A business expense spreadsheet is used by business owners to monitor their financial standing. This spreadsheet makes sure that your business is financially stable and it can go on operating smoothly.

Table of Contents

Types of business expenses spreadsheets:

A system is needed for your business to keep track of your spending. By using a business expense spreadsheet, you will benefit a lot. Let us discuss below some different types of business expenses spreadsheets;

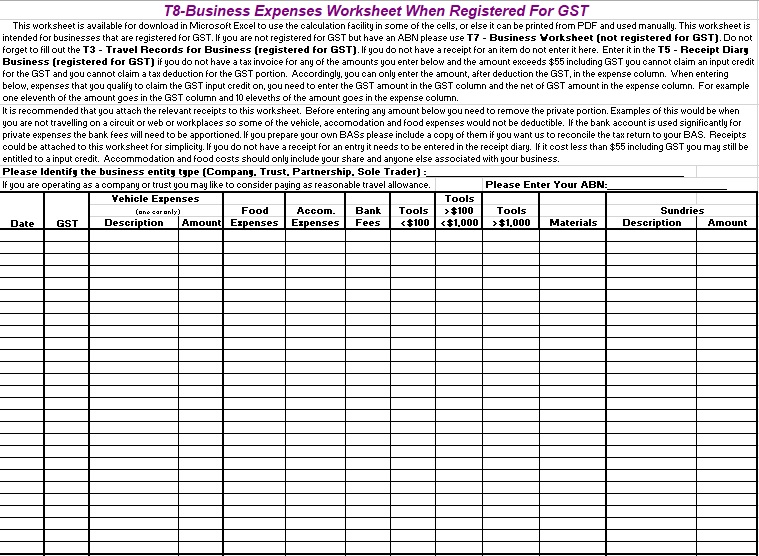

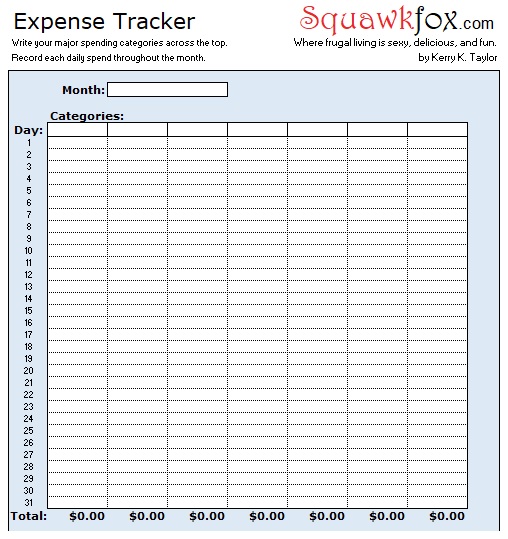

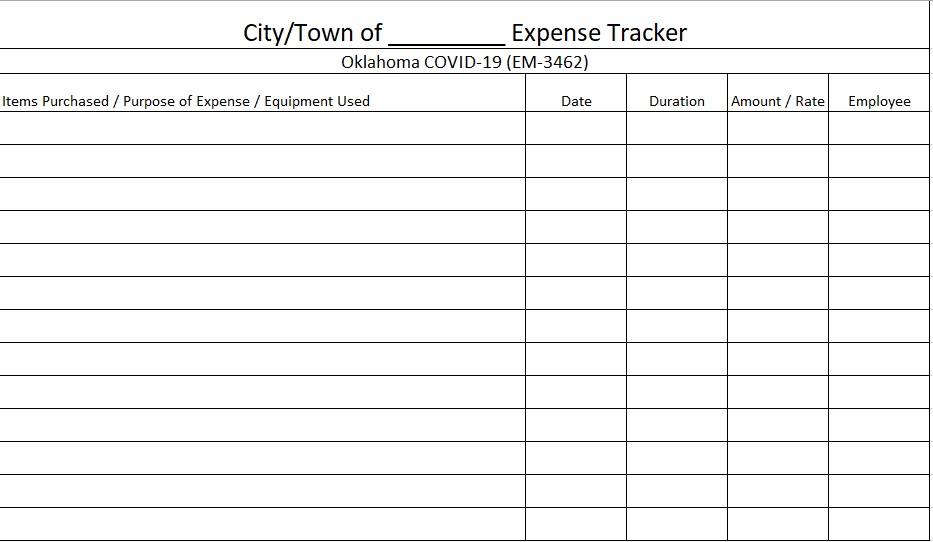

Basic Expense Template

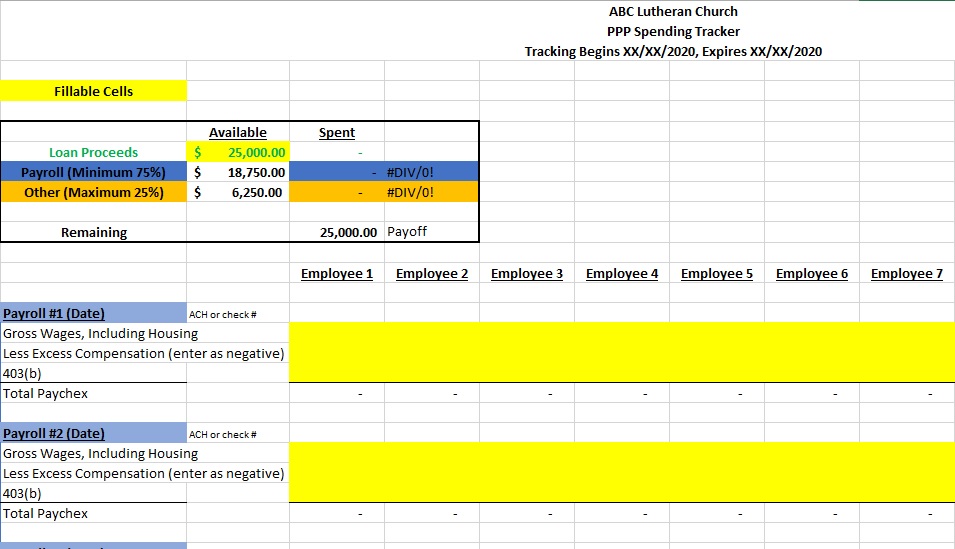

This template is used to keep track of the payment method, date, expense description, vendor, and amounts. For start-up companies and small businesses, these are appropriate as they are very simple.

