A rent receipt template is used by tenants to keep a record of the payments they made to their landlords. It prevents the tenants from future despites and misunderstandings. This document serves as proves that the landlord received a tenant’s rent payment. When your tenant makes a payment each time you should provide a rent receipt to him.

Table of Contents

- 1 The importance of rent receipt:

- 2 Basic components of rent receipt:

- 3 What should be included in a rent receipt?

- 4 How can you use a rent receipt?

- 5 How to create a rent receipt?

- 6 How to send your rent receipt?

- 7 The benefits of rent receipts:

- 8 How do rent receipts provide tax benefits to tenants?

- 9 Conclusion:

- 10 Faqs (Frequently Asked Questions)

The importance of rent receipt:

Some states demand landlords to provide rent receipts to tenants. It keeps all of the financial information organized and acts as evidence that the tenants have paid their rents. With the help of a rent receipt template, you can maintain professionalism when transacting with your tenants. Moreover, each month when the landlord provides the receipt to the tenant, he keeps it in a single file to prove that he has paid his rents.

If the landlord states that the tenant hasn’t paid the rent for a specific month then he can show a copy of the receipt. It also contains the date of payment. In case, tenant wants to charge a fee for late payment, you can show him the date of payment mentioned on the receipt.

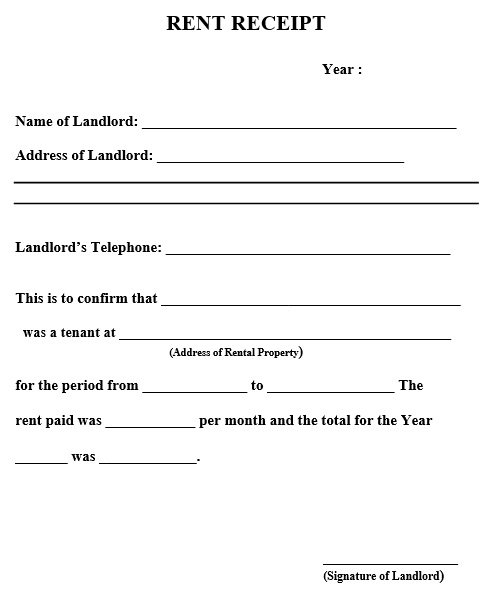

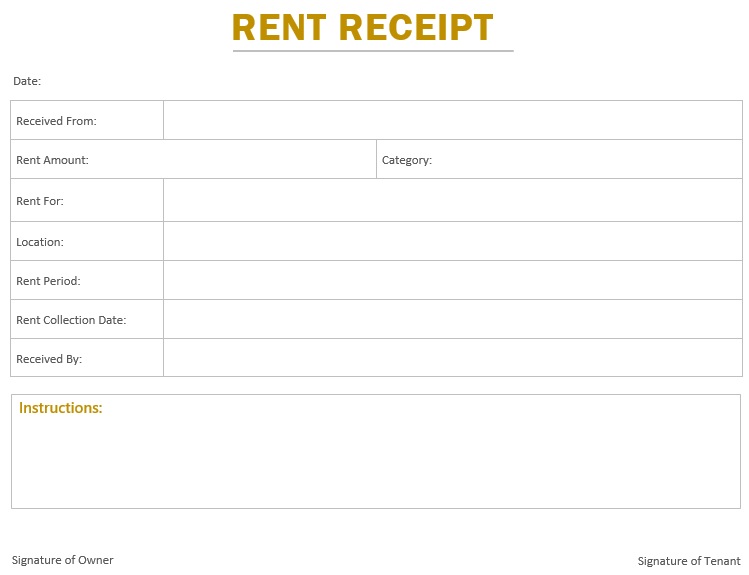

Basic components of rent receipt:

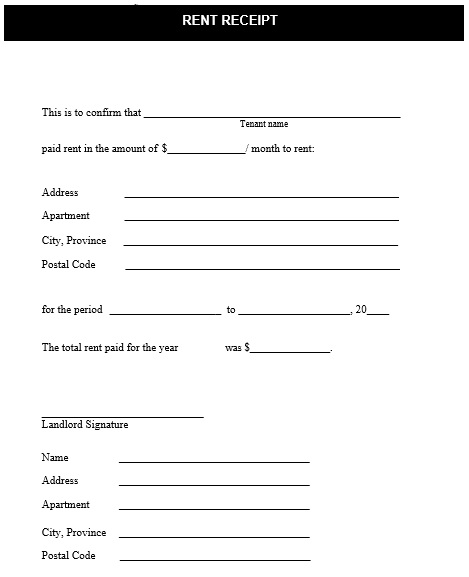

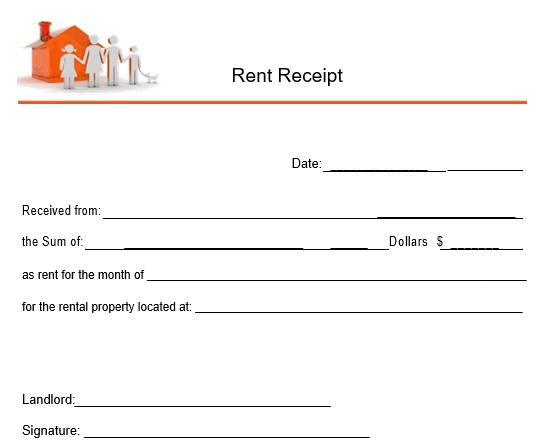

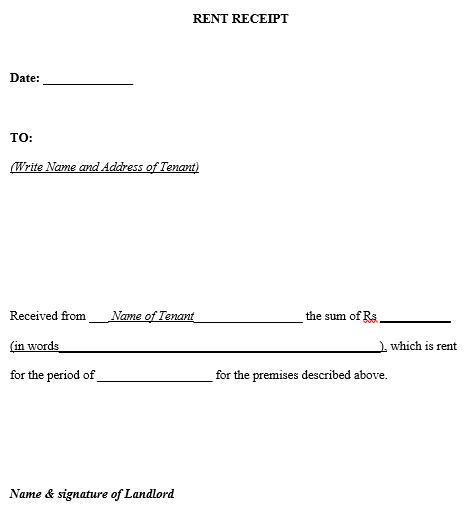

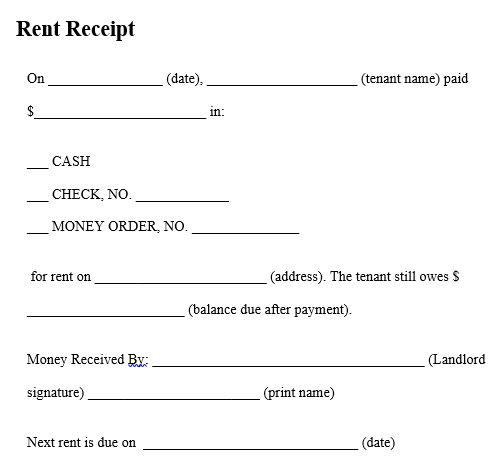

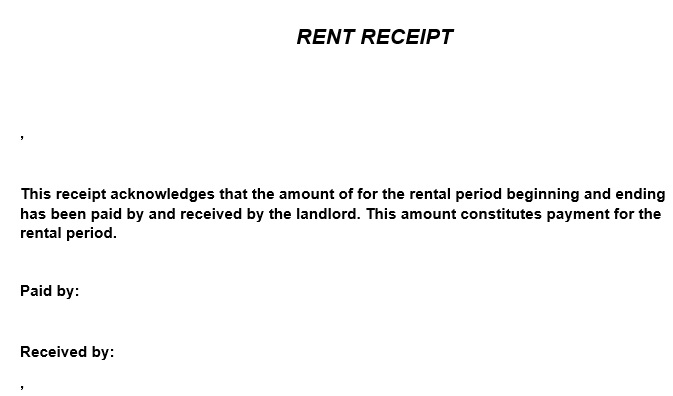

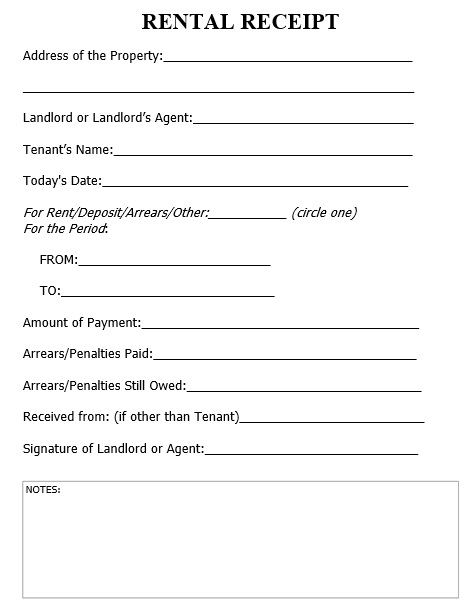

Your rent receipt should contain the following information;

- Contact information

- Name of the person (tenant) who is giving the payment.

- The amount of the rent tenant paid.

- The place of the rented property

- The time period covered by the payment

- Payment method

- Mention the date the tenant gave the payment.

