Managers and business owners use a payroll template to track employee information, organize schedules, and calculate payroll costs. This tool provides simple solutions for managing payroll. It helps you to stay organized so you avoid all problems or issues relevant to your company’s payroll.

Table of Contents

- 1 What is payroll?

- 2 What is payroll accounting?

- 3 What is a payroll check?

- 4 Why do you require a payroll template?

- 5 Different approaches for managing payrolls:

- 6 The components of payroll:

- 7 When using payroll templates, what to do and what not to do?

- 8 How do you manually calculate payroll?

- 9 How to select the right payroll template?

- 10 Faqs (Frequently Asked Questions)

What is payroll?

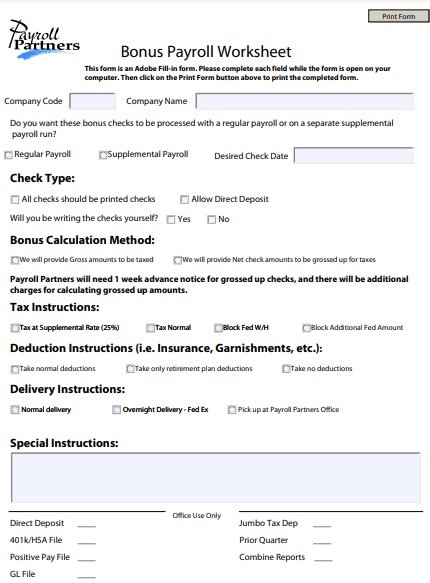

Payroll is the list of employees who are paid by the company. During each pay period, it’s the total amount that employers pay to the employees. It includes the following things as a business function;

- Creating an organization pay policy that contains bonuses, leave encashment policy, etc.

- Define the basic payslip components such as basic, variable pay, HRA (health reimbursement account), LTA (leave travel allowance).

- Collects the payroll inputs.

- The real calculation of gross salary, legal as well as illegal deductions, and arriving at net pay.

- With the right authorities and filing returns deposit the dues such as TDS, PF, etc.

What is payroll accounting?