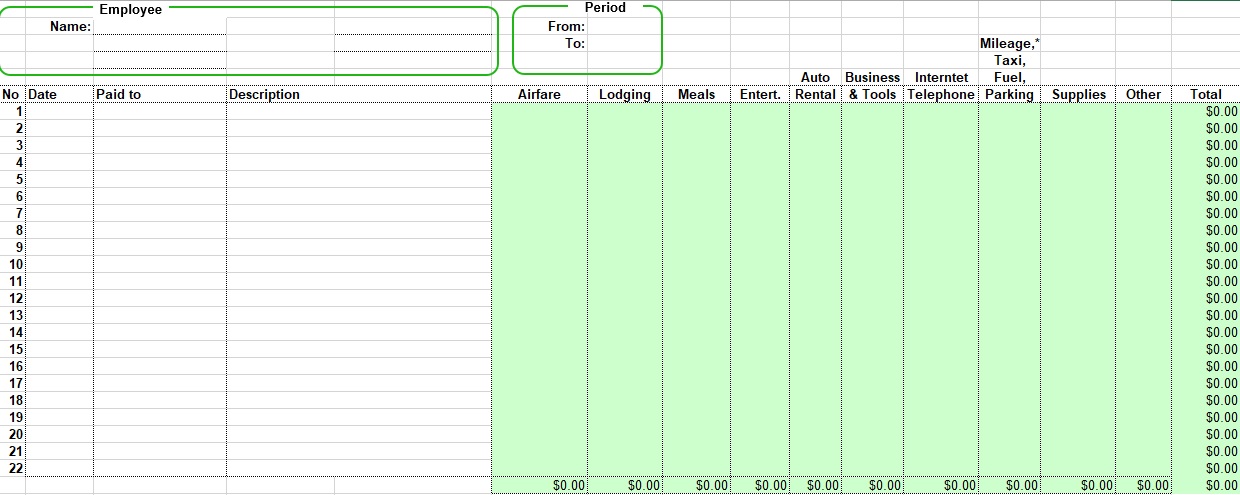

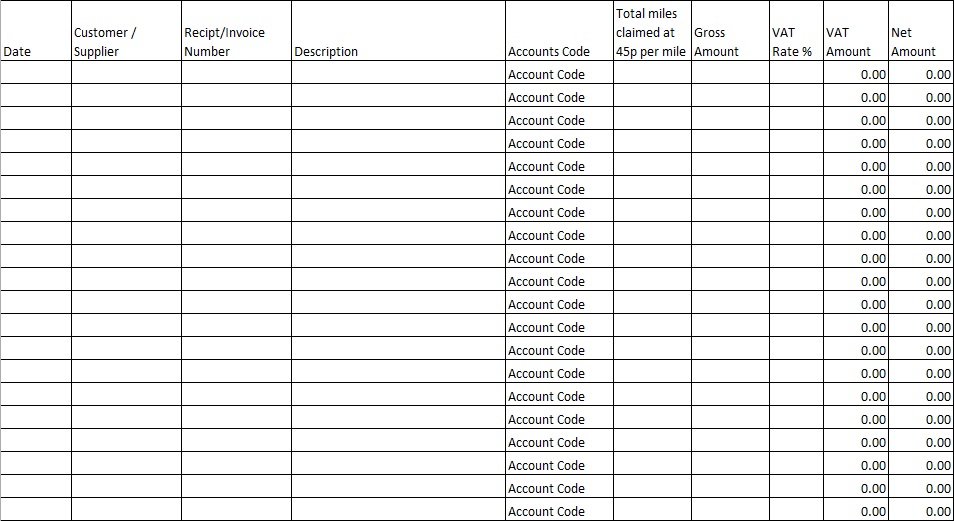

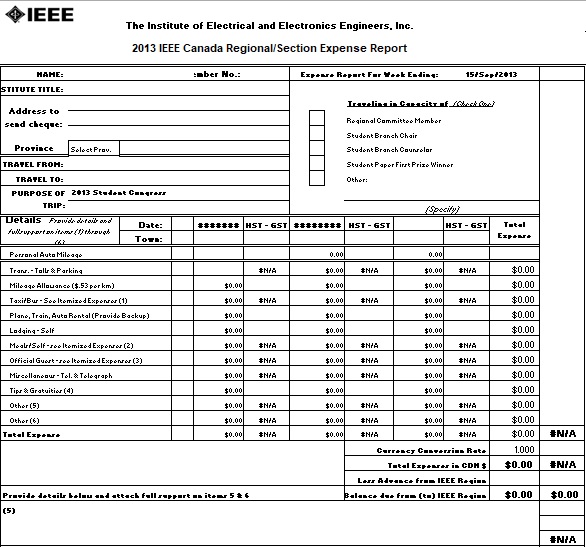

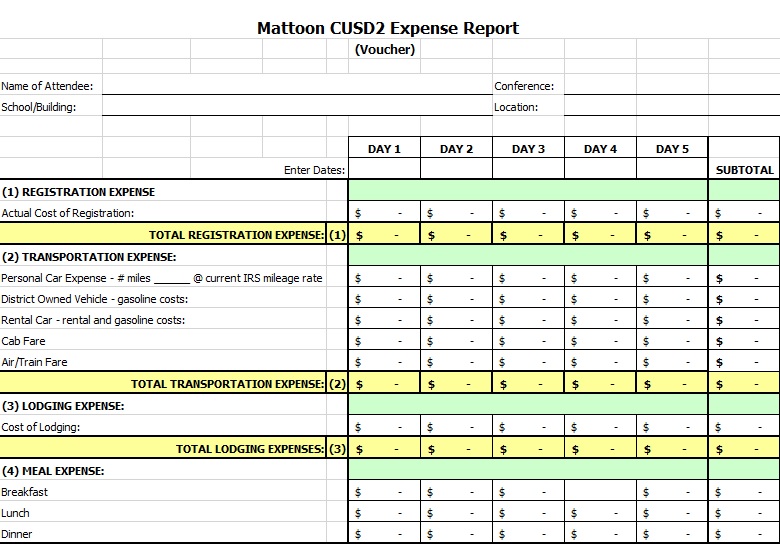

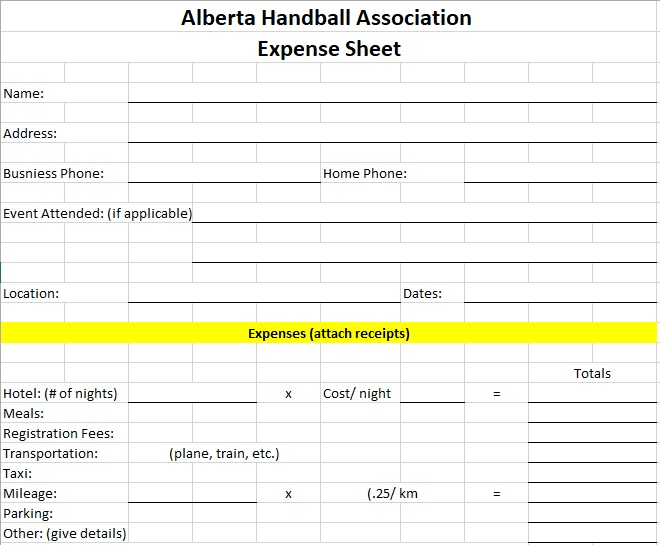

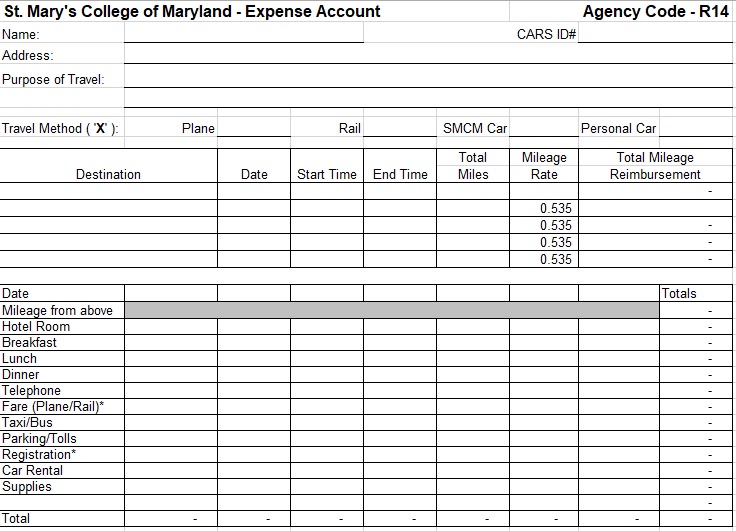

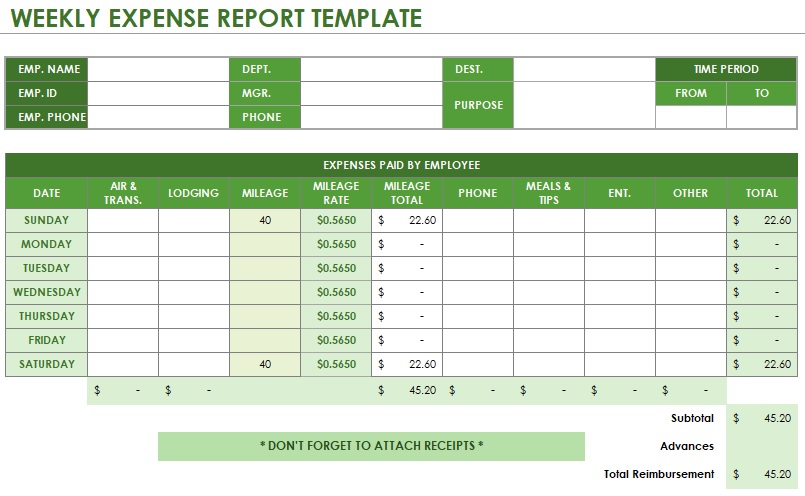