The above-mentioned information is the basic components of each rent receipt. This information is important for both the tenant and landlords. Also, create a section that where you write the late fees or other penalties that the tenant has to pay. To ensure that you file everything in one place, you can keep printed or digital copies of the receipts.

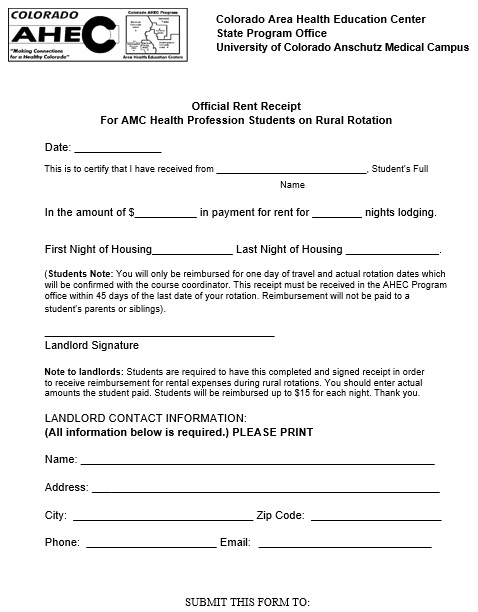

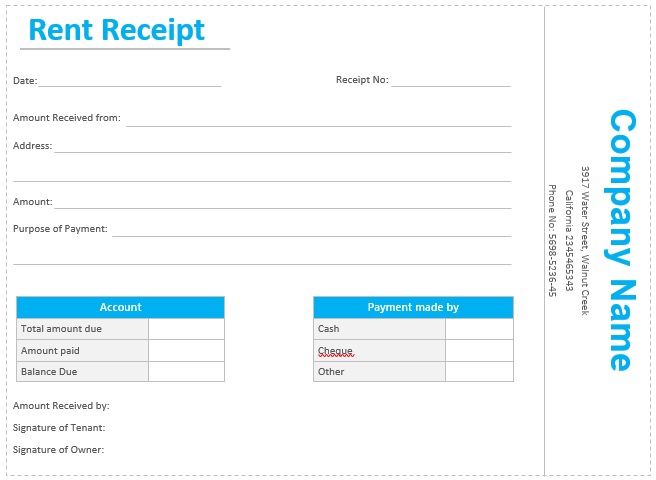

What should be included in a rent receipt?

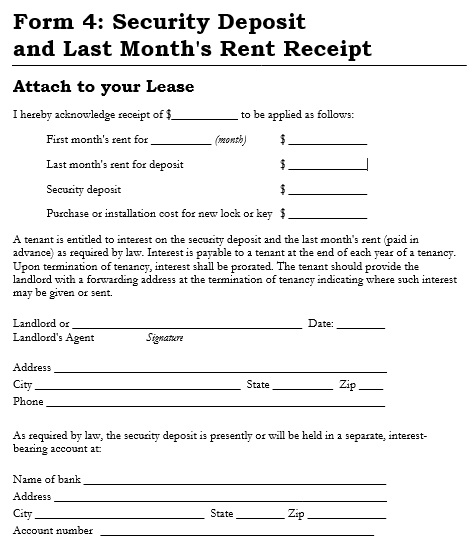

In order to make controlling payments and late fees an easy process, rent receipts should include all the important details. Your receipt should include the following information to satisfy state requirements;

- Receipt number

- Date of payment

- Payment amount

- Rental period

- Recipient

- Tenant’s full name

- Rental property address

- Payment method

- Late payment fees

- Signature of the property manager or landlord

How can you use a rent receipt?

