It is a good idea to fill out an affidavit of heirship form if you have a considerable amount of property to leave behind. The affidavit of heirship prevents any arguments regarding property for those you leave behind.

Table of Contents

- 1 What is an Affidavit of Heirship?

- 2 What is a declaration of heirs?

- 3 When do you require an Affidavit of Heirship?

- 4 What are the outcomes of not having an Affidavit of Heirship?

- 5 How does heirship work in Texas?

- 6 In Texas, who can file an affidavit of heirship?

- 7 How much cost you require to file an affidavit of heirship in Texas?

- 8 Conclusion:

- 9 Faq (Frequently Asked Questions)

What is an Affidavit of Heirship?

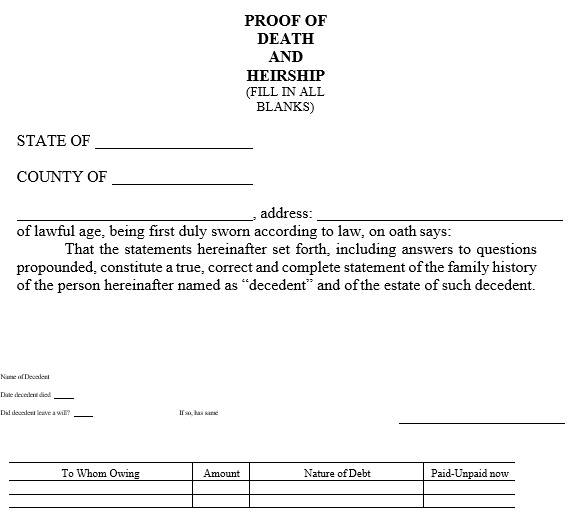

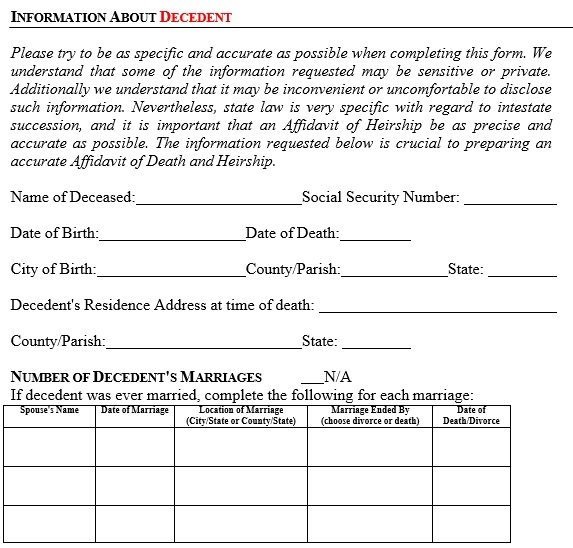

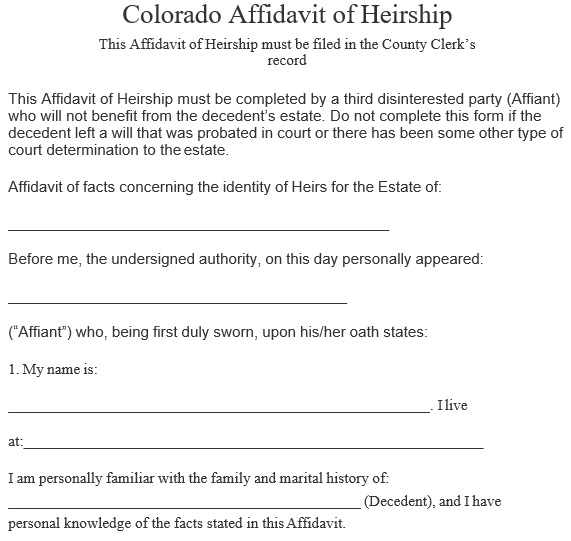

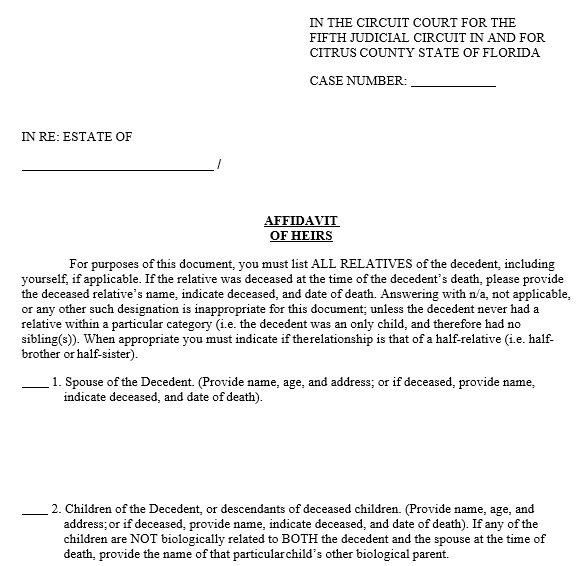

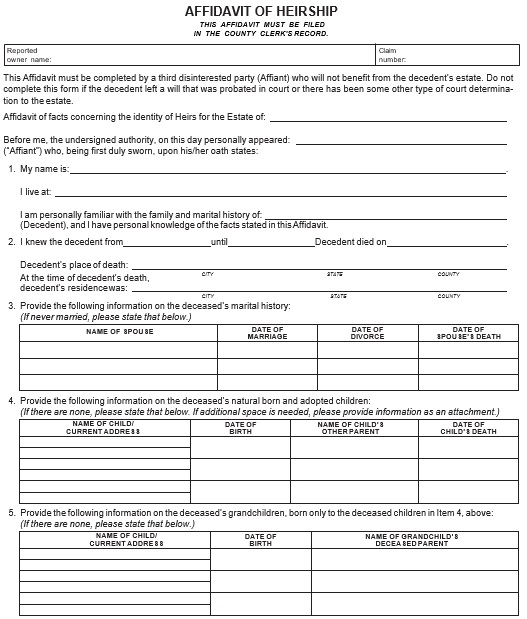

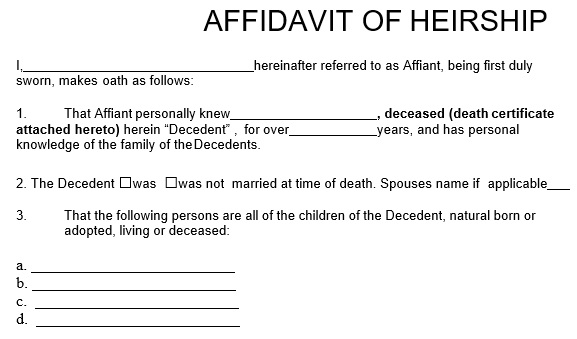

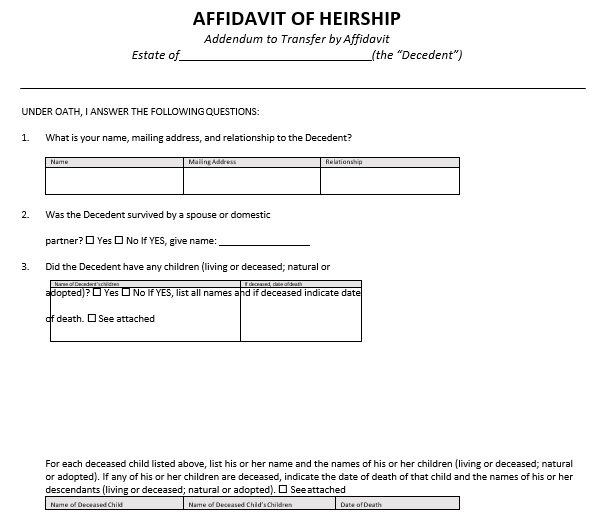

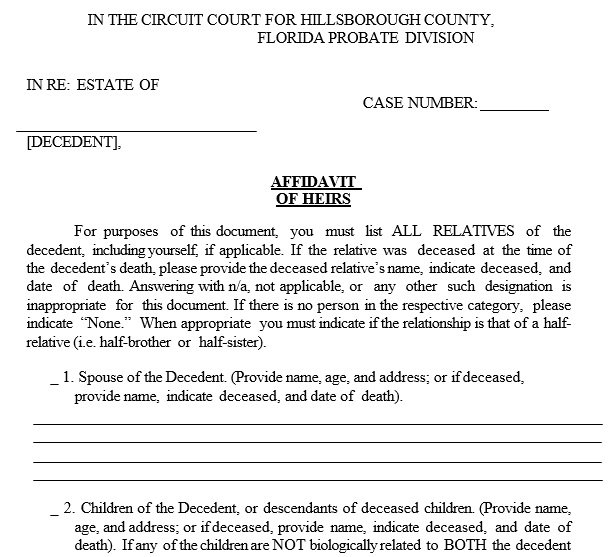

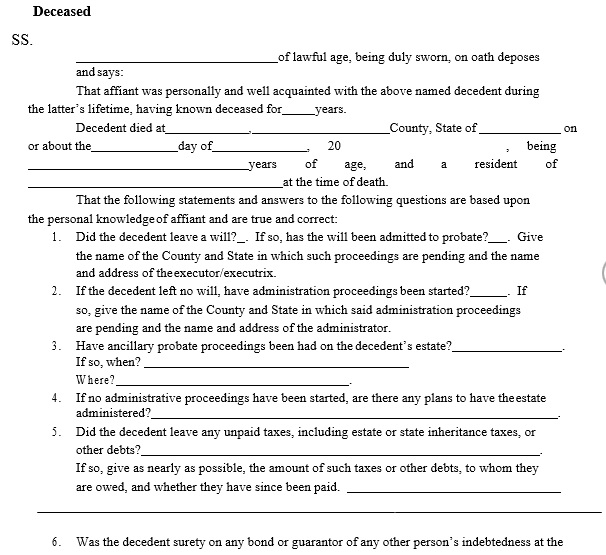

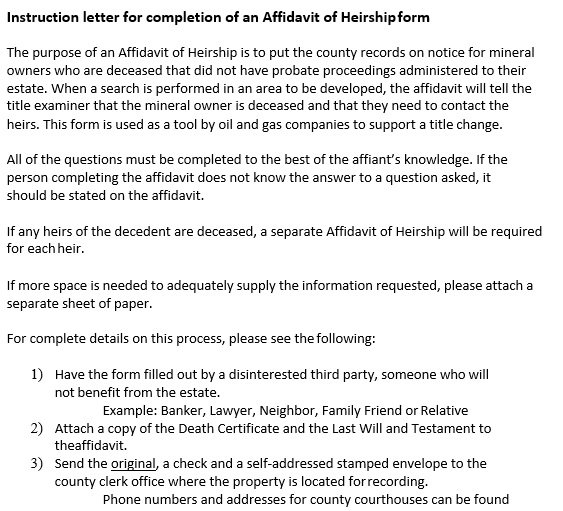

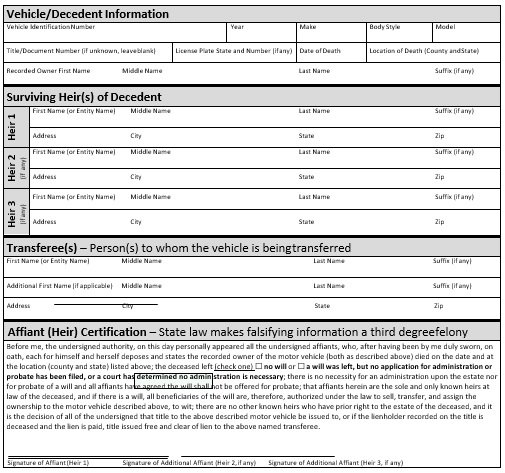

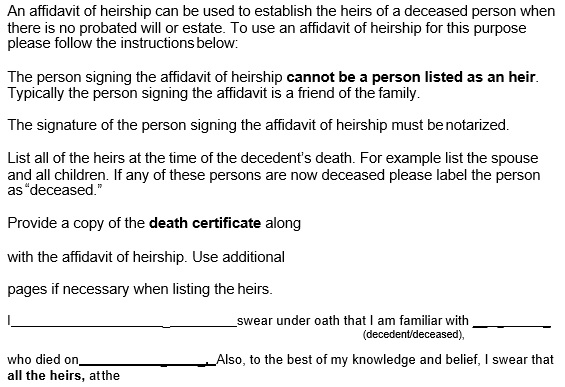

