A trust amendment form is used when you want to update your existing living trust. With the help of this form, you can make specific changes to your trust document such as adding a beneficiary, editing a specific provision, and more.

Table of Contents

What is a trust amendment form?

A trust amendment form is a legal document used to change one or more provisions of your revocable trust. It doesn’t change your trust document as a whole. Instead, it just saves you from the hassle of drafting a new living trust. If you make a new document then you have to transfer all the assets from your existing trust into the new trust. Thus, you can make these minor changes without too much time or effort by using the living trust amendment form.

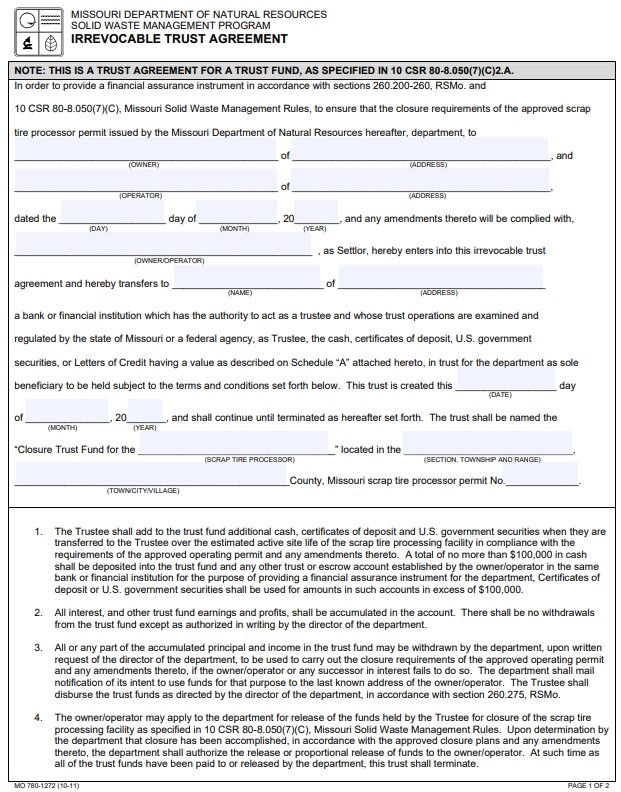

Remember that you just amend a revocable living trust by using a trust amendment form. You can’t use it for irrevocable living trusts. This is because the grantor without the permission of the beneficiaries can’t alter or revoke the irrevocable trust.

When to use a trust amendment form?

You can use a trust amendment form in the following situations;

Update your trustee

If your selected trustee isn’t willing or able to manage the trust then use a trust amendment form to designate another person or organization to manage your trust.

Change or add beneficiaries

Your beneficiary’s preferences change as your life and relationships change. For example, after creating your trust, you may remarry and become a step-parent. In such a case, if you want to add your stepchild as a beneficiary then use a trust amendment form.

Delete or modify specific distributions

A distribution is a present that you leave for your loved ones or donate to charities. You can use this form to make specific changes like adding or removing a gift.

Revise a particular provision or term

You may have to adjust specific provisions in case your situation has changed or the defined goals for your trust have been modified. Since an amendment form doesn’t impact the trust as a whole so you can use it to make these amendments.

According to the state-specific requirements

Every state has its own preferences regarding what to include and what not to include in your trust documents. You may want to amend your trust if you make your trust while living in one state and then move to another. Doing so is important to meet the preferences of your new location.

Difference between trust amendment and trust restatement:

You need a trust amendment form if you want to make amendments that won’t impact your trust as a whole. On the other hand, you need to complete a trust restatement if you want to make changes to your entire trust and you have to rewrite your document.

A trust restatement comes in handy when you need to replace or rewrite all the existing provisions in your trust. Basically, you require this document when the goals of your trust have been modified. In addition, if you haven’t made any changes to your trust over a few years then you should also opt for a trust restatement. This way, you can avoid keeping track of multiple amendment forms.

Both documents a trust amendment form and a trust restatement form should be executed properly meaning they have to be signed, witnessed, and potentially notarized.

Difference between trust amendment and codicil:

A trust amendment form and codicil are legal and official documents that enable you to make amendments to your estate plan.

A codicil is used to make changes to your last will and testament while a trust amendment form is used to make amendments to a revocable living trust.

