An account statement template is a useful tool to provide your clients with a summary of the products or services that you’re going to bill them. Basically, a statement is a declaration coming from a person that you can use for different purposes. It is a written document that contains the person’s signature or a stamp from the concerned authority.

Table of Contents

- 1 What is an account statement?

- 2 Different types of statement templates:

- 3 Importance of a statement of account:

- 4 What are the uses of an account statement?

- 5 What to include in a statement of account?

- 6 How to get an account statement?

- 7 Where to get an account statement?

- 8 Conclusion:

- 9 Faqs (Frequently Asked Questions)

What is an account statement?

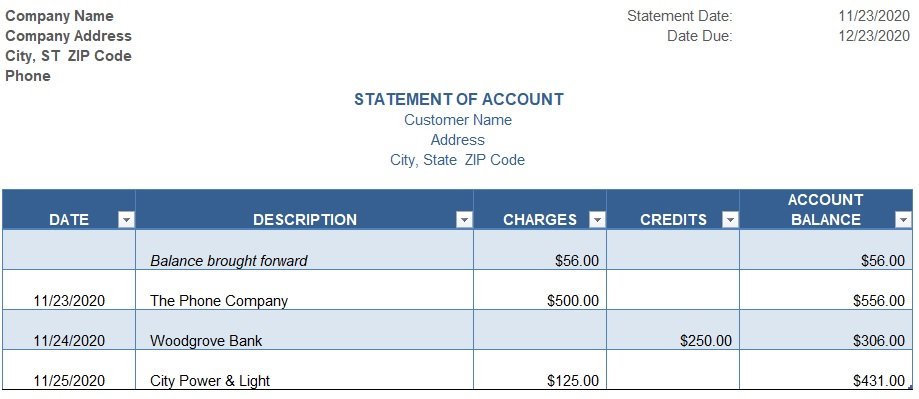

An account statement explains the sales of the business in a specific month. This statement is issued by customers who have an account with the company. Calculating the running balance automatically is the biggest benefit of using the statement of account. Usually, this document specifies monthly transactions over a particular period.

Different types of statement templates:

A statement template has the proper structures and guidelines that you have to follow. Depending on your situation, there are various ways for you to write statements. Let us discuss below some different types of statement templates;

