You have to fill up a direct deposit authorization form if you want to set up a process with your bank to be able to transfer funds electronically. By filling this form, you give authority to your bank to deposit funds electronically either from your account or to your account.

Table of Contents

- 1 What is a direct deposit?

- 2 Different kinds of direct deposit authorization form:

- 3 Important information should be included in all kinds of direct deposit form:

- 4 Helpful information in filling out your direct deposit authorization form:

- 5 The working of direct deposit authorization:

- 6 Setting up a direct deposit:

- 7 How to pay employees without direct deposit?

- 8 The advantages of direct deposit:

- 9 Conclusion:

- 10 Faqs (Frequently Asked Questions)

What is a direct deposit?

An electronic transfer of funds into someone’s bank account is referred to as a direct deposit. A person who is transferring the payment is known as the payer. While the person receiving the funds is known as the payee. Furthermore, any physical or paper checks aren’t involved in this type of transfer. You just need a network that allows deposits to be made between banks. This electronic network is referred to as an automated clearing house (ACH).

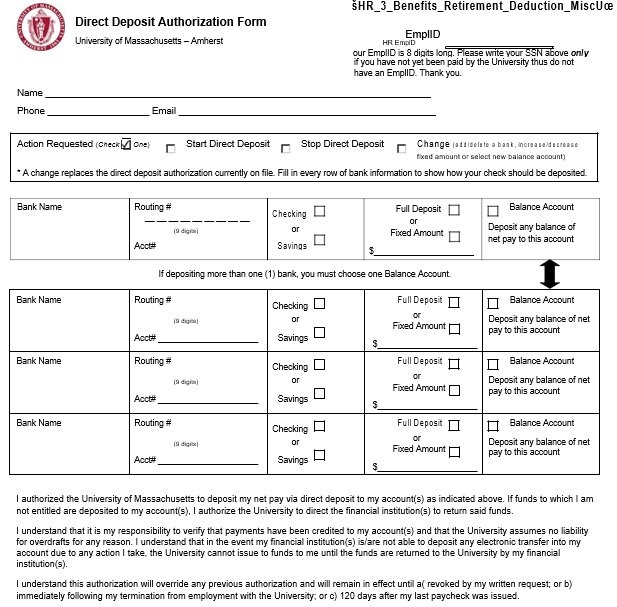

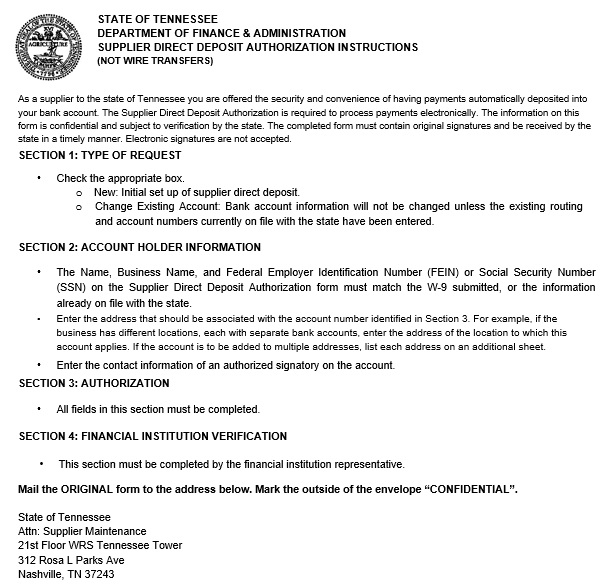

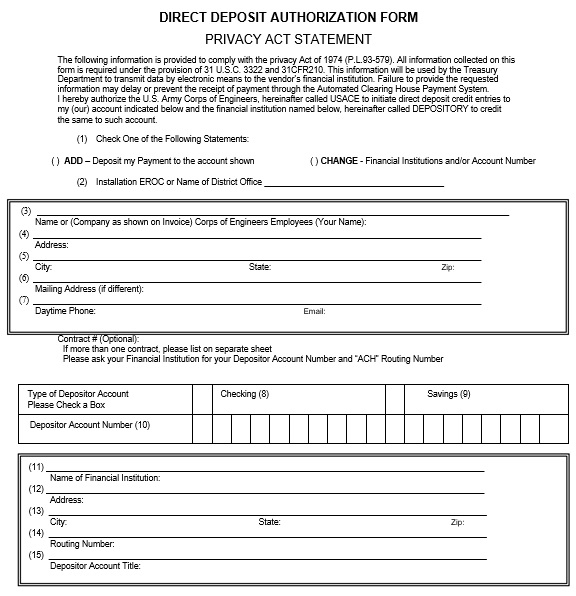

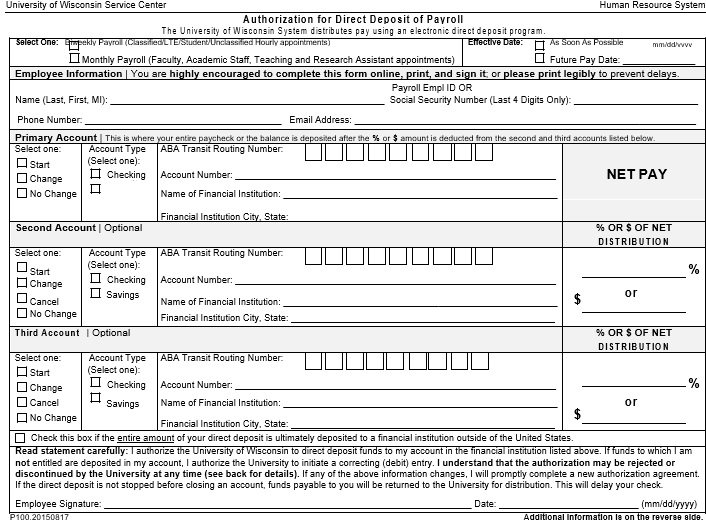

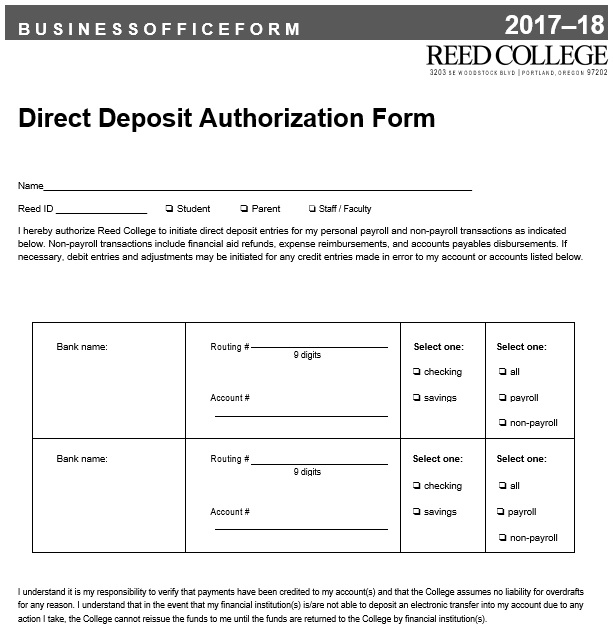

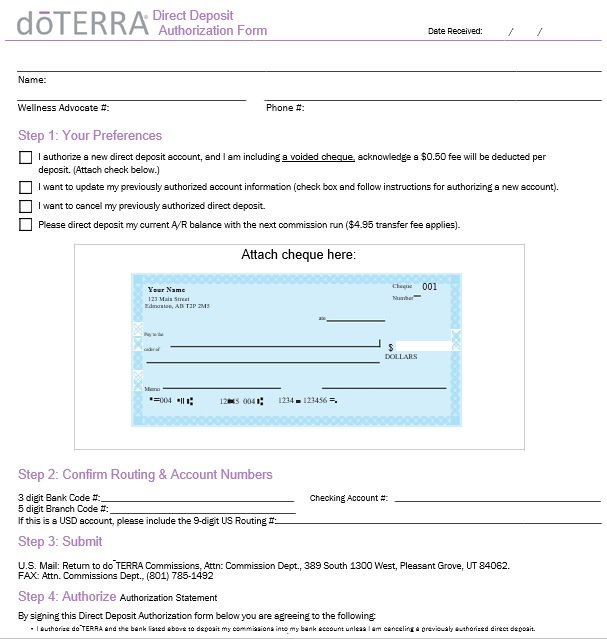

When you are going to your bank or to your employer to get a direct deposit authorization form then you must know which kind of authorization form you would need. However, there are three most common kinds of forms;

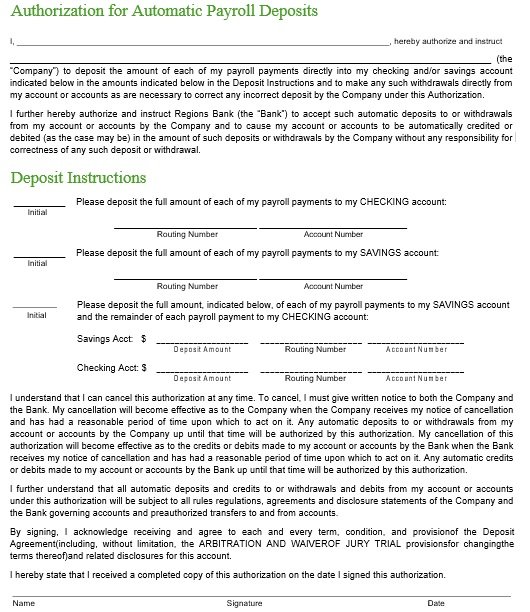

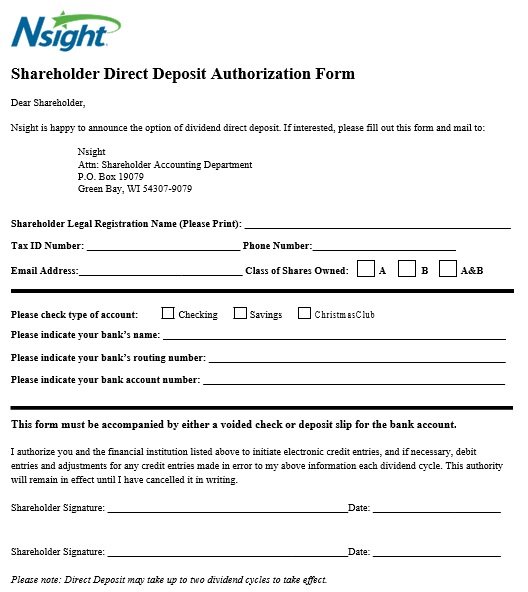

This kind of authorization form is used widely. It is used to set-up your accounts to receive deposits or payments. Moreover, it enables you to deposit payments for your monthly bills and obligations from your account.