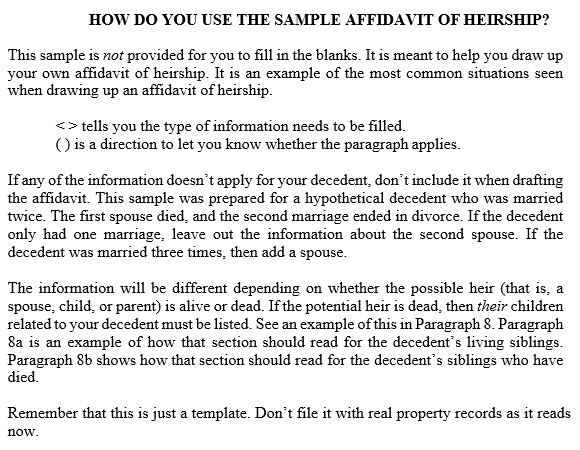

An affidavit of heirship is a legal document that determines the heirs of a dead person who passed away without a valid or enforceable will. With the help of this document, a spouse or family member builds ownership of the person’s real property and ownership of personal property. You can avoid expensive and time-consuming process of settling the deceased’s hires in court by making this document.

All the details regarding the deceased is included in the affidavit as well as his or her all known family relations in order to distribute his/her property accurately. All heirs of deceased have to agree on how the property should be divided. Additionally, it is important that a third party must sign the affidavit most probably a witness who knows the deceased and isn’t an heir.

What is a declaration of heirs?

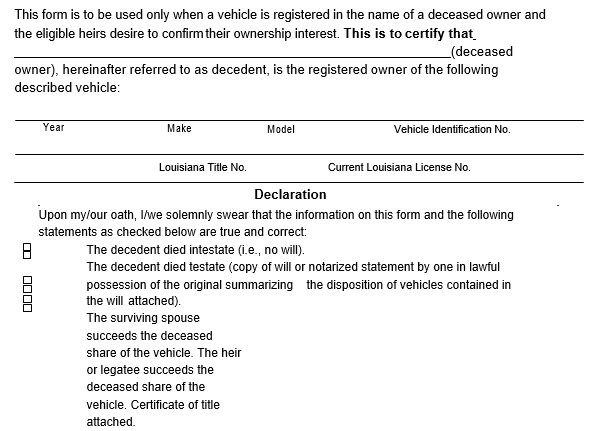

A declaration of heirs is another document other than an affidavit of heirship. In case, you die without an enforceable or valid will, this document determines your heirs. In the event of your death, a member of your family use this document to build ownership of your real property.