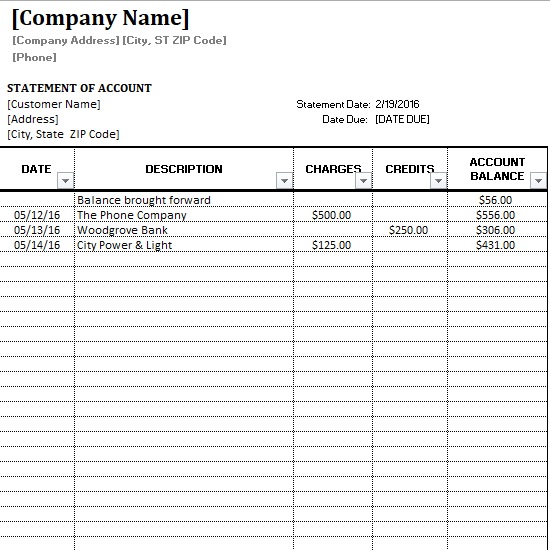

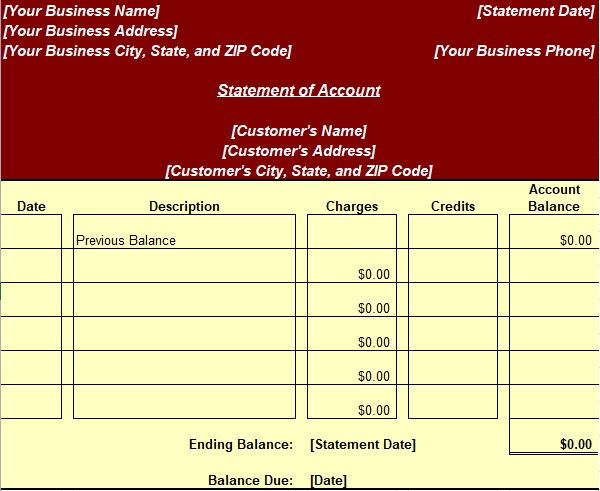

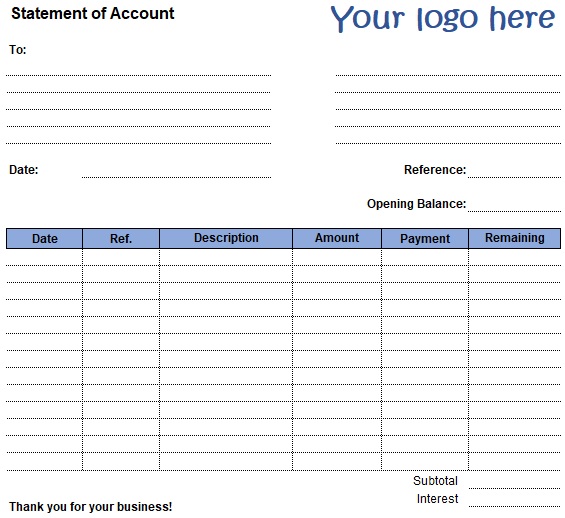

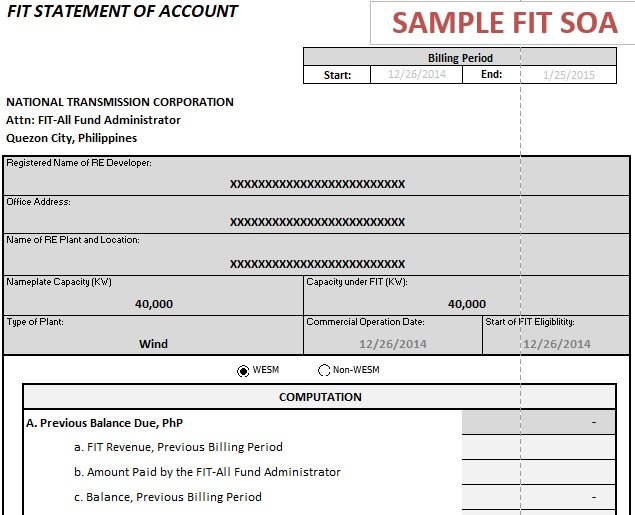

Account statement:

It is used to make a proper account statement.

Bank statement:

This template is used by the bank managers to create a perfect template for their clients. Also, it contains a set of instructions. These instructions help the clients to understand what’s written on the document.