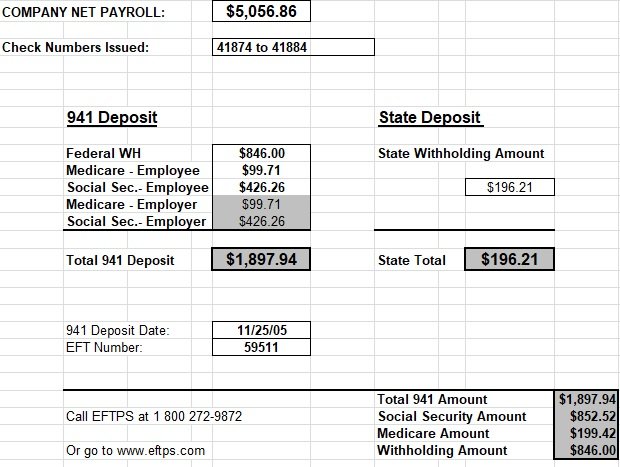

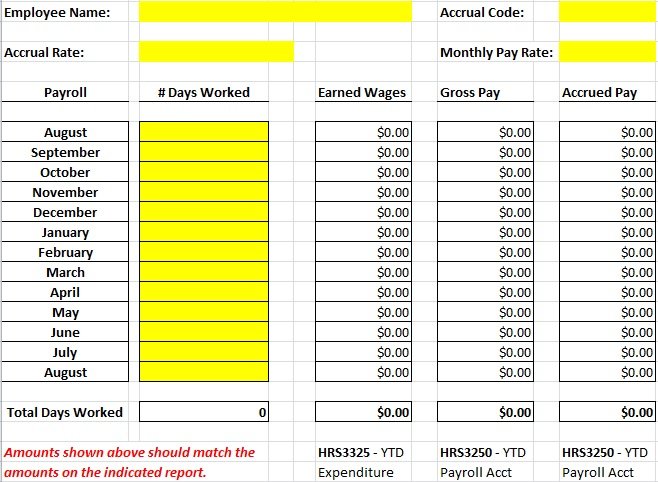

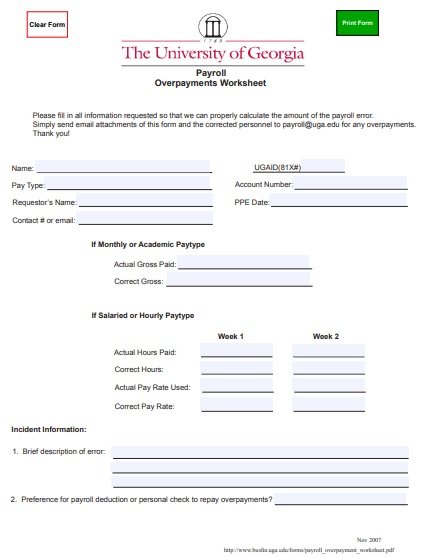

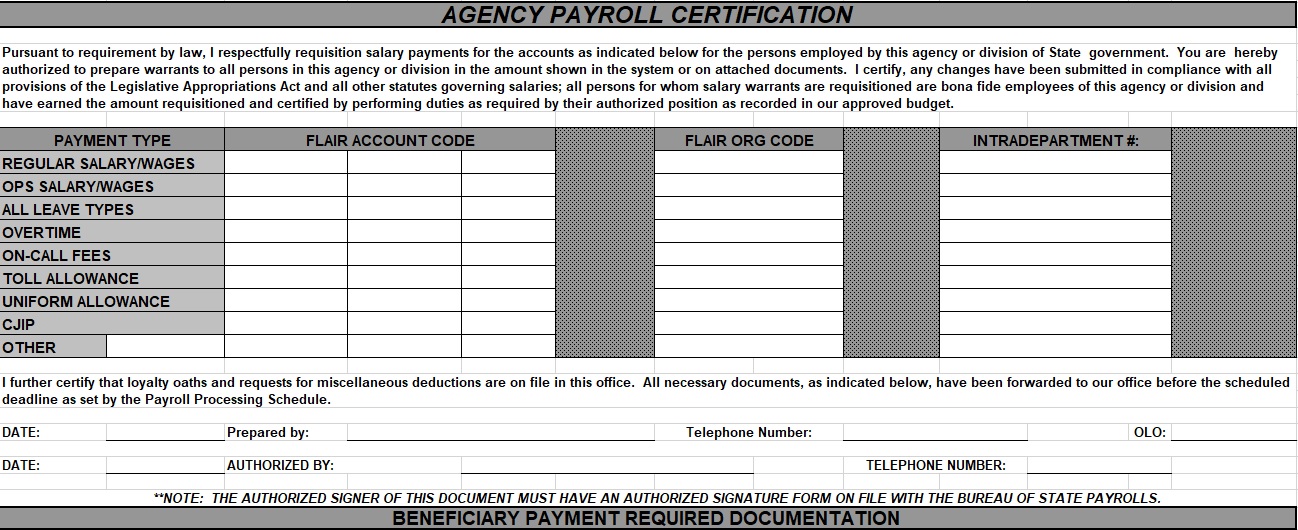

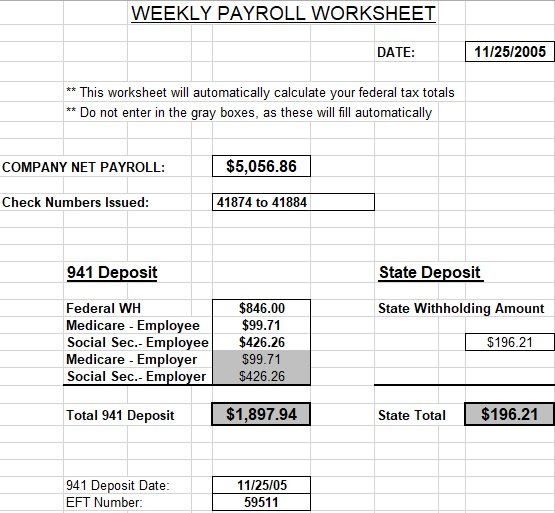

Payroll accounting refers to filing and tracking employees’ compensation data. The compensation data includes withheld from each paycheck, taxes, and advantages the employees get. In addition, it is generally the calculation of management, recording, and examination of employees’ compensation. The payroll calculations depend on each country’s’ legal requirements. Payroll accounting must include the following things;

- Gross wages, salaries, flexible benefits, and commissions.

- Employers and employees withholding taxes.

- Restraining of salary, insurance premiums, and savings plans.

What is a payroll check?

