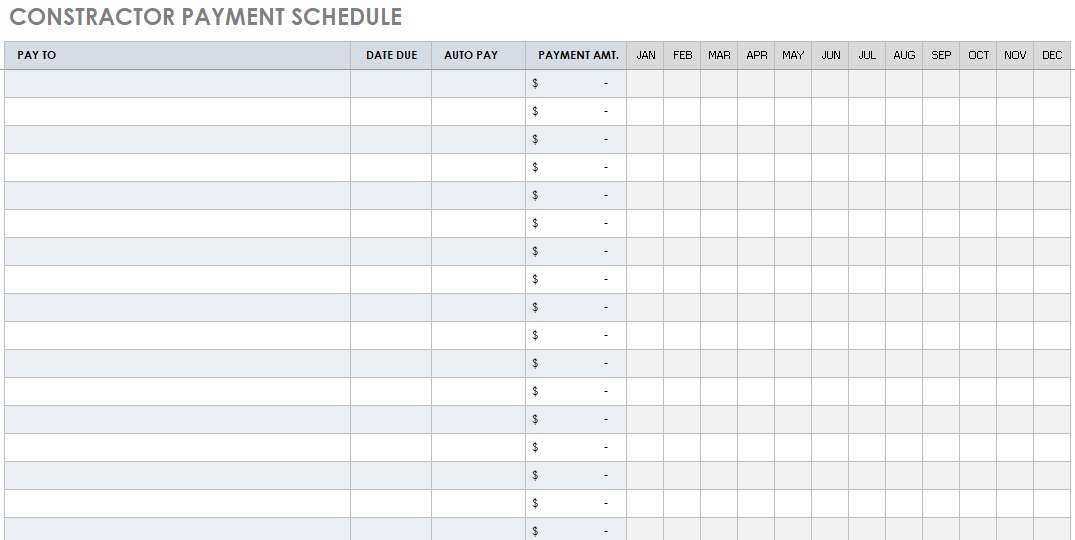

A payment schedule template is a useful tool used by large companies that employ huge numbers of workers as per the labor demands. Every employee might have joined the company on different dates as well as their paydays fall on different dates. The payment schedule is the best tool to track records on which employee joined at what date, the amount due to them, and how many workers were on duty at a certain date.

Table of Contents

- 1 What is a payment plan schedule?

- 2 Why is the payment schedule template essential?

- 3 How is the payment schedule calculated?

- 4 Types of payment schedules:

- 5 Types of payment schedule templates:

- 6 What is a payment schedule in construction?

- 7 What to include in a construction payment schedule?

- 8 How to create a payment plan schedule?

- 9 Pros and cons of payment schedules:

- 10 Conclusion:

What is a payment plan schedule?

Generally, payment plans come with payment plan schedules. This document provides information on the dates payments are to be made and the amounts to be paid at each of those dates. It is essential to include this so that both parties know when the payments will be made and when the entire payment will be paid in full. Here are the two pain types of payment plan schedules;

A payment schedule which is parameterized

This type of schedule is created by using some parameters on the basis of market conventions and some rules that highlight the frequency of the payments. These parameters are the following;

- The frequency of payments

- The day of payment

- A rolling payment date

- The start date

- The end date

A payment schedule which is customized

This type of schedule is created by the exact dates when payments will be made. The business or the lender or everyone involved may set these dates.

Why is the payment schedule template essential?

This schedule helps you in keeping records of your payments and indicating the payment dates and amount. Employers who make payments to large numbers of employees make use of it. It is also useful to people who manage loans, or bills at close intervals.

How is the payment schedule calculated?

At first, draft all the payment details the company is committed to. Write down the name of every employee if it is employees and note the date they joined the organization. After that, according to the letter of employment, write down how much is the agreed payment for each employee.

For each employee, fill in the payment date and include other details such as overtime accrues, social security deductions, loan deductions, and advances, among others. This way, the employee will receive their net payment on time. In the bill payment schedule template, capture the bills that the company has to pay.

According to the dates the payments are made, divide the schedules. This could be daily, weekly, fortnight, or monthly. Next, match them with the names of the employees who get payments on each certain date.

Open your payment schedule template, when your draft is ready and start keying information by following the below steps;

Name your monthly payment schedule

You have to use the payment recurrences as the name. This could involve the names of the teams such as Lab techs, managers, support staff, errand runners, and so on.

Insert date

When the first payment is made, insert the date as well as the date when the last payment is made. For daily, weekly, fortnight, and monthly payments, the process works the same. Select a date that will work for every month owing to the difference in the number of days per month.

Insert a payment period

According to the frequency of payments, insert payment periods. It could be every week, every two weeks, twice a week, or monthly. You can edit the template payment sheet and adjust it anytime.

Types of payment schedules:

There are three factors in the payment schedule;

- The name of the employee: it is the name of the individual employed by the person or an organization.

- The period of payment: It explains the number of days authorized to an employee or the number of days the employee worked.

- The date of payment: it is the date when the employee get the payment.