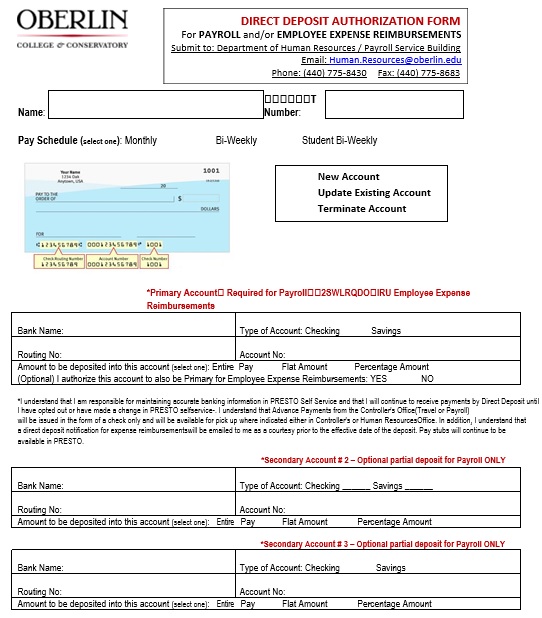

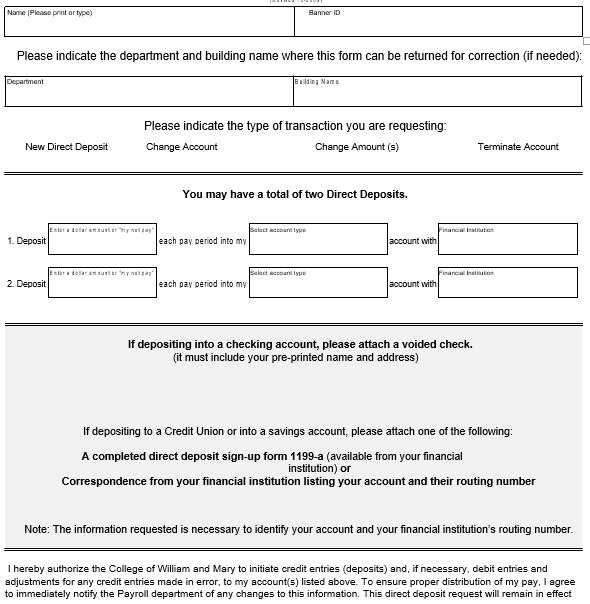

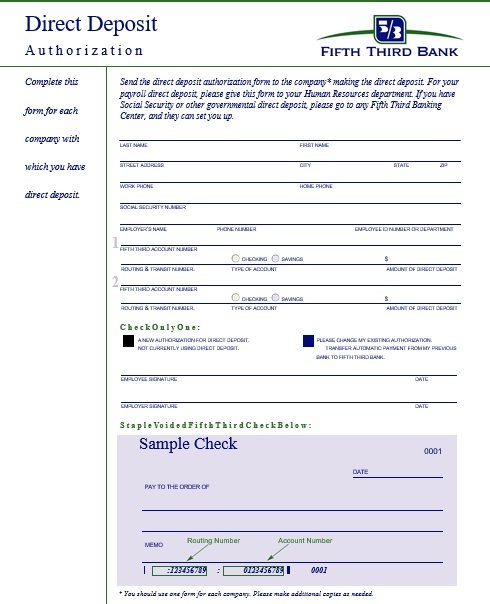

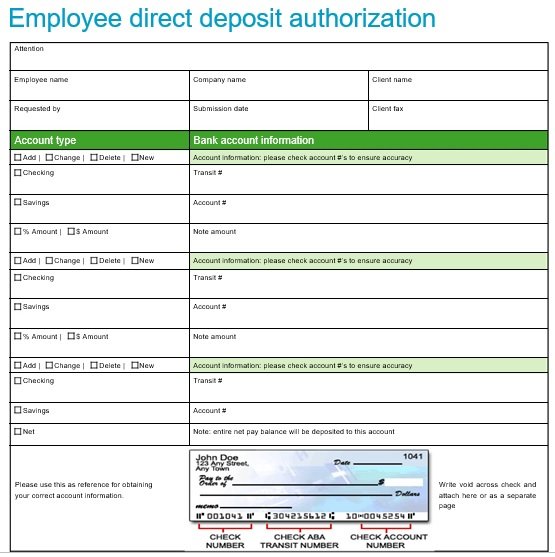

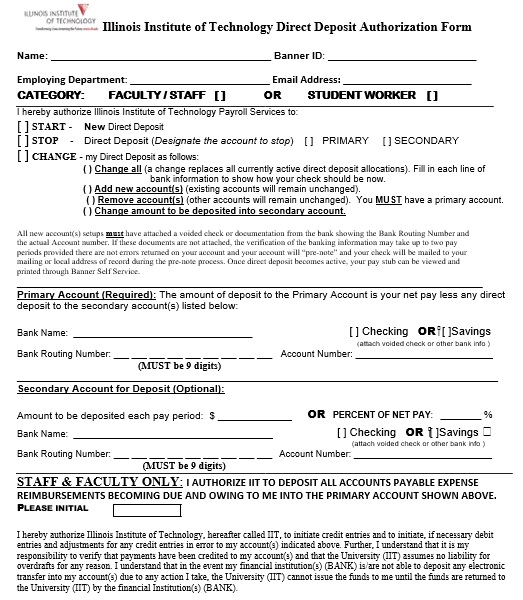

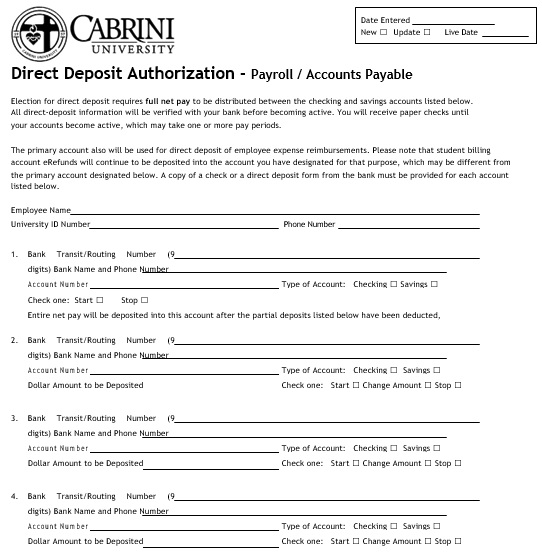

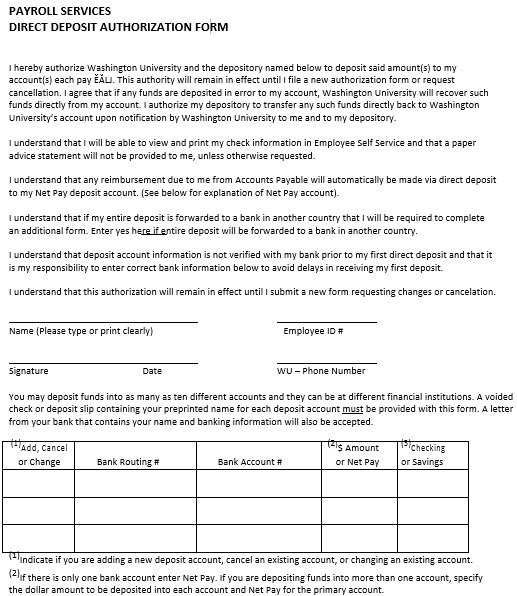

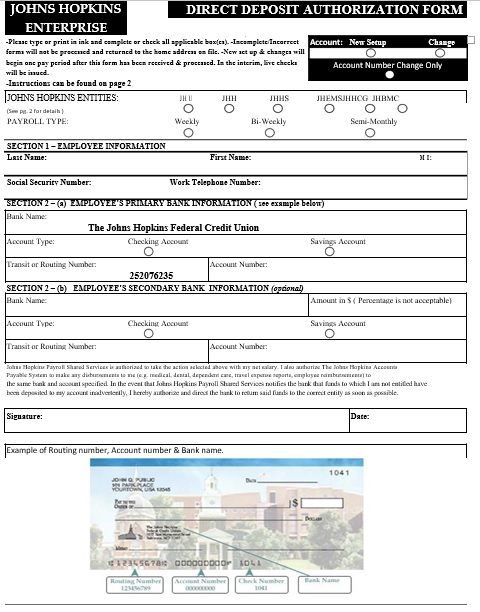

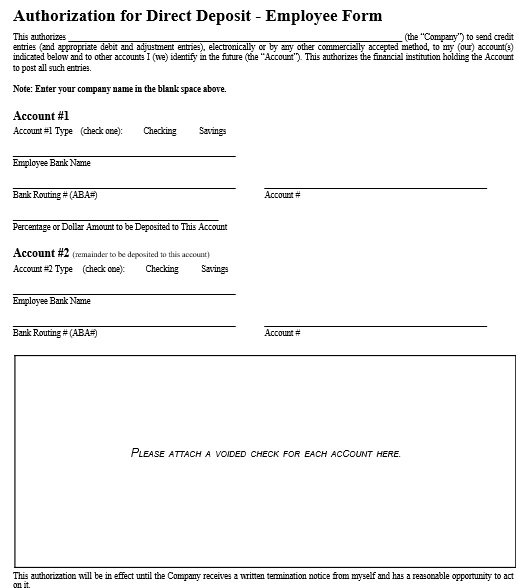

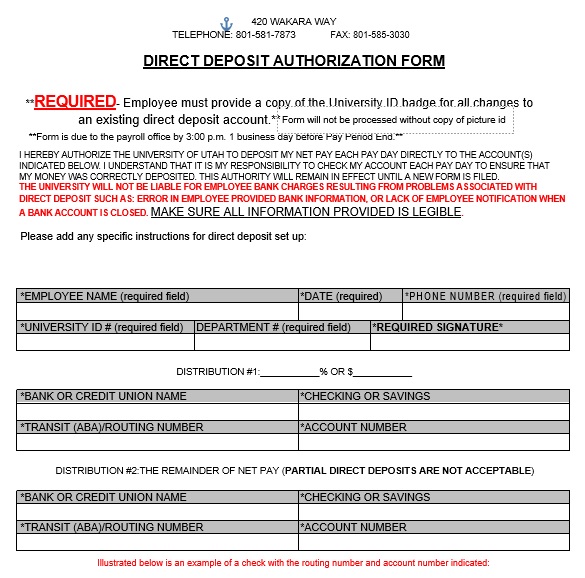