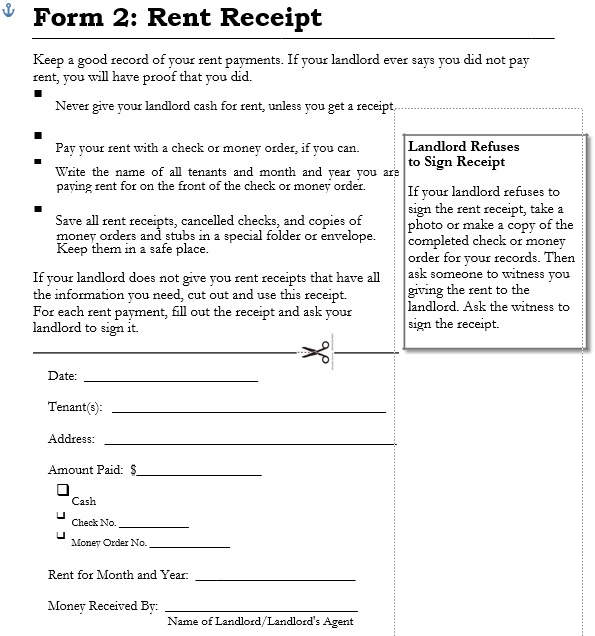

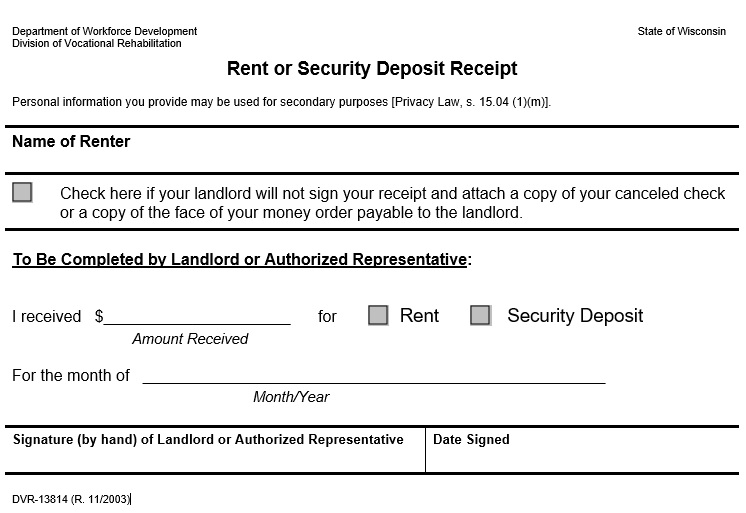

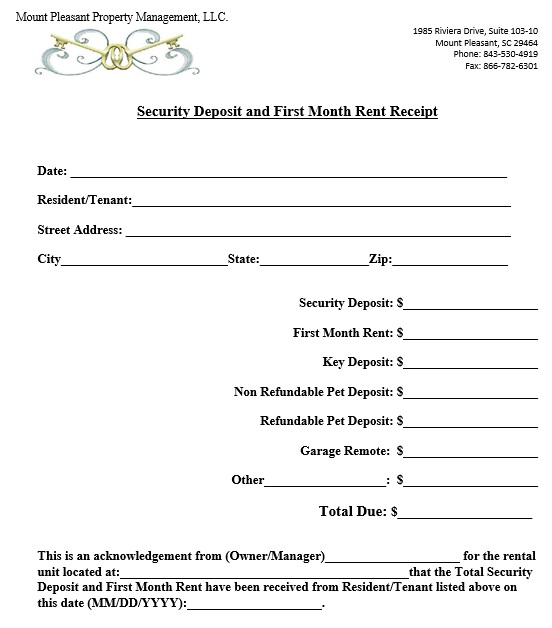

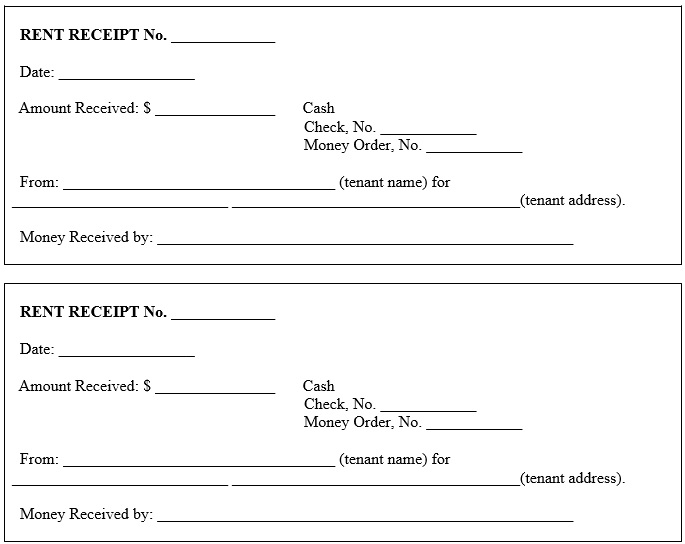

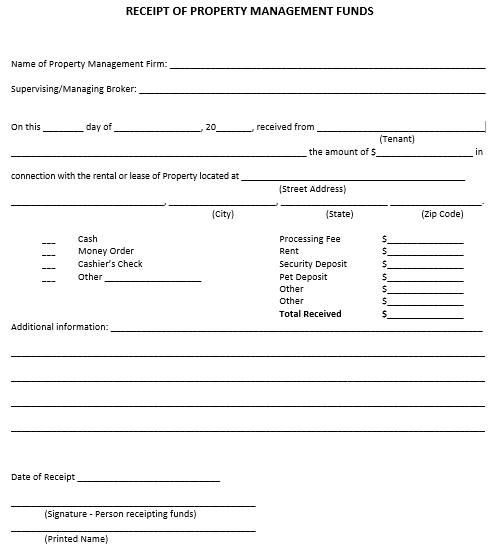

It is an important document that keeps a record of rental payments tenants have paid to landlords. It acts as evidence that the tenant gave his due payment to the landlord according to his obligation in the rental agreement. This document makes the tenant able to keep track of all incoming payments and keep a check on any late payments. Additionally, for the tenants who give cash payments, this document acts as proof that they have made the payment. On the other hand, if someone pays with checks, the rent receipt doesn’t state that the checks have cleared. Therefore, the landlord has to make sure that the check has cleared.

