A quitclaim deed form is a different form of a warranty deed that covers no guarantees, warranties or promises to the grantee. Quitclaim deeds are required by the seller who don’t want to convey any covenants to the interested party. If sellers don’t want to guarantee for the liabilities and titles then these forms are used. Let’s discuss below the facts about the quitclaim deed;

Table of Contents

- 1 What is a Quitclaim Deed?

- 2 Unlike any deed, they have least amount of protection:

- 3 They are only accepted because of trust and know-how:

- 4 They can be used to clear title defects:

- 5 They are effective if the title is good:

- 6 They only affect the ownership:

- 7 What to include in a quitclaim deed form?

- 8 How a Quitclaim Deed works?

- 9 When to use a Quitclaim Deed?

- 10 How to create a quitclaim deed form?

- 11 What is a Quitclaim Deed with the right of survivorship?

- 12 Conclusion:

- 13 Faqs (Frequently Asked Questions)

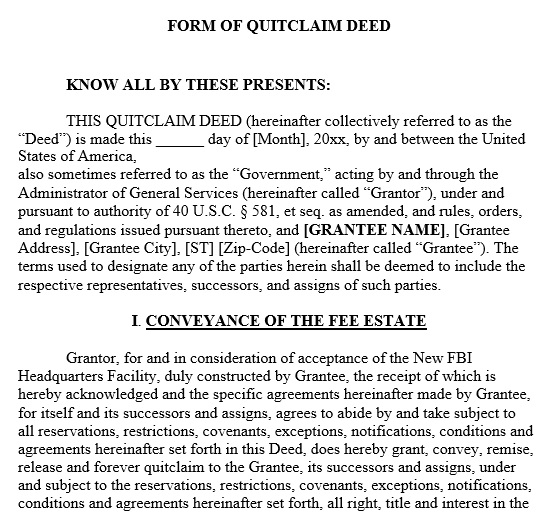

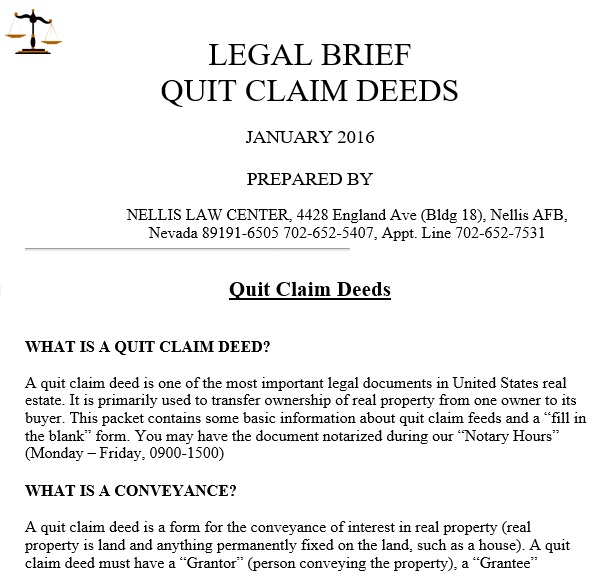

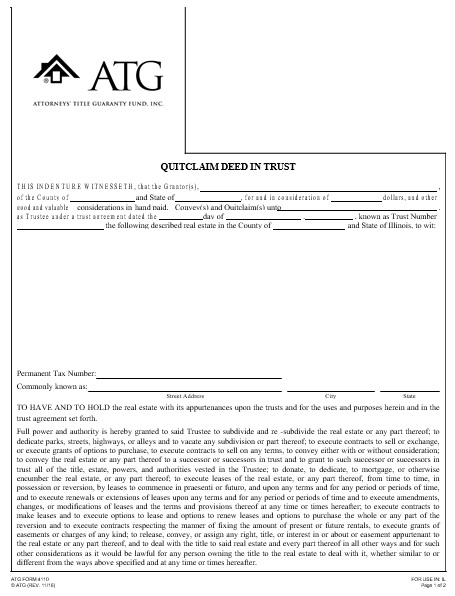

What is a Quitclaim Deed?

