Wire transfers are the financial world’s version of a high-speed rail system – fast, efficient, and capable of traversing borders with ease. Whether you’re an individual sending money to a loved one or a business making a critical payment, the ability to rapidly and securely move funds between bank accounts is an invaluable tool. However, like any complex transportation network, navigating the intricacies of wire transfer form can feel daunting at first.

In this comprehensive guide, we’ll demystify the world of wire transfers and equip you with the knowledge to confidently complete these transactions. From understanding the key information required on the form to uncovering expert tips for ensuring a smooth process, you’ll emerge as a wire transfer aficionado by the time you reach the end.

So buckle up, because we’re about to take a deep dive into the inner workings of wire transfers and explore how you can leverage this powerful financial mechanism to your advantage.

Table of Contents

The Fundamentals of Wire Transfers

At their core, wire transfers are electronic fund transfers that move money directly between bank accounts, both domestically and internationally. This method of payment stands in contrast to other common forms of money movement, such as paper checks or Automated Clearing House (ACH) transfers, which can take days to process and clear.

The speed and efficiency of wire transfers are made possible by the secure financial networks that facilitate these transactions. In the United States, the primary wire transfer systems are the Federal Reserve’s Fedwire network and the Society for Worldwide Interbank Financial Telecommunication (SWIFT) network, which enables cross-border transfers.

But what exactly happens when you initiate a wire transfer? Let’s break down the process step-by-step:

- Gather the Necessary Information: To complete a wire transfer form, you’ll need to have certain details on hand, including your own banking information, the recipient’s banking details, and specifics about the transfer itself (e.g., the amount, purpose, and any reference numbers).