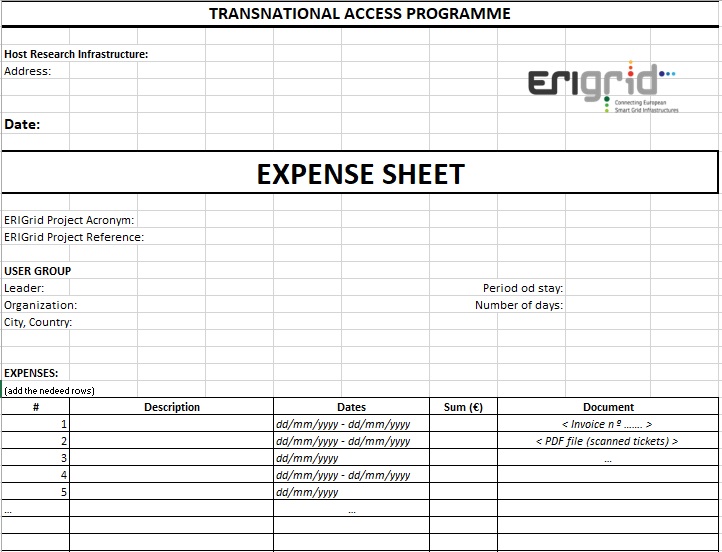

Travel Expense template:

You can use this template to organize charges for meals, transportation, and hotels as well as the mileage of the car you use.

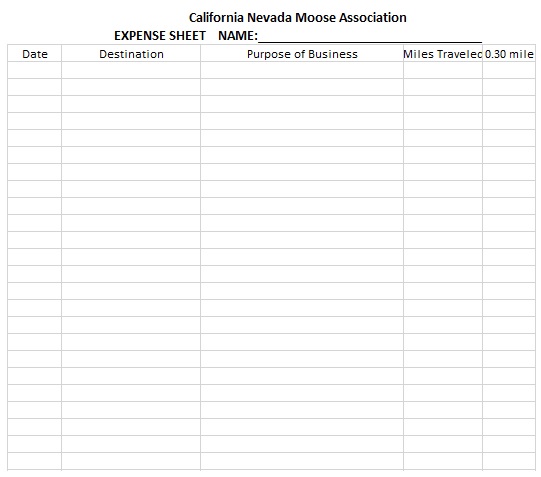

Business Mileage Expense Template