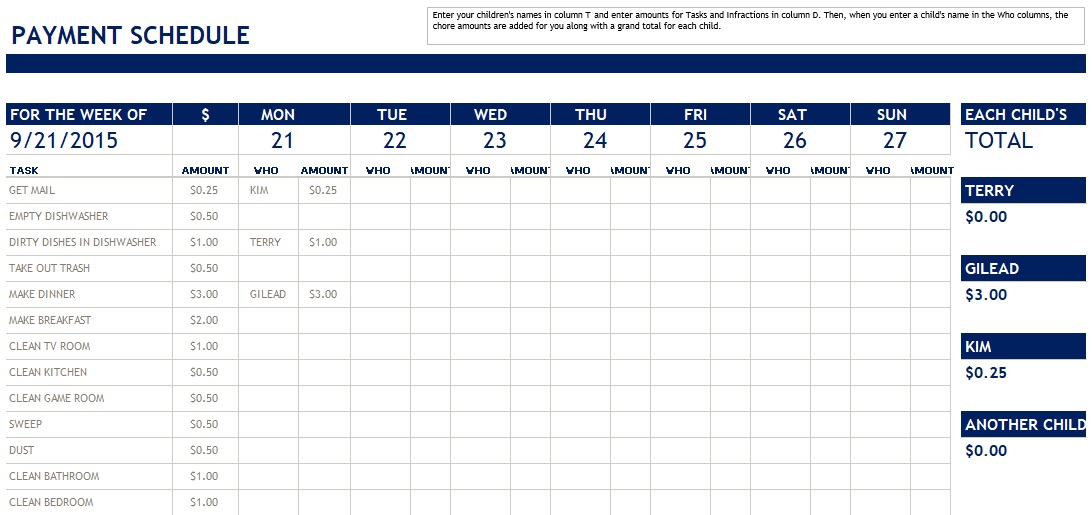

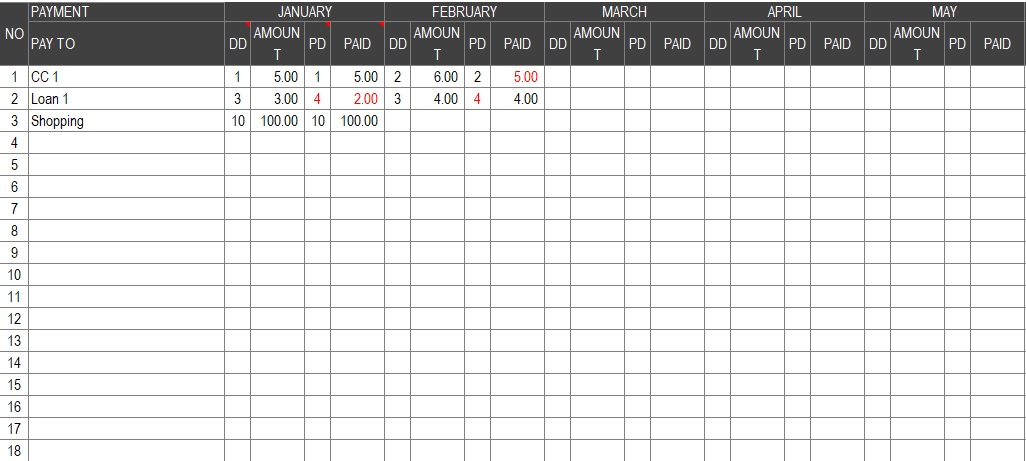

You can include the following four types of payment schedules in a contractor payment schedule or a monthly payment schedule;

- Weekly payments: they are done at intervals of every seven days. During the week, it is a particular day when the payment is done.

- Bi-weekly payments: every seven days on certain set days, these are payments done twice.

- Fortnight’s payments: they are made every fourteen days on a specific set date.

- Monthly payments: once every thirty days on a certain agreed date, these payments are made.

Types of payment schedule templates:

Here is a list of the different types of payment schedules;

