You should use a monthly expenses template in order to keep your financial condition stable. This document makes sure that you are wisely saving and investing. By comparing expenses and income, it allows you to track your expenditures each month.

Table of Contents

- 1 What is a monthly budget template?

- 2 The importance of monthly expenses template:

- 3 Examples of monthly expenses:

- 4 How to keep track of monthly expenses?

- 5 How do you create a monthly expense spreadsheet?

- 6 Why should you use a monthly budget template?

- 7 Some tips and tricks for monthly budget:

- 8 Conclusion:

What is a monthly budget template?

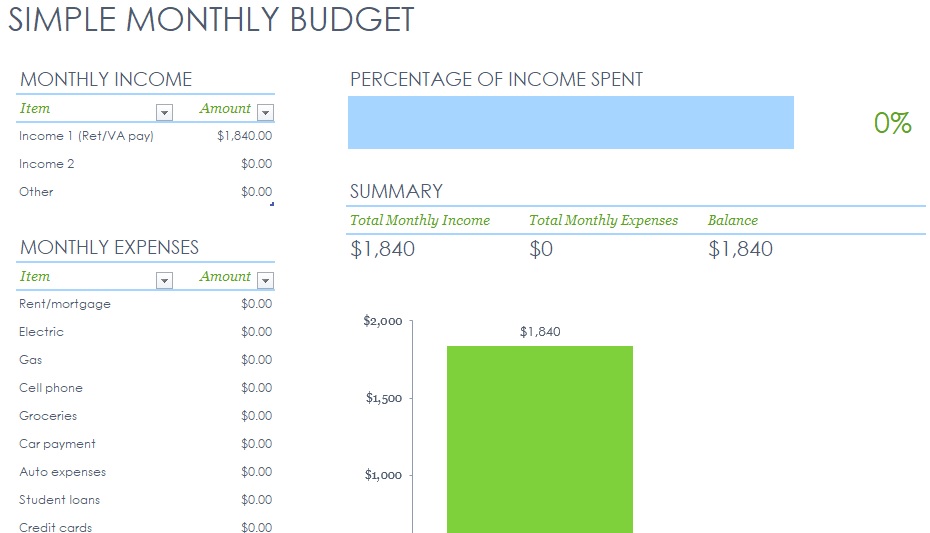

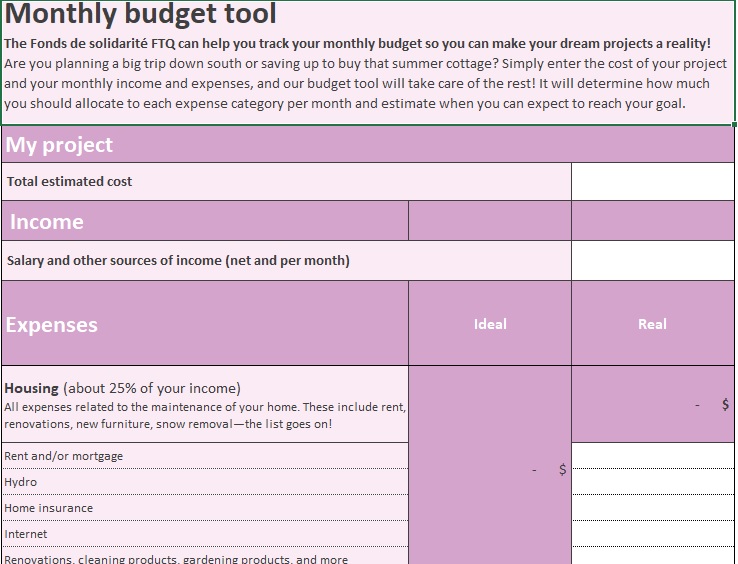

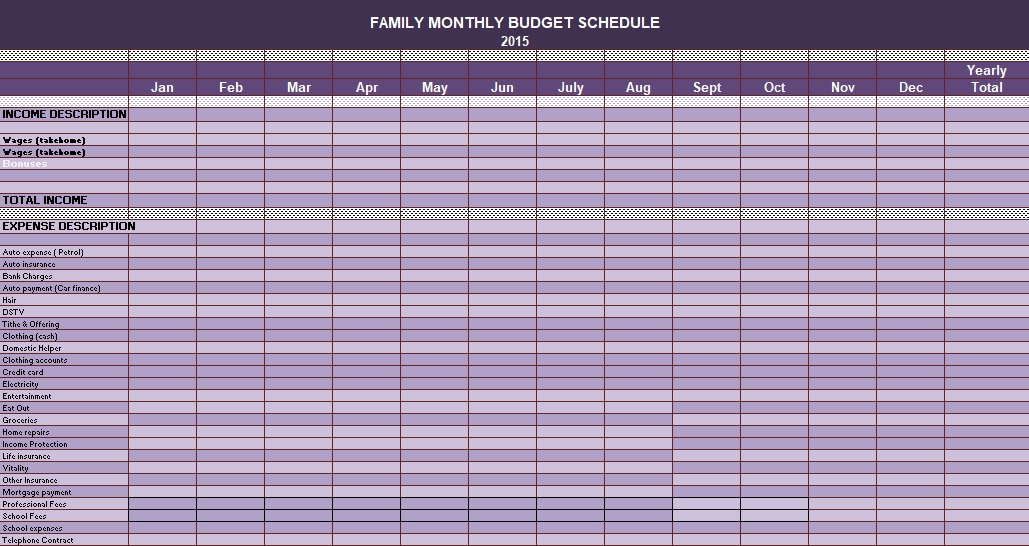

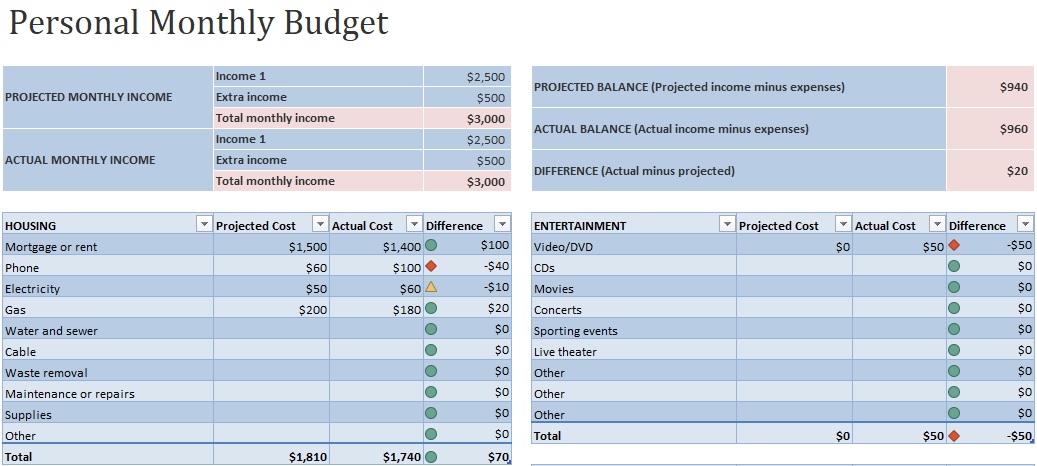

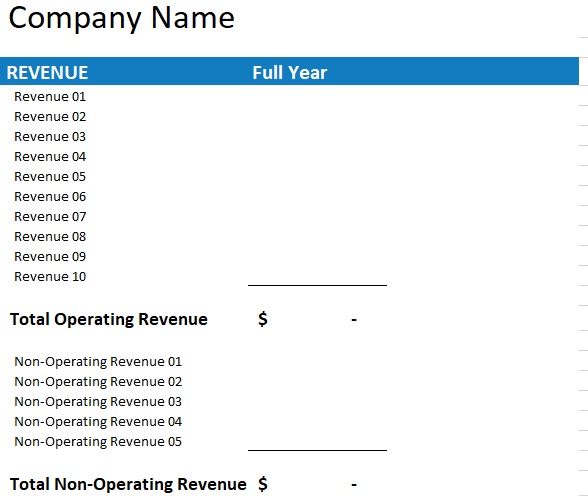

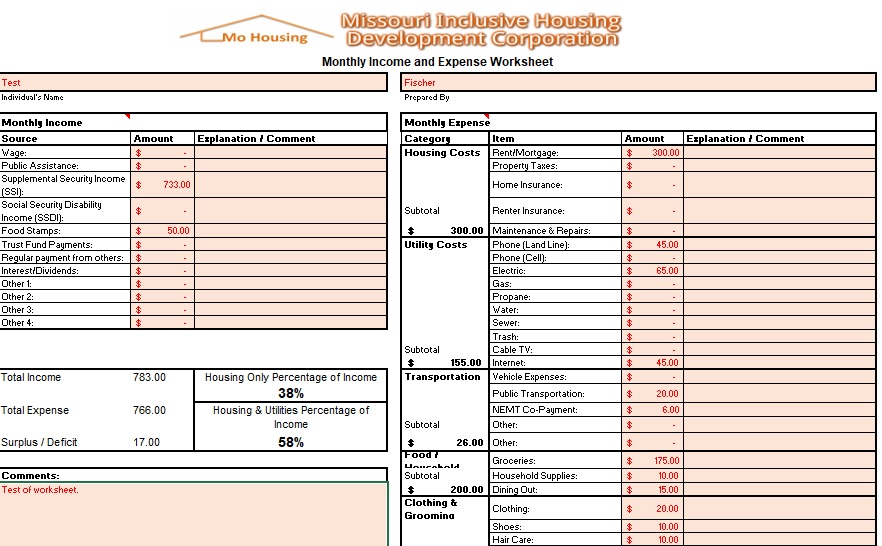

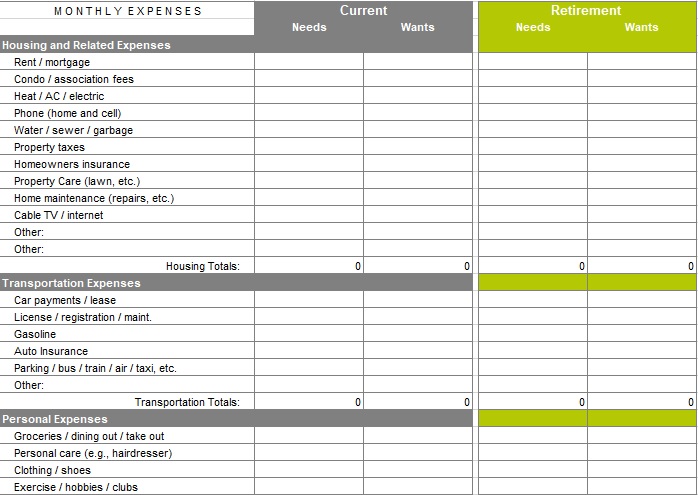

A monthly budget template is an effective tool that allows its users to compare their budgeted expenses and income to their actual expenses and income. It helps them in planning how to spend their money. Furthermore, it gives them a bird’s eye view of their current financial situation. With the help of a personal budget template, they can split their income and expenses into categories.