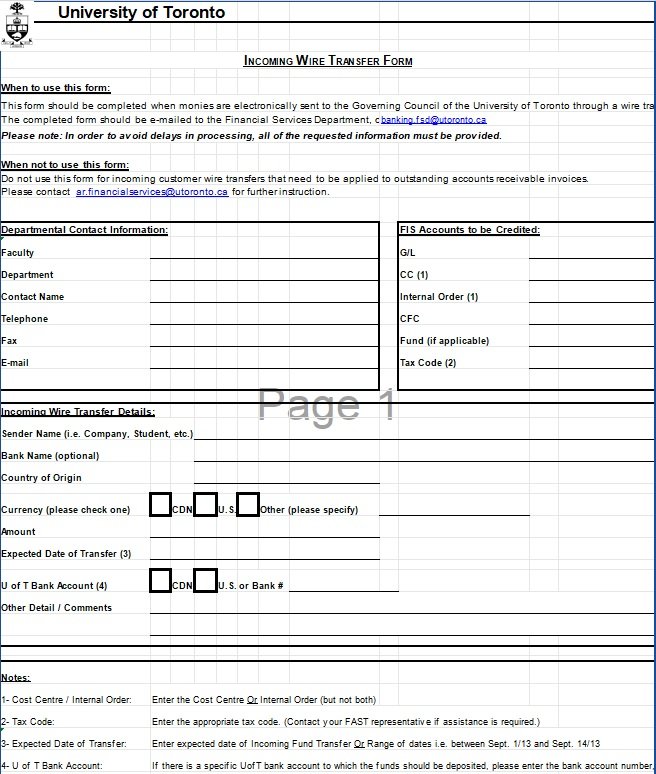

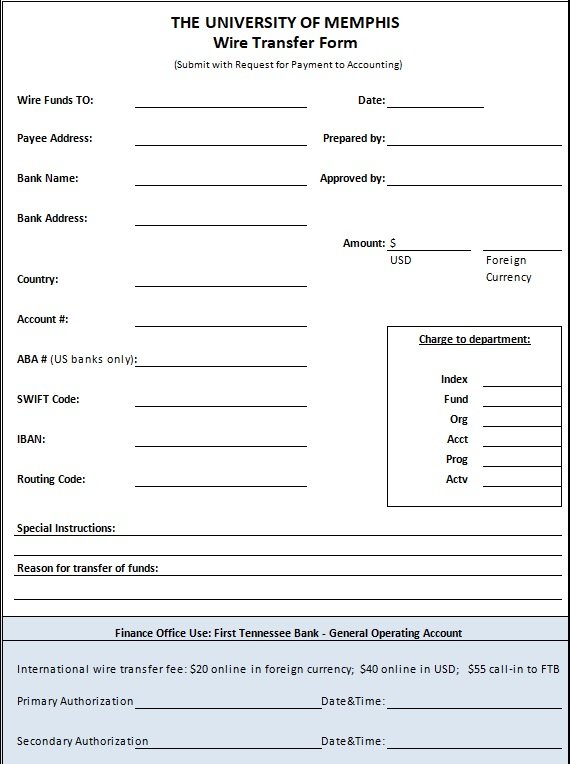

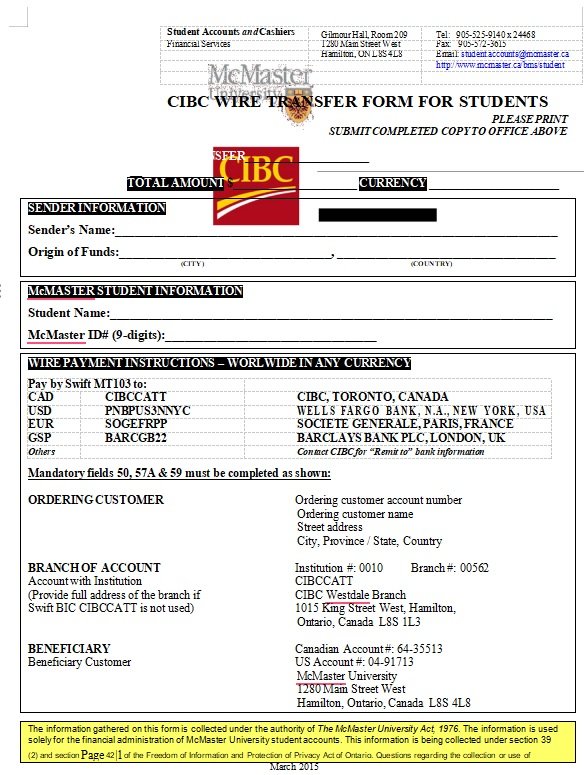

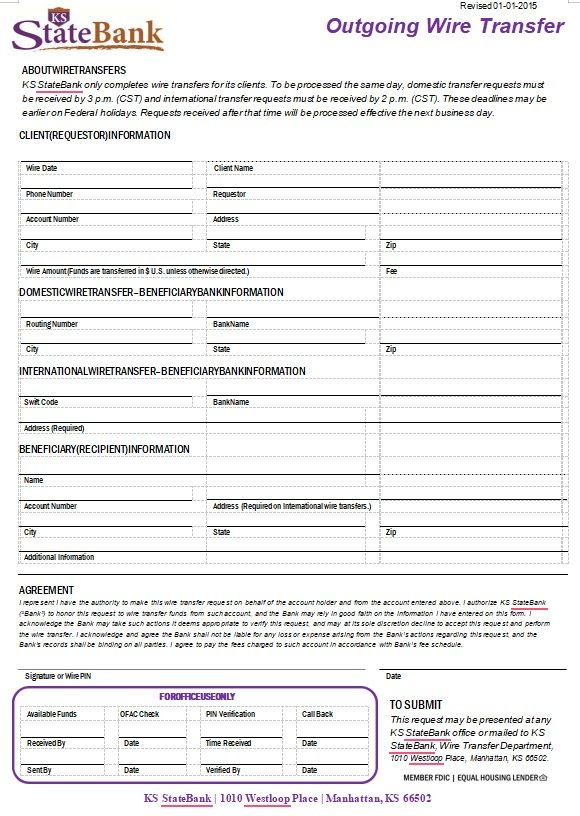

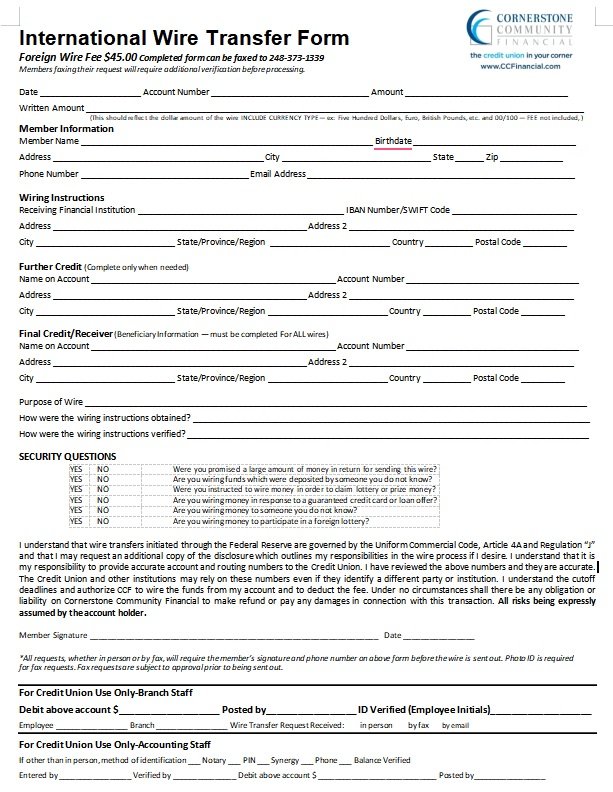

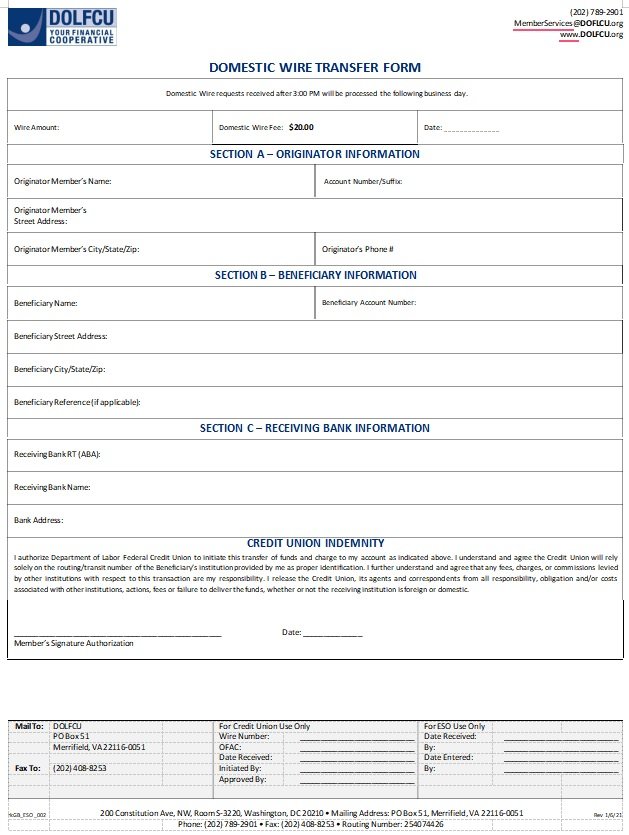

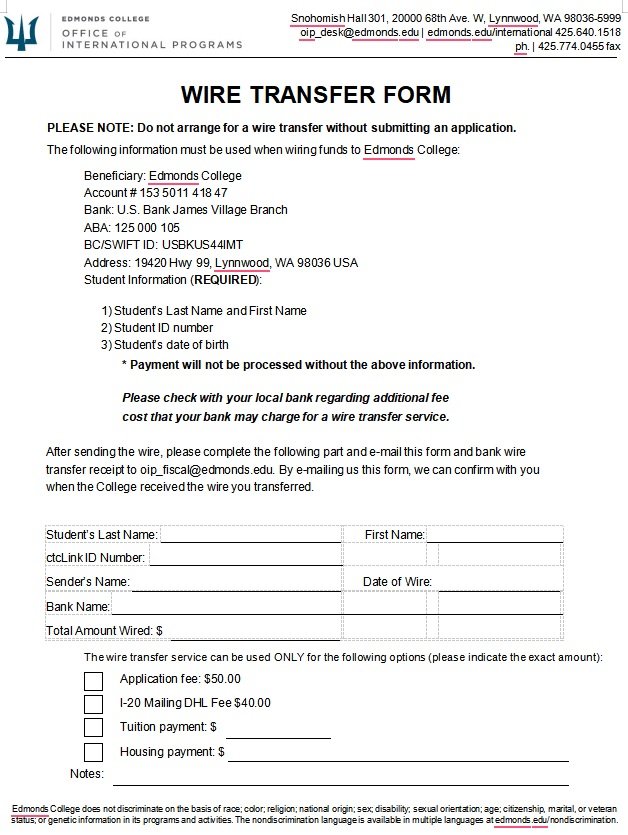

- Fill Out the Wire Transfer Form: Armed with the required information, you’ll then need to carefully fill out the wire transfer form provided by your financial institution. This form will typically include fields for the sender’s details, the recipient’s information, and the transfer specifications.

- Submit the Form and Authorize the Transfer: Once the form is complete, you’ll need to submit it to your bank or financial institution, often by visiting a branch, using online banking, or speaking with a customer service representative. Depending on your institution’s policies, you may also need to verbally authorize or confirm the transfer.

- Monitor the Transfer Status: After initiating the wire transfer, you can typically track its progress through your bank’s online portal or by contacting customer support. This allows you to ensure the funds have been successfully delivered to the intended recipient.

The speed and security of wire transfers make them a popular choice for a wide range of financial transactions, from paying international suppliers to sending money to family members abroad. However, the process of completing a wire transfer form can seem daunting if you’re unfamiliar with the required information and best practices.

Decoding the Wire Transfer Form: Key Details to Provide

The specific layout and required fields on a wire transfer form may vary slightly between financial institutions, but there are several core pieces of information that you’ll almost always need to provide. Let’s take a closer look at each of these elements:

Sender Information

- Full Legal Name: Ensure that you enter your name exactly as it appears on your bank account or identification documents. This helps verify your identity and ensures the transfer is properly associated with your account.

- Bank Account Number: Provide the account number for the bank account from which the funds will be withdrawn. Double-check this number to avoid any costly mistakes.

- Bank Routing Number: Also known as an ABA number, the bank routing number is a nine-digit code that identifies the financial institution holding your account. This number is essential for directing the transfer to the correct bank.

- Address: Include your complete mailing address, as this information may be required for security or regulatory purposes.

Recipient Information

- Full Legal Name: Just as with the sender details, the recipient’s full legal name must be provided exactly as it appears on their bank account or identification.

- Bank Account Number: Enter the recipient’s bank account number where the funds will be deposited.

- Bank Routing Number or SWIFT/BIC Code: For domestic transfers, you’ll need the recipient’s bank routing number. For international wires, you’ll typically use the recipient bank’s SWIFT (Society for Worldwide Interbank Financial Telecommunication) code or BIC (Bank Identifier Code) instead.

- Bank Name and Address: Provide the full name and physical address of the recipient’s bank. This information helps ensure the wire transfer reaches the correct financial institution.

Transfer Details

- Transfer Amount: Clearly specify the exact dollar amount (or foreign currency equivalent) that you wish to transfer.