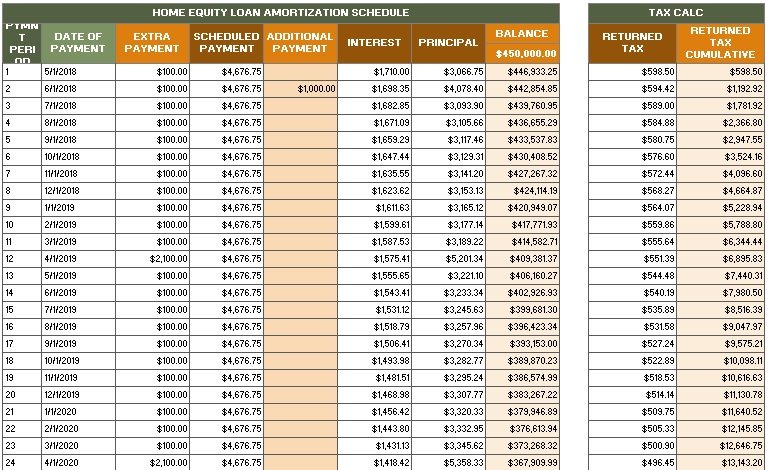

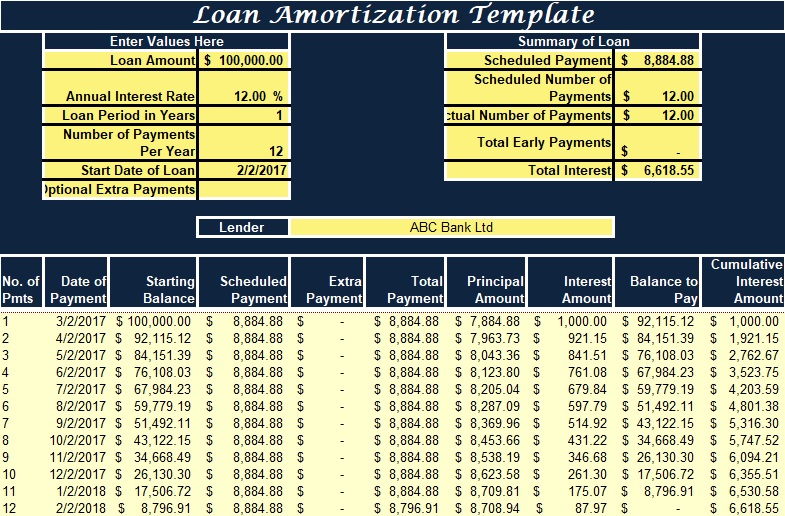

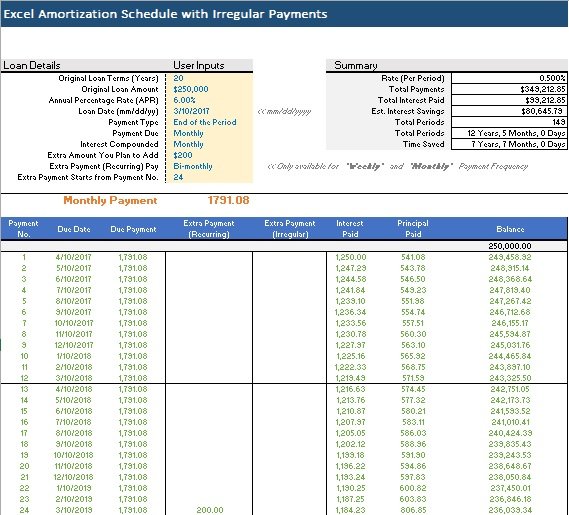

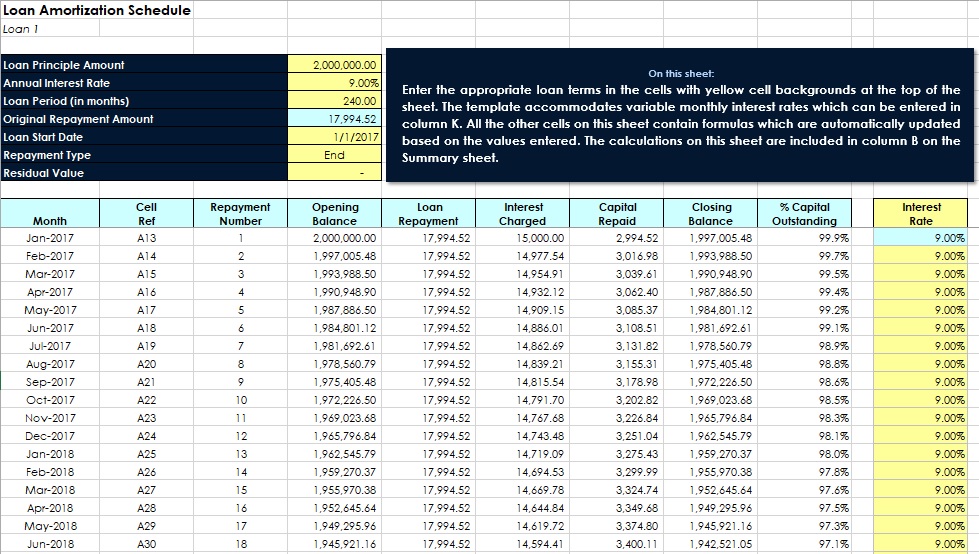

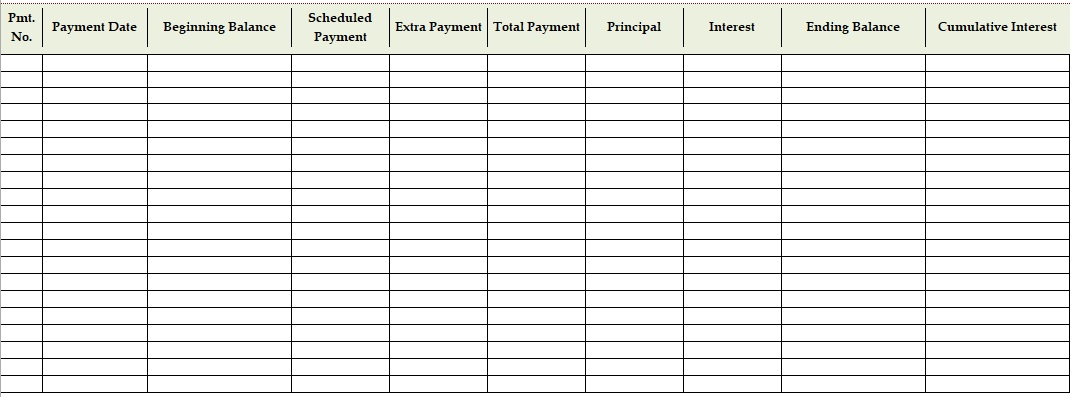

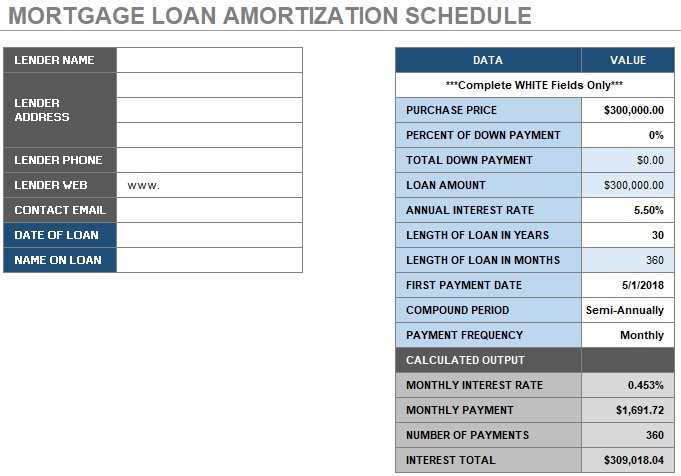