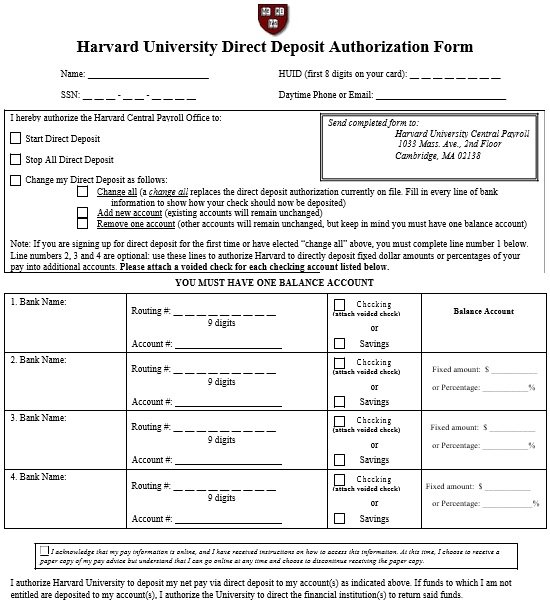

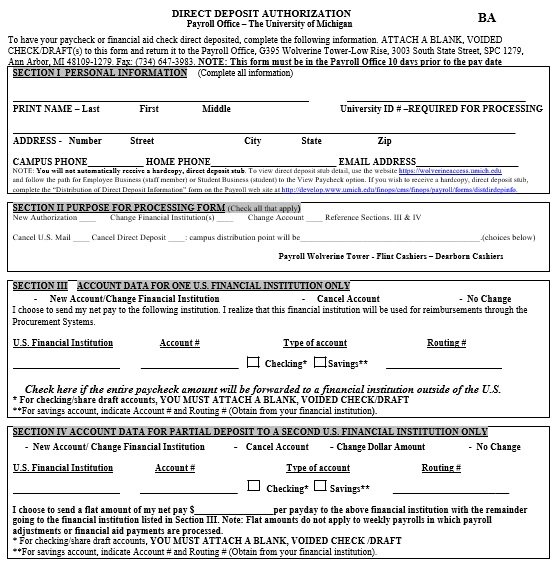

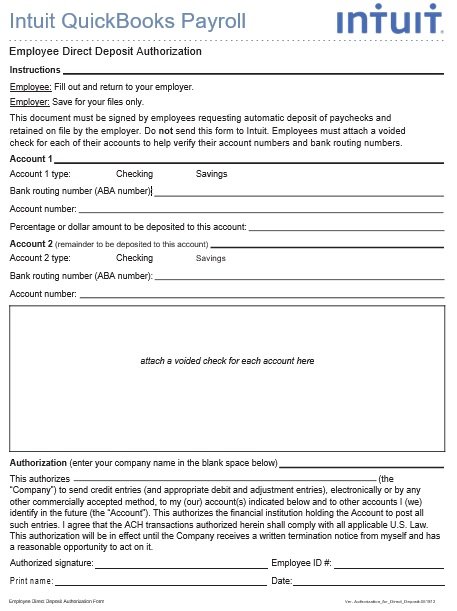

The employee direct deposit form is usually filled up by the employee of a company. By filling out this form, the employee gives the authority to the employer to directly deposit any funds to his/her account. In addition, this form also includes the options to authorize, revise, or cancel direct deposit to the account.

Likewise employee direct deposit form, this form is also used for the employee’s paycheck to be deposited directly into his/her account. This form is used by the payroll department of a company. With the help of this form, the payroll department keeps a record of the employees who have given them authorization for direct deposit.

