An IOU template is referred as an “I Owe You”. It is an informal document that includes information about the debt owed by an individual or an organization to another party. If two entities want to document a transaction without having a complex agreement then creating an IOU note is an easy and simple solution in such circumstances. Typically, friends, family members, or business partners use an IOU form. This is because they already have trust with each other.

Table of Contents

- 1 When to use an IOU template?

- 2 What to include in an IOU template?

- 3 Do you require a formal IOU?

- 4 Legal implications of an IOU template:

- 5 How to create an IOU template?

- 6 What are the consequences for not using an IOU?

- 7 How IOU differs from a promissory note and a loan agreement?

- 8 Does an IOU prove useful in court?

- 9 Conclusion:

- 10 Faqs (Frequently Asked Questions)

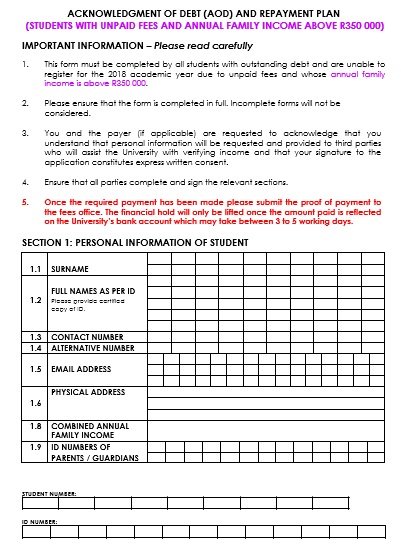

When to use an IOU template?

An IOU is known as an informal loan contract that benefits both the lender and the borrower. You can use it in the following cases;

- If you loan a specific amount of money to an individual and you want a simple written agreement.

- If you borrow a particular amount of money from an individual, you can use it for knowing the terms of your agreement.

- Use it to specify relevant payment information like interests.

- In the past, you have transacted with the person and accept an IOU note.

- You can also give an IOU note to the merchant for the balance if you don’t have enough money to pay for an item.

- You can use an IOU note when you need money for making a down payment.