A quitclaim deed is a formal document that without a guarantee of ownership transfers the ownership of real property. Transferring an owner’s property interest to another party become fast and straightforward by using a Quitclaim Deed form. They are usually used among people who have a trusted and established relationship because there is no guarantee of ownership.

Unlike any deed, they have least amount of protection:

Since it conveys the interest of the grantor in the property so it is also known as a non warranty deed. In this quitclaim deed, the grantor releases and quitclaims their property to the grantee. This means that there is no guarantee or promise about the title made to the buyer. The grantee has no right of warranty against the grantor if he doesn’t have any interest in the property. Thus, they have the least amount of protection.

They are only accepted because of trust and know-how:

You need to first think about the quitclaim deeds when the seller demands it because it makes no warranty about the quality of the grantor’s title. So, you should only accept it when there is low risk involved or no risk at all. You can accept it from an individual whom you know very well and consider trustworthy. These claims are not used for businesses in this litigious society. They are also not used for exchange among people who are strangers. You can only use them for siblings or partners who want to add them to the title. You just have to make sure the credibility of the person.

They can be used to clear title defects:

In the history of real estate title, they are used to clear the defects. The issues that are present in the title are known as title defects. These may include missing signatures, usage of incorrect wordings, failure to record real estate documents, spelling mistakes, etc. By resolving any of the specific issue, you can present it in public records.

They are effective if the title is good:

Likewise, warranty deed, and quitclaims can be conveyed effectively but only when the title is good. However, quitclaim deed less is attractive to a grantee because it lacks of promises, warranties and guaranties. It even seems appropriate if the grantor is unsure about the status of the title.

They only affect the ownership:

A quitclaim deed exposes the guarantee to particular risks. Therefore, they are mostly used by family members. When the grantee wishes to have guarantees and promises then it is not used. It is only responsible to affect the ownership. It is neither responsible for the mortgages nor the warranties.