Important information should be included in all kinds of direct deposit form:

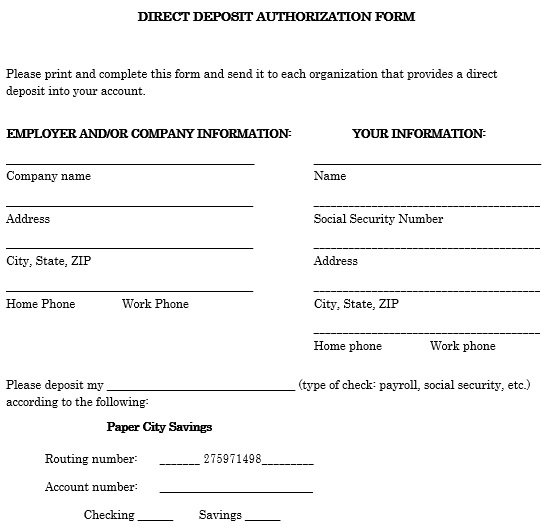

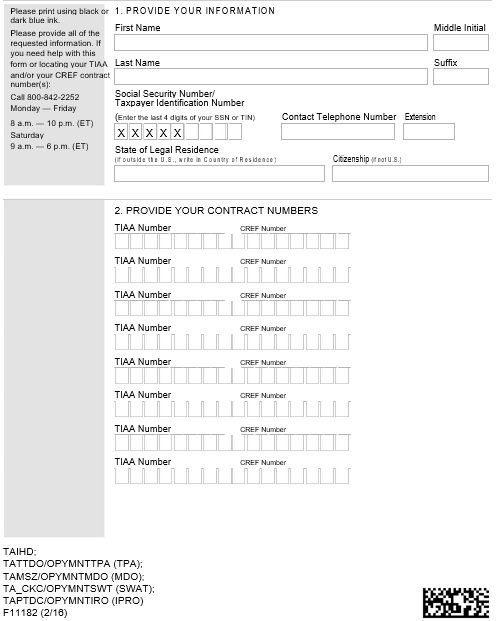

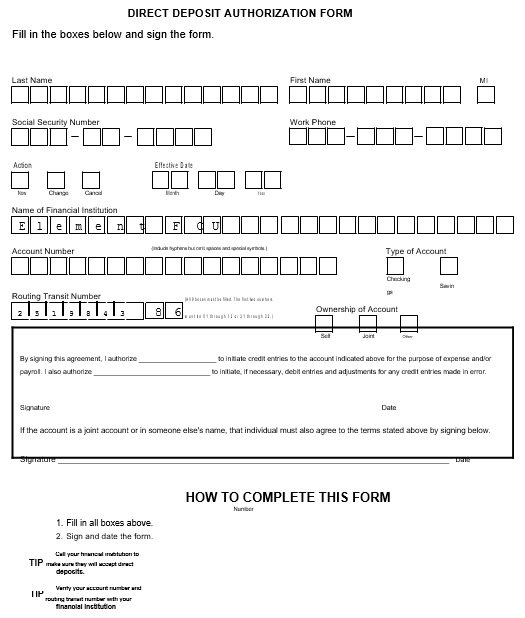

In all kinds of direct deposit form, you should include the following important information;

- At least mention 3 different places to deposit your money and all these choices must contain the following information;

- Name of the bank

- Your account number

- The routing number

- Mark the options if it is savings, checking, or investment account.

- The amount will be deposited in each account.

- A statement about the supplementary documents.

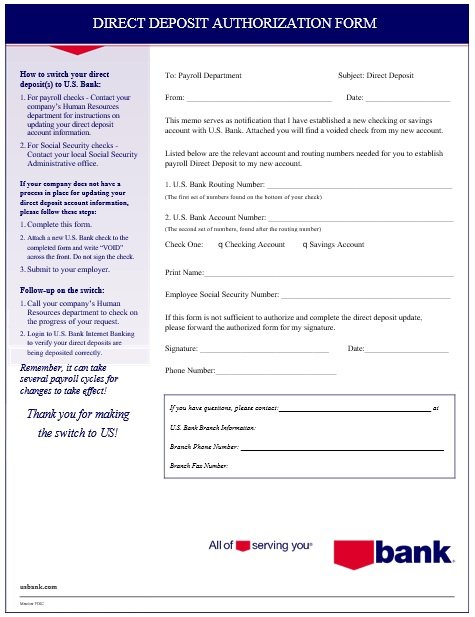

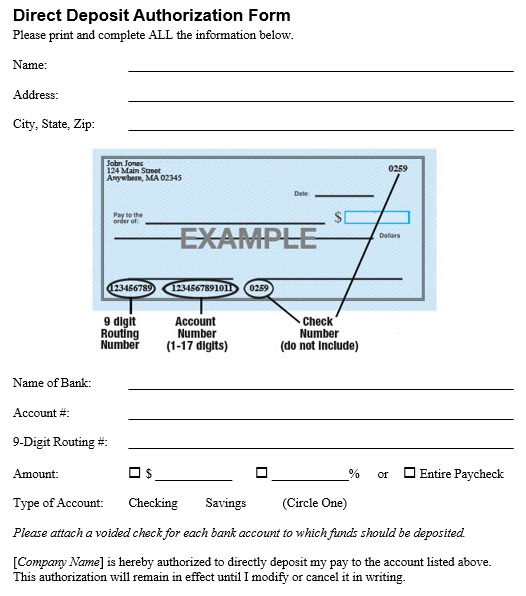

Before setting up a direct deposit with the bank, you would first need to understand all the information available in the different forms. Let us discuss some helpful information that will help you in filling out the form effectively.