For business trips, employees use their personal vehicles in many cases and then the company will compensate the employee for the time they used their car. With the help of this template, the companies can keep track of this information.

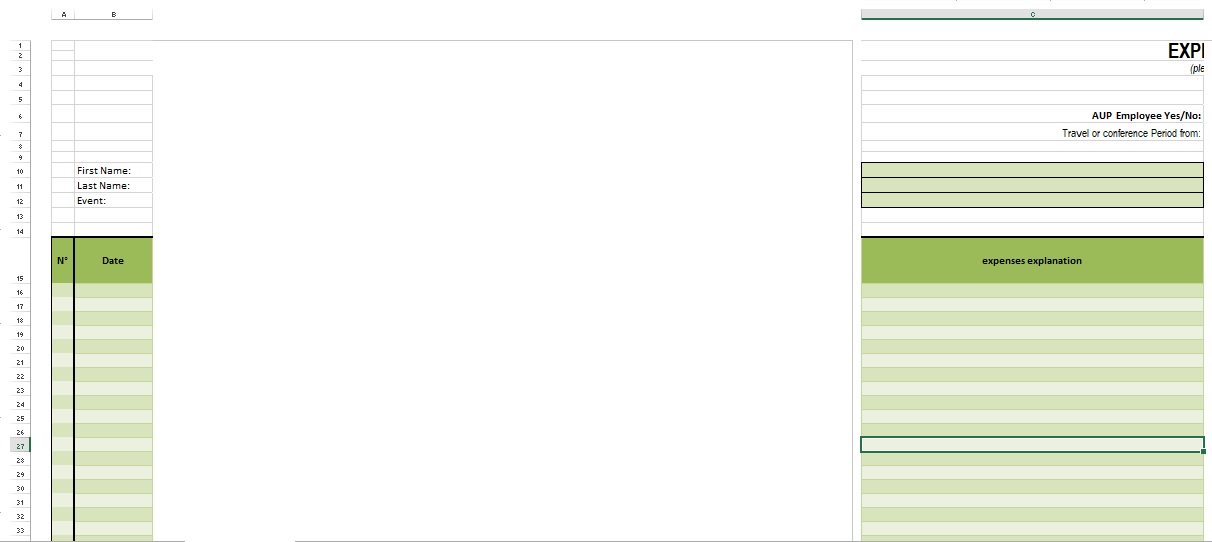

Event Expense Template

For each aspect of an event, this template is useful to track estimated against the actual cost. The report serves as both an expense report and a budget. This is because it gives an added layer of data that ensures the event stays on track.