The importance of monthly expenses template:

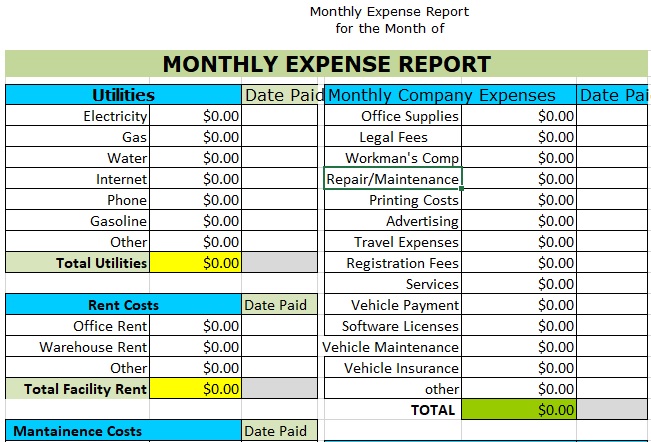

A monthly expenses template assists you in assigning your budget for each month for different expenses. In this way, you can assign a budget easily for specific expense categories. Then, during the present month, you can take note of the actual costs you have incurred for the same categories. The template contains your income details for each month. Moreover, the spreadsheet is a useful tool for keeping track of several categories and expenses that cover all kinds of expenses or payments that you incur.

Examples of monthly expenses:

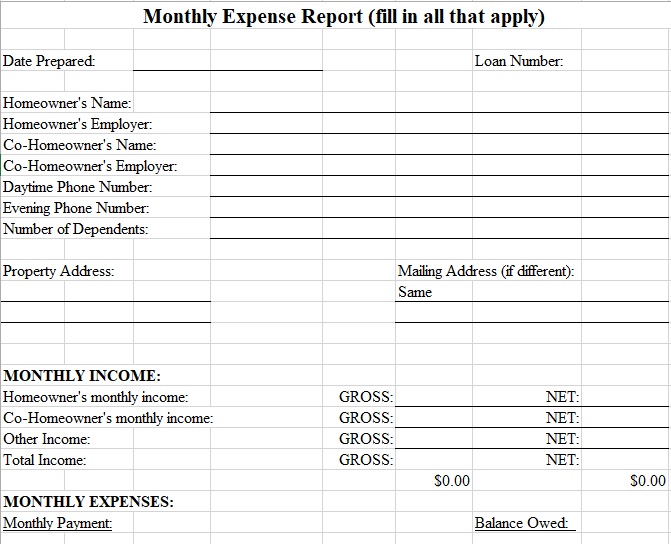

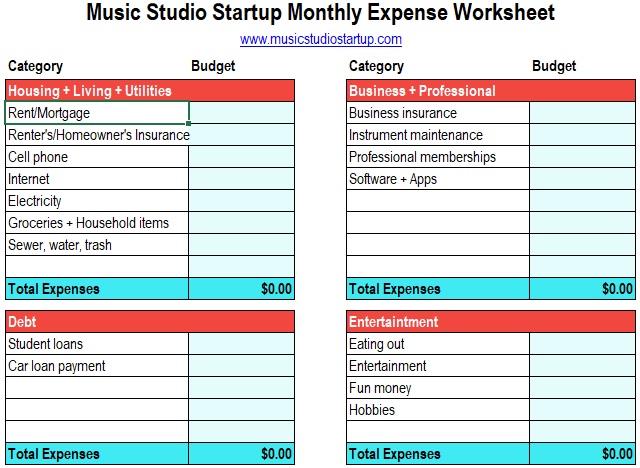

By determining recurring and common expenses such as mortgage or rent payments, you can easily plan your expenditures and create a monthly expenses template. For certain expense categories, a budget contains spending guidelines. You must have a list of your individual expenses before making a budget. However, you can include the following some examples of monthly expenses while making your document;

- Rent and renter’s insurance

- Mortgage and homeowners insurance

- Property tax

- Health insurance

- Life insurance

- Auto insurance

- Unexpected medical costs

- Electricity

- Water

- Groceries

- Gasoline

- Sanitation

- Toiletries and other essentials

- Car payments

- Public transportation

- Phone bill

- Student loans

- Other loans

- Child care

- Child support

- Alimony

How to keep track of monthly expenses?

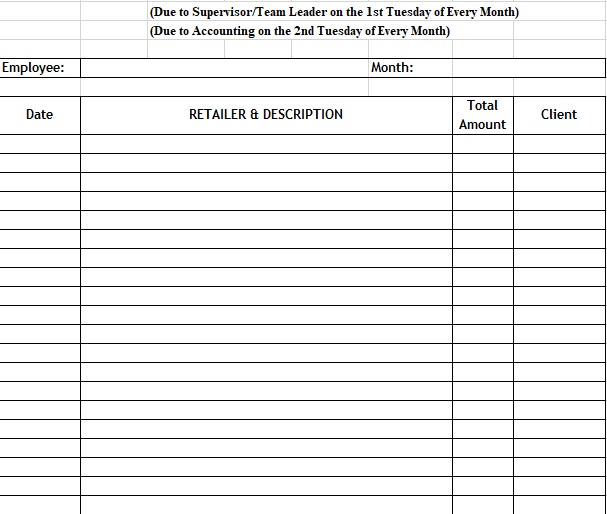

With the help of a bill tracker template, you can keep track of your expenses regularly. It provides you an accurate overview of where you’re spending your money. Here are some tips on how to keep track of monthly expenses;

Go through your statements of account

At first, determine all of your money habits. Then, by including all of your credit cards and your checking account, create an inventory of all your accounts. All these accounts assist you in pinpointing your spending habits. Also, this way, you can have a sense of your cash flow each month.

