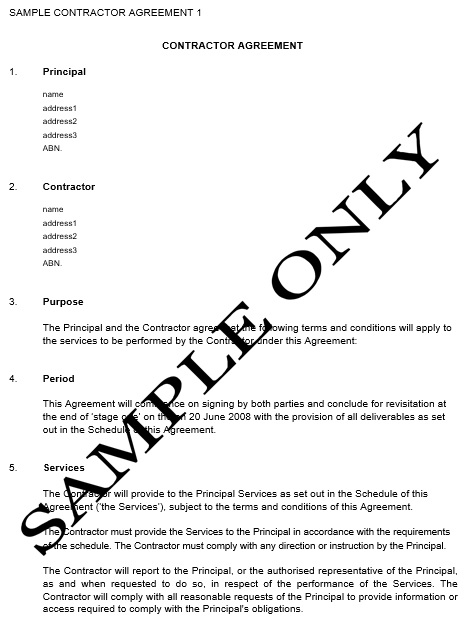

An independent contractor agreement template is a helpful document that simplifies your hiring process of an independent contractor. Before seeking service of an individual or an agency, this document is used to clearly define the scope of work and mention all the relevant terms and conditions.

Basically, an independent contractor is a person or a business that is usually self-employed. They give a service or product in exchange for compensation in the form of monetary payment. So, an independent contractor template is a working agreement between yourself and the contractor.

Table of Contents

- 1 Who can use an independent contractor agreement?

- 2 What to include in an independent contractor agreement?

- 3 How can you differentiate between an independent contractor and an employee?

- 4 How do you write an independent contractor agreement?

- 5 How do you hire an independent contractor?

- 6 Conclusion:

- 7 Faqs (Frequently Asked Questions)

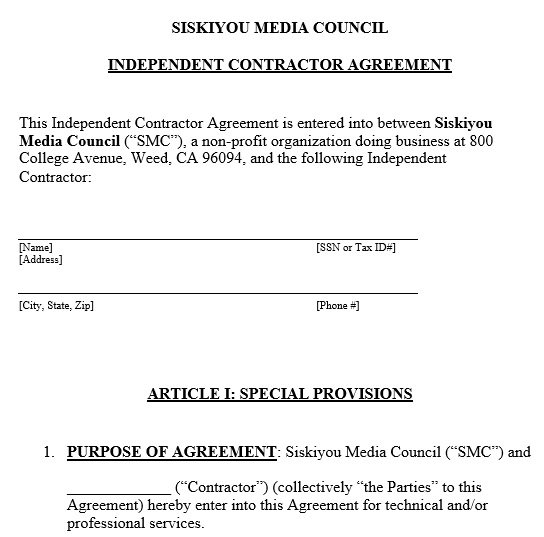

Who can use an independent contractor agreement?

Contractors, freelancers, and consultants who require a written agreement with their clients use an independent contractor agreement. In addition, this agreement is also beneficial for customers, clients, or businesses who want to highlight the service arrangement in a written contract. The document specifies the terms and conditions that reduce the risk of any conflict down the road.

What to include in an independent contractor agreement?