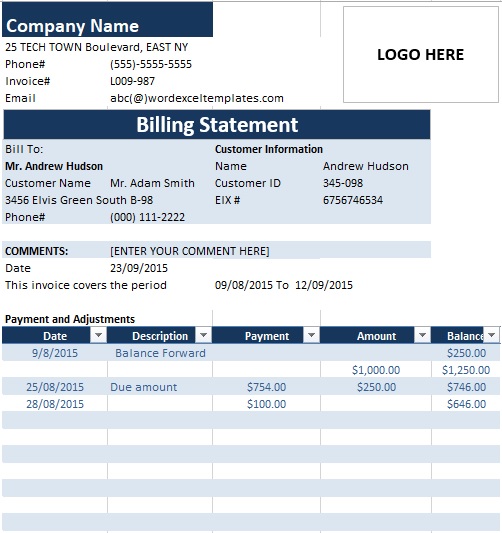

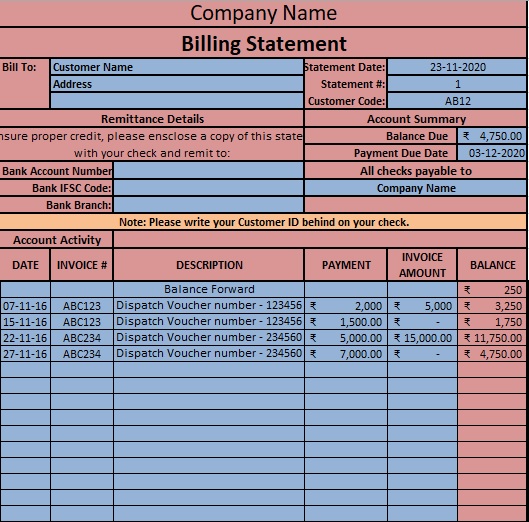

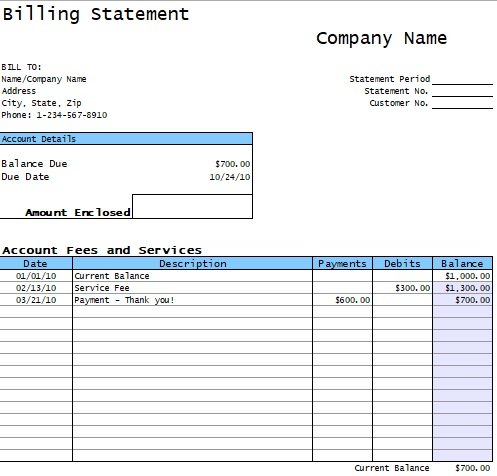

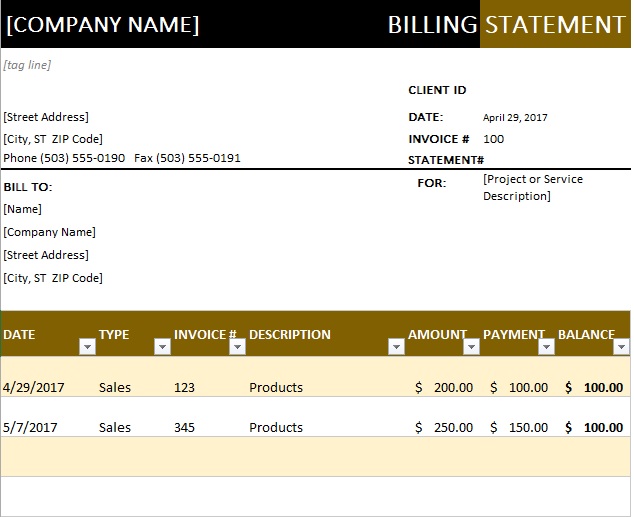

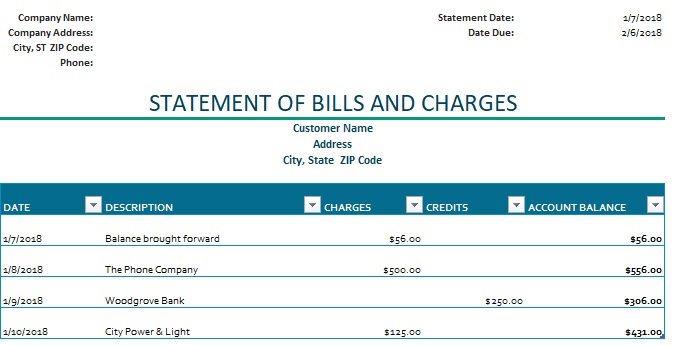

Billing statement:

This statement template is used by store managers, business owners, and other service providers in order to create bill statements for their clients.

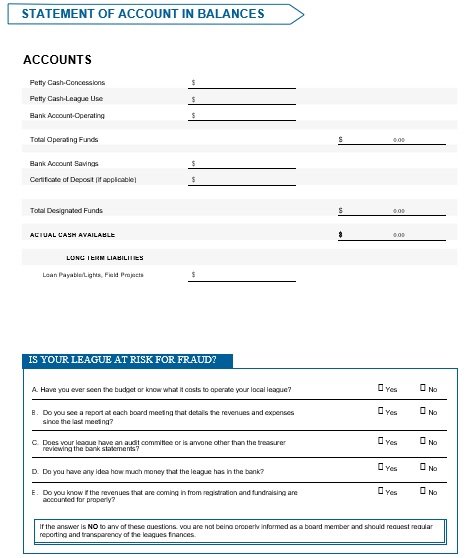

Balance record statement:

At start, this template has an official cover page then an index page. On the basis of the information you want to include, the rest of the pages contain contents in both tabled and paragraphed formats.

Cash flow statement:

All of the details required to understand your business’ cash flow are included in this document.

Dividend statement:

It is issued by the company directors to shareholders so that they can stay informed on dividends.