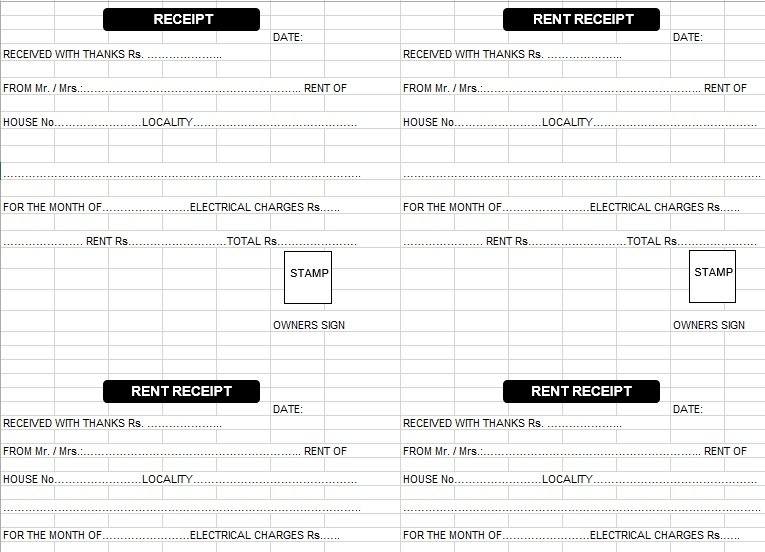

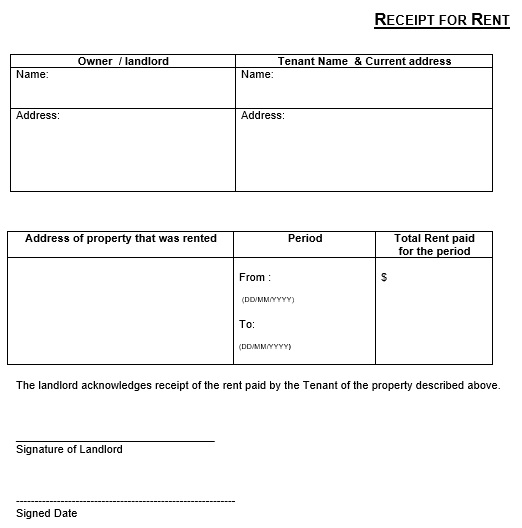

The landlord should state all information on the rent receipt that either the tenant gave a full payment or partial. In case the tenant pays the rent late then include the amount of balance and the late fee on the receipt. After filling out the receipt, the landlord provides the tenant with a signed original copy, and it’s a better idea for the landlord to keep one copy for himself.

How to create a rent receipt?

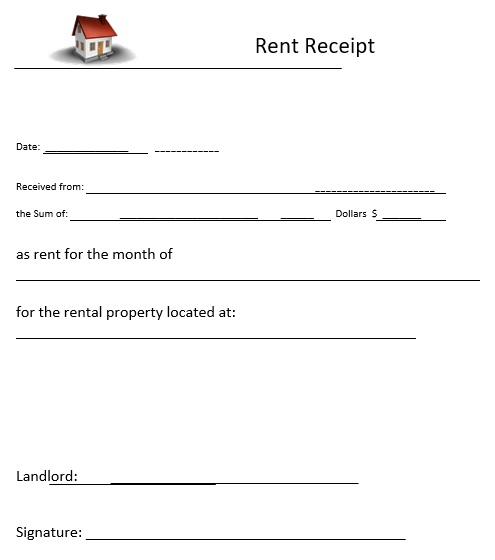

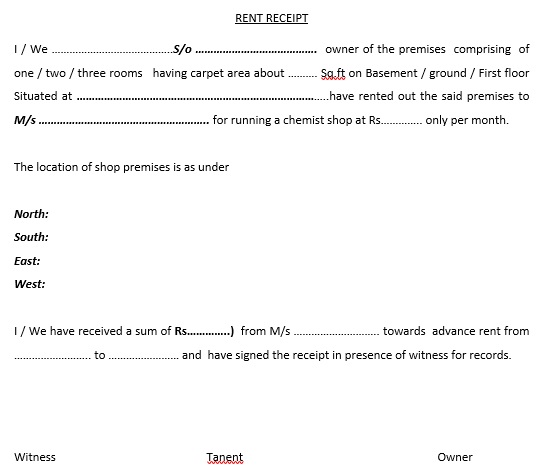

Here are some tips to guide to create your own rent receipt;