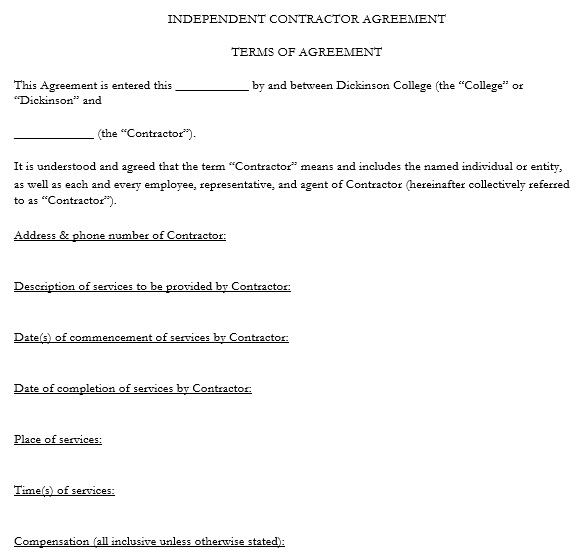

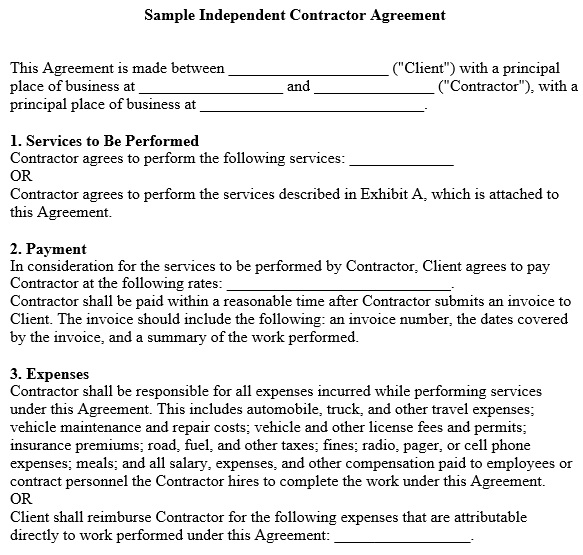

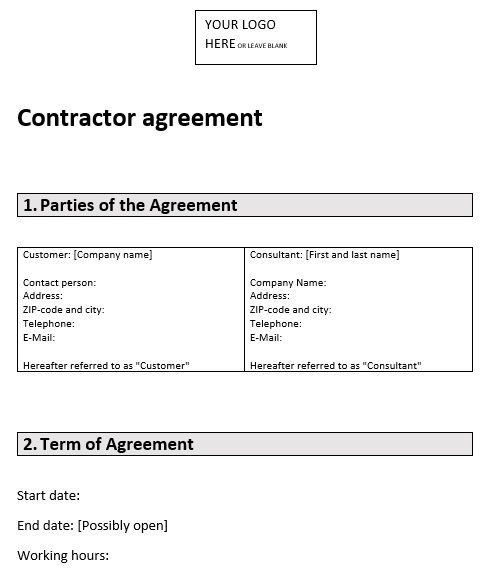

An independent contractor agreement usually includes the following elements;

- Hiring company; the entity in requirement of a contractor

- Contractor, the individual hired for a task or project

- Services, these are certain details of tasks to perform or products to deliver

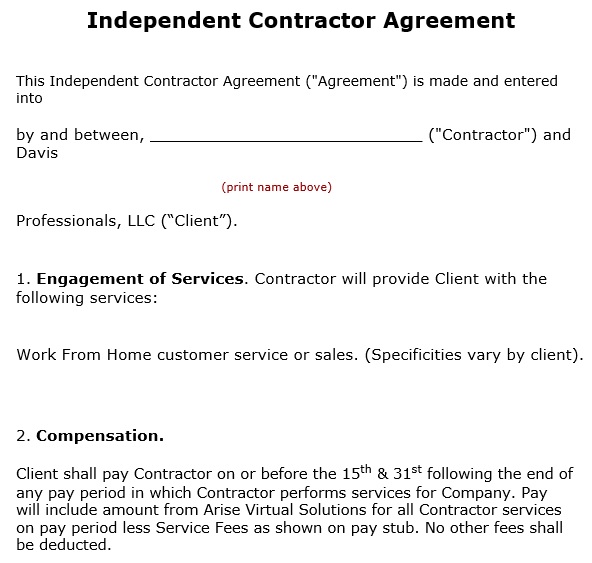

- Compensation; it is the amount and frequency the contractor will get paid

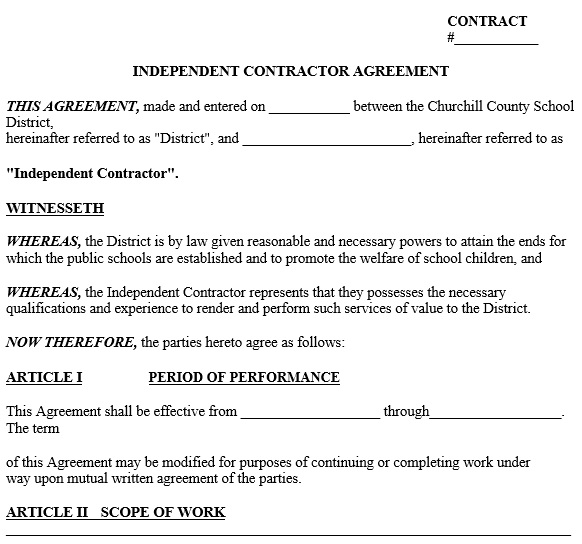

- Effective date; it is the date when the job and agreement start

- On the basis of terms in agreement, termination may happen

- Fringe benefits; it indicates that the contractor can’t take part in any of your company’s employee advantages

- The contractor assistants whom they hire on their own

Above all, the agreement should also include the following;

Assignment

Both parties aren’t able to transfer the responsibility to the job to complete or the payment to another party until previous written permission exists.