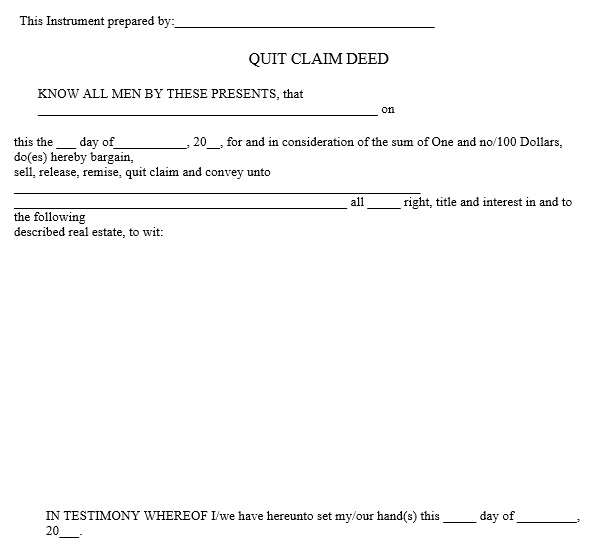

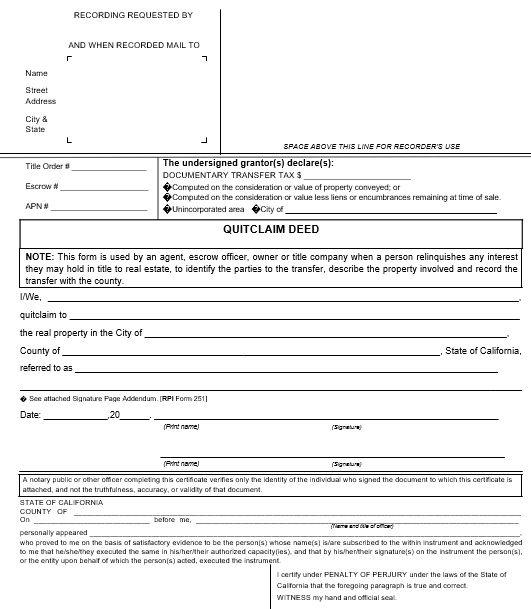

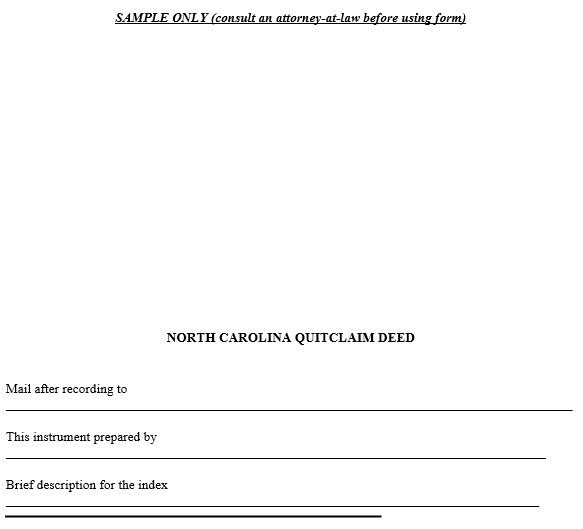

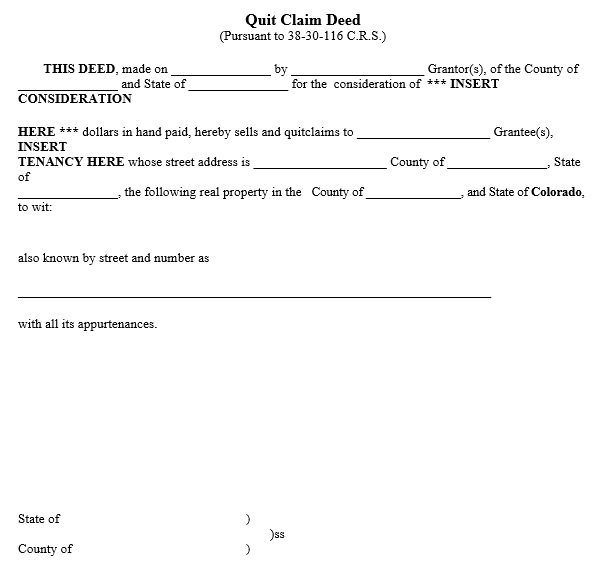

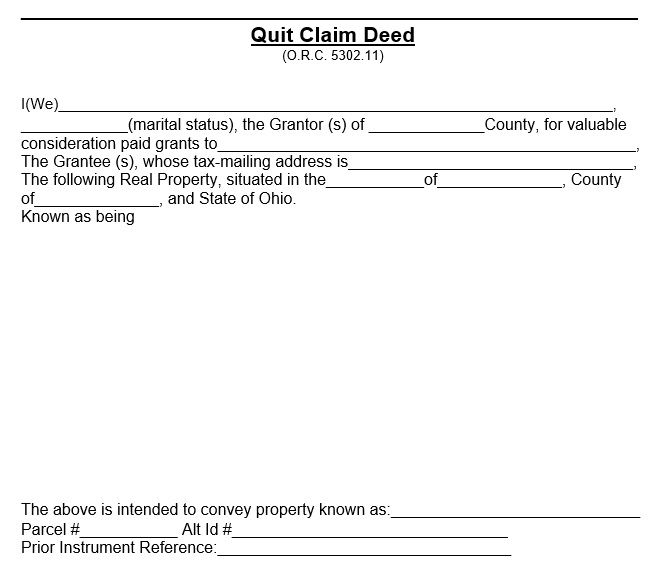

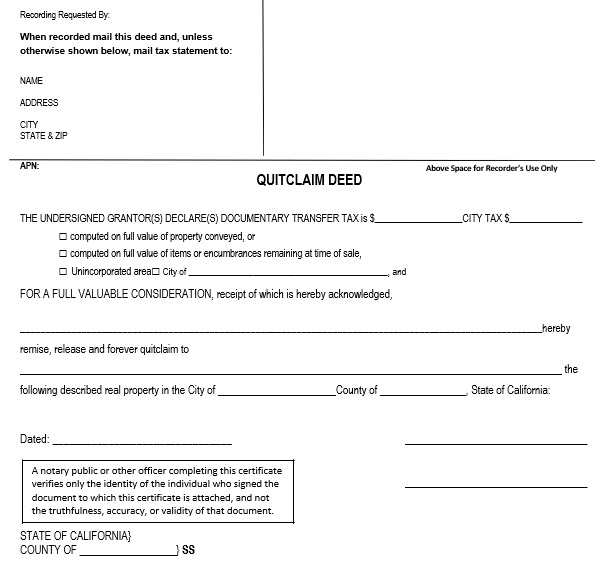

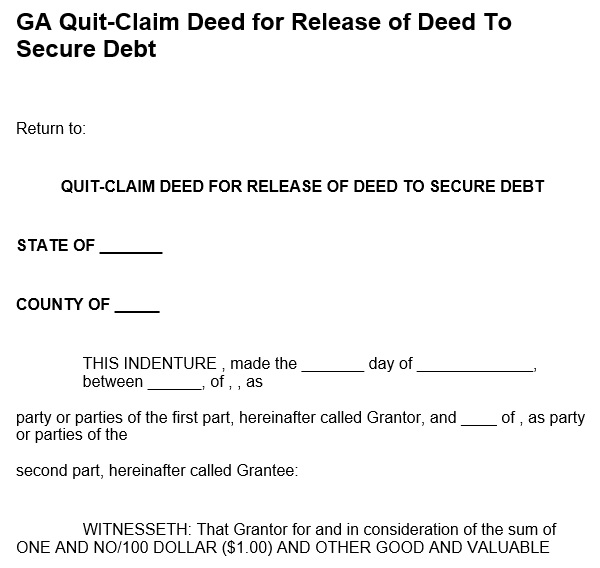

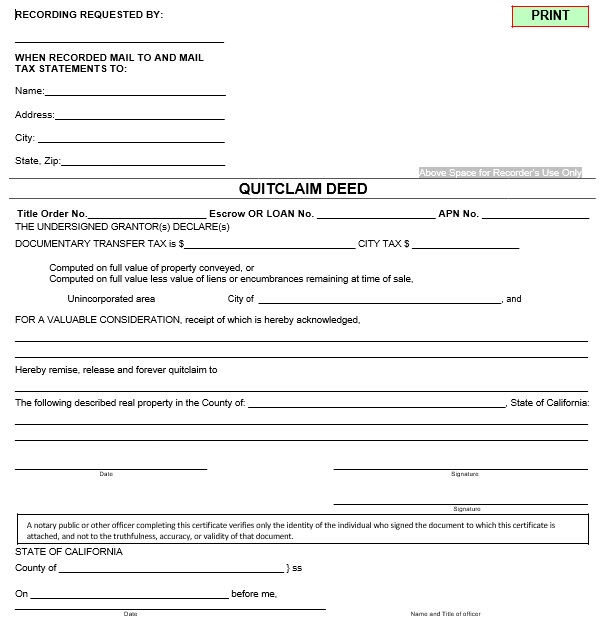

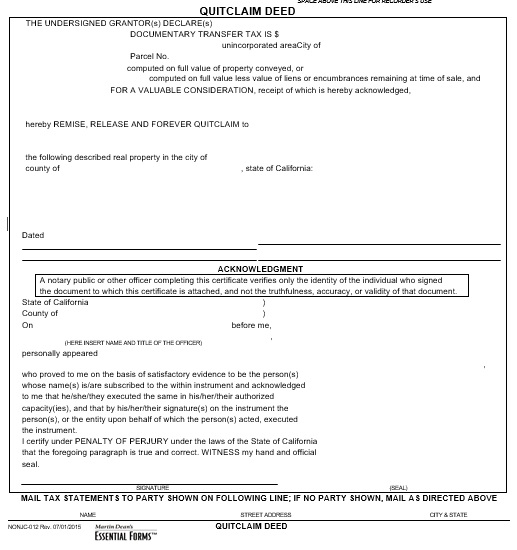

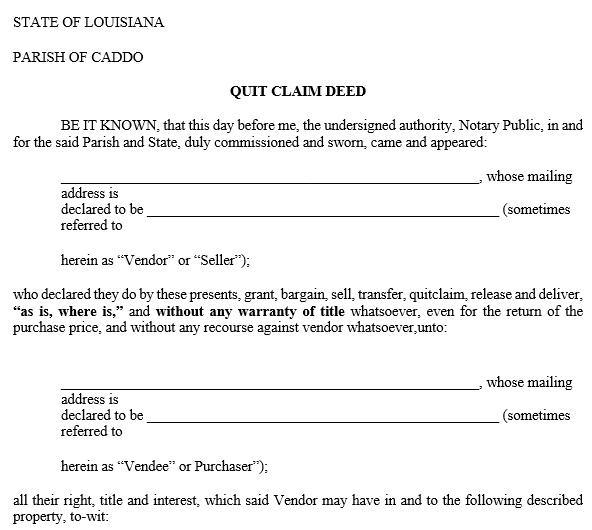

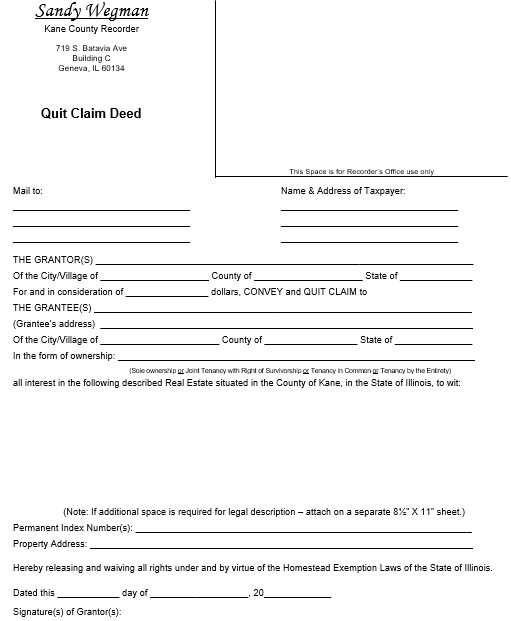

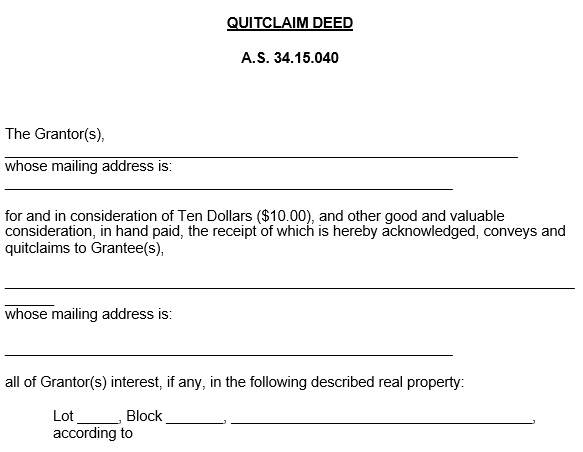

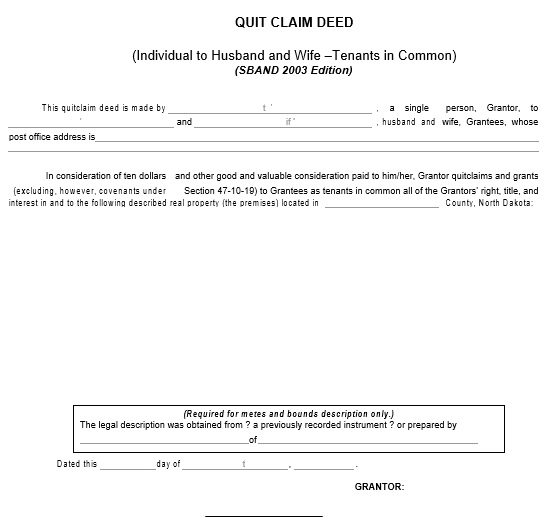

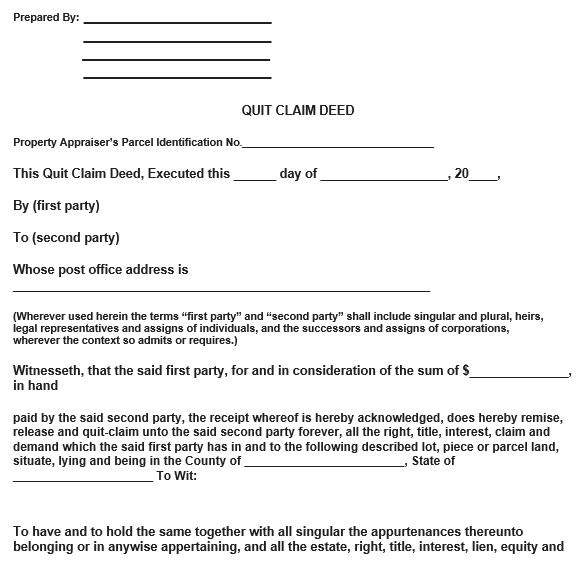

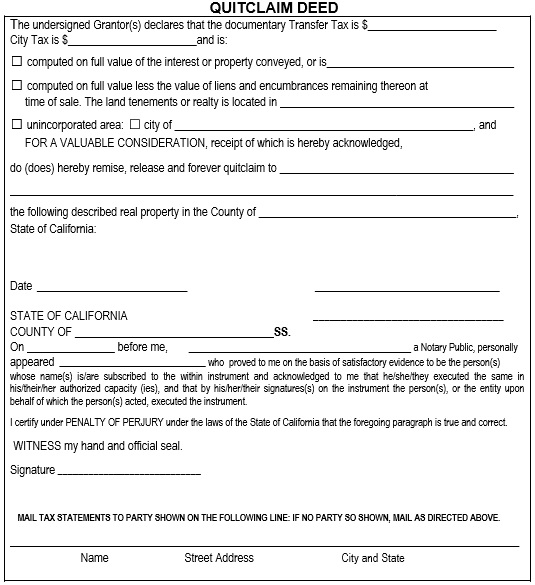

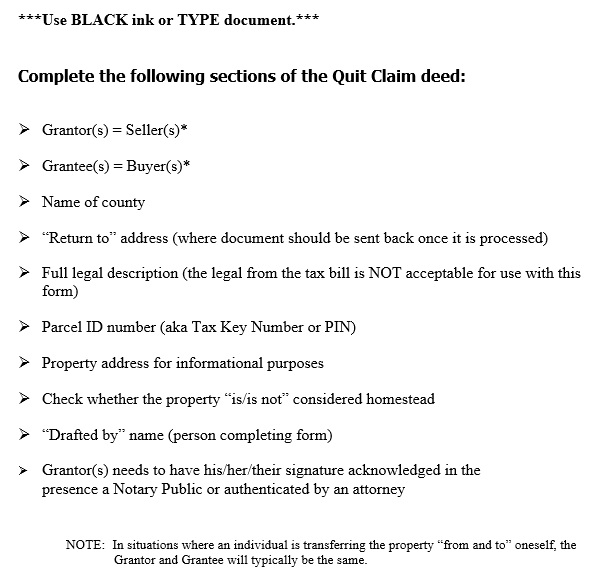

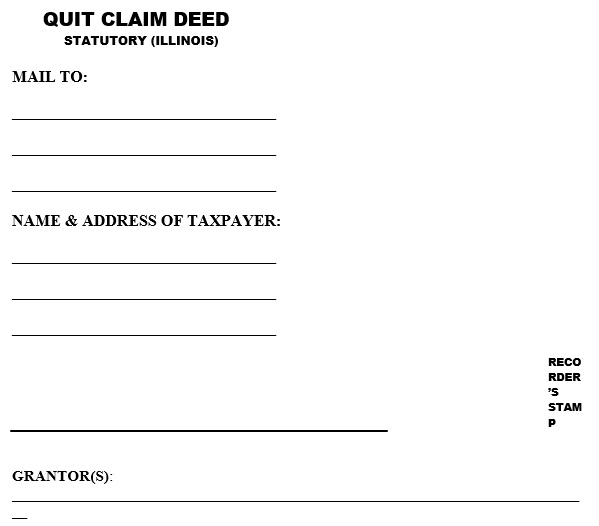

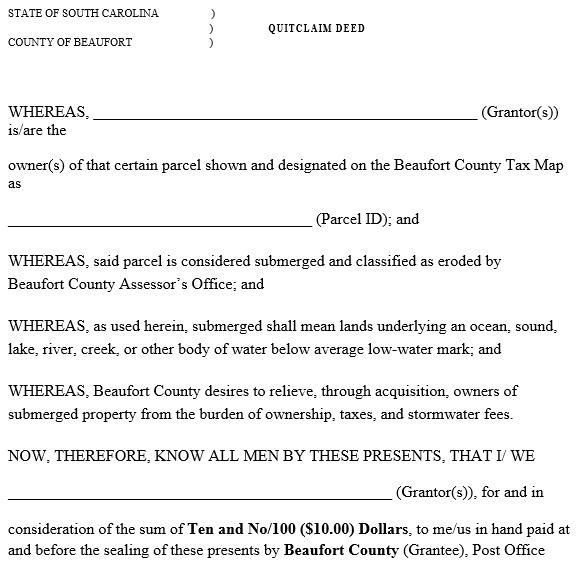

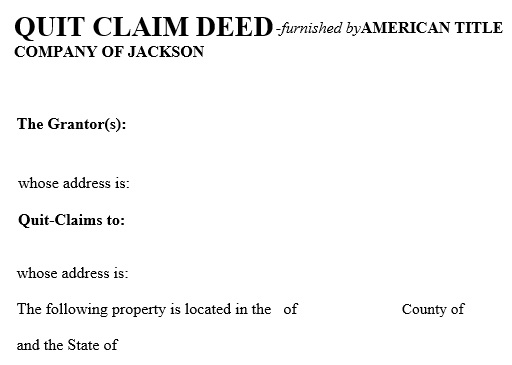

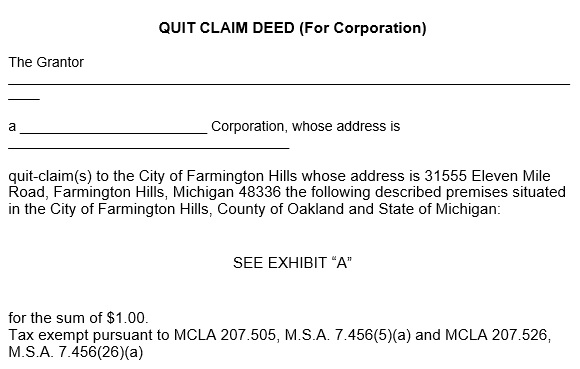

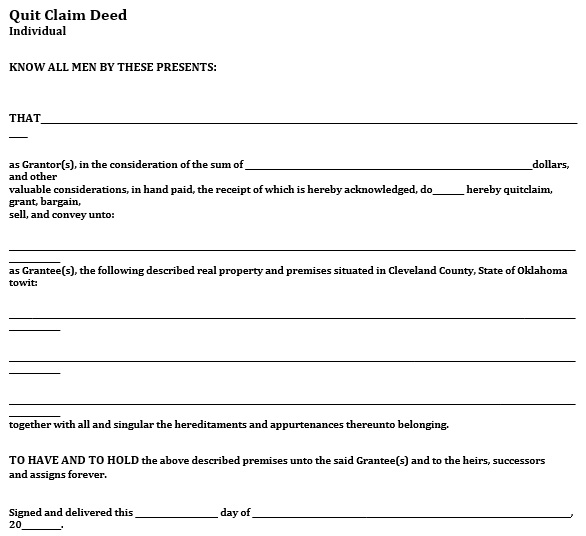

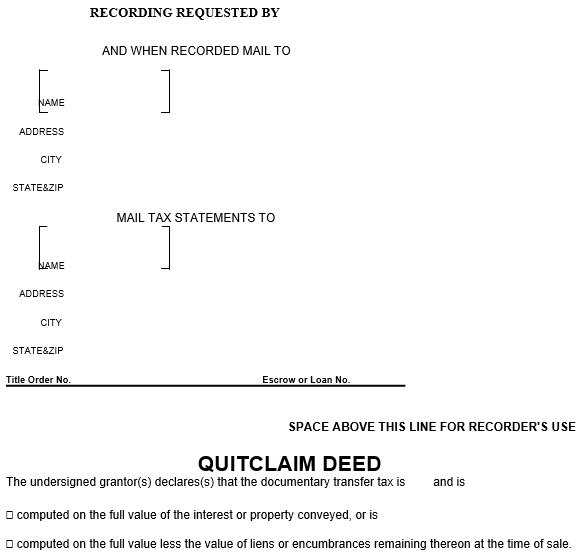