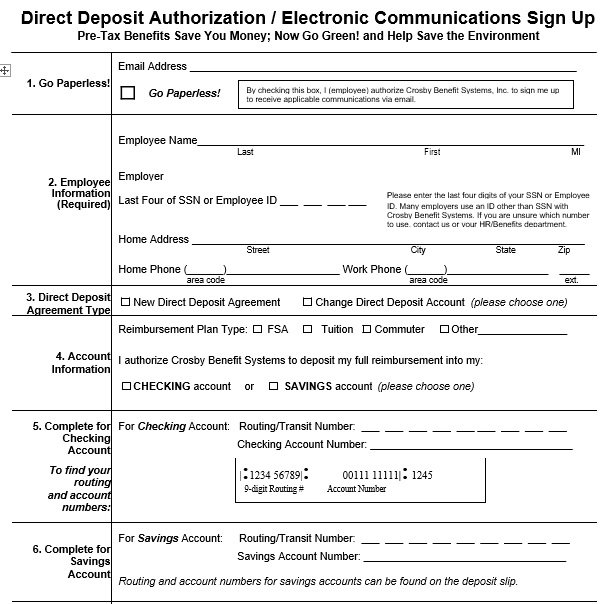

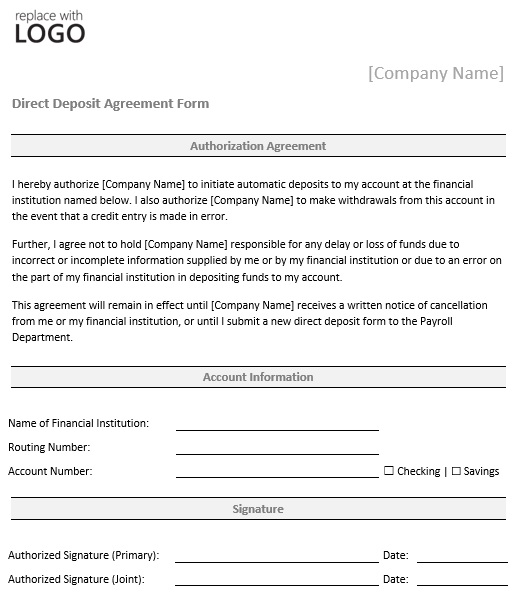

Basically, authorization comes with boxes where you have to mark the action you want to carry out.

- If you mark as Authorize then it means you are giving authority to your employer or to the bank to deposit any funds through your account electronically.

- If you mark at Cancel then you are removing the authority of your bank or your employer to do direct deposits.

Personal information:

Personal information includes the following things;

- Your name

- Your contact details

- Other pertinent information.

Account information:

Next, you should state details of your account like the type of account, either savings or investment. If you have more than one account then you have to provide all the details of all accounts that you are going to use for direct deposit.

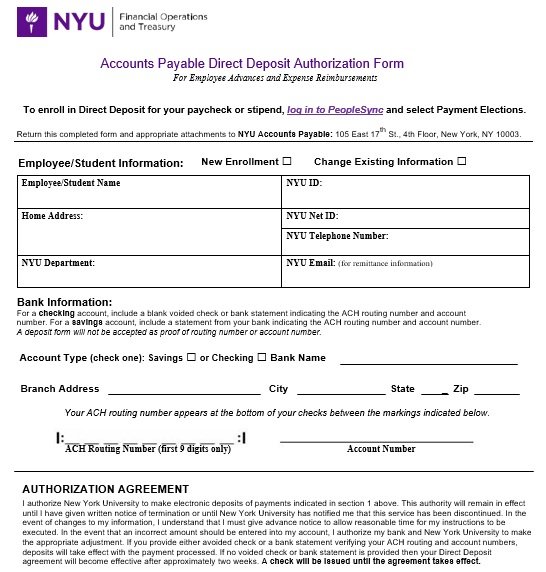

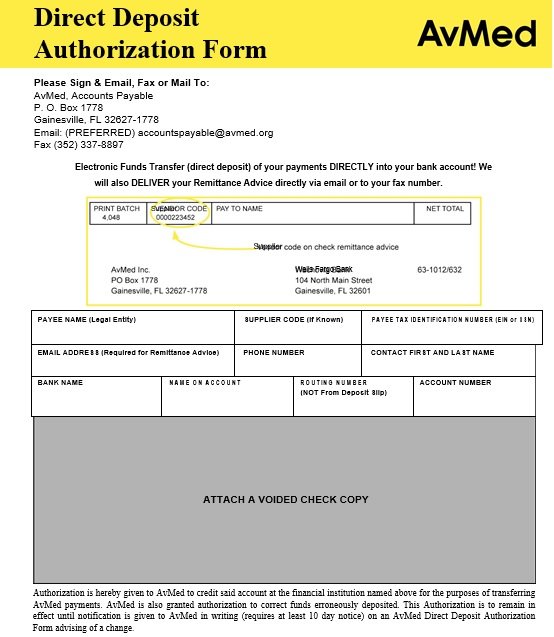

In direct deposit authorization, a payee authorizes a payer to transfer funds into his/her account. To carry out the direct deposit, the party transferring the funds should use a direct deposit authorization form because it contains all the necessary information.