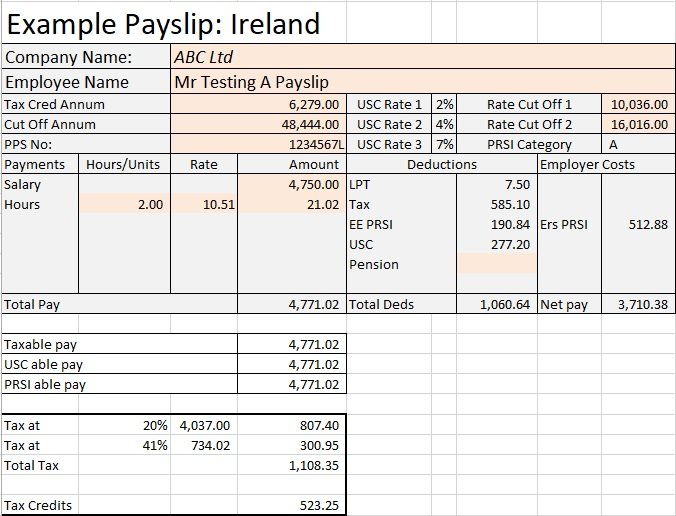

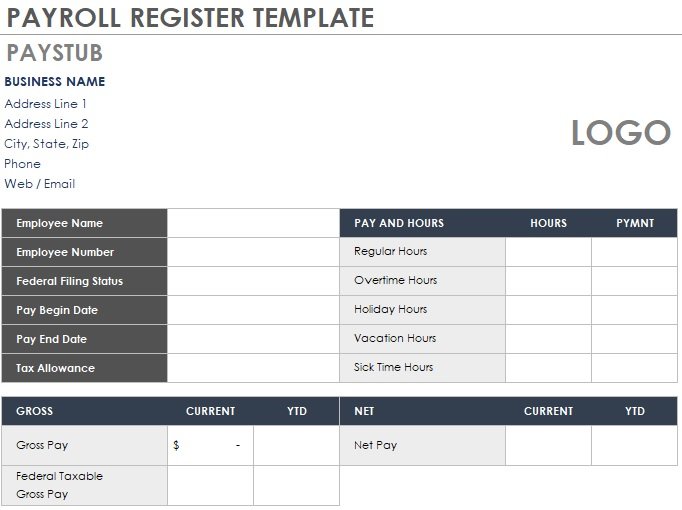

A payroll check is a check given to the employee as a set of amounts for the work or services he has rendered. It is generally issued after every two weeks and in some cases weekly or monthly. The payroll check can be directly deposited into the employees’ bank account. In this way, their pay can be automatically showed up on a payday. A payroll check is generally known as net pay.

A pay stub is also attached to a payroll check. It contains how much money paid to employees after tax deductions, gross wages, etc.

Why do you require a payroll template?

You must have a reliable payroll management system if you own a company with more than one employee. This system helps you to compensate your employees for the hours of work they’ve put in. However, if you want to look for a simple solution then the payroll templates are the best.

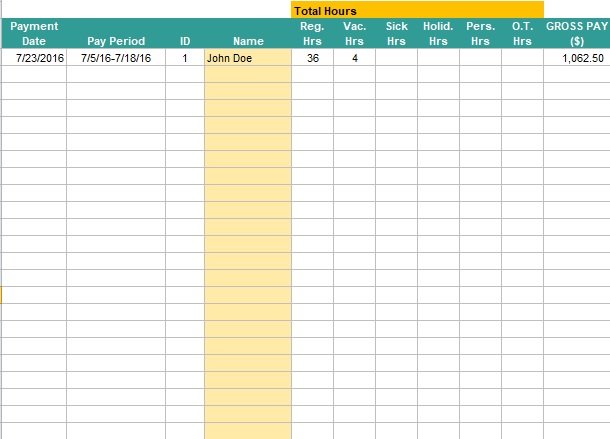

They will help you in keeping a record of submitted timesheets and pay dates. By having this template, you can stay on top of your company’s payroll budget as well as avoid payroll miscalculations.