- Purpose of Transfer: Many wire transfer forms will ask you to briefly describe the reason for the transaction, such as “Business payment,” “Family gift,” or “Investment.”

- Reference Numbers: If the transfer is related to an invoice, purchase order, or other transaction, include any relevant reference numbers or identifiers.

Additional Details

- Requested Transfer Date: Indicate the date on which you would like the wire transfer to be processed. Keep in mind that same-day transfers may incur higher fees.

- Special Instructions: Use this field to provide any additional details or notes that may be relevant to the wire transfer, such as specific delivery instructions or payment terms.

- Your Contact Information: Furnish a phone number or email address where you can be reached in case the bank needs to follow up with you about the transfer.

Providing complete and accurate information on each of these fields is crucial for ensuring a successful wire transfer. Even a minor error, such as a digit missing from an account number or a typo in a bank’s name, can result in delayed processing or, worse, the funds being sent to the wrong destination.

Expert Tips for Flawless Wire Transfers

Now that you’ve gained a solid understanding of the key details required on a wire transfer form, let’s explore some expert tips and best practices to help you navigate the process with confidence:

- Gather Everything in Advance: Before even beginning to fill out the wire transfer form, make sure you have all the necessary information on hand. Collect the banking details for both yourself and the recipient, as well as any relevant reference numbers or transfer specifics. This will prevent you from having to stop midway through the process to hunt down missing information.