Writing an amendment to your trust:

Consider the following steps to write an amendment to your trust;

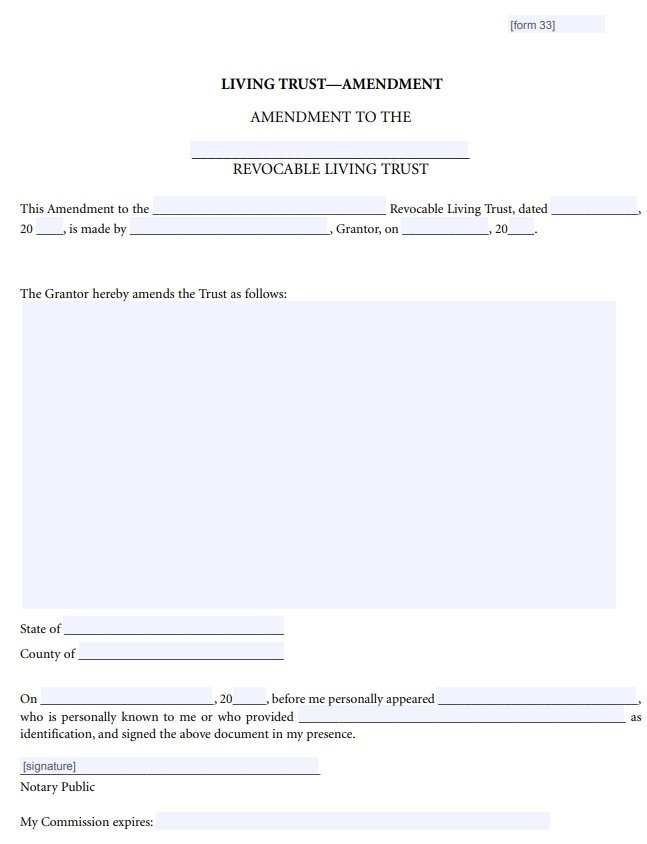

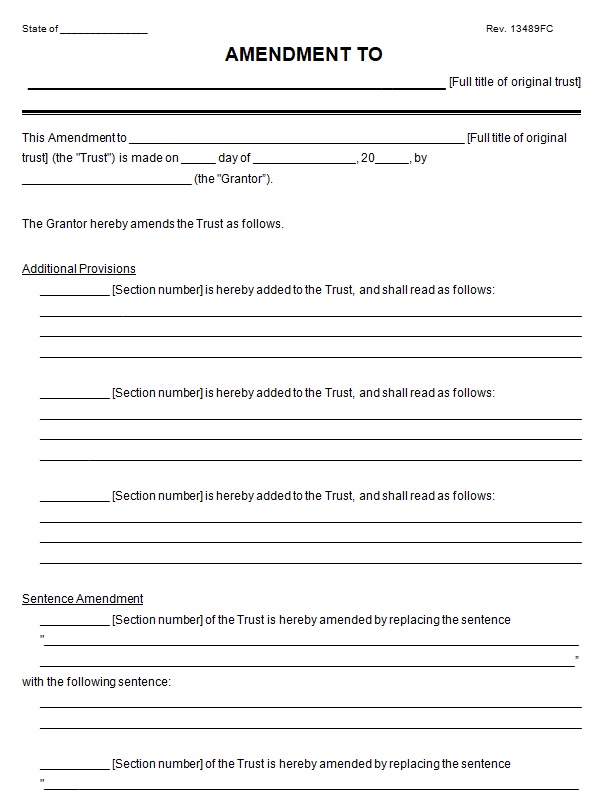

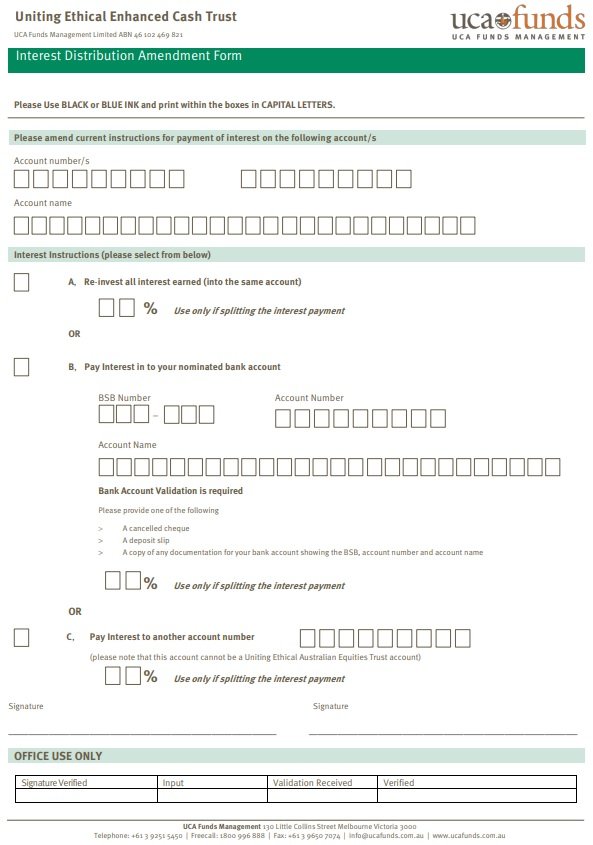

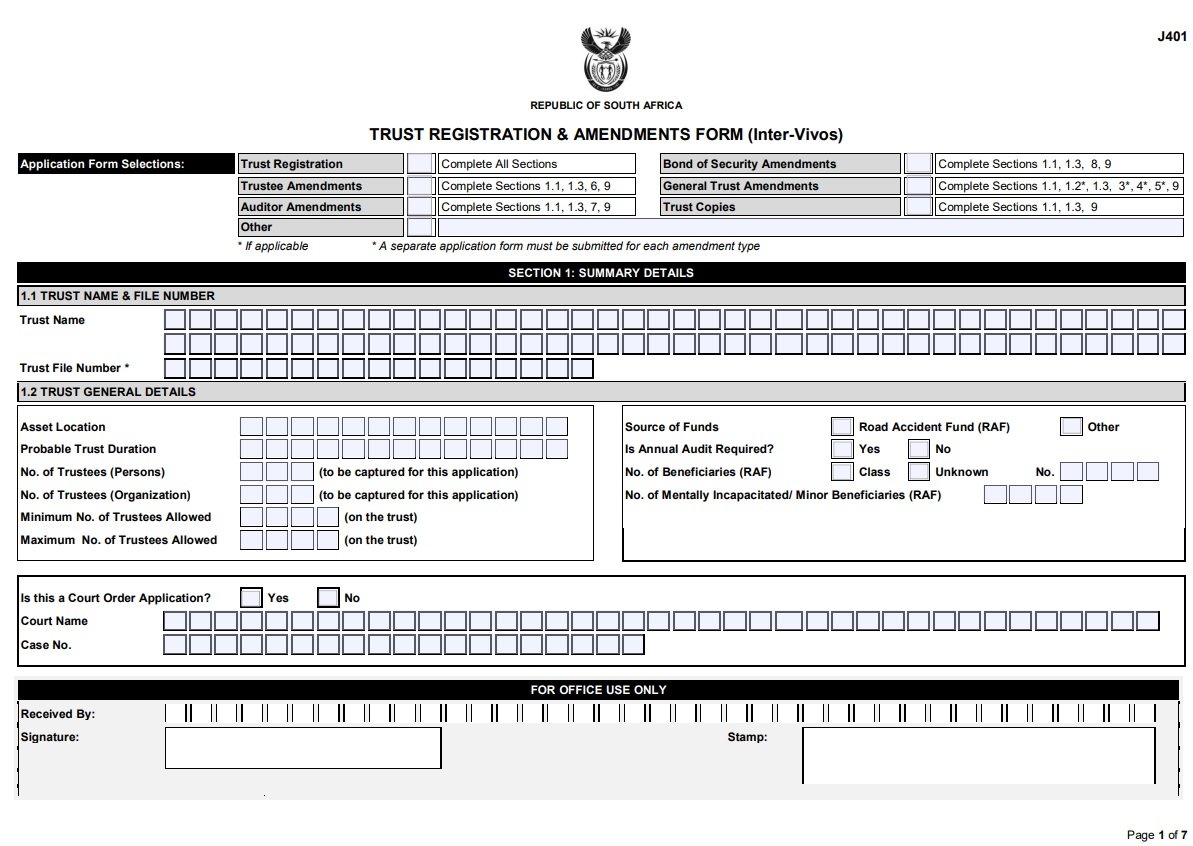

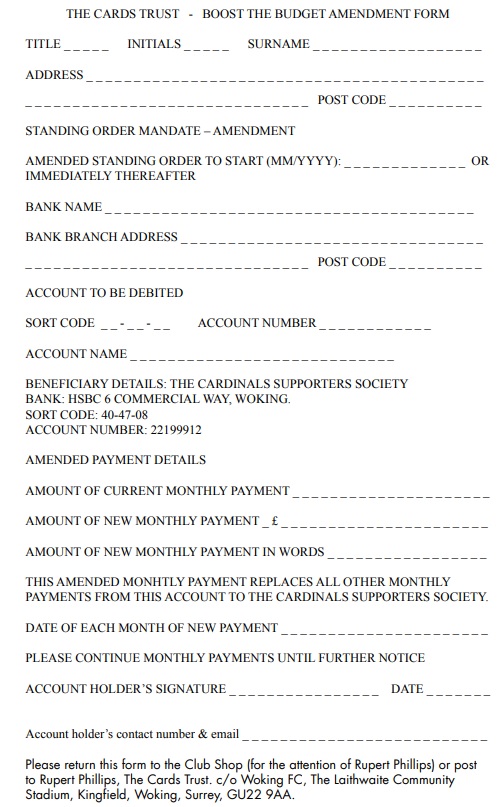

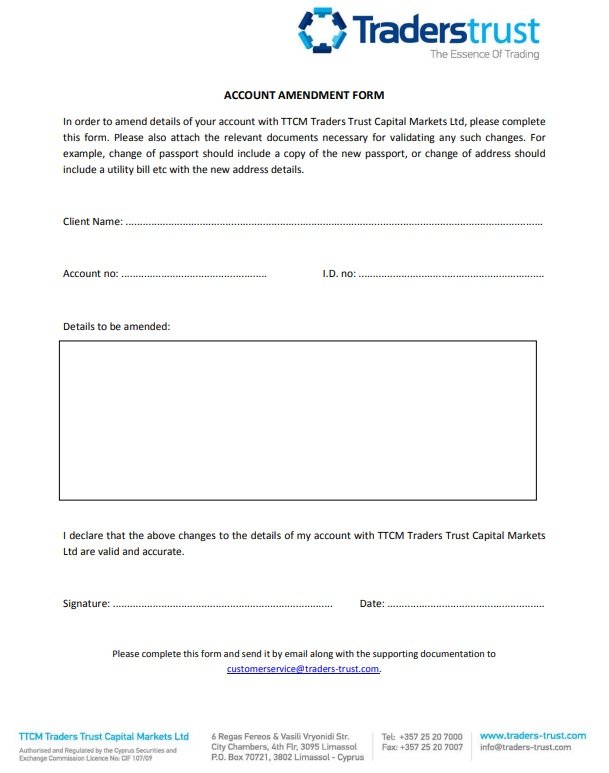

Get an amendment form

You can download an amendment form template online or can request one from an estate planning attorney.

Identify your changes

First, determine what you want to change and where this information lies in your trust document.

Fill out the amendment form

Fill out your entire amendment form clearly and describe your changes clearly. Include the following details;

- Jurisdiction