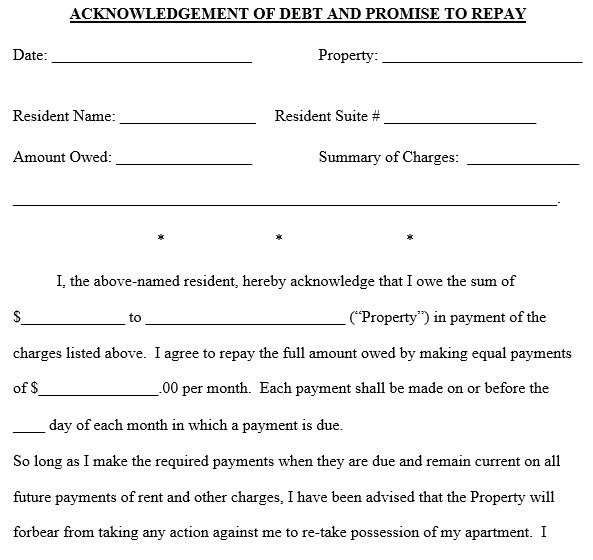

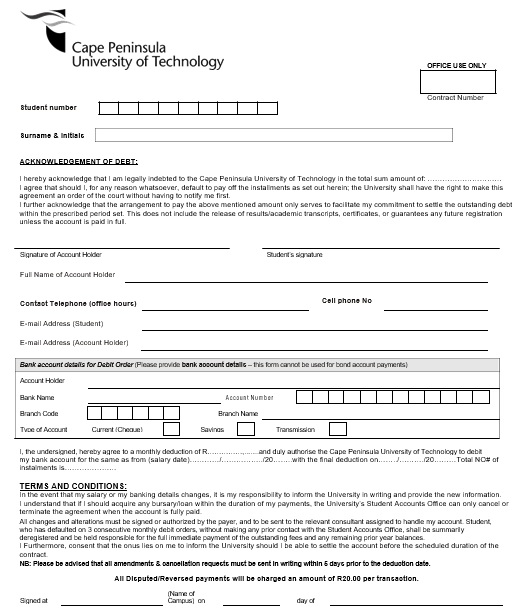

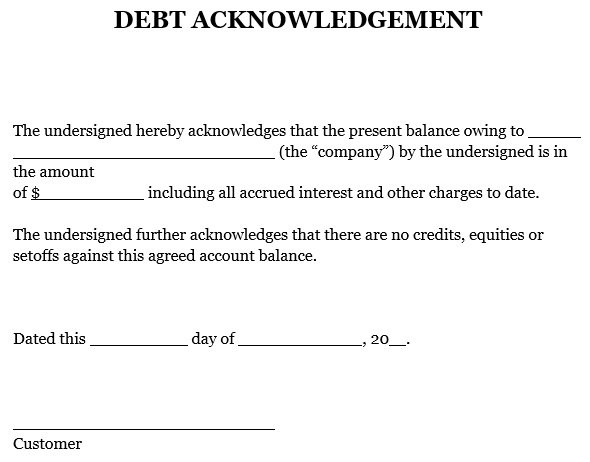

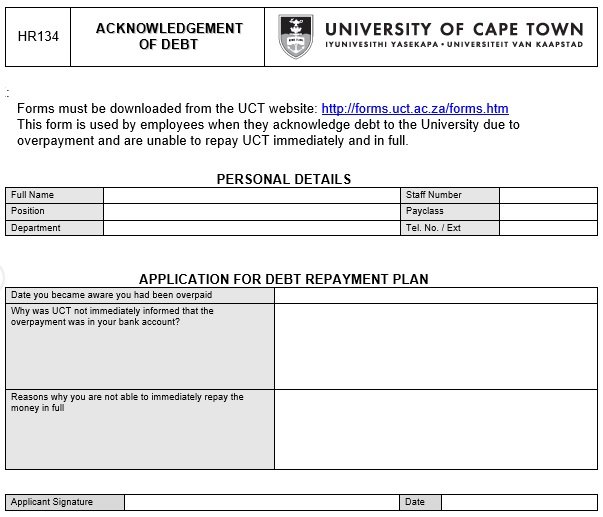

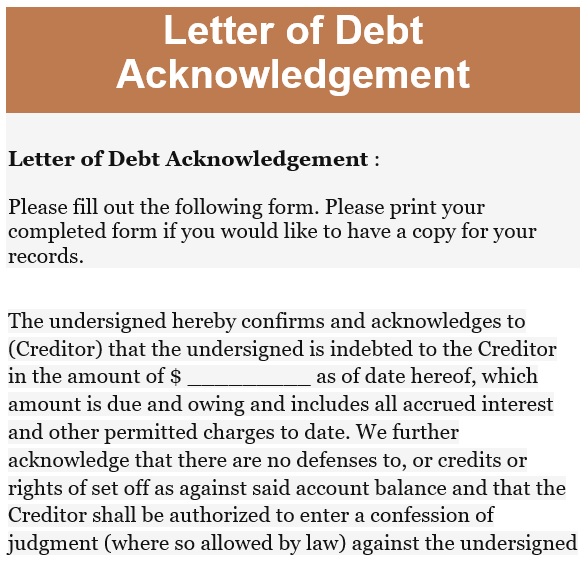

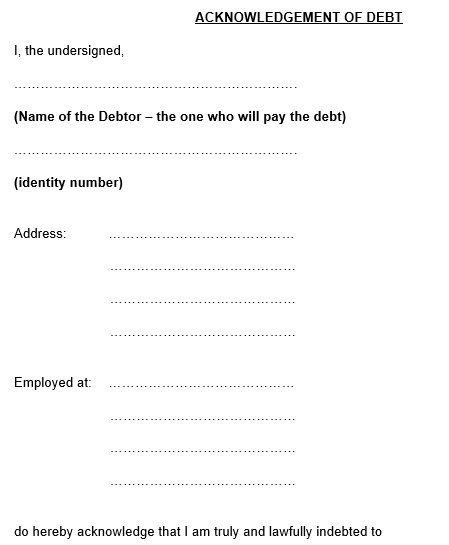

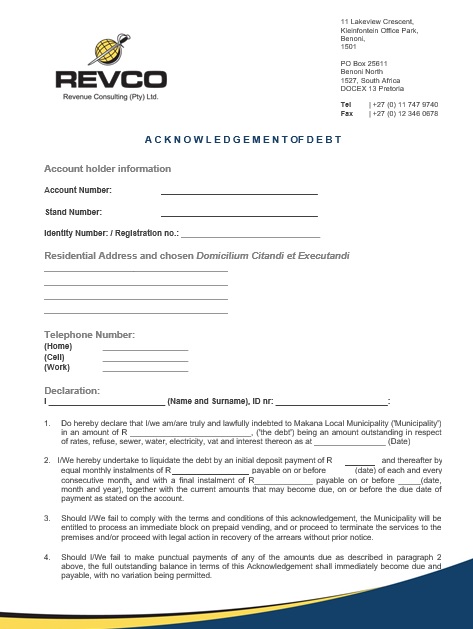

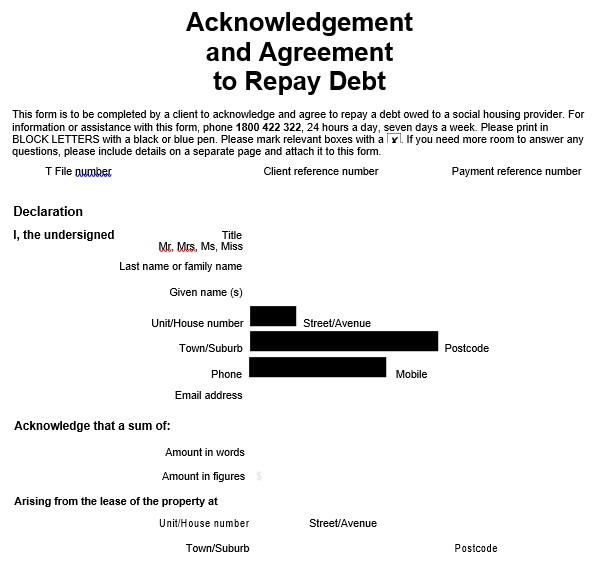