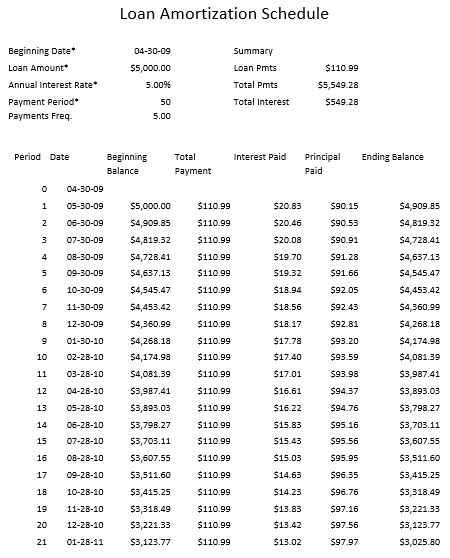

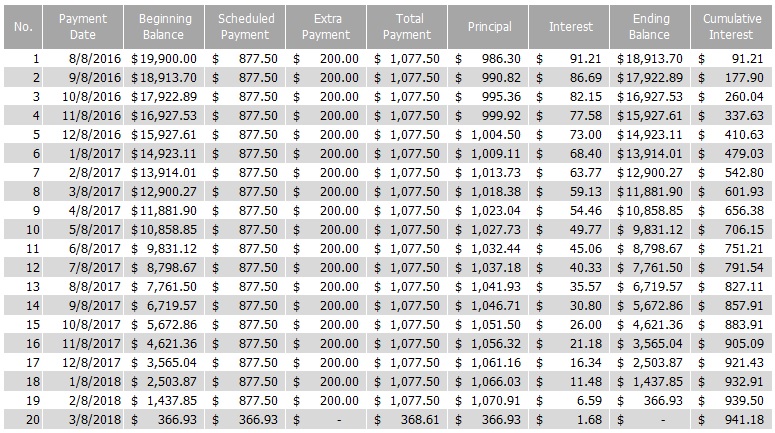

Loan payment schedule template

This type of payment schedule template is mostly favored by credit companies, mortgage companies, and shark tanks. This template is used to track the following;