What to include in a quitclaim deed form?

A quitclaim deed form includes the following elements;

Grantor:

Grantor is the person who has currently the ownership of the property. Grantor can be an individual or a corporation.

Grantee:

The grantee is the person or corporation who is interested in buying the property and will become the new owner of the property.

Mailing address:

The mailing address is the physical street address that includes no P.O. Box number.

Parcel number:

It is the number listed on the property tax treatment. You can always visit or call your local court office if you are facing any difficulty in locating the parcel number.

Consideration:

The money that is given against the property by the grantee to the grantor is known as consideration.

Witnesses:

During the quitclaim deed by law, witnesses are required. The signatures of both the grantee and the grantor are witnessed by these people.

Legal Description:

It is the description of the property that is going to be transferred to the grantee. This usually includes the details of the property.

Notary:

A legal representative or attorney is the person who transfers the property to a notary public. To check the authenticity, they are responsible to confirm the signatures on the deed. You should also check Eviction Notice Templates.

How a Quitclaim Deed works?

A quitclaim deed makes the owner able to transfer residential or commercial real property to a recipient without ensuring that the title has no defects. A party like bank or other lender has a legal claim on the property title without a guarantee of ownership and the recipient knowing.

The transferring party can’t be accountable for any damages the recipient experiences in case a recipient gets real property via a Quitclaim Deed form and the title ends up with a defect. That’s why, this deed gives no protection to the recipients.