Income statement:

As a business owner, you must write your own statement while claiming refunds or filing your taxes. When you avail of government benefits or doles, you can also need this.

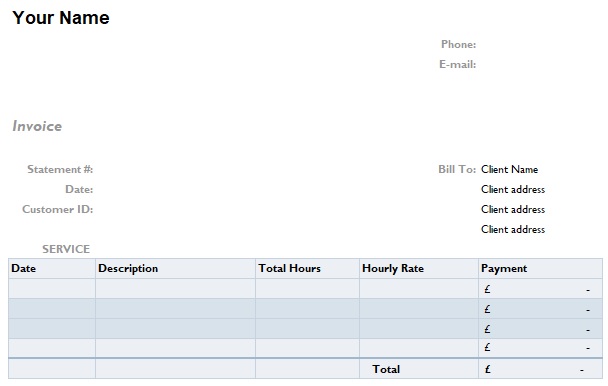

Invoice statements:

This type of statement can create for various purposes by you as a business owner, your store manager or your shopkeeper. You can also make this statement during filing your taxes or for claiming insured money.

Personal financial statement:

You qualify to acquire income tax benefits while taking a loan from a bank or another lending institution. You have to disclose your financial situation using this document to avail of these benefits.

Profit and loss statement:

Financial executives or accountants of companies create this type of statement. Your financial decisions for the future are based on this document. Therefore, you have to write this statement by using a standardized format.

Importance of a statement of account:

Along with a summary of the products or services that you’re going to bill, a statement of account also verifies the payments that your customers have already remitted for a specific statement period. Furthermore, this statement becomes more helpful when you have regular customers and you have to create invoices for them on daily basis. This statement is basically an addition to the individual invoices. Below are some other uses of this statement;

- This tool can be used payment reminder. This is because it provides you an idea of your customer’s recurring expenditures. It also allows you to send reminders for advance payments.

- If there is any inconsistencies in business records then with the help of this statement, you can check whether your customer has already paid their dues or not. Also, this is a great way to determine any inconsistencies in your data.

- It assists you in determining transactions that have been accidentally duplicated.

- For each of the items that you have sold to your customers, this statement provides you with an accurate record of the price. This makes you able to keep record of the information of customers for a specific period of time.

- The statement also helps you in identifying errors.

What are the uses of an account statement?

There are many different uses of an account statement, let us discuss them below;

- In the banking industry, the account statement is the most common. Government officials and public leaders require it as part of the declaration of one’s assets.

- You may have to present an account statement of your bank account to the Embassy of your country. It serves as evidence that you have enough amount of funds for your travel as well as you have the capability to survive in a foreign land.

- It is also used for record-keeping as they are detailed and consist of correct personal information. Therefore, confidentiality is taken as a very serious matter by banking institutions and other financial institutions.

- Account statements are also used by insurance companies to record all of the payments that you have to your insurance account.

- To indicate details of one’s loan, a loan account statement is used. This statement contains their principal loan amount, monthly amortization, interest, outstanding balance and more.

- You will also need an account statement when you are planning to get a credit card.