Binding effect

If another company or individual takes over the contractor or your company, the agreement remains in effect.

Entire agreement

The prior agreements you may have are no longer valid. You have to make any future modifications in a written amendment.

Expenses

Until you have pre-approved certain costs and the contractor submits invoices, each party bears responsibility for their out-of-pocket expenses.

Governing law

If you encounter any issue, the laws of your state apply.

Indemnification

The contractor should bear responsibility if any issue arises. It should defend your company from liability.

Insurance

Your company’s insurance policy isn’t responsible to cover the contractor. The contractor should bear their own insurance.

Notices

You have to write and deliver all communications perfectly.

Representations

To make the agreement legally binding, both parties should have the authority and power to enter in it.

Severability

The other part of your agreement remains legal in case one part becomes invalid.

Waiver

Releasing a right or claim should be written.

Warranties

The contractor promises they have all of the permits, registrations, and licenses required to complete the task or project.

How can you differentiate between an independent contractor and an employee?

Let us discuss below some contrasting features to make difference between them;

Independent contractor

- Independent contractor has the right to talk about a project’s scope and terms directly with the customer.

- In contracting business, they have a personal investment and as a result, they may incur profit and loss.

- In order to complete services, they may hire employees or subcontractors.

- They use their own instruments.

- They are allowed to sign an independent contractor agreement.

- Independent contractor generally works on a fixed project basis.

Employee

- The job description of an employee is created by their employer.

- Their wages are controlled by an employer.

- They are allowed to sign an employment contract.

- Employees get employment benefits like medical, pension, vacation, or sick pay.

- They can obtain in-house training.

- They may have to go through employment reviews.

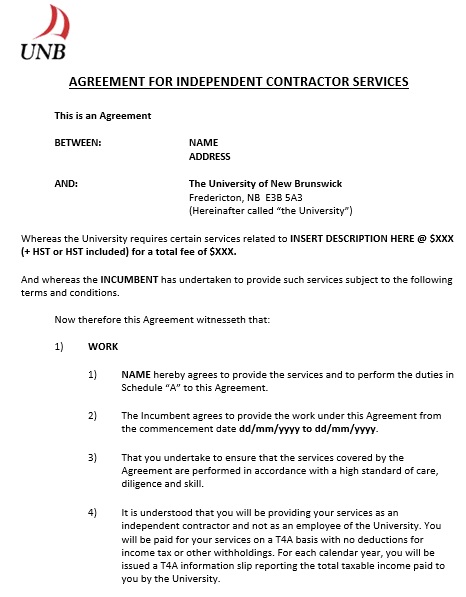

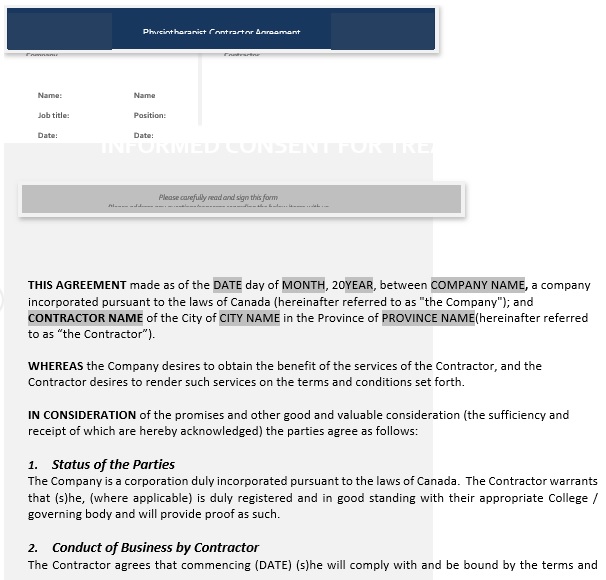

How do you write an independent contractor agreement?