- The date under which each loan falls

- The amount to be paid

- The interest

- The company or individual who has given the loan

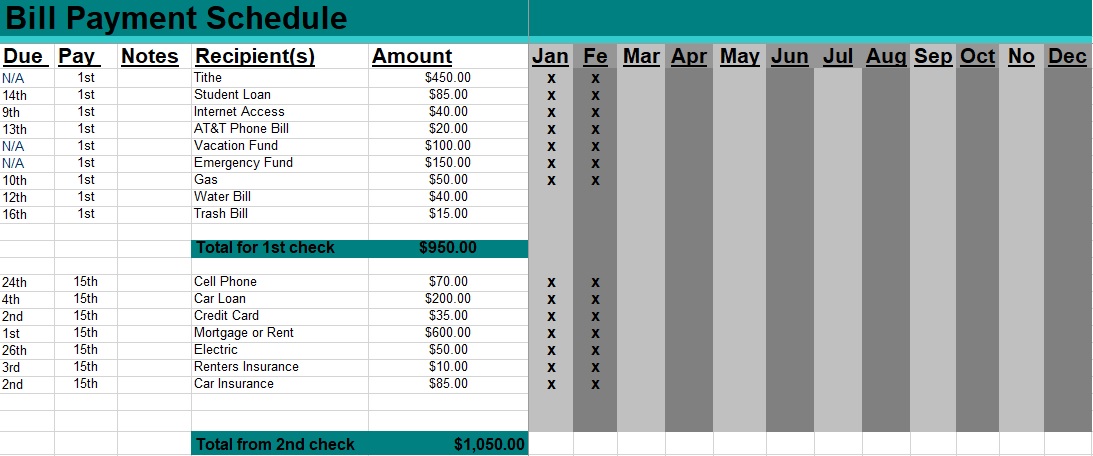

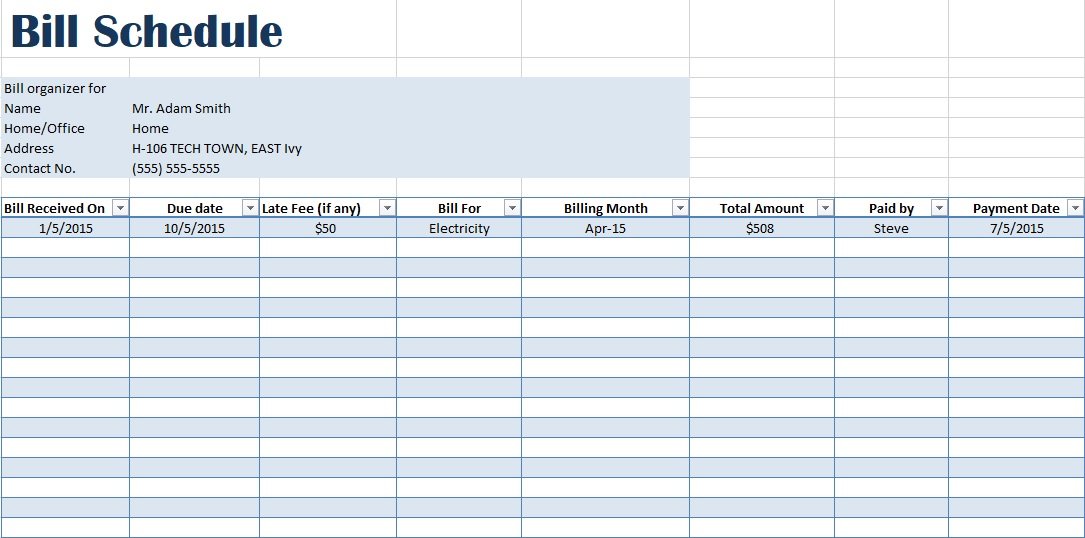

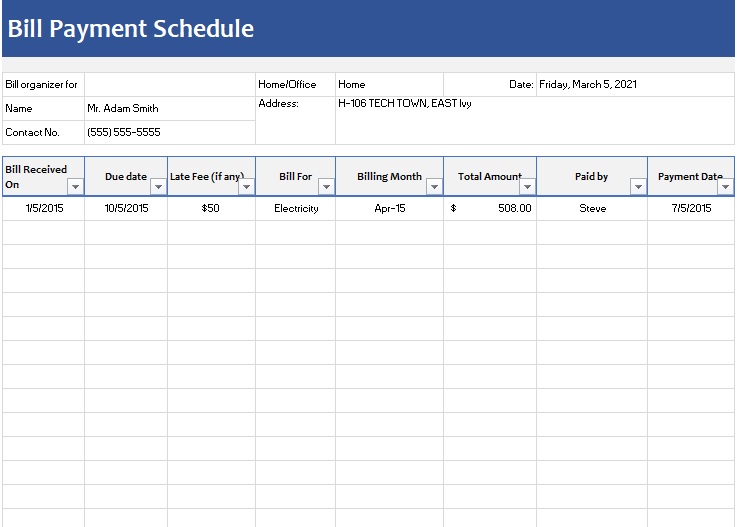

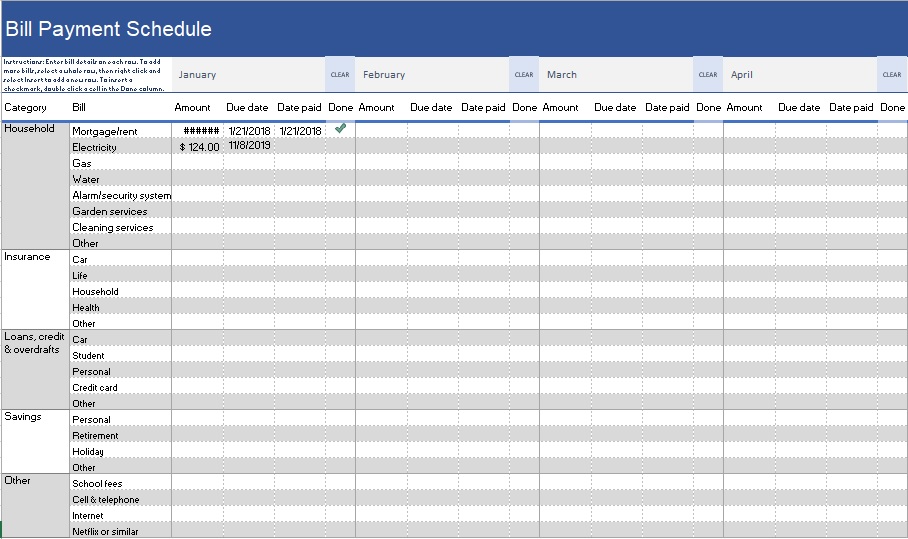

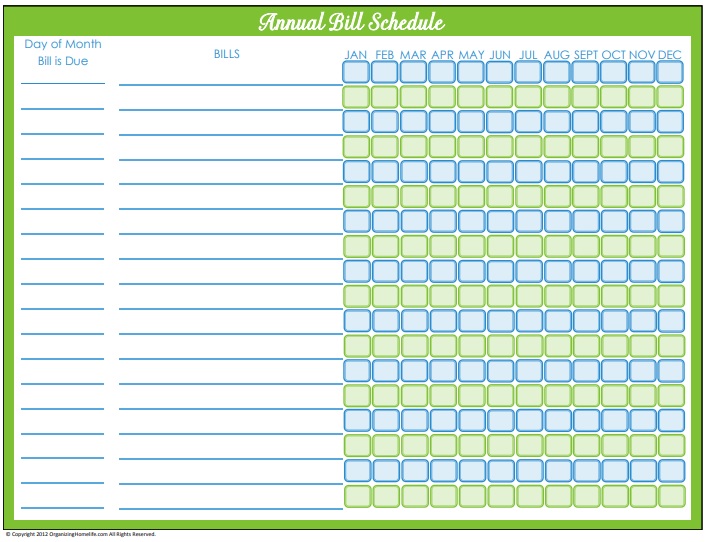

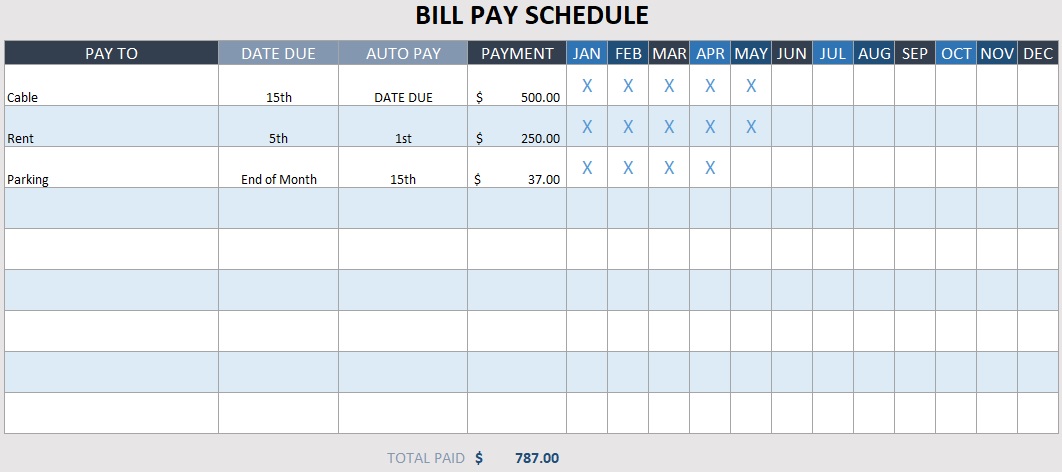