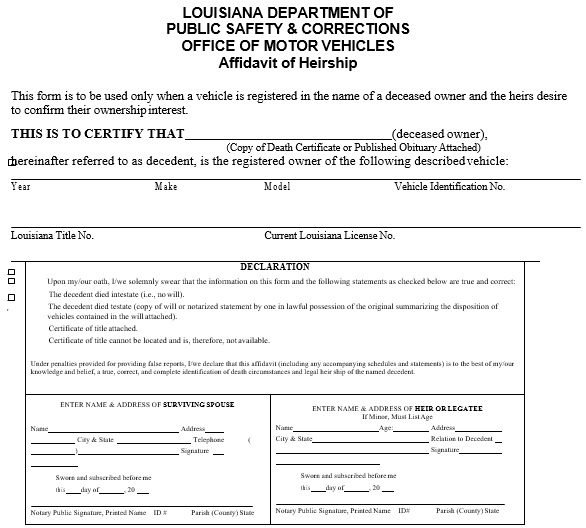

In some states, the use of an affidavit of heirship sample is allowed to build ownership of personal property such as cars or bank accounts. To avoid the time-consuming and expensive process of settling your estate in probate court, the members of your family may allow the use of this document.

Furthermore, the primary purpose of this document is to present all of the known information about you and this involves all family relations. This makes the process of distributing your property easier for the court. All the heirs, for this to occur, must all agree with how they will distribute the property.

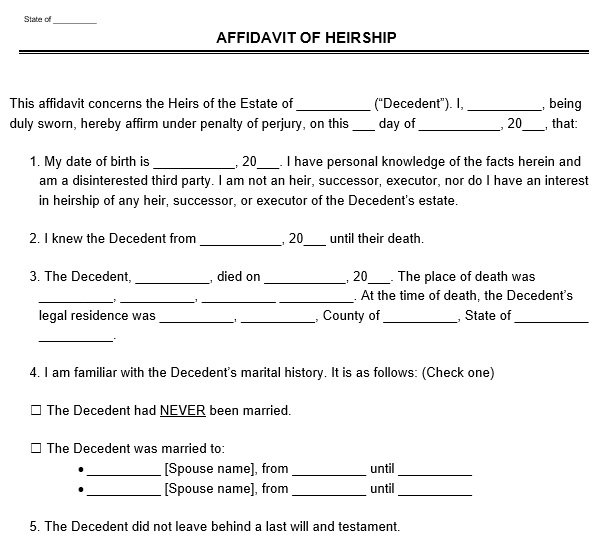

For the affidavit, one requirement is that a disinterested third party must sign it. This witness is generally an individual who you knew in life. The heirs will submit the document to the court after the completion of all requirements. Also, submit it in the deed records of your local county. This document should include the following;

- Decedent

- Intestate

- Decedent’s estate

- Real property

- Personal property

- Heir

- Affidavit

- Witness

- Notary

In transferring ownership of the real property to an heir, most states limit the use of this document.

When do you require an Affidavit of Heirship?

When someone’s died without leaving a valid and enforceable will, then an affidavit of heirship comes in handy. The deceased’s family may have to go through a lengthy and expensive probate process in the court without having this document. Furthermore, you can only use this document if all the heirs of the deceased are agreed on the distribution of the property.

An affidavit of Heirship also requires when deceased was alive and want to transfer his or her real property to a specific person but unfortunately he/she can’t state it in writing. For instance, in the will a deceased may state that he wants his sister should have his car when he passed away. Hence, the deceased intentions are cleared in the will.

You should make use of an affidavit of heirship to address such intentions in detail. You can also prevent yourself from being determined by a probate court. Also, if someone’s die without leaving a valid will then as per the state rules the distribution of real and personal property of that person happen.

What are the outcomes of not having an Affidavit of Heirship?

The surviving spouse or other heirs without having an affidavit of heirship have to go to the probate court to settle an estate. Going to probate can be expensive and you have to wait for months or even years to resolve this matter. When the estate is in the court then the spouse or other heirs can’t sell the really property, can’t access bank accounts, and can’t sell automobiles or other vehicles. In addition, they also can’t access safety deposit boxes and distribute assets.

How does heirship work in Texas?