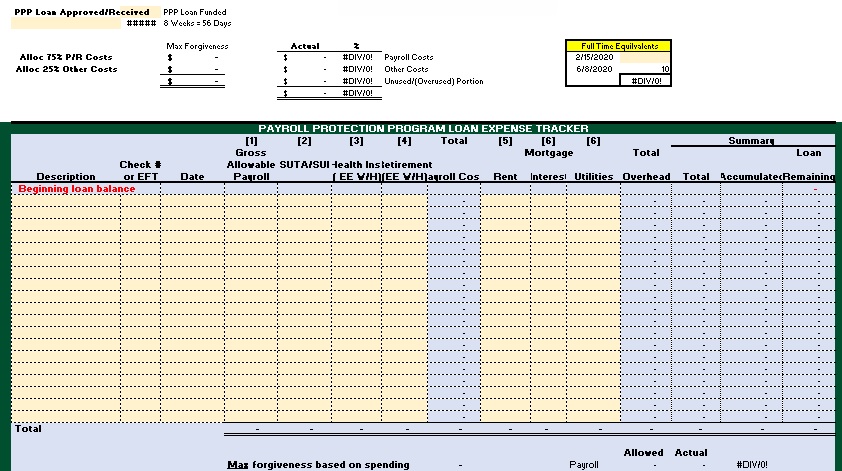

Project Expense Template

All of the attributable expenses that incurred during a specific project is reported and tracked by this template. To align with budgets, the expenses types and expenses have been pre-approved by the management.

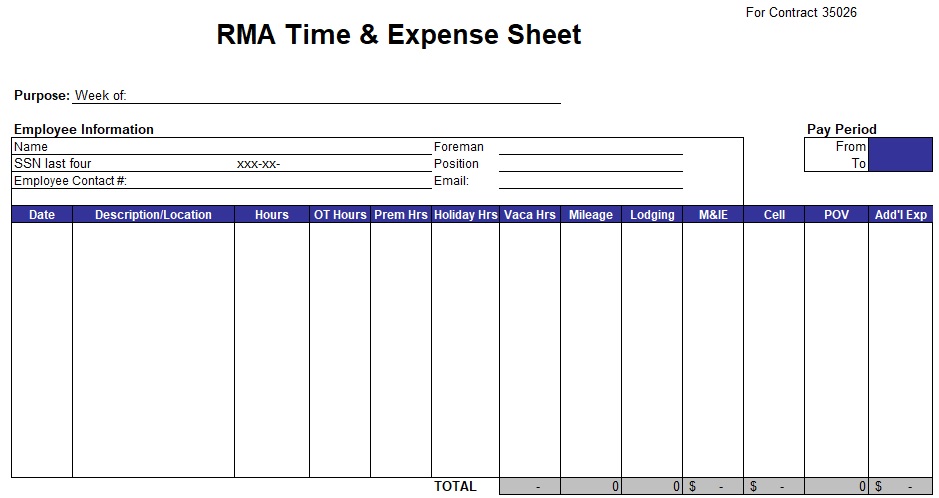

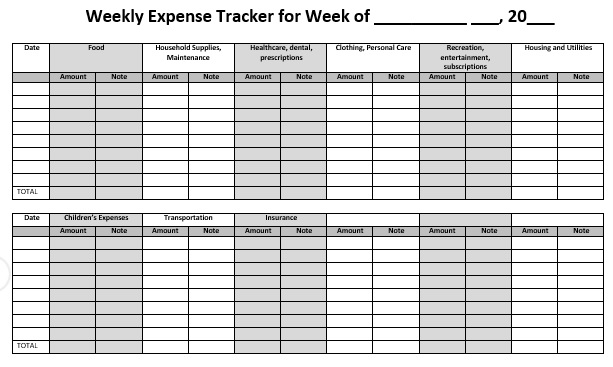

Timed Expensed Reports

The expenses reports usually file on an annual, quarterly or monthly or weekly basis. On the basis of your organization’s accounting practices and payment structure, you may use one or more of this expense report template. You may also like Partnership Agreement Templates.