At the start of the work agreement, you should make clarifications in your contractor agreement. The best way to accomplish this is by putting everything in writing. Here are the tips that will help you in writing a simple contractor agreement;

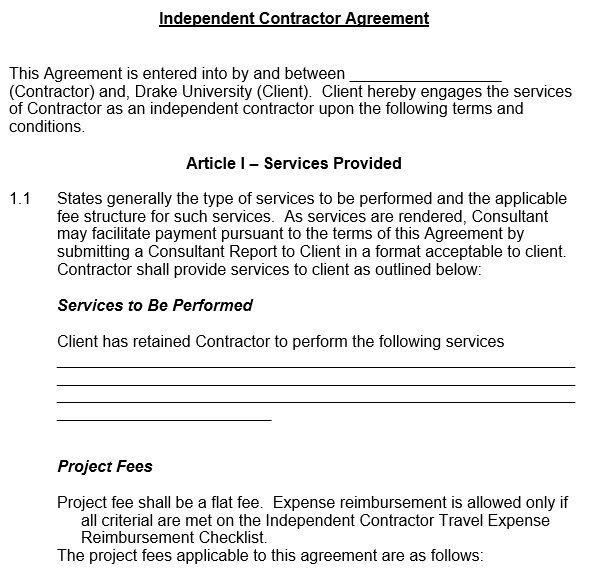

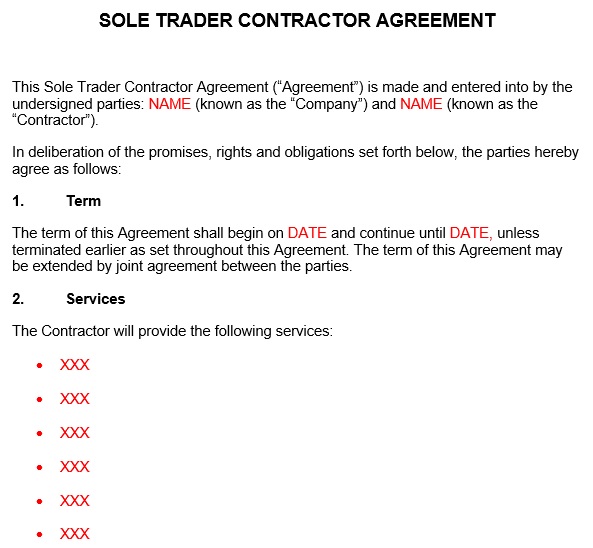

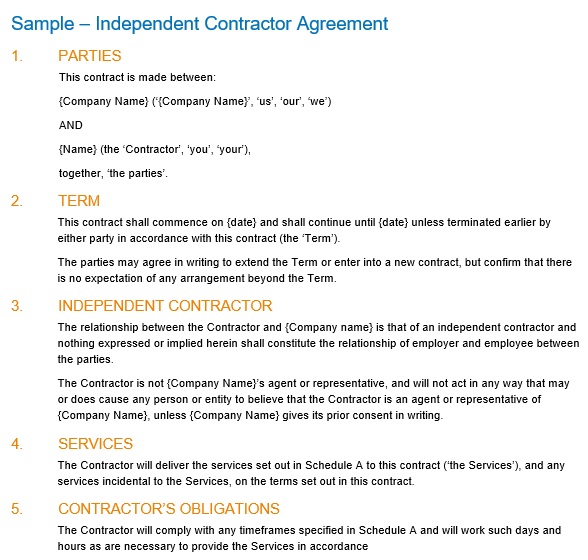

Nature of the work and general agreement

This is the first section of the agreement that states in detail the responsibilities of both parties.

Independent contractor status

This is one of the most essential parts of the agreement. It clearly defines the worker as an independent contractor not an employee. This section mentions the contractor’s rights to perform jobs for others. He has to perform these tasks until the services will compete or conflict with their work in your company directly.

The agreement clearly indicates either the contractor must do the work or they may hire other people to help them out.

Contractor payment

This section of the contract is typically clarified payments to the independent contractor. Also, such payments won’t have withholding for payroll taxes or income tax. You shouldn’t withhold federal tax from payments to the contractor until required by backup withholding requirements. You shouldn’t have to set these payments on behalf of the contractor.

Who pays the expenses?

In the agreement, specify who will pay for specific expenses. The contractor is typically responsible for all of the expenses in most cases. These may contain vehicle maintenance, mileage, and other travel or business expenses as well as the payments to their subcontractors or employees.