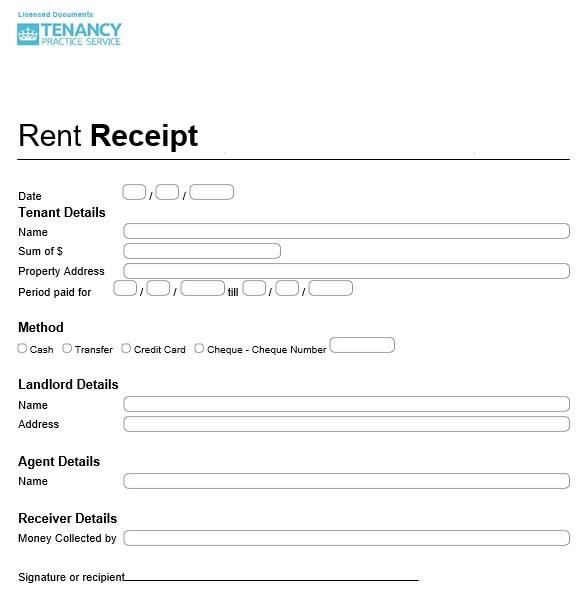

- At first, you have to think about the frequency of the rental payments. Also, estimate the form of payment you want to accept.

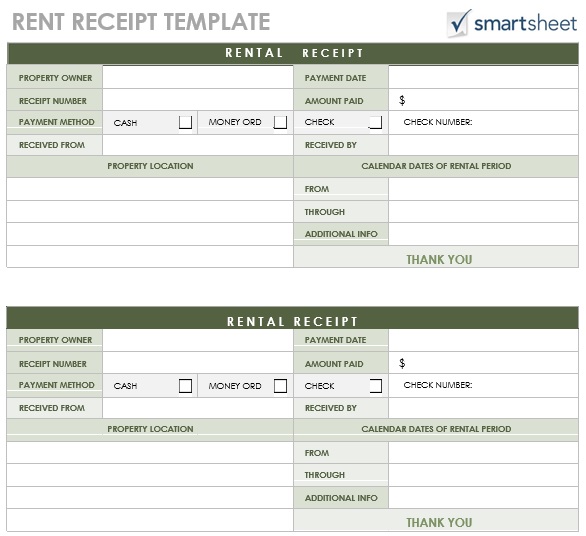

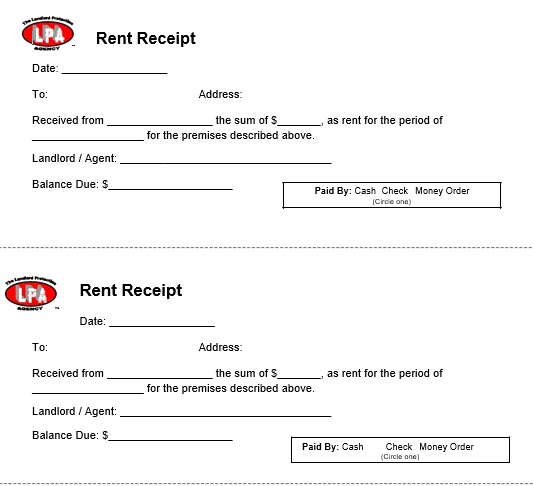

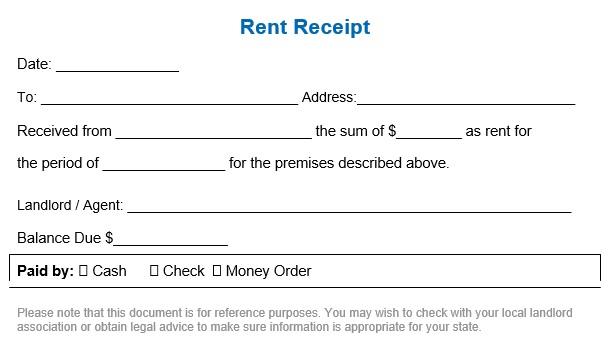

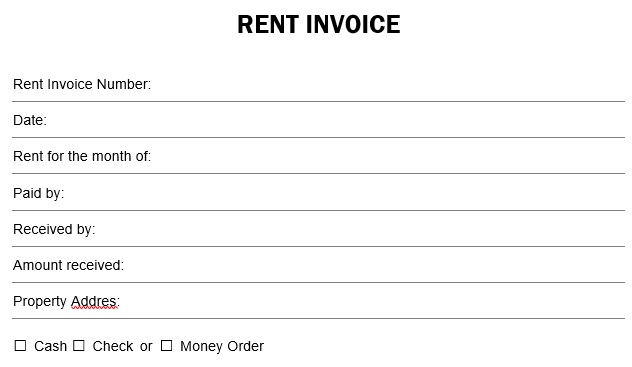

- Then, download a rent receipt template from any website and make changes according to your needs and preferences.