Different approaches for managing payrolls:

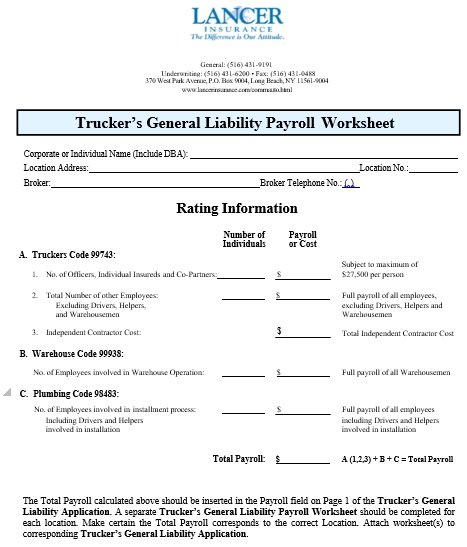

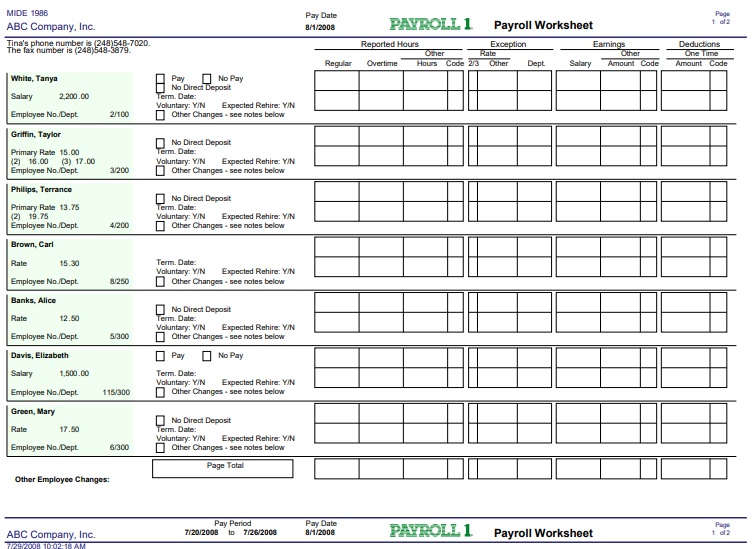

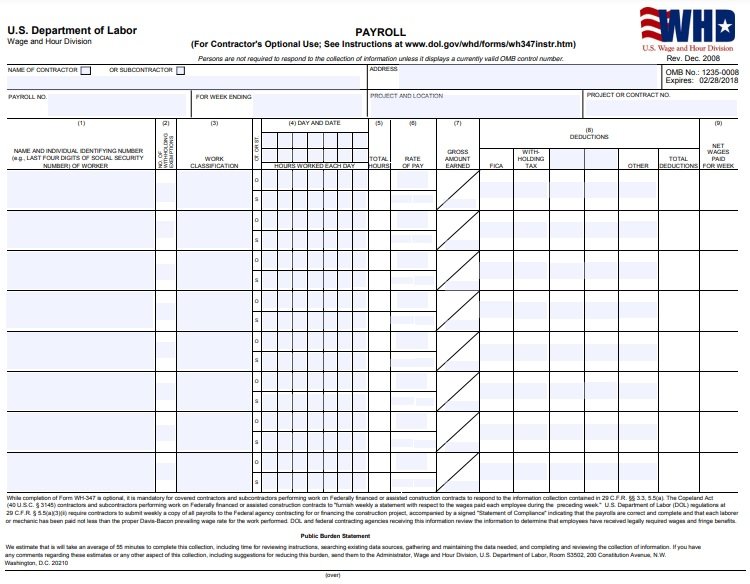

Paychecks are generally calculated on the basis of the structure of a particular company. Employers use the system while process payroll that automatically tracks money owed to employees. However, an employer can select from any of these three options while managing payroll template;

Manual payroll

Calculating payroll manually can be confusing and tiresome but it is the least expensive option. However, this is a non-issue id one is an expert. Let us assume an employer falls in the category of people having no extensive training in payroll. In such a scenario, they may be convinced to learn the complicated important payroll procedures. An employer may be vulnerable to costly mistakes and penalties from the IRS without extra care and alertness to proper payroll best practices.