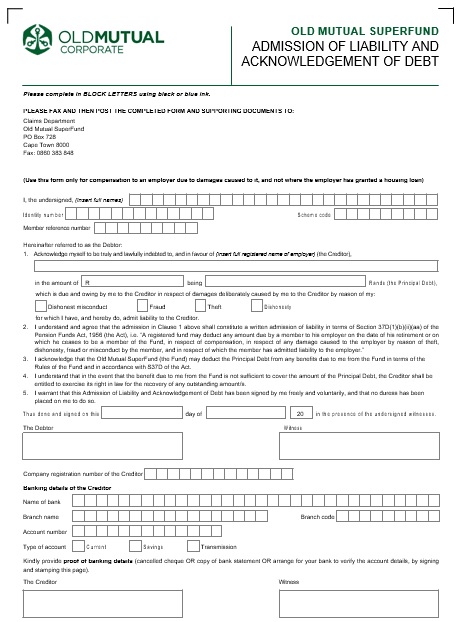

What to include in an IOU template?

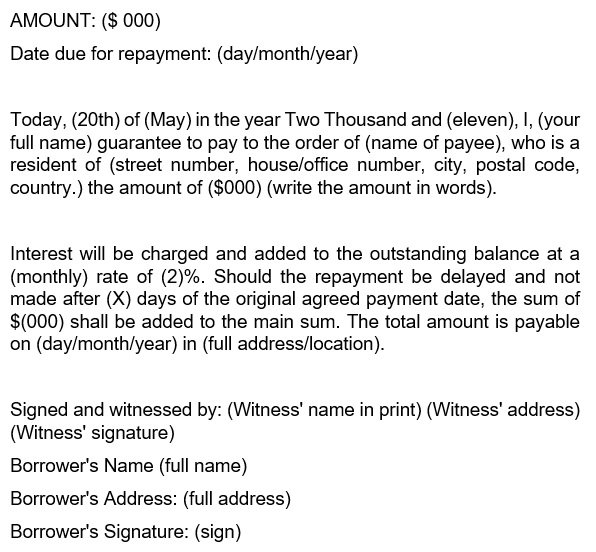

The lender and the borrower use the IOU to set the terms and conditions of the repayments when they made a transaction. However, you can include the following information in it;