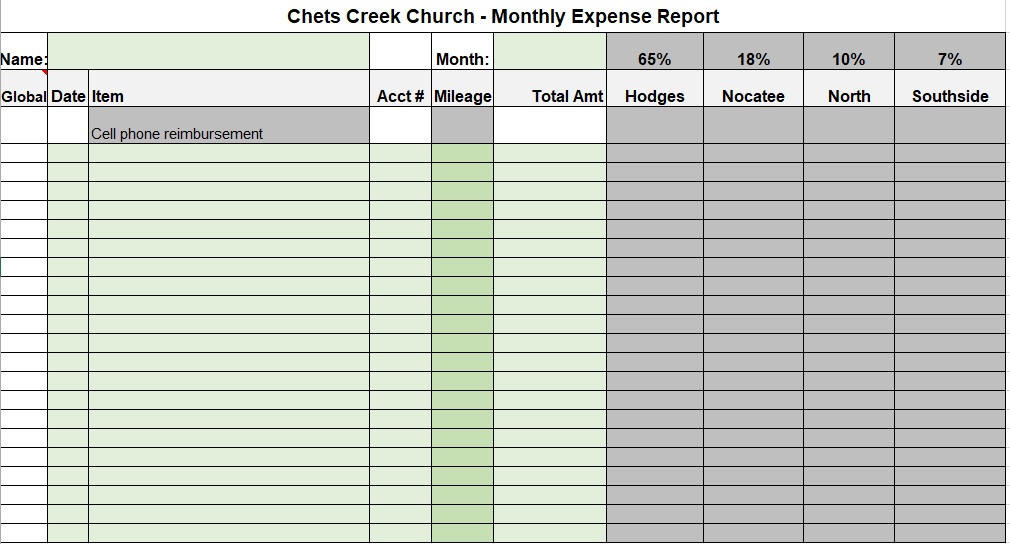

Categorize your expenditures

Now, group your accounts into categories. However, in categories, some credit cards tag your purchases automatically. This makes things easier for you. You can discover a lot of things by going through this process.

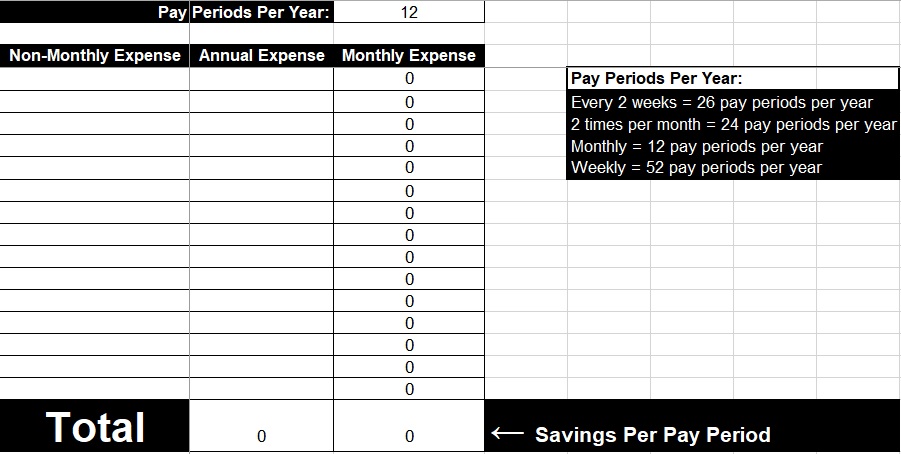

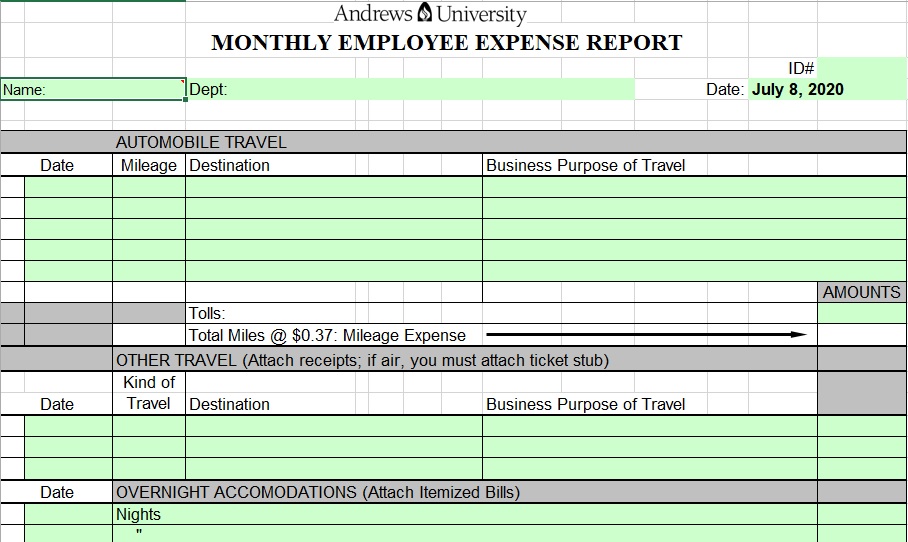

Use a budgeting monthly bills template

You can make your own and download these templates online. You can also use a budgeting app if you have a more comprehensive financial portfolio.