Using a payroll software

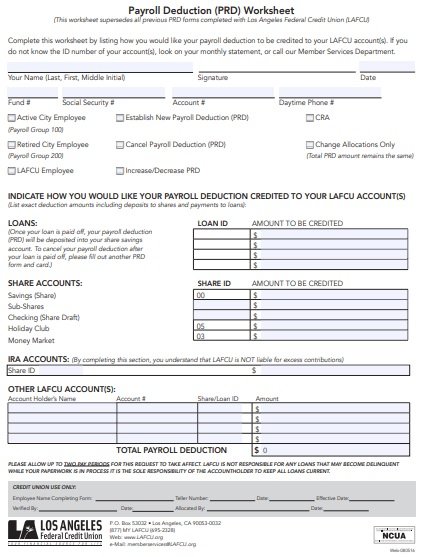

It is beneficial to use payroll software to manage payroll because it makes an employer able to handle various payroll managements online rather than on paper. It may be costly to invest in payroll software. But, it assists in limiting the amount of time spent on payroll management. Furthermore, it becomes easier for the employer to handle complex parts of the payroll process like keeping track of important payroll deductions. Most importantly, payroll template and software mistakes and errors that can be damaging to the company reduce the risk of them.

Outsourcing payroll

The most expensive method of payroll management is outsourcing payroll. On the basis of the amount of time an employer saves and the number of compliance problems and potential fines avoided, it can still be one of the most cost-effective solutions. To an outside company, when a company outsources a payroll administration, this means that the employer has access to payroll and other human resource professionals that can take care of every payroll management procedure. The employer holds complete control and direction over their employees even the outsourced payroll management company manages all these processes.

The components of payroll:

A typical payroll management system consists of two major elements. These elements further consists of multiple aspects that must be addressed by an employer of a small business. These include the following;

Account registration and payroll decisions

An employer must address the following essential aspects under account registration and critical payroll decisions;

Employer’s identification number

An employer will first need to apply for an EIN before developing a payroll management system. This nine-digit number is assigned by the IRS in order to determine each business. When submitting specific payroll documents to the IRS and federal government agencies, an employer must include their EIN. While, for all businesses, an EIN is not important, it is required by the law in case employer;

- Has employees

- As a corporation or a partnership, operates their business

- Employment tax returns, excise duty, or alcohol, tobacco, and firearms are filed

- Withholds taxes on income paid to a non-resident alien other than wages

- For self-employed people, has a retirement plan

If, he has involved in the listed types of organizations;

- Estates

- Non-profit organizations

- Farmer’s cooperatives

- Plan administrators

- Trusts not including specific grantor-owned revocable trusts, IRAS, and exempt organization business income tax returns. A small business owner after obtaining an EIN must also register their business for an Electronic Federal Tax Payment System (EFTPS) account for paying federal tax purposes. It is usually free to register for EFTPS and it provides business owners a convenient way to pay taxes online or via phone. For registration, you must provide information such as a tax payer identification number, an EIN, a valid bank account number, a routing number, and the business owner’s name and address.

State-specific registration

An employer may be required to do some business setup work on the basis of the company’s location. This may include some employer ID numbers for state and local governments. Since each state has its new hire reporting process so this may diverge from state to state. You can find most state’s new hire reporting process information online. That’s why, a business owner can register their business through online. Following state-specific information will be collected by one;

- Date elements (both mandatory and optional)

- Name and address of the employee

- The reporting time frames

- Contact information

- Transmission method

- Specify whether or not the state needs the reporting of independent contractors.