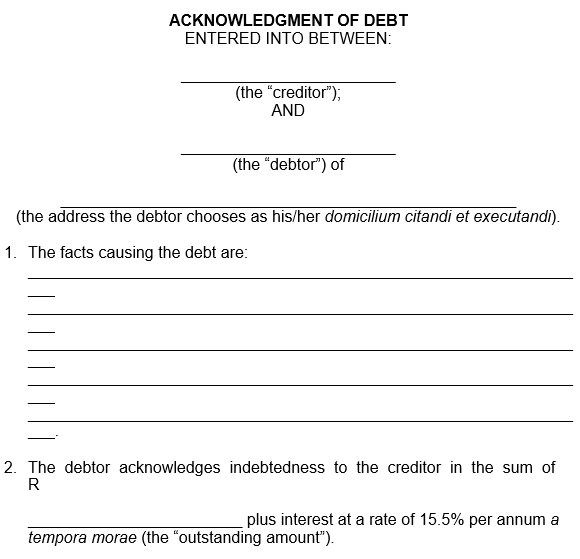

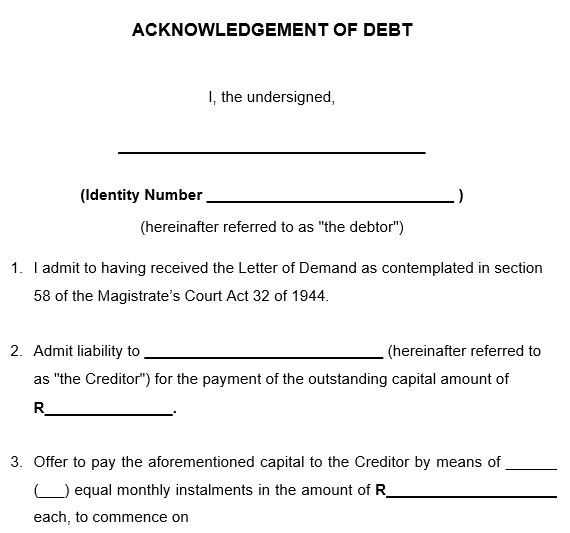

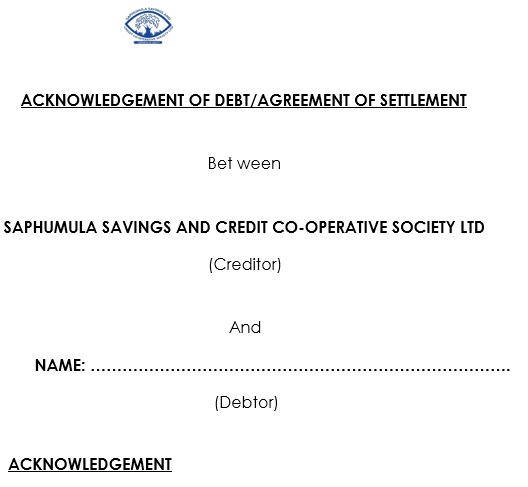

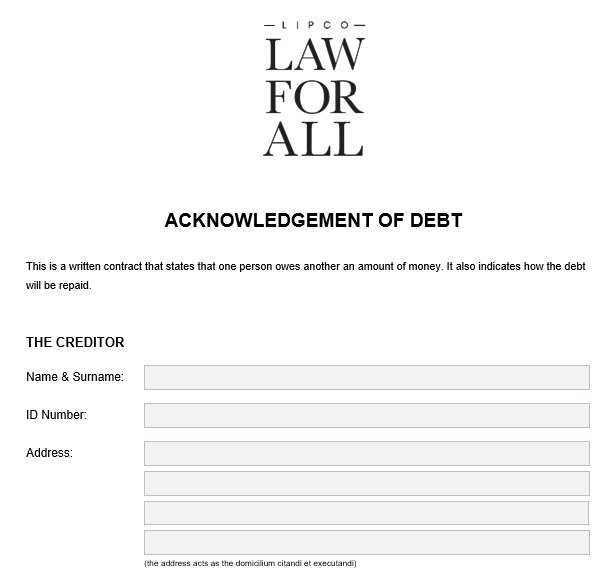

Basic information:

At first, include the basic information about the entity involved in the transaction. This includes the full names, addresses, and contact details of the people.