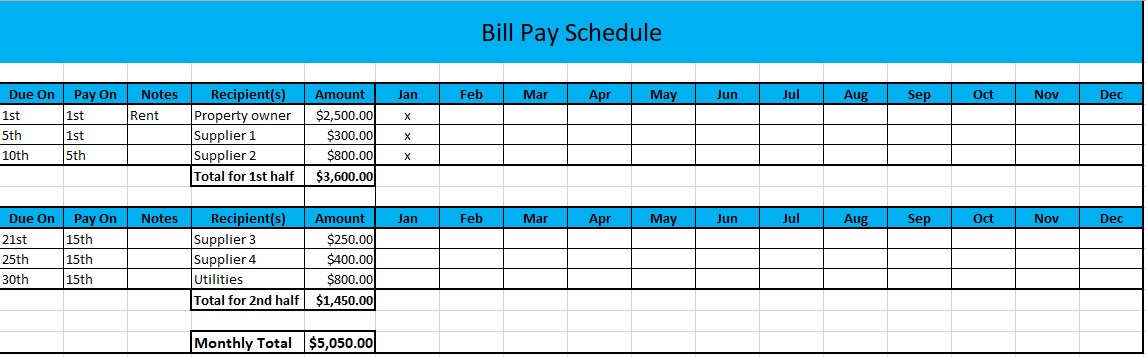

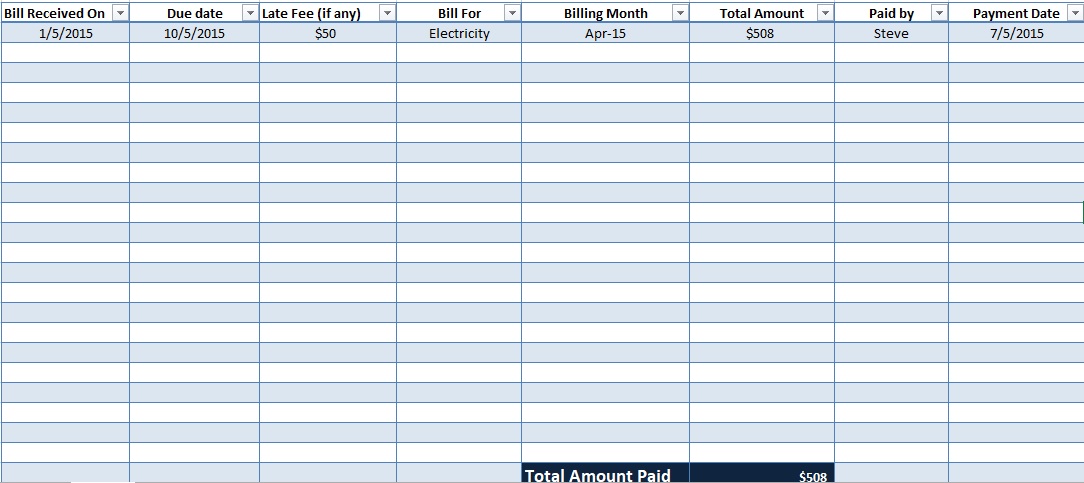

Bill payment schedule template

The various bills a company incurs every month and the amount payable against each bill, this template is used to organize them. The bills such as water, electricity, telephone, sewerage services, garbage collection, and more are captured by it. The template contains the following;