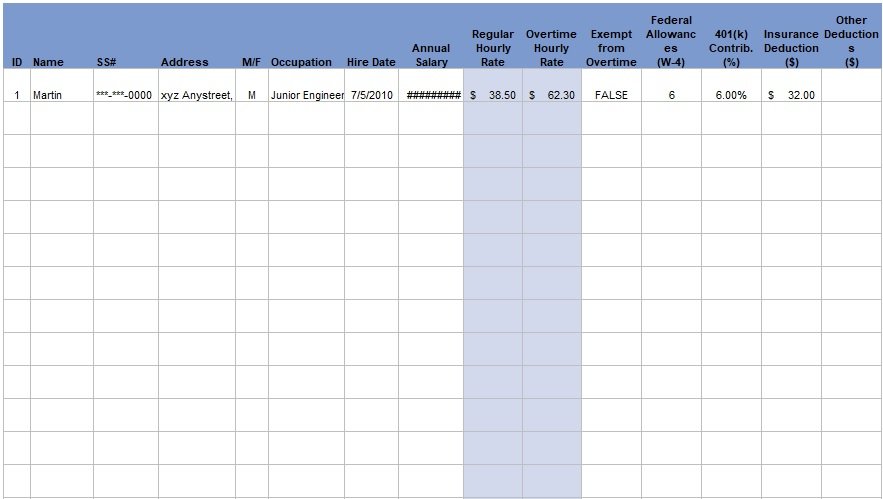

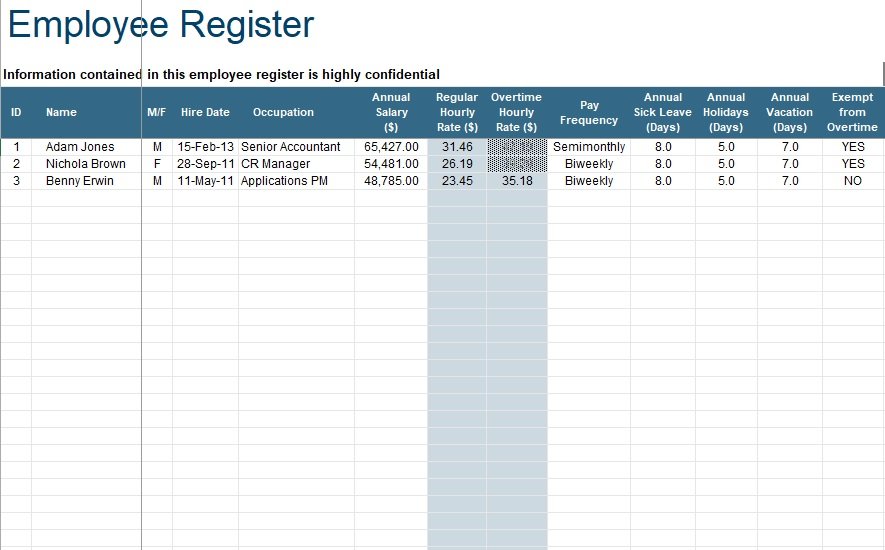

Pay frequency and salary status

It is also important for the small business owner to decide how often his/her employees will be paid and how they will be paid precisely. Pay frequencies tend to be weekly or monthly for most companies. Paychecks, payroll cards, direct account deposits, and cash payments are the most common payment methods. Which of the employees will have hourly or salary wages and exemption status is another aspect that the employer must address. When you are making this decision, it is important to note that as per the employment laws, non-exempt employees have to be paid at least the set minimum wage and obtain overtime pay. Contrarily, exempt employees are not eligible for overtime pay and they have to meet the following specific requirements;

- Paid on a salary basis

- Per year, accumulate at least $23,600 or $455 per week

- Must be in positions that are considered exempt. For instance, an Executive, Administrator, etc.