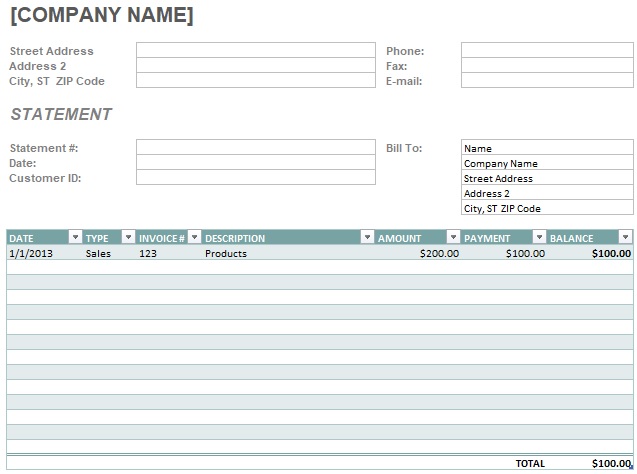

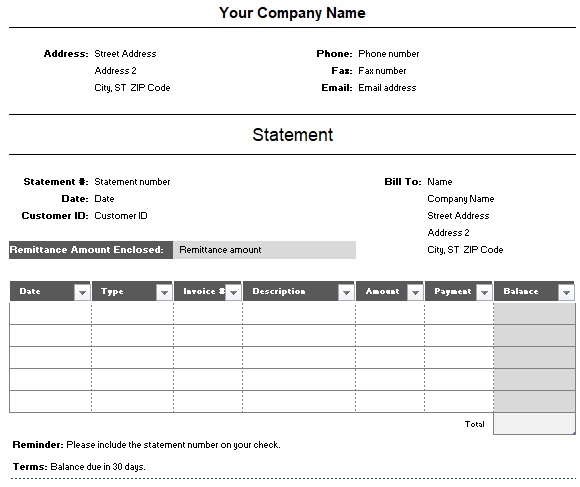

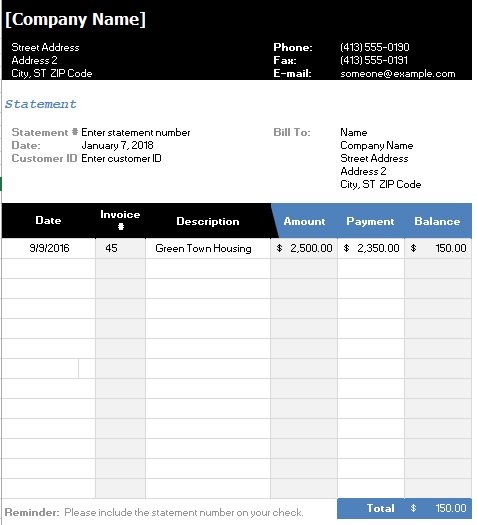

What to include in a statement of account?