- Verify, Verify, Verify: Double-check and triple-check every piece of information you enter on the wire transfer form. Ensure that account numbers, routing numbers, SWIFT/BIC codes, and all other details are 100% accurate. Even a single digit or letter mistake can result in a failed or misdirected transfer.

- Understand the Fees: Wire transfer fees can vary significantly depending on your financial institution, the destination of the transfer, and whether it’s a domestic or international transaction. Before initiating the wire, be sure you understand all the associated fees for both the sender and the recipient. This will help you budget accordingly and avoid any unexpected charges.

- Consider Timing: While wire transfers are generally faster than other payment methods, the timing of your transfer can still impact the process. Same-day transfers may be subject to higher fees, while transfers initiated late in the day or on weekends/holidays may not be processed until the next business day. Plan accordingly based on your needs and deadlines.

- Monitor the Transfer Status: Many banks and financial institutions offer the ability to track the status of your wire transfer online or through their customer service channels. Take advantage of these tools to ensure your transaction is progressing as expected and to quickly address any issues that may arise.

- Document Everything: Keep meticulous records of your wire transfer, including the date, amount, recipient details, any confirmation numbers or references, and any fees you incurred. This documentation will prove invaluable if you need to follow up on the transfer or provide proof of payment for accounting or tax purposes.

- Leverage Technology: Some banks and financial service providers now offer the ability to initiate wire transfers directly through their mobile apps or online banking portals. Leveraging these digital tools can streamline the process and reduce the risk of errors, as the forms are often pre-populated with your account details.

- Consider Alternatives: While wire transfers are a popular choice for rapid, secure money movement, they may not always be the best option. Depending on your needs and the relationship with the recipient, you may want to explore alternatives such as ACH transfers, digital payment apps, or even good old-fashioned paper checks.

By incorporating these expert tips into your wire transfer workflow, you can help ensure your transactions are executed flawlessly, without any unnecessary delays or headaches.

The Benefits of Mastering Wire Transfers

Now that you’ve gained a comprehensive understanding of wire transfer forms and best practices, let’s explore some of the key benefits you’ll enjoy by becoming a wire transfer aficionado:

1. Speed and Efficiency

One of the primary advantages of wire transfers is their lightning-fast speed. Unlike other payment methods that can take days to clear, wire transfers are typically completed on the same business day, with funds often arriving within just a few hours. This makes wire transfers an invaluable tool for time-sensitive payments, urgent financial needs, or quickly capitalizing on investment opportunities.

2. Enhanced Security

Wire transfers are considered one of the most secure ways to move money, thanks to the robust financial networks and authentication processes involved. By leveraging encrypted electronic systems and verifying the identities of both the sender and recipient, wire transfers minimize the risk of fraud or unauthorized access compared to physical payment methods like checks.

3. Increased Reliability

Unlike some other transfer options that can be susceptible to delays or processing issues, wire transfers are renowned for their reliability. Once initiated, the funds will reach the intended destination barring any unforeseen complications, providing you with greater peace of mind and confidence in the transaction.

4. Global Reach

One of the standout features of wire transfers is their ability to seamlessly cross international borders. Whether you need to send money to a supplier in Asia, pay tuition for a child studying abroad, or make an investment in Europe, wire transfers offer a convenient and secure way to facilitate cross-border payments.

5. Improved Cash Flow Management

The speed and reliability of wire transfers can also be a boon for businesses, allowing them to more effectively manage their cash flow. Urgent vendor payments, payroll, or other time-sensitive transactions can be executed quickly, helping organizations maintain their operations and financial obligations.

6. Easier Bookkeeping and Accounting

The detailed documentation and records associated with wire transfers make them a breeze to track and reconcile for accounting and tax purposes. This can save businesses and individuals valuable time and effort when it comes to managing their finances and preparing financial statements.

By mastering the art of wire transfers, you’ll unlock a powerful financial tool that can be leveraged to your advantage in a wide variety of scenarios. Whether you’re an individual sending money to a loved one or a business managing cross-border payments, the benefits of wire transfer expertise are sure to pay dividends.