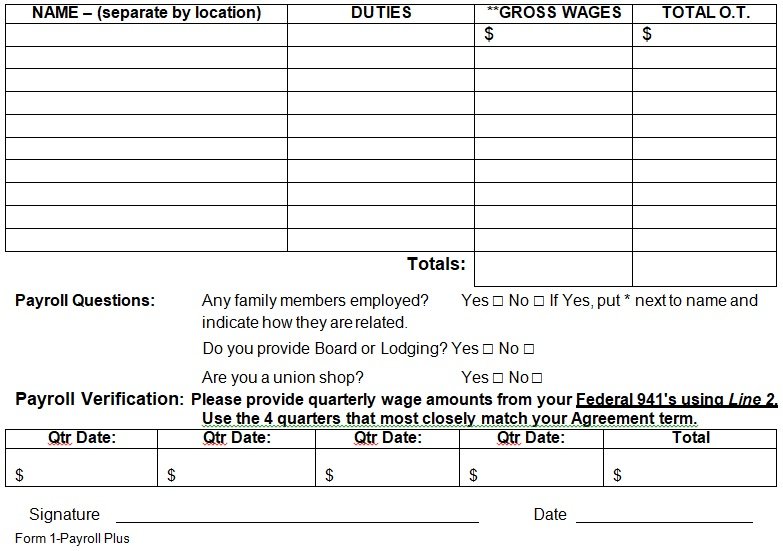

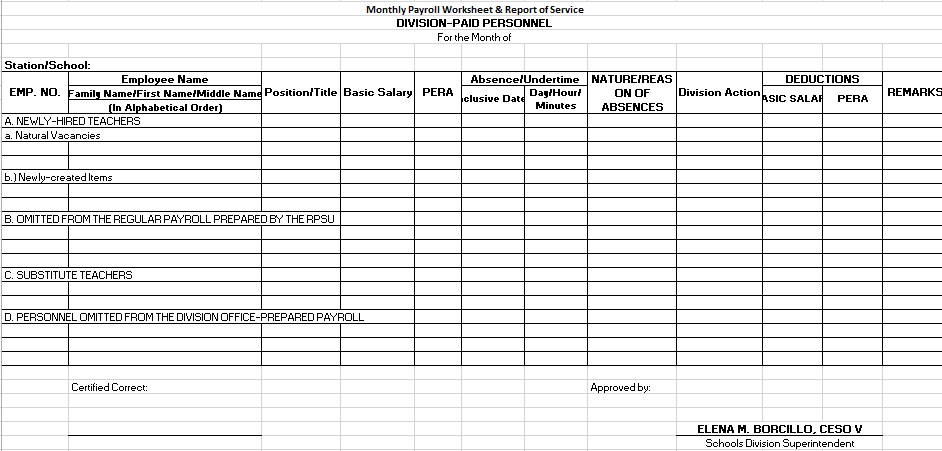

Collection of employee information

For this element, business owners have to collect employee information. Existing employees will have to fill out form W-4 to build how much individually they will have withheld payroll taxes. The number of dependents and allowances that every employee will be claiming are detailed in the Form W-4. This way, the amount of tax that the employee must pay is reduced. Employers are recommended that each new hire have to fill out Form W-4. Also, new employees must fill out the form 1-9 along with the W-4 form. This is important in order to verify their employment eligibility before starting work.

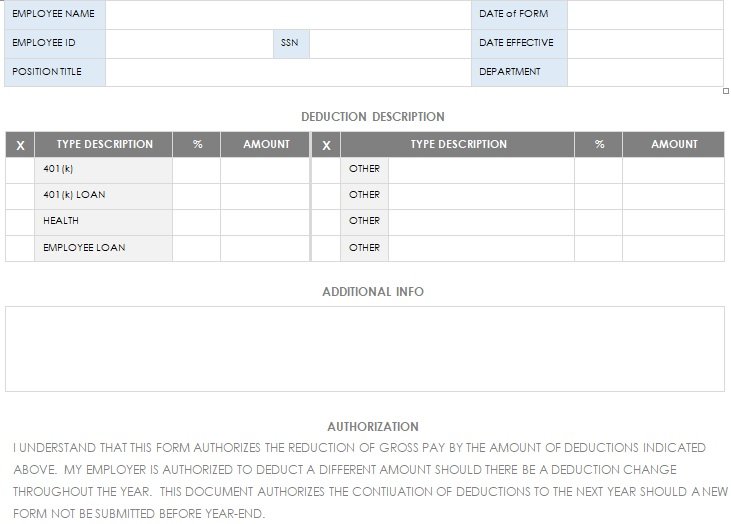

At the end of the year, within the organization, Form W-2s must also be submitted to every employee. The benefits information should also be provided by the employees as this plays an important role in payroll management. An employer will have to know how much to deduct from their paycheck into the benefits in case an employee pays into benefits like health insurance, retirement plans, etc.

In addition, payroll software can be used by an employer that is generally configured with specific settings that generate the required reports. The software makes the employer able to automatically send these reports to the respective parties. Hence, by using such software, you can save time and manage payroll more efficiently and accurately than manual payroll systems.

When using payroll templates, what to do and what not to do?

Here are some important “do’s and don’ts” when it comes to payroll sheets and templates;

- In your payroll templates, don’t include off-the-clock entries. If your employees work overtime then definitely you have to pay them. But, you don’t need to encourage such actions so that they complete their work within their allotted working hours.

- Don’t include compensatory time while making your draft.

- You shouldn’t do any improper deductions from your salaried employees because it may ruin your employee’s exempt status.

- Include a policy for overtime in your template. This enables you to deal with overtime situations effectively when they arise.

- Inform everyone in your organization when you make any changes to your policies.

How do you manually calculate payroll?