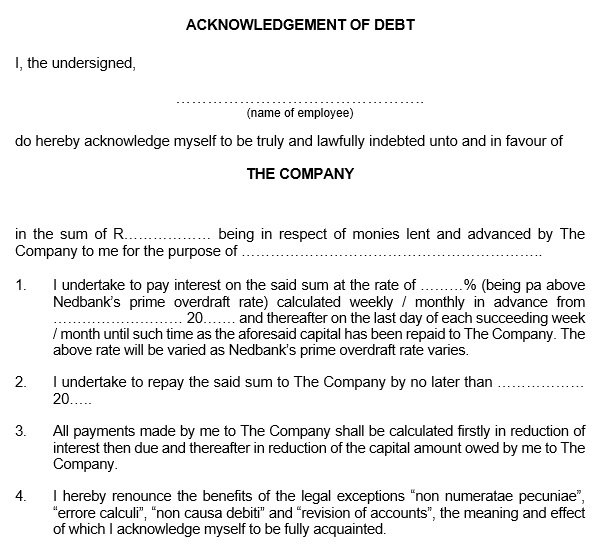

The payment information:

The payment information includes the loan amount, the minimum payments, and the due dates of payments, interest rates, and penalties for late payments. It is also important to mention payments methods such as online payment, bank deposit, and cash. You should be as specific as you want while providing the payment information. Also, mention the fees the borrower has to pay when he makes late payments.

The signatures:

To make this document legal, affix the signatures of both the borrower and the lender. When you have finalized the document, ensure that you ask the other party to sign.

Termination details:

In this section, indicate that what would happen if the borrower doesn’t pay the loan.

Signature of a notary public:

It depends on the state you are in. All the states don’t require the signature of a notary public.

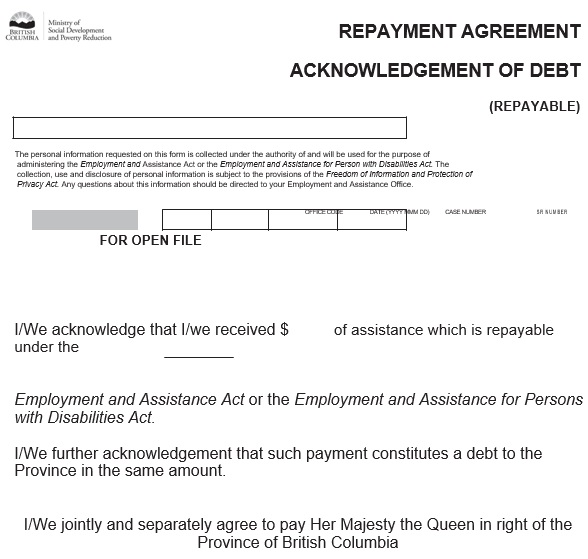

Do you require a formal IOU?

Friends, partners, or family members use IOU to avoid a strain on their relationship. But if there is no record and the borrower doesn’t pay back the loan, this will cause a lot of difficulty for you. Moreover, it doesn’t matter how you look at it, creating an IOU form is interesting. Sometimes a lender won’t ask for such document because he isn’t willing to get back loan payment.

The IOU protects both the lender and the borrower. It forces the borrower either he will able to pay the loan back or not. When the lender asks the borrower to sign the document then he will think whether he wants to risk ruining their relationship in case he can’t repay the loan. Therefore, it doesn’t matter how close you are to the person this IOU is important in case anyone decides to borrow money from you.

Legal implications of an IOU template:

Here are the legal implications of an IOU;

- The legally binding IOU helps you when you get audited by the IRS. So, you have to ensure that the IOU has the proper format and include all the important information.

- If you made an IOU as an informal agreement then it’s difficult to enforce an IOU in court. It’s better to notarize your IOU so you can use it in court if necessary.

- Consult with the lawyer in case of any doubts about the IOU template. No matter how small your IOU is, the lawyer demonstrates all the legal details associated with IOUs. In case of any issue, lawyers also provide you suggestions about any legal actions.