- The name of the service provider

- The due date of payment

- The amount

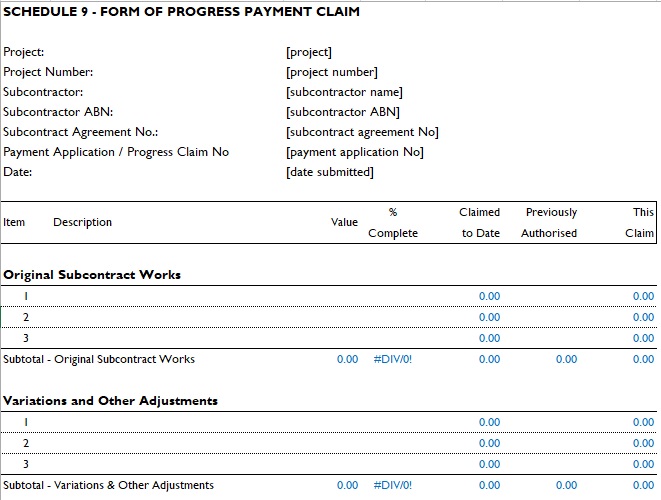

Project payment schedule template

It is used to organize project payments as stipulated in contract terms.

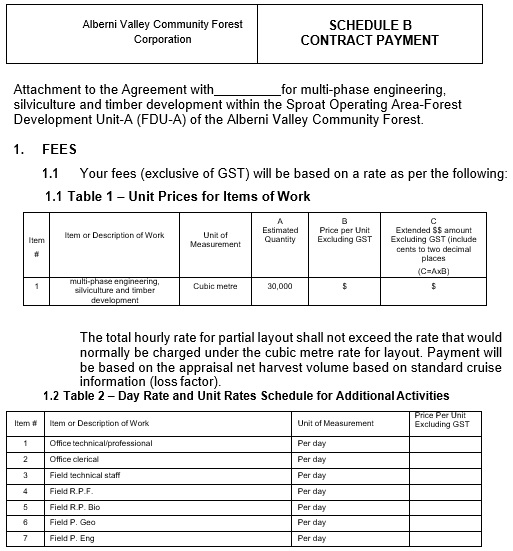

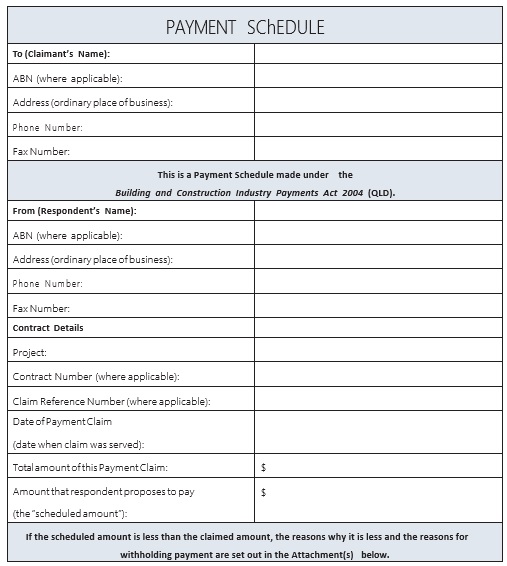

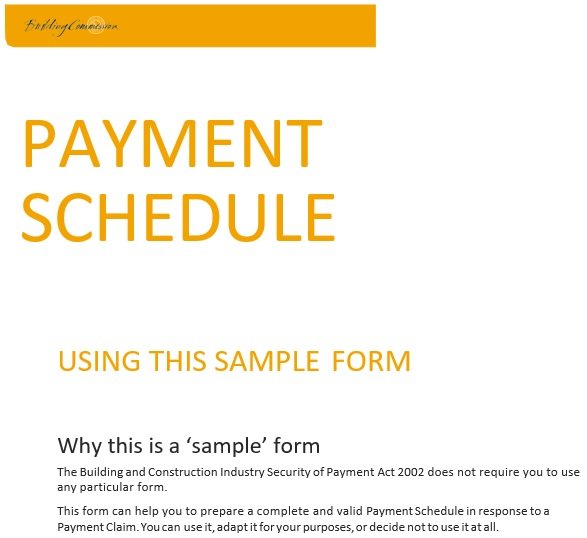

Construction payment schedule template

To make payments against project progression by phase and the total value of the said project, the contractors use it.