- Full title of trust

- Date of amendment

- Determine the grantor

- Amendments

Sign the form

To make your form legally valid, you have to sign it. In some states, you may have to sign it in the presence of the witnesses or notary.

File the form

Attach your trust amendment form along with your trust document and keep them together. Depending on the requirements of your state, you also have to file your amendment form with your local court or county office.

Make copies for others

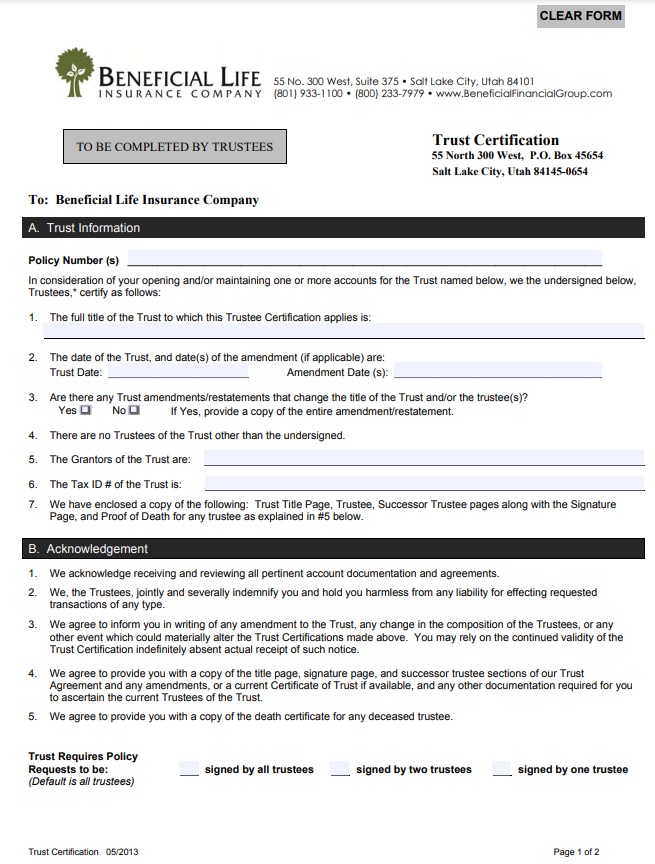

If you have a bank account in your trust, you should give your bank a copy of your form to inform them that you’ve just changed who your trustee is or the powers they have.

How much cost is required to amend a trust?

The cost of amending a trust depends on the following factors;

- How you decide to do it

- Where you live

- The complexity of the original trust

- The amendment process

However, the costs could easily exceed $1,000 if you are planning to revoke the old trust and have an attorney create a new one.

FAQs (Frequently Asked Questions)

The main purpose of a trust amendment form is to make changes to an existing trust like changing the trustee, adding or removing beneficiaries, and more.

A trust amendment form must include the following details;

1- The date of the amendment

2- The name of the trust

3- The amendment language

4- The name of all parties involved

5- The signature of the trustee

6- The signatures of all beneficiaries

7- Any attachments or other documents