Eligibility for benefits

The contract should include a statement that states the contractor understands that they aren’t entitled to or eligible for;

- Retirement or pension benefits

- Holiday pay

- Vacation pay

- Health insurance

- Sick pay

- Other fringe benefits given by employers

Insurance

Specify in the agreement that the company won’t give auto liability insurance, liability insurance or other general insurances for the contractor. This indicates that the contractor won’t get coverage from the liability insurance policy of your company. In case any loss or injury happens that the contractor causes, including this clause gives your company protection.

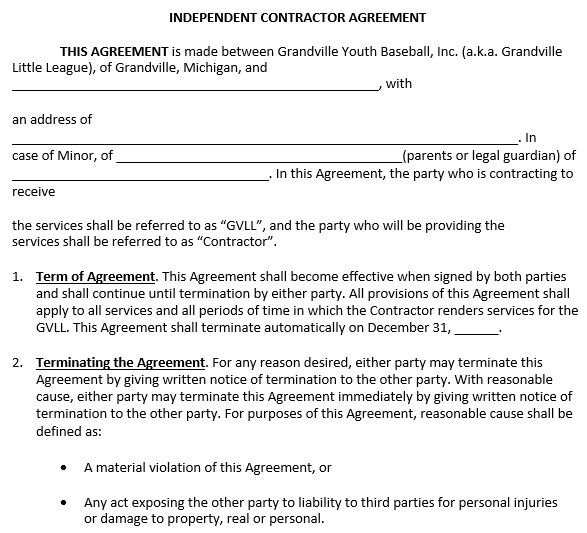

Termination of the contract

The agreement is among your company and an independent contractor so it should clearly state that party may terminate the contract without or with notice. This depends on how your project pushes through or how your relationship evolves.

How do you hire an independent contractor?

Here are the steps to follow for hiring an independent contractor;

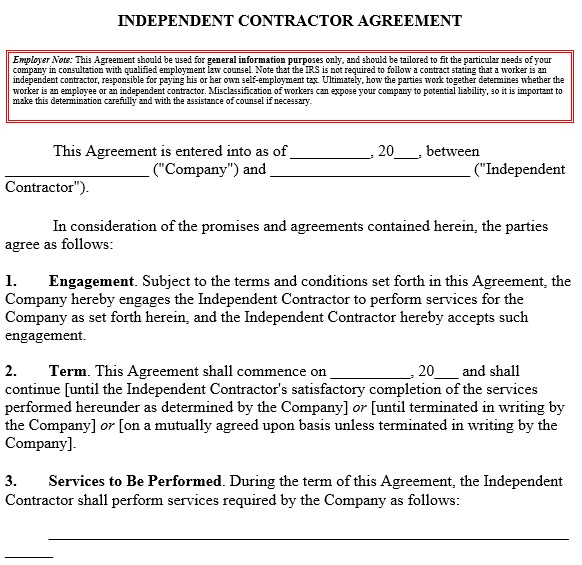

Classify an independent contractor accurately

The businesses have to strictly classify an independent contractor for tax purposes according to IRS. You can get an official determination to cover your bases by using a tax professional or submitting IRS form SS-8.

Make a request for completed W9 form

An IRS W9 form must be completed by independent contractors for each employer that has paid them at least $600. As a business owner, the taxpayer information that you require can be obtained by a W9 form builder.

Complete an independent contractor agreement form

You and the freelancer should complete the independent contractor agreement form in order to officially record the work agreement. Go over each point before signing the document in order to ensure that they accurately reflect the negotiated terms. You should focus on the following most important sections;

- Services

- Compensation and expenses

- Non-compete, non-solicit, non-disclosure, and product ownership

- Legal disputes and termination

Sending out IRS form 1099

In order to report taxes on payments to independent contractors, you have to file IRS form 1099. For every independent contractor to whom you’ve paid at least $600 for services, this have to be done.

Conclusion:

In conclusion, an independent contractor agreement template is an agreement between yourself and the contractor for a specific project or service. It includes a company or a person hiring another to achieve on a specific task.

Faqs (Frequently Asked Questions)

You have to look at the terms and termination section of the agreement in order to terminate an independent contractor agreement. You can terminate the contract after a set period of time or on the completion of the agreed work.

You can write your own independent contractor agreement in case you’re hiring an independent contractor. Using a template is the best way to make sure that you don’t miss out any important information.