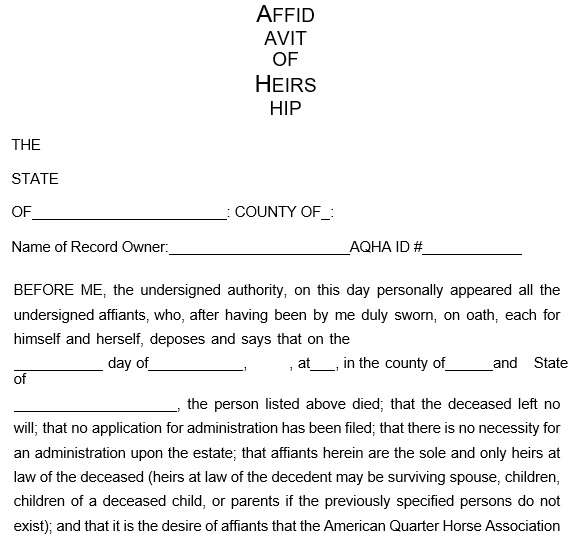

Your heirs generally need to file a case in probate court if you die without a will and leave behind the personal or real property. This way, they can get the said property. The use of this document is the most common and affordable way to transfer the title from your name into your heir’s name. But, this document is only valid in the following situations;

- When someone die without leaving a valid will

- An individual wants to determine himself as a lawful heir

- Without undergoing probate, a person wants to take possession of your estate.

- All of your heirs have agreed on how to distribute your property

Generally, to settle an inheritance issue, heirs want to avoid going to probate court. This is the main reason behind using a certificate of heirship. Transferring the title of real property is cheaper, faster, and easier than going through the probate process.

In addition, there will be no need to attend probate court hearings with a letter of heirship. The heirship proceeding is still considered as a court proceeding. It is used to establish who your heirs are. You are referred as a ‘dying intestate,’ in case you die without leaving a last will and testament.

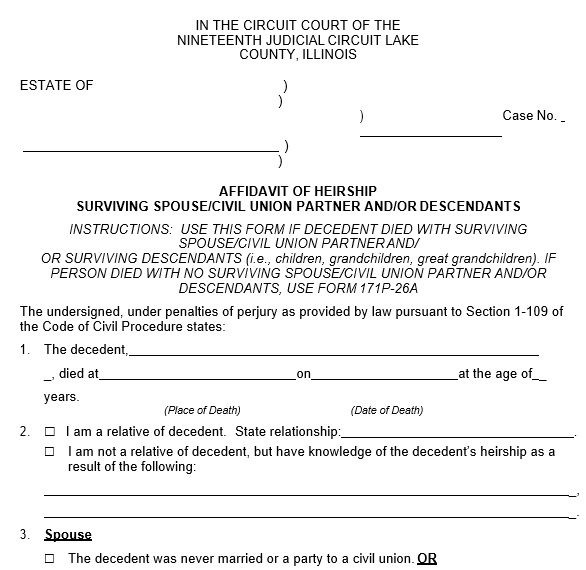

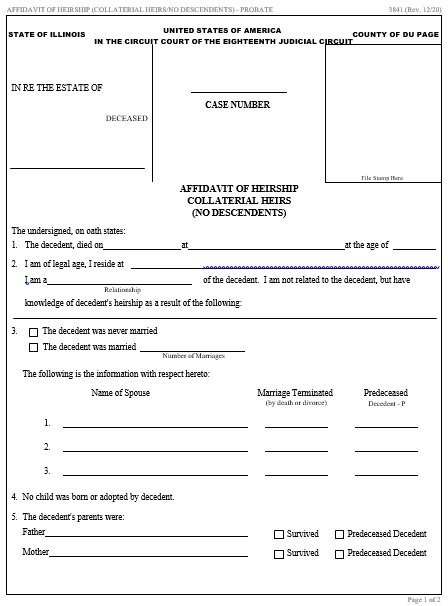

The Texas Estates Code gives what the deceased’s heirs will inherit. For example, the courts won’t suppose about the identity of heirs. When the process of determining the deceased’s heirs is commonly straightforward and easy still it requires an heirship proceeding. A court-appointed lawyer is involved in the court proceeding who will investigate your family history. After that, it confirms to the court the identity of your heirs. Following are the important points that you should remember about an heirship proceeding;

- The court appoints an attorney that performs an investigation to find out who the rightful heirs are.

