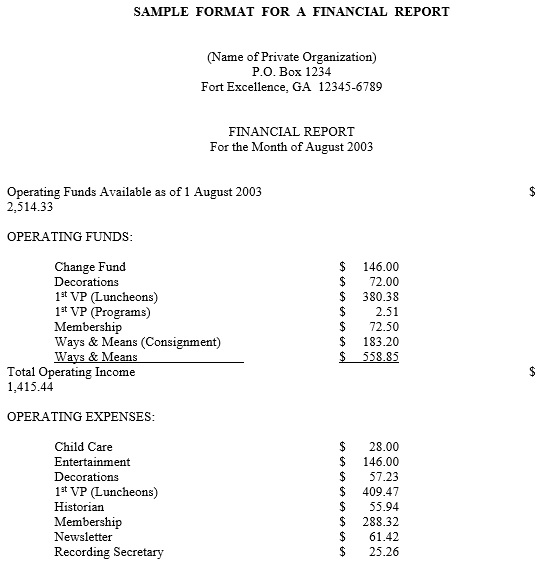

Annual income and expenses

In the annual income, mention the salary you take, dividend income, rental income or any income generated from other sources. The expenses refer to them that suck your income. Both annual income and expenses should be listed in your personal financial statement template.

The money you spend on the purchase of household items is come under your expenses. Also, include a section of contingent liabilities in a good personal financial statement template. You may also see Financial Management Report Templates.

Conclusion:

In conclusion, a personal financial statement template is a powerful tool that helps you in managing your finances effectively. This document enables you to pay yourself first by setting money aside for your savings.