Furthermore, other types of payment schedules templates include the following:

- Mortgage payment schedule payment

- Excel loan payment template

- Building contract payment schedule template

- Freelance payment schedule template

- Printable project payment template

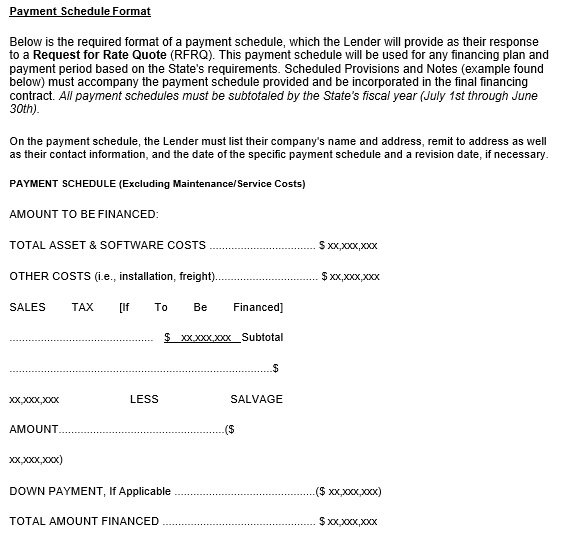

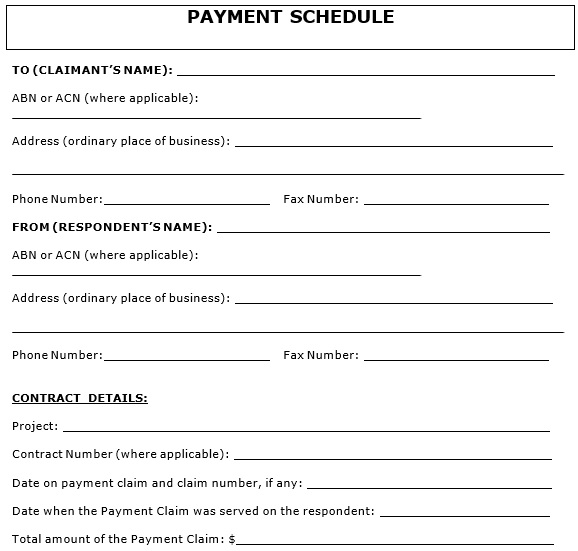

What is a payment schedule in construction?

Contractors, in the construction industry, are satisfied with their clients on the methods of work, timelines, milestones, and deliverables. A certain amount is paid at each phase of the project as per the contract terms.

Furthermore, after completing the general structure of the building and another final payment once the finishing works are completed, according to the agreement, the contractor may get another payment.

A payment schedule in construction is used to help follow-up on the accomplishments versus payments. In the schedule, the dates are included that indicate when a payment should be made, to who it should be made and the goal of the payment.

What to include in a construction payment schedule?

The payment schedule should contain the following information;

- Date when the contract has begun

- The initial made that has to be made

- The subsequent payment intervals that follow the first one

- The agreed time that shows when the project should be completed

- In terms of capital, material, and other resources, the total value of the project

How to create a payment plan schedule?

Here are a few guidelines that will assist you in making the template and the essential information that are important in an efficient schedule;

- Start formatting your document by opening your software of choice. For your schedules, select whether you want to use a landscape or portrait format. Now, set the margins and then ensure that they are all equal so all the material will be centered.

- At the top, type in the title of your document and make it bold and with a bigger font size. Something like “Payment Plan Schedule.”

- In case of a parameterized payment plan schedule, you have to specify the start date, which indicates date when the first payment is to be made. At the top, place this so it can be easily seen and read.

- You would have to set the parameters for parameterized schedules and make them clear. Specify when payments will be made and the amount of each payment (particularly in case the amounts are different for each payment).

- Moreover, set the payment days and the rolling payment date. This way, you are sure that payments will be made, it doesn’t matter what the circumstance.

- Finally, include in the end date or the date in which the payment will be created in full.

- Customized payment schedules are generally placed in a table format. Thus, you can make a table on your document. At first, count how many rows and columns that you have to use then make your table.

- Create a blank template first and note down all the dates and amounts manually then enter them into your computer. If you want to edit your information then open your file and start editing the information.

Pros and cons of payment schedules:

With each type of payment, there are advantages and disadvantages associated. Let us discuss them below;

Weekly payments

With wage earners, freelancers, and contract-based workers, this method is common. Workers who love receiving their pay often most favor it. While, it is not advantageous to the paying entity as the cost of processing payments each week can be higher. The weekly payment method as the preferred method is used by many online companies. This is because their worker database may contain a hundred thousand workers who work on different schedules grabbing different payments.

Bi-weekly payments

For workers who work on an hourly basis, this method of payment is popular with them. The reason behind it is that their total work hours vary week after week and could total 40 hours in a particular week, and twenty hours in another week. It’s become a challenge for the organization that incurs processing costs and gets in busy schedules, calculating the value of the payment due to every worker. Charging the workers a payment processing fee that can be captured in the payment schedule template is a way for the organizations to cushion against payment processing losses.

Bi-monthly payments

Salaried employees who do not like waiting for thirty days to receive payments prefer this method. Usually, payments are created two times a month mostly on the 1st day and the 15th day of every month. This payment method is favored by the companies because it is less costly.

Monthly payments

Once every month, this payment method is done and employees prefer it the most as it costs the least in terms of processing costs. However, the employees who feel the thirty-day waiting period is long, it is least preferred by them.

Conclusion:

In conclusion, a payment schedule template is a helpful document that assists large companies or organizations in listing down the joined date of the employees, the amount due to them, and how many workers were on duty at a certain date.