- For the identity of the heirs of the deceased person, two disinterested witnesses testify in court.

- There must be an estate administration after the heirship proceeding.

Any of your heirs, representatives, or secured creditors can file a request with the probate court of Texas before the heirship proceeding begins. On the application, all heirs should affix their signatures. In addition, the Texas Probate Court is responsible for outlining how to complete the application. Before the proceedings can start, all the heirs should sign the application.

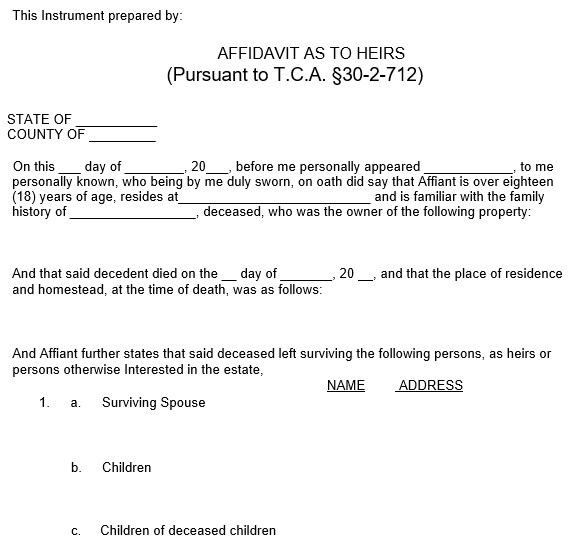

In Texas, who can file an affidavit of heirship?

The issues may arise that who will get your title and the proper percentages when you die without a will and the title to your property. In question, such property is the “heirship property.” It is basically unsellable. Also, the insurance company won’t insure the title unless your heirs have dealt with and resolved the matter. They can get this by;

- In a county court, a probate proceeding. This results in the appointment of the estate’s personal representative. Ultimately a judgment determines heirship.

- With the help of an affidavit of heirship that is signed by the surviving heirs in favor of a new owner.

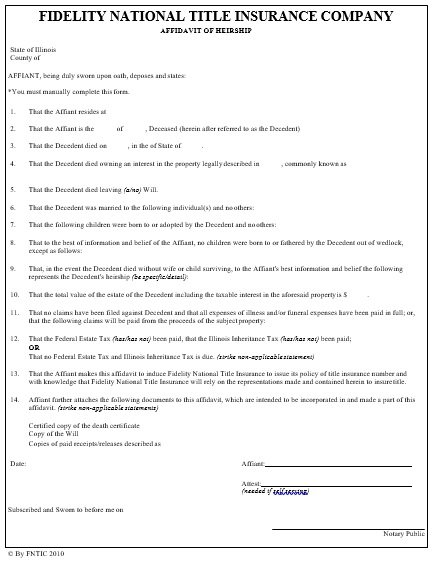

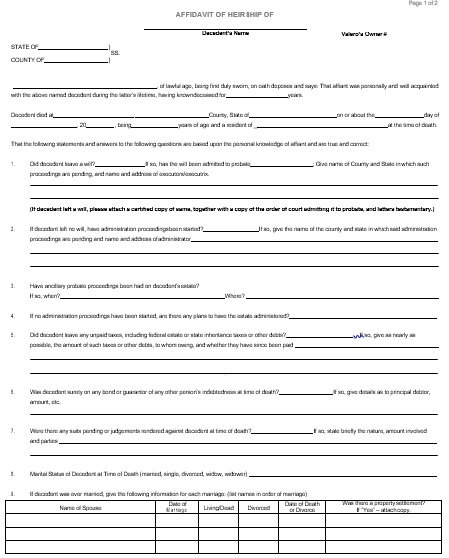

Your heirs making a case when they file a certificate of heirship. This case should be as persuasive and firm as possible. While creating an affidavit or letter of heirship, here are the steps that heirs should follow;