How to keep track of business expenses?

You should always keep track of your business expenses in order to make sure that your business will always have updated financial information. Follow the below steps to make your tracking process easier and faster;

Separate business and personal expenses:

Don’t mix separate business and personal expenses together. You should place them separate so that you will have a better understanding of your business’ costs. It also acts as the verification that you have the exact amount of tax-deductable expenses come tax season.

Select your accounting method for your business:

During tracking expenses, most small businesses use the cash accounting method. Here, you can record income when you receive it and expenses when making payments. Furthermore, there is also another method i.e. accrual method. It allows you to count sales when you make them. For documentation purposes, you can also use an expense tracker template.

Save your expense receipts:

When tracking business expenses, you have to ensure that you keep all receipts of any business-related purchase you make. While making business-related expenses, you can simplify this process by using one debit or credit card.

How to do an expense spreadsheet?

A business expense spreadsheet is a detailed report made on a daily basis. It contains all of the expenses your business has experienced. The money you have spent, this document just tracks it. You should follow the below guidelines to create this spreadsheet;

Start with a blank spreadsheet

When creating the report, it is suggested to start with a clean sheet. This way, you have the option to customize the document to serve its purpose.

List all of your expenses

It becomes easier for you to make categories or add to existing groups by listing down the expenses.

Classify your expenses into categories

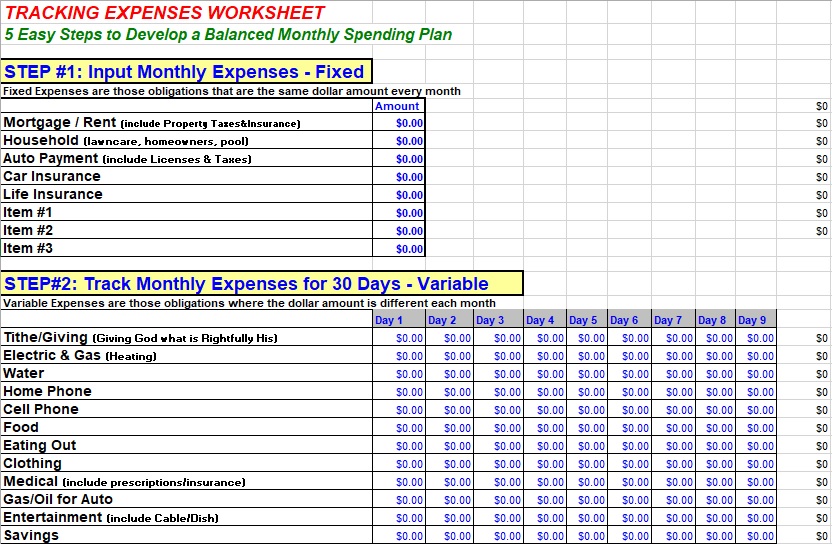

With the help of the list you have collected, categorize the operating cost whether into variable, periodic or fixed expenditures.

Be as honest as possible

Don’t exclude any purchases. Their inclusion provides you the opportunity to make improvements. This makes you able that next time you will only concentrate on what matters. You will never improve without honesty. You have to create an expense sheet that is both effective and perfect.

How to keep track of business expenses and income in Excel?

Here are the steps to keep track of business expenses and income in Excel;