- Ensure that your template contains all the important information. You can also include other information that you think you need the receipt to have.

A rent receipt is a beneficial document for both the tenant and the landlord. Having and giving receipts to the tenants keep all the financial records organized and accessible. Most importantly, include the date on the receipt that when the tenant made the payment. It makes sure that either the tenant made payment before or on the due date.

If tenant-paid through a check then he has to provide evidence of the invalid check. Mention the address of the rental property is important too. If a rental property is an apartment then you should include the number of apartments and the street address. Providing the tenant’s name on the receipt is also important. Hence, by including this information, you can eliminate the confusion that who made the payment and the renting property.

In the end, after accepting and verifying the payment, affix your signature on the receipt. It’s a better idea to include your name along with your title and signature on the receipt. It indicates that you have accepted the payment and you have the authority to collect it.

How to send your rent receipt?

The first step in sending the rent receipt is to have the proper information. You should ensure that your document looks good and provides a clear view of all information. Organize the information well on the template. Moreover, include the same information at one place such as the name of the tenant, the address of the rented property, and the payment’s rental period. In the next area, place the payment details.

When you have filled in all the information, it’s time to send it to the tenant. You can send it through several ways, but the best way and time to give it is right after you’ve filled in all of the information in front of your tenant. You can also send the receipt via email if you want to go paperless and have a PDF template.

The benefits of rent receipts:

Let us discuss below why rent receipts are important to landlords and tenants;

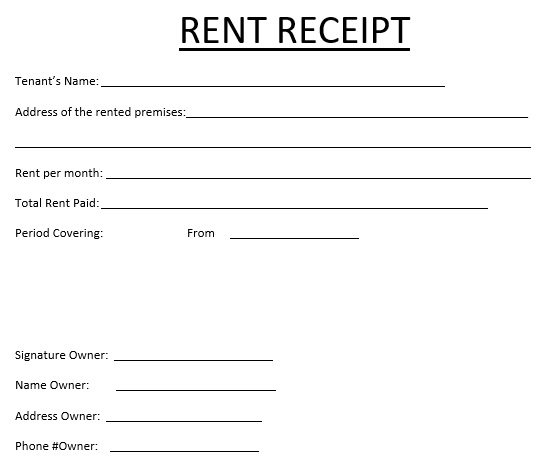

For tenants

- Rent receipts act as proof of payment. Sometimes, landlords make mistakes while recording the exact date when the rent was paid. Tenants can protect themselves from paying late fees through rent receipts.

- These receipts can provide proof in case you get into a legal process because of unpaid rent.

- If you work from home, some States allow you to deduct rent from your income taxes.

For landlords

- With the help of a rent receipt, landlords can monitor payments and late fees because they serve as clear proof of when a tenant has paid their rent.

- Through receipts, commercial transactions are typically backed. When you issue a rent receipt in any sector, it acts as a sign of seriousness and professionalism.

- When you write a receipt, it proves that a payment has been made and no more rent will be requested. Thus, it allows you to create accountability with tenants.