Prepare the affidavit

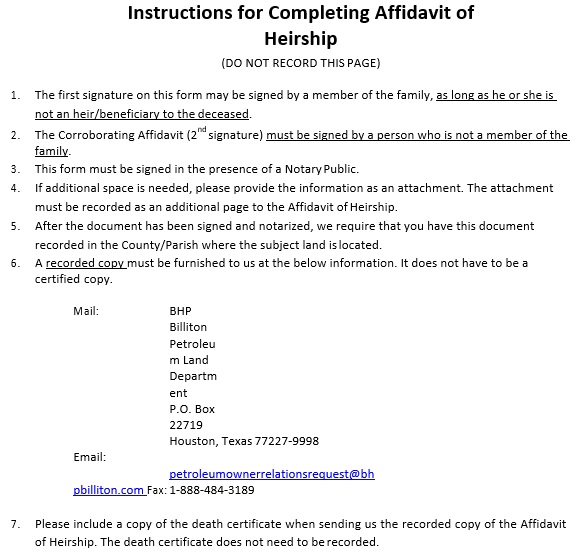

A two-step process is generally involved to resolve heirship issues outside of the probate court. At first, the heirs must prepare the affidavit. After that, sign it by a person with first-hand knowledge of your family’s history. You should hire a lawyer for this process as creating this document is as much a science and an art.

Prepare the deed

After drafting the affidavit, the next step is the execution and filing are also completed is the deed transfer. This document pays attention to the title of the property getting passed to a single heir that may either sell the property or keep it. Sometimes, all hires have to sign to convey the property to a third-party buyer.

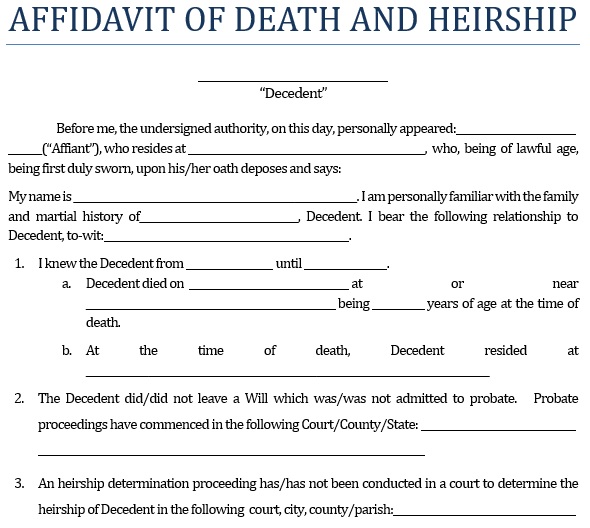

How much cost you require to file an affidavit of heirship in Texas?

An affidavit of heirship is a legal document that determines the heirs of a dead person. This affidavit is used to transfer the real estate of deceased to the heirs of the deceased as his heirs are already mentioned in the real property records.

Nowadays, $500 is the required price for this affidavit including the lawyer’s fee to create the affidavit and to record in the real property records. If you decide to document the affidavit own your own then you can save up to $75.

Conclusion:

In conclusion, an affidavit of heirship form is an important document that identifies a deceased person’s heirs. The main purpose of this document is to transfer the deceased’s real estate to the deceased’s heirs.

Faq (Frequently Asked Questions)

Here are the steps to follow to get an affidavit of heirship;

1- You have to create the document and answers a few questions.

2- Then, send or share it to get a legal advice.

3- Affix the signature of third party i.e. witness

Affidavit of inheritance is basically another name of Affidavit of Heirship which a legal document that determines the heirs of a dead person.

Yes, an Affidavit of Heirship should be notarized in front of notary public. In order to make this document legally valid, it must contain a notary seal.

No, Affidavit of Heirship can’t be used for transferring title. However, it can be used as proof of a title. An affidavit just have an opinion of matter like title. It doesn’t have right to grant ownership of an asset to an heir.