Setting up a direct deposit:

It is relatively a simple process to set up a direct deposit if you are using a pre-prepared authorization template. You just have to fill in the important details and before submitting it, confirm the deposit amounts.

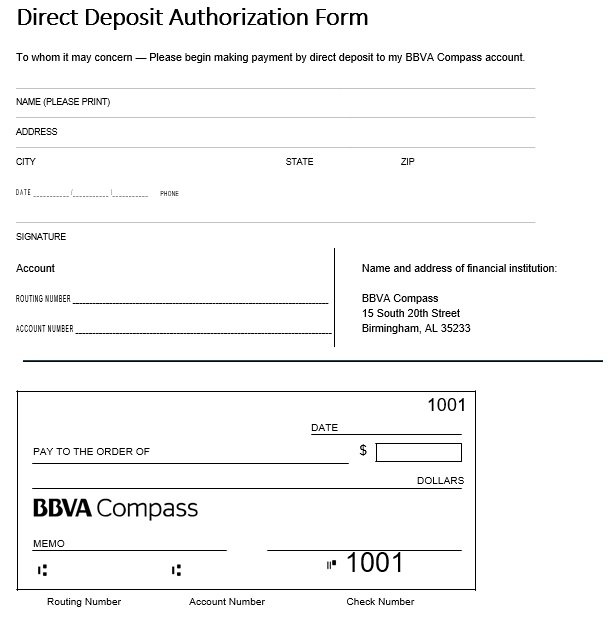

Sometimes, the transferring of the funds wants to make sure that the account is valid. In this circumstance, you will also have to submit a voided check (checking account) or a deposit slip (savings account). In addition, you have to ensure all the direct deposit information on the authorization form and the identification of the payee in case you or your company will be making the deposit. After that, you become able to make the deposit via your or your company’s bank account.

How to pay employees without direct deposit?

You can pay your employees without direct deposit in the following ways;

Physical paycheck

You can handwrite or print out paychecks for your employees when you have added hours and accounting for tax and other withholdings. Handwritten paychecks can be more time-consuming. So, you should print them and ensure that your printer is reliable and have backup ink and paper.

Cash

Handing out cash can assist you dodge fees. But, you have to ensure that you have concrete records of all the cash you distribute. Organizations that pay their employees with cash, the IRS keeps a sharp eye on them.

Payroll Card

The payroll card is similar to direct deposit. But, in this method, the money isn’t going into a personal bank account.

Virtual wallet

You can also transfer employee’s salary into virtual wallets such as Venmo or Apple Pay. However, the fees and conditions may vary on the basis of the service.

The advantages of direct deposit:

There are multiple advantages of direct deposit;

- A better way to access money: When you have your paychecks through direct deposit then your check gets cleared immediately. Hence, it means your money directly goes into your account.

- Before holidays get payments: If your payday falls on a holiday then by having a direct deposit you will still receive your pay as it directly goes into your account.

- An opportunity to earn rewards: Several banks provide promotions or rewards to their customers if they use a direct deposit feature in their accounts. So, every time when you make transactions you can earn rewards that could be beneficial for you in the future.

- No maintenance fees: Direct deposit directly handles checks so you don’t have to pay fees for check handling. However, in some cases, monthly maintenance fees may be waived.

- Become better at budgeting: If you want to save up something special such as a trip, a car, or even a house, you can do it much easier with direct deposit. You just have to create an account and your paycheck directly goes into your account every payday. By doing this, you can also specify the amount which goes into your spending account.

- Become more conscious about the savings: When you have different accounts then through direct deposit your money will be directly deposited into your spending account, saving account, etc. In this way, you will be able to boost your savings in no time.

- Free and convenient: Setting-up a direct deposit account is totally free and doesn’t contain any hidden charges. Also, setting it up is very easy. You just have to fill out the direct deposit authorization form and submit the form to the bank or to the employer.

- Transferring banks would be easier: Transferring banks would be an easy process via direct deposit. You just have to make a payroll or employee direct deposit authorization form and fill it up with your new bank’s details and submit it to your employer or in your new bank.

- Effortless: Most importantly, you don’t require any effort to access your finance. Online or mobile banking allows you to check all the payments which go into your account; you just have to sign in.

- Privacy: No one at your work can know about your financial information as your pay directly goes from your employer to your personal account.

Conclusion:

In conclusion, a direct deposit authorization form is a helpful tool that allows you to set up a process so that you can transfer funds electronically. Before filling out the form, you must read the form carefully and provide all the information. In addition, if you want to keep your information private then submit it as soon as it is complete.

Faqs (Frequently Asked Questions)

Direct deposits make the process faster than using physical checks because they are made electronically. It typically takes 1 to 3 business days before the money appears as a debit on the payee’s account. Sometimes, it may take up to five days depending on who is sending the funds.

You just have to fill out a new direct deposit authorization form in order to change your direct deposit account.