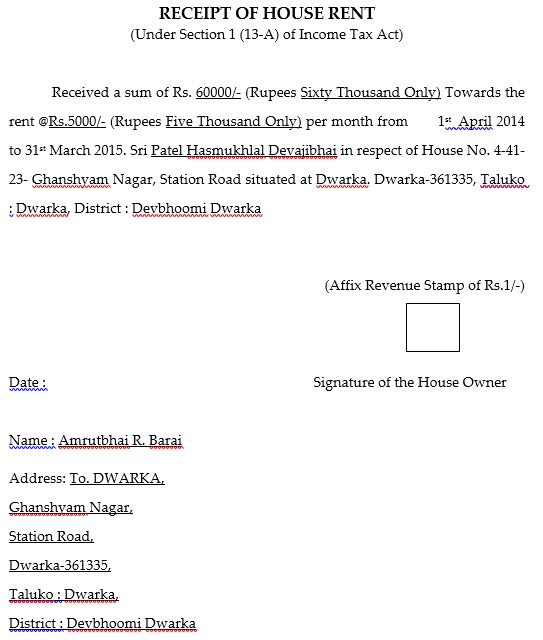

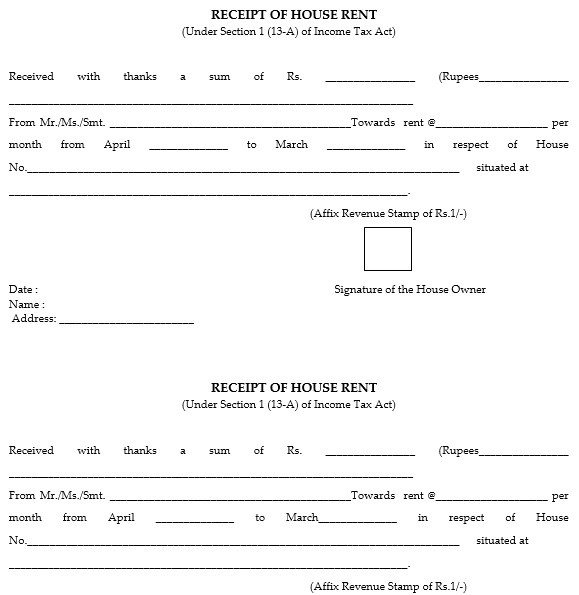

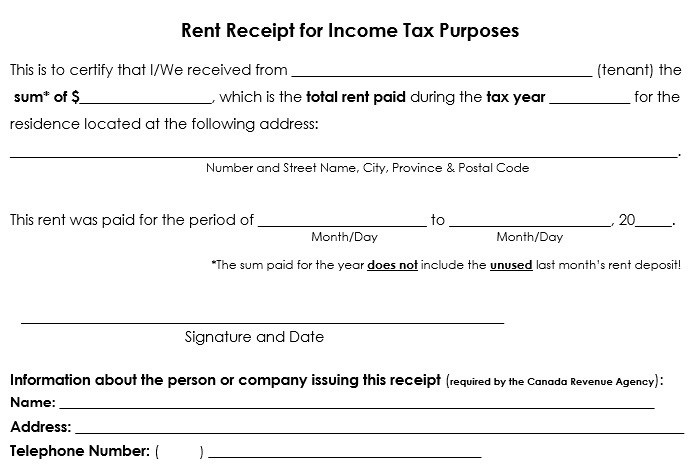

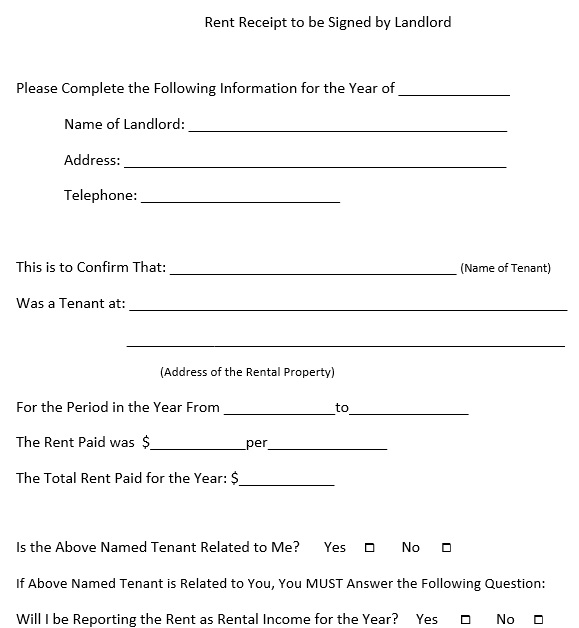

How do rent receipts provide tax benefits to tenants?

Some states provide tax benefits for tenants. For the tenants who present rent receipts, the tax deductions are approved. Also, they have to justify their rental expenses. Generally, the return amount is calculated on the basis of the total rent payment in a year.

A home office deduction might be entitled to those who work from home. Factors such as the use of regular or simplified formulas to evaluate expenses and the size of your office may influence the amount of the deduction.

Conclusion:

In conclusion, a rent receipt template is a helpful tool in creating an effective rent receipt. It keeps your all information organized. This document serves as proof that the tenants have made the payment. It also contains the date of payment which indicates when the tenant has paid the amount. It also helps you to keep track of all incoming payments and keep a check on any late payments.

Faqs (Frequently Asked Questions)

Landlords must keep copies of rent receipts. These receipts can be used as proof in case any legal claims regarding their real estate income arise. After filing the return, the tenants who are getting benefits from home-office-related income tax deductions have to keep rent receipts for a minimum of 3 years.

The first step is to input the right information on the rent receipt. All of the information should be well-organized on the receipt in order to make sure the receipt looks good.