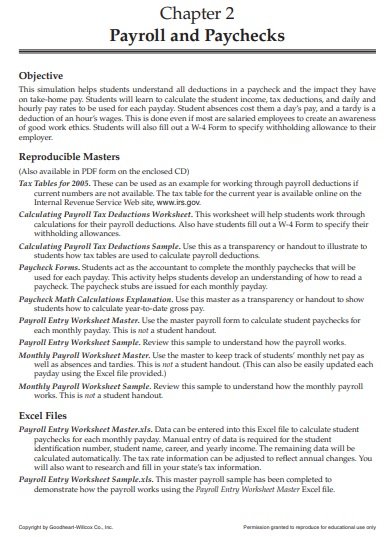

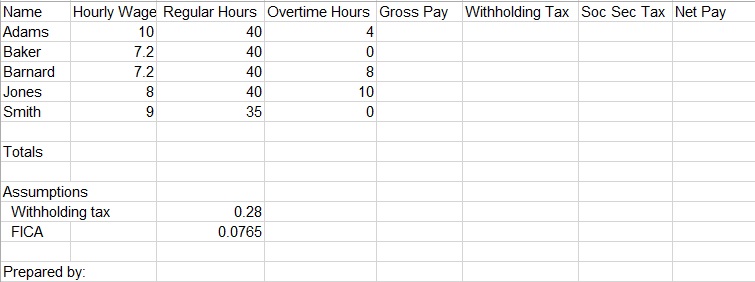

Let us discuss step-by-step how to manually calculate payroll;

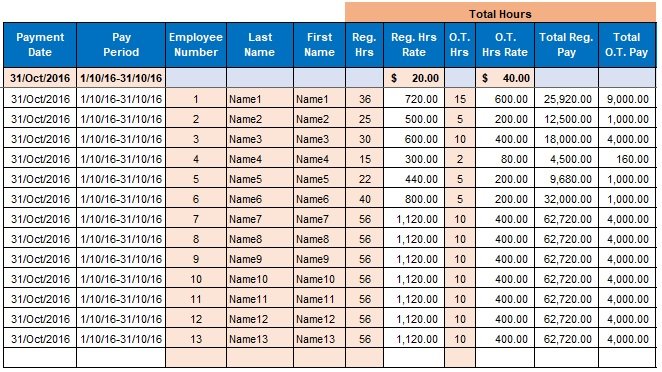

- Firstly, identify the pay for the hourly employees. This will enable you to have the gross pay for the week or the month.

- Secondly, check the overtime hours work of your employee. If you are going to include overtime hours in the manual payroll calculation then it is paid 1.5 times the employees’ regular pay rate.

- Thirdly, identify the pay for the salaried employees. To do this, you have to divide the employees’ yearly salary for each period’s pay. If the employee has the payment adjustment then also calculate it, and it will change the salary.

- The last step is to subtract the deductions. Subtract the legal or voluntary deductions from the gross pay. You can use the IRS Publication 15 and employees’ W-4 form to identify the federal income tax.

How to select the right payroll template?

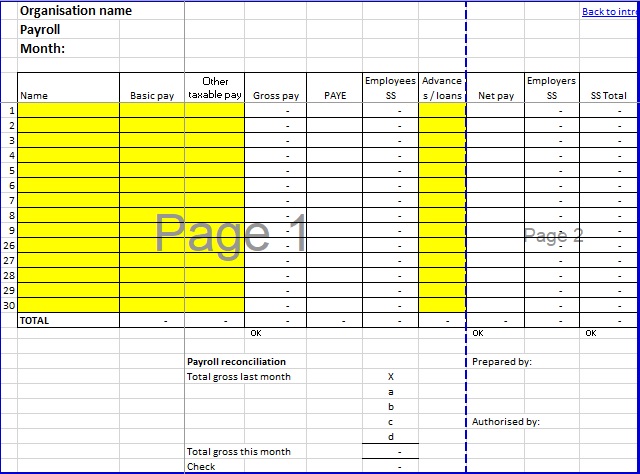

You consider the following to choose the ideal one for your particular business;

Payroll Schedule

Make sure the template you select should according to the payroll schedule you have implemented (weekly, biweekly, bimonthly, or monthly).

Type of workers

The template should cater to hourly employees if you have them. It needs to accommodate your worker’s salaries if they are salaried.

Format

There are a variety of formats on which payroll templates come like Microsoft Excel and Word, Google Sheets, and PDF. Select the format that your team is most comfortable with.

Ease of use

Making it easier to process payments is the main goal of a payroll template. Therefore, don’t select overly complicated templates because it would be difficult to understand and use them.

Faqs (Frequently Asked Questions)

You just have to fill out the preformatted payroll templates with your information. They serve as a calculator and have formulas that calculate a number of important figures.

It depends on your specific situation. An Excel Spreadsheet format is the best to use if you are comfortable with it. You can also select an alternative option like Google Sheets in case you don’t have MS Office.