Conclusion: Mastering the Art of Wire Transfers

Wire transfers may seem like a complex financial mechanism, but by understanding the key details and best practices, you can quickly become a wire transfer pro. From gathering the necessary information to filling out the form with precision, this comprehensive guide has equipped you with the knowledge to execute seamless transactions, whether you’re an individual sending money to a loved one or a business managing cross-border payments.

By leveraging the speed, security, and reliability of wire transfers, you’ll unlock a powerful tool that can benefit you in a wide range of scenarios. Whether you need to make a time-sensitive investment, pay an urgent vendor invoice, or transfer funds to a family member abroad, wire transfers offer a convenient and trusted way to get the job done.

Remember, the key to success lies in attention to detail. Double-check your information, understand the associated fees, and maintain meticulous records. With these practices in place, you’ll be well on your way to wire transfer mastery, able to navigate the process with confidence and ease.

So why wait? Dive in, start practicing, and experience the transformative power of wire transfers for yourself. Your financial future is waiting.

Frequently Asked Questions About Wire Transfers

As you continue your journey towards wire transfer proficiency, you’re bound to encounter a few common questions along the way. Let’s address some of the most frequently asked inquiries:

The speed of a wire transfer can vary depending on several factors, including the time of day the transfer is initiated, whether it’s a domestic or international transaction, and the specific policies of the financial institutions involved.

For domestic wire transfers within the United States, the funds are usually available on the same business day, with many transactions being completed within a matter of hours. International wire transfers, on the other hand, may take 1-2 business days to be processed and credited to the recipient’s account, as they often need to navigate multiple banking systems and time zones.

It’s important to note that while wire transfers are generally faster than other payment methods, the exact timeline can still be influenced by factors outside your control. Always check with your financial institution for their specific turnaround times.

There are generally no strict legal limits on the maximum amount you can transfer via wire. However, individual banks and financial institutions may impose their own internal policies that cap the size of wire transfers.

These limits can vary widely, with some banks allowing transfers up to $25,000 or $50,000, while others may have caps as high as $100,000 or more per transaction. If you need to transfer a larger sum, you may need to either make multiple wire transfers or discuss special arrangements with your bank.

It’s always a good idea to check with your financial institution about their specific wire transfer limits before initiating a transaction, to ensure you don’t encounter any unexpected roadblocks.

Once a wire transfer has been initiated and processed, it can be extremely difficult, if not impossible, to cancel or reverse the transaction. Banks and financial institutions take great care to ensure the security and integrity of wire transfers, making them a less forgiving payment method compared to some other options.

If you’ve made a mistake on the wire transfer form or need to cancel the transaction for any reason, your best course of action is to contact your bank or financial institution as soon as possible. In some cases, if the transfer has not yet been completed and the funds have not yet been deposited into the recipient’s account, the bank may be able to cancel the wire and return the money to your account.

However, once the transfer has been successfully executed and the funds have reached the recipient’s bank, reversing the transaction becomes exponentially more challenging. You’ll likely need to coordinate directly with the recipient to attempt a return of the money, which may incur additional fees and can be a time-consuming process.

While wire transfers are a popular and convenient payment method, they are certainly not the only option available. Some common alternatives to wire transfers include:

ACH (Automated Clearing House) Transfers: ACH transfers are an electronic payment system that allows you to move funds between bank accounts, often at a lower cost than wire transfers. However, ACH transfers can take several business days to clear.

Digital Payment Apps: Services like Venmo, Cash App, and PayPal offer quick and user-friendly ways to send money to friends, family, or businesses, often without the need for bank account details.

Cashier’s Checks or Money Orders: These physical payment instruments can be a good alternative for larger transactions, as they provide a high level of security and traceability.

Traditional Paper Checks: While slower than wire transfers, paper checks are a familiar and widely accepted payment method, particularly for domestic transactions.

The best alternative to a wire transfer will depend on factors such as the urgency of the payment, the relationship between the sender and recipient, any applicable fees, and the need for speed versus security. It’s worth exploring the pros and cons of each option to determine the most suitable payment method for your specific needs.