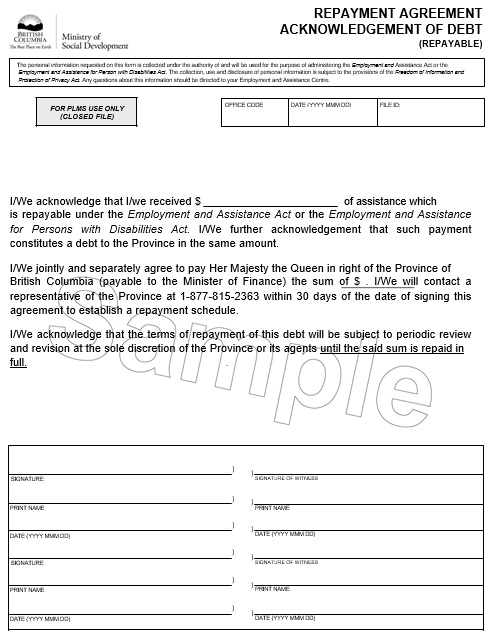

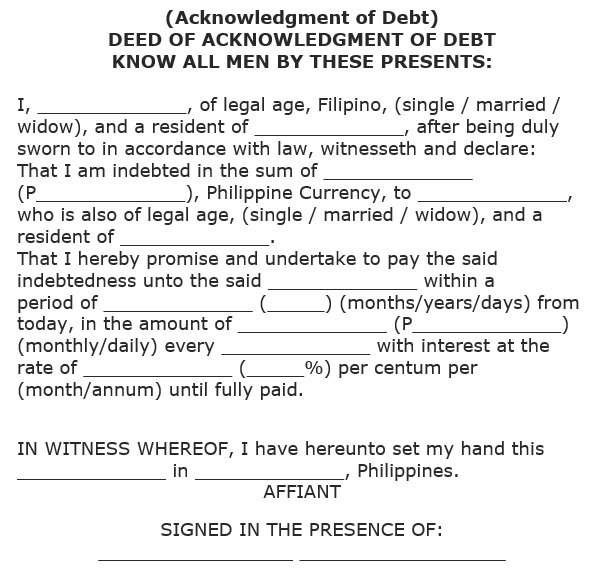

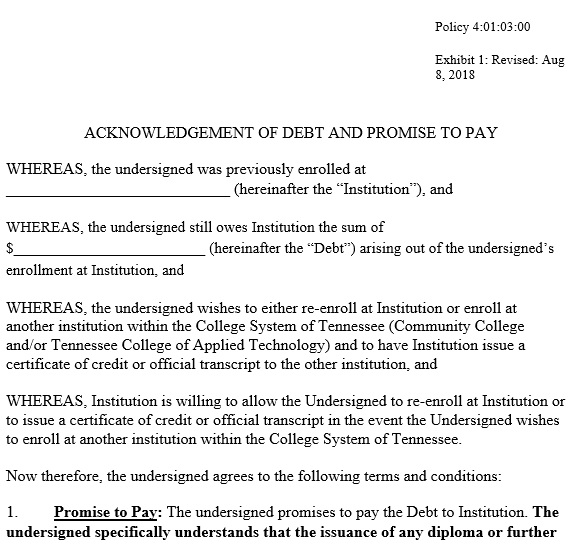

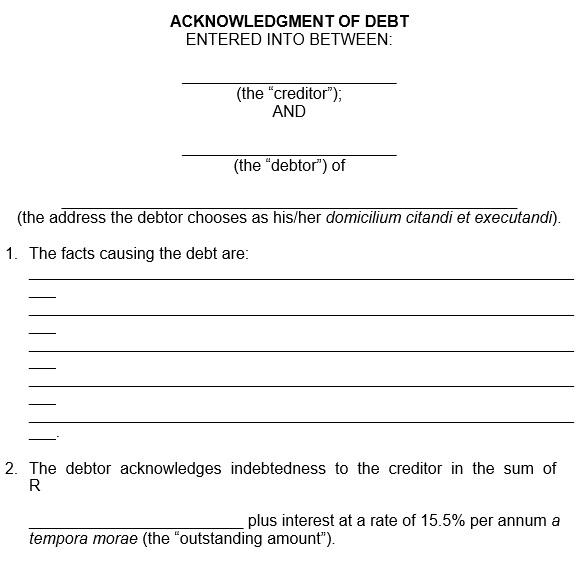

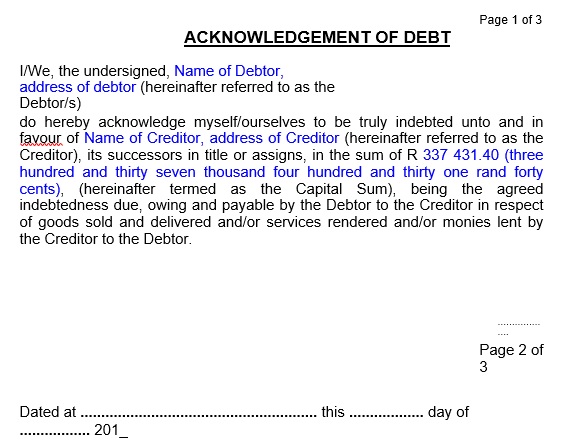

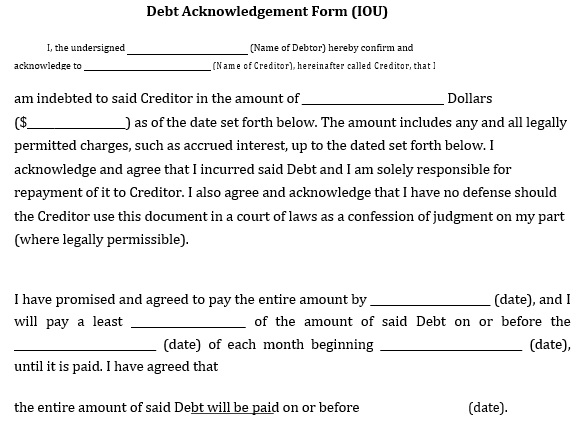

How to create an IOU template?

Consider the following steps to make an IOU template;

- At first, specify the names of the debtor and creditor. Also, write the loan amount in numeric and written form.

- Next, you have to provide details regarding how the money will get repaid. You just simply input the full amount in case the loan is to get paid off in one payment. Enter the final date in which the money must get paid off as well as the date in which you have to sign the IOU form.

- The signatures of the borrower and the lender are required to make the document legally binding. You should also check your state laws about a notary public’s signature as some states need them on IOU to become valid.