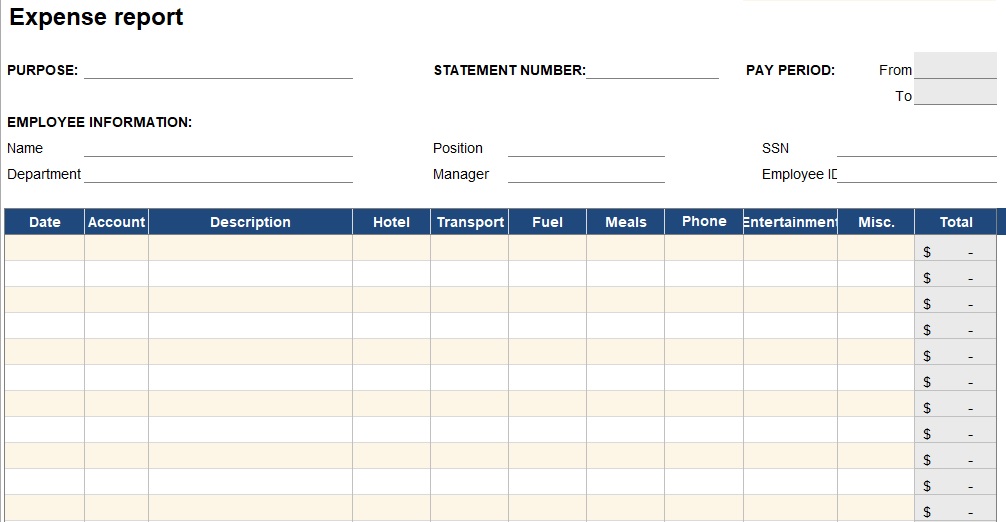

Categorizing

For the columns of the spreadsheet, the categories that you use for the columns of the spreadsheet will identify how you will classify the methods according the way your business will spend money. You can use the categories included on their Schedule C tax form in order to avoid any problems with the Internal Revenue Service. Supplies, cost of goods sold, rent, depreciation, and utilities are the categories you may include.

Creating the Spreadsheet

Your spreadsheet serves as your ledger that can keep track of expenses. Below are the steps for this;

- For the categories, you should use the first row of the columns.

- For the date and the columns, use the columns on the far left next to those for the vendor’s name.

- Enter each expense amount in the columns that is relevant to their category.

- By using the right formula, calculate the total amount that your business has spent on each of the categories.

- You can use a calculator to get the total amounts in order to use a handwritten journal for the same purpose.

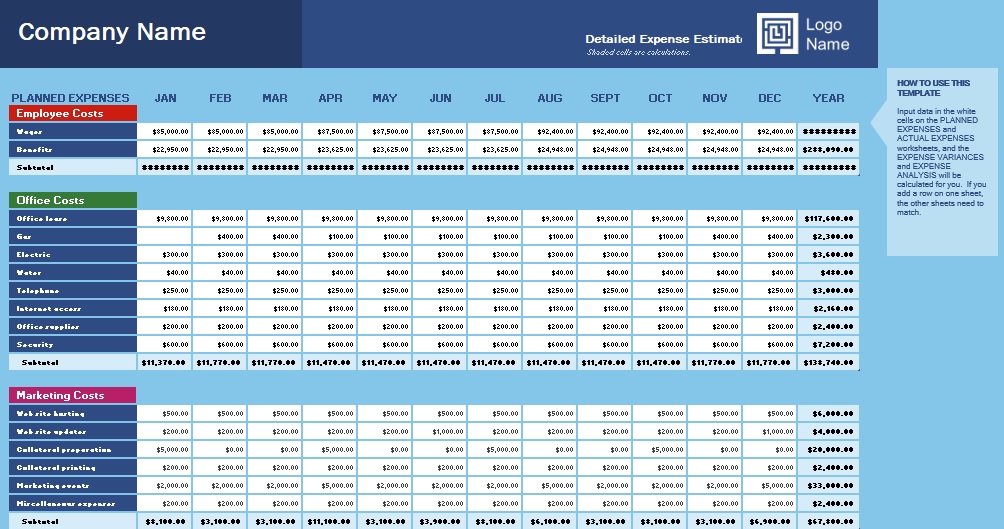

Using Different Spreadsheets

Use a spreadsheet in order to create a summary of your expenses and compare the expenses over time. Most of the businesses use this spreadsheet for taking an overview. This is because it makes them able to clearly and quickly see how their expenses in each category vary from one month to another. It also allows them to see how their expenses in the various categories compare.

Conclusion:

In conclusion, a business expense spreadsheet is a comprehensive report that keeps track of how much you’re spending. It is important for every business owner to have a system to monitor their financial standing. With the help of this spreadsheet, you can keep track of your business expenses.