How do you create a monthly expense spreadsheet?

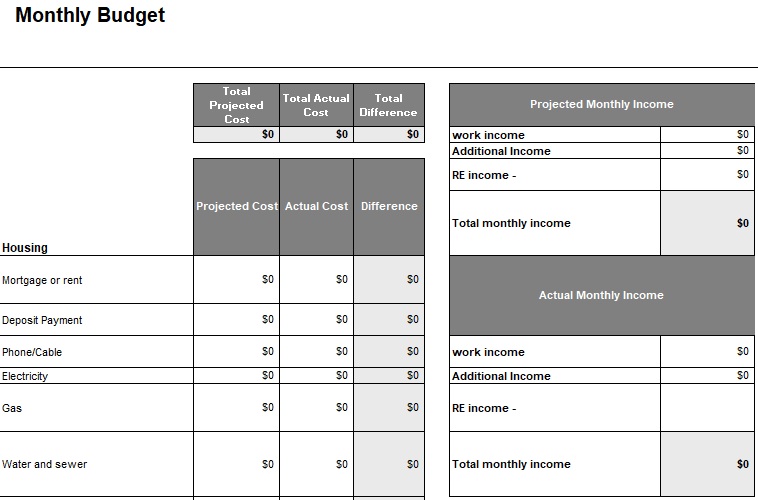

You should follow the below steps while making your own monthly budget template;

Launch the spreadsheet software that you want

You can use the software of your choice if you don’t have the Microsoft Excel installed in your computer.

Add the headings of the columns

- You have to skip 1st cell and then in the next cell enter ‘Amount.’ This column keeps track the value of all the other items on your sheet.

- Then input “Due Date” in the next cell. This column is made to record the due dates of your payments or bills.

- Again, move to the right and input “Paid.” This is an optional column. It makes you able to check either or not you have already paid your bills and other payments.

Record your monthly income

In the first column, input ‘Income,’ it acts as a heading for all of your income items. Move one cell down then input ‘Net Pay’ and then input “Other Income.” On the basis of the income that you receive for that month, input the corresponding values.

To calculate your total monthly income, make a cell with a formula

After creating cells for all your sources of income, you have to make a cell for totals all of these values. Right under the last line of your income items, make this cell. In the cell, input ‘Total Income.’ To calculate your total income, create a formula on the right of the total income cell. “=SUM” formula is the simple formula for this.

Add the expense titles

Next, input your expenses in the same manner as you have entered the information for your income. You can place more individual line item expenses instead of income items. This makes it easier to divide your expenses into general categories. After the cell with “Total Income,” you can start by skipping one line and then followed by “Expenses.” Move down one cell then input “Housing.” Under this, you can place several housing expenses that you spend every month such as rent or mortgage payments, insurance, and utilities.

Sum up your expenses

Create a cell that automatically totals all of these values for you after inputting all of your expense categories. Input “Total Expenses,” just below the last line of your expense item. Again, input your sum formula by moving one cell to the right.

Save your template

After completing the spreadsheet, you have to ensure that you save your blank template.

Why should you use a monthly budget template?

You should use a monthly budget template due to the following reasons;

Assists in tracking minor details

You can keep track of minor details by tracking your expenses and income in a professional template. Minor or variable expenses might be missed without a budget template. You can miss valuable details that can assist you in making better-informed decisions.

Visualizing your budget

It is important for anyone to make a monthly budget template to get control of finances. With the help of a well-crafted budget, it can assist you in saving money, paying down debt, and getting other financial goals. It also makes it easier for you to see all your income and expenses day-to-day or week-to-week.

Helps in long-term financial goal planning

Aside from a snapshot of your current financial situation, your monthly budget is also an efficient tool for long-term goal planning.

Some tips and tricks for monthly budget:

Here are some tips that you should consider;

Let yourself fail

The first few months of your monthly budget might be a disaster in case you’re a budgeting newbie. You don’t need to worry about it as no one nails budgeting the first time around. You should try to see your setbacks as learning experiences rather than beating yourself up.

Create a plan

You need to have a plan if you want to save money. Firstly, you should decide how many you want to save each month and then make plan regarding it.

Use a budget template

You should make use of a template in case you don’t know how to make a budget.

Conclusion:

In conclusion, a monthly expenses template is the best way to have control of your expenses. This isn’t a difficult task. With the help of this document, you can keep track of your finances. You can use it as reference to pay your bills, save money, and more.