- You must have your document notarized even your state laws don’t require the signature of a notary public on the document. Doing so provides protection to both you and the borrower.

What are the consequences for not using an IOU?

The lender may have to face the following consequences if they don’t use an IOU;

- Not able to enforce a verbal promise

- They may have to pay expensive lawyer fees to recover money unpaid.

- Loss trust of their family or loss friendship

The borrower may have to face the following consequences if they don’t use an IOU;

- Unpaid expenses

- They may have to pay expensive lawyer fees to pursue money promised

- Loss trust of their family or loss friendship

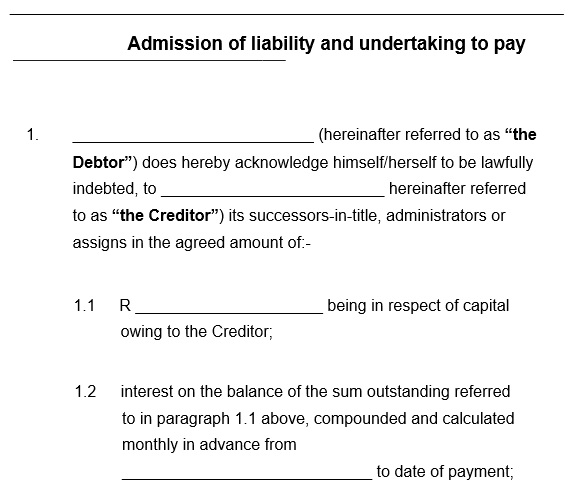

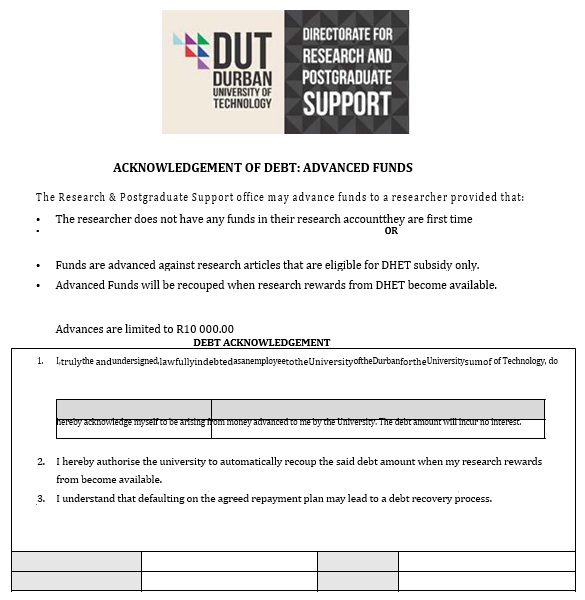

How IOU differs from a promissory note and a loan agreement?