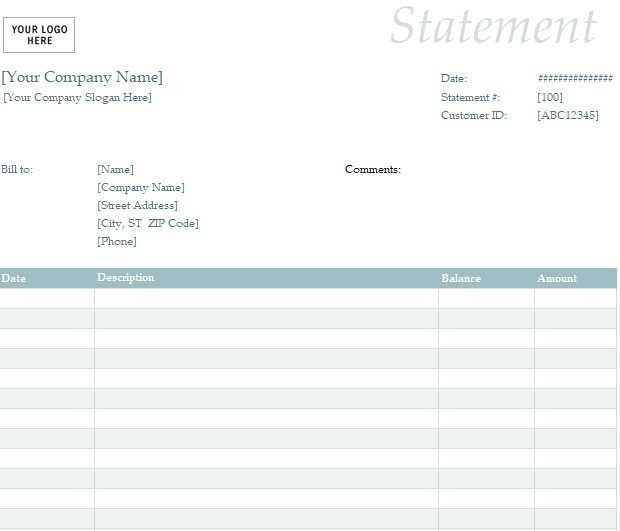

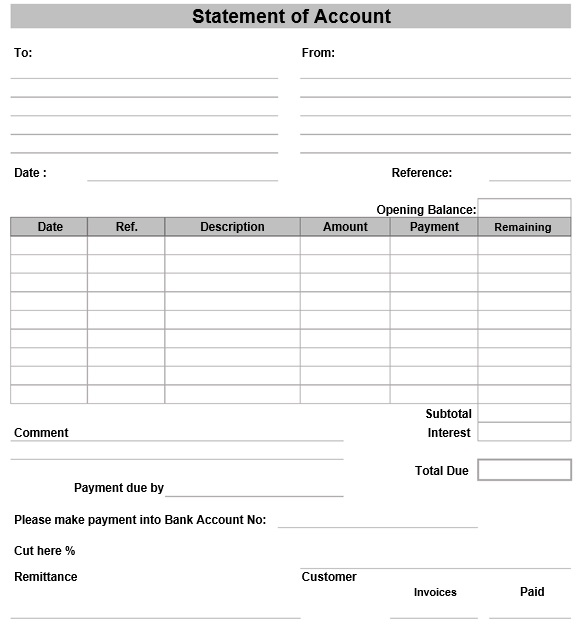

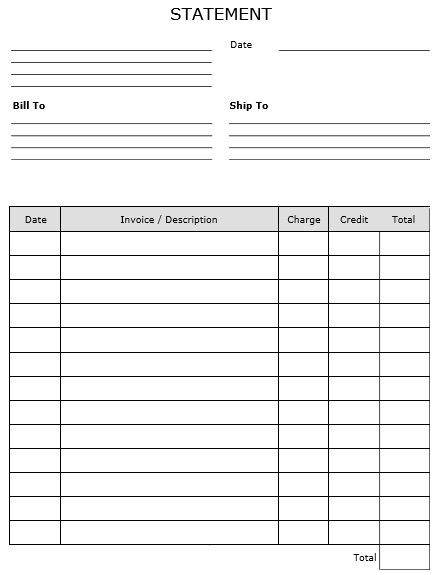

A statement of account can be made as a more comprehensive report of the contents of your personal or business account. For example, it is issued to a customer indicating payments from and billings to the customer at a specific amount of time. The main purpose of this document is to remind your customers of sales that are still unpaid. However, you can send this statement as a printout or electronically through email. The statement usually includes the following basic information;

- The total of all unpaid invoices

- The date of invoice and invoice number. Also, the date of the total amount for each invoice that you have sends your customer for a specific time period.

- For each of the miscellaneous credits you issued to your customer, provide the credit date, credit number, and the total amount.

- The date of payment and the total amount for each of the payments you obtained for a particular time period.

- The remaining balance of all of the listed transactions. This indicates the total payable amount.

- At the bottom of the document, a payment slip that you can tear off and use as a remittance slip. It includes the name of your customer, a mail-to address, and space for the customers where they can write the amount they’re paying.

In addition, you can also add a block where you can include contact details. Here, you can also provide information about your staff.

How to get an account statement?

Getting a copy of your account statement isn’t as such difficult. You can get this either online or in person. Your online banking page lists all of your statements for a digital copy. Then, you can download the file in a PDF format. You can also request your bank the statement template in person.

Where to get an account statement?

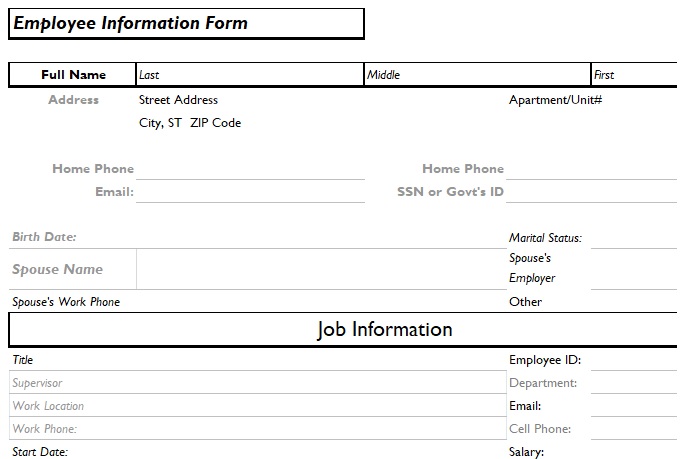

You can get an account statement from a number of institutions and agencies. However, the process that you have to follow may vary from institutions to institutions. You will need to follow their particular procedures in order to get an account statement from different institutions. Here is a few places or institutions from where you can get an account statement;

- Any banking institution

- Lending and other financial institutions

- Current employer

- Recurring service providers such as utility, telephone, cable, etc.

- Government institutions where you have to give a contribution periodically until you reach a specific age

- Credit card providers

- You can check your account statement online if it is an online account

Conclusion:

In conclusion, an account statement template is a tool that helps you in making an effective account statement for your customers. It provides your customers a summary of the products or services that you’re going to bill them. The template contains the proper structures and guidelines that you should follow to make a statement of account.

Faqs (Frequently Asked Questions)

These are the following;

1- Date range: the time period covered by a statement.

2- Opening balance: in the account statement, it is the starting amount and it indicates the amounts due for the previous period.

3- Invoiced amount: the total amount of goods or services that during the current period customer consumed.