When to use a Quitclaim Deed?

A quitclaim deed is used for;

- Transferring property interest to a family member, an organization, and from a trust to an heir.

- After marriage, include the name of spouse to a title.

- During the divorce, remove the name of spouse from a title.

- Eliminate a lien from a title.

- Fixing a defect on a property title.

How to create a quitclaim deed form?

Let us discuss step-by-step how to create a quitclaim deed form;

Write the names of the grantee and grantor:

The first step in creating a quitclaim deed is listing the names of grantee and grantor. These are the people who transfer the right of ownership of the property to another party. The grantee is the person who is going to receive the title of ownership.

Deciding the consideration:

The decision for consideration is the next step. In the property, for the interest, it is the price of the grantee who pays the grantor. The amount may vary. But if it is a gift then it has a small amount ranging from $1 to $10.

Describe the property:

For the property, a legal description is an explanation included in the quitclaim deed. You can explain and highlight the information only with respect to the property. There is no other information should be mentioned under this section. Additionally, a legal description of the property must include the parcel ID number.

Execution of the deed:

The last step involves the grantor putting his/her signatures on the deed in front of the notary public. They are filed in the registry office once they are signed and sealed. After being recorded, they are sent over to the grantee.

What is a Quitclaim Deed with the right of survivorship?

A Quitclaim Deed with the right of survivorship makes various people able to get and jointly own real property. When a joint owner dies then without having to go through probate the property title ultimately transfers to the surviving owner. The remaining joint owner has sole ownership of the property.

Conclusion:

In conclusion, a quitclaim deed form is only accepted by the purchaser when the property does not involve any risk. A quitclaim deed is only agreed by family members or when the buyer is one who the seller trusts. It has no promises and guarantees for real estate property. In addition, a quitclaim deed requires least level of protection. You can also download quitclaim deed form from any website.

Faqs (Frequently Asked Questions)

Yes, Quitclaim deeds transfer ownership of real property from one entity to another. Mostly, it is used for transfer that doesn’t involve a sale or purchase of the property.

You don’t require a lawyer for a Quitclaim deed. You can make it easily by using online templates.