Let us discuss different types of documents that you can create in such cases;

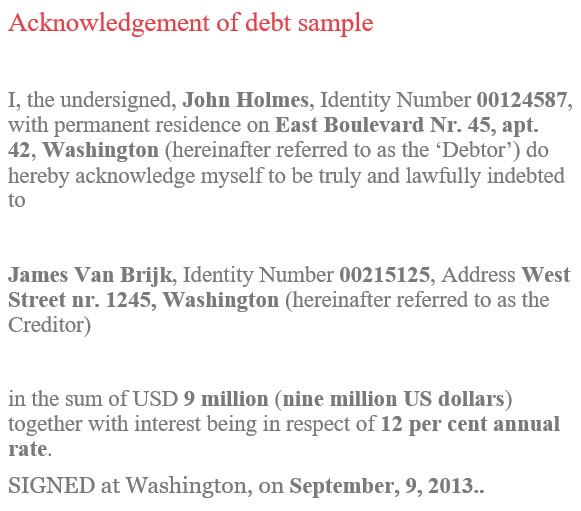

IOU:

We have discussed above that it contains the basic information like the loan amount, the due date of the loan, and the names and signatures of both borrower and lender. If you need an informal type of document, you can use it. It is the simplest and the least formal type of documentation that require only the borrower’s signature.

Promissory note:

It includes more information like;

- Amount of the loan

- Due date of the loan

- Borrower’s name and signature

- Installment payments and installment dates description

- Details of collateral terms

- Details of the interests if any

This document is used when he borrower may need to pay you back little by little. Furthermore, to charge interest or to ask for collateral this document is used.

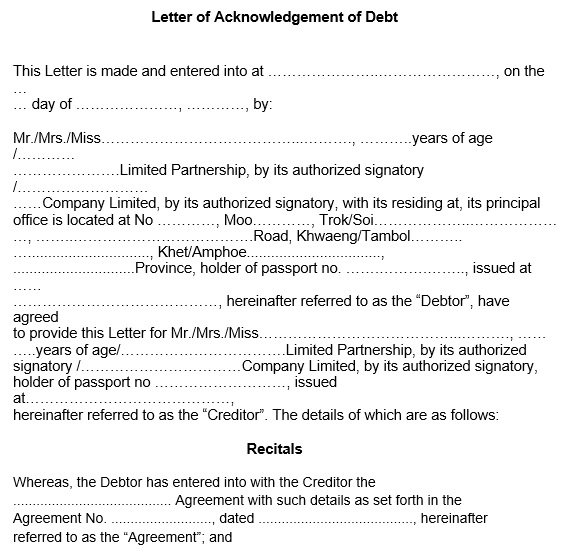

Loan agreement:

This document includes the detail such as;

- Loan’s amount

- Due date of the loan

- Lender’s name

- Borrower’s name and signature

- Installment payments and installment dates description

- Details of collateral terms

- Details of interest if any

- The consequences if the borrower doesn’t repay

- Fees in case of late payment

- Prepayment discounts

Hence, this document is used in case you’ve loaned a huge amount. It is the most formal document and more enforceable in the courts.

Does an IOU prove useful in court?

The IOU acts as written evidence of debt and also it acts as proof in court if the borrower signed this. An IOU with signatures and simpler format and wording is as good as a promissory note. Hence, you can use it in court as required.

Conclusion:

In conclusion, an IOU template is an informal document that contains the terms and conditions of the repayments when the lender and the borrower made a transaction. It is very simple and convenient to make. You can download free IOU template forms and websites and edit it according to your requirements.

Faqs (Frequently Asked Questions)

Yes, a handwritten IOU is legal and stand up in court to recover debts. You just have to make sure it contains the essential elements no matter whether the agreement is typed or handwritten.

Yes, an IOU is a legal document that you can use in court. This document enforces a loan